Cluster Search indicator for Cluster analysis

Indicators make the trader’s life easier and help him to perform his work. For example, a trader could miss important information and a respective indicator would give him a clue about the omission and put a mark in the chart. Also, indicators help in analysis, ‘scan’ history and charts and look for what a trader needs.

The Cluster Search indicator is exactly such a useful assistant. The present article is about this useful instrument for the search of clusters.

Read in this article

- How the Cluster Search indicator works.

- How to add the indicator to the chart.

- What Cluster Search looks for.

- Examples of settings.

- Example of the market situation analysis.

How the Cluster Search indicator works

For many decades, a bar (or a Japanese candle) was the primal element of the exchange chart. This element was indivisible.

In the course of development of computing and trading technologies, the market participants got a possibility to ‘look inside’ a bar and see its components – clusters. Cluster analysis allows seeing what takes place ‘in the body’ of every bar with maximum details.

Cluster Search (as the name tells us) searches for clusters within the set parameters and highlights them in the chart for a trader.

How to add the Cluster Search indicator to the chart

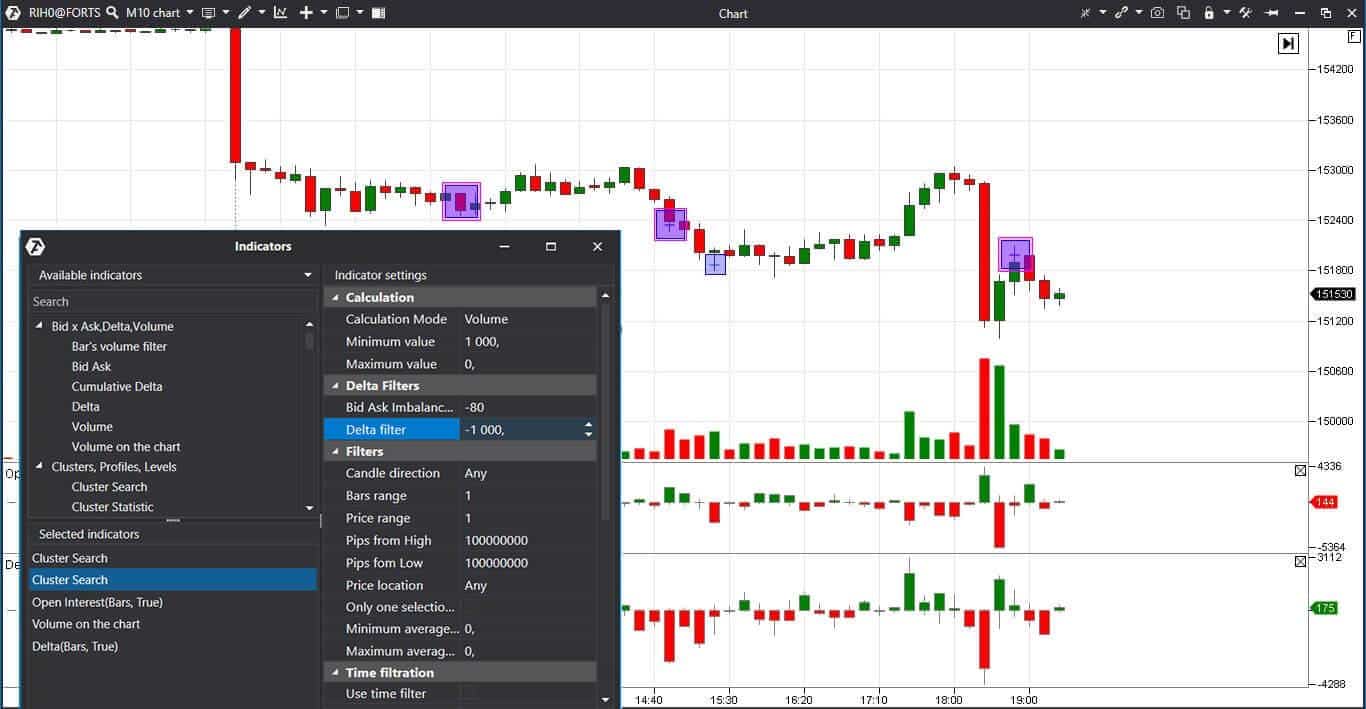

You will need to use the indicator manager in order to add the Cluster Search indicator to the chart in the ATAS platform. It could be called from the upper menu (1) or from the context menu, which opens when you mouseover the chart and click the right mouse button. See Picture 1.

Select the Cluster search in the indicator manager and press Add. That’s it. Bright pink squares (default settings) tell us that the indicator has been added.

How to set up the Cluster Search indicator

Cluster Search has many settings and every user will find a proper variant for his or her trading strategy.

It is important to remember that Cluster Search is not a magic automatic indicator, which will show where to buy and where to sell. In order to use Cluster Search in your work, it is necessary to understand what to search for and why to do it.

As a rule, not the highlighted clusters themselves are important but what a story about the fight between bulls and bears they tell us.

The indicator doesn’t have universal settings. You would need to select them for every instrument and for different times of the day, because the markets are unique. Moreover, liquidity changes during the day.

What Cluster Search looks for

Cluster Search looks for such clusters, which satisfy the set criteria. For example, the indicator might help to find the clusters where:

- big and small volumes were traded;

- delta values were above or below the average (in other words, market orders dominated). If a big volume of market orders of one direction cannot shift the price, it means that limit orders interfere with them. Managed money often works as limit orders.

- aggressive market order buyers or sellers entered. Market orders should push the price in their direction. If this doesn’t happen, the traders get into a trap and start closing loss-making positions.

- the number of trades or time duration differed from average values.

Usually, traders are interested not in the ‘special’ orders themselves but in the levels which are formed near such clusters. That is, the indicator helps to identify important support/resistance levels.

Filtering out search results

Additional filters could be added to the main indicator settings:

- select exact location of the cluster in the candle – at high or low or in the candle shadow;

- add additional filtering by Delta. In order to detect the excess of Bids over Asks (what Asks and Bids are), the filter value should be negative, for example, -80%. In order to detect the excess of Asks over Bids, the filter value should be positive, for example, 80%;

- add additional Delta values;

- combine several price levels.

Examples of different indicator settings

Let’s consider an example in the 5-minute RTS index futures (RIH) chart. We added two Cluster Search indicators to the chart and, as a result, violet and lilac squares appeared in the chart.

The first picture: the indicator looks for clusters with the volume of more than 1,000 contracts and filters these clusters out so that:

- there were more Bids than Asks by 80%;

- the Delta value was less than 1,000 contracts.

Such a setup allows highlighting clusters with big market sells. See Picture 2.

We changed the indicator settings in the second chart in order to look for Bids from 1,000 contracts. Additionally, we want to have more Bids than Asks by 80%. That is, we pursue the goal to see aggressive market sells but set up the indicator differently. See Picture 3.

Both settings produced practically the same result since we knew for sure what we want to find, namely – big market sells.

Indicator visualization

Visually, you may set several indicators in one chart with various shapes and colours. For example, big trades could be shown as red squares while big Delta values – as a green circle.

The indicator may help you to detect maximum levels by Volume and Delta in every bar. In order to understand how to set up the indicator for this, watch this video on our YouTube channel.

Difference of Cluster Search from Big Trades

Cluster Search looks for trades accumulated in every bar. That is, the set indicator value should be traded with market orders in every cell. These could be small or big trades – the indicator sums them up and then marks the cluster.

Big Trades looks for individual big trades in the Smart Tape and highlights them in the chart. If the aggregation is set, the trades will be united by several prices.

Example of working with the indicator

Let’s consider an example in the daily PAO Severstal stock (CHMF) chart.

The stock price was falling from June until October 2019. The price reached the low in October and consolidated. The trend could have reversed but it was risky to accumulate long positions without confirmation. See Picture 4.

We added two Сluster Search indicators to the chart:

- The first one looks for Bids from 30,000 items in the upper candle shadow. The excess of Bids over Asks should be minimum 80%. The value in the ‘additional filtration’ field should be -80% for a correct setup. We want to find the entry of sellers in the upper part of the bars with the help of this indicator. We identified the support and resistance levels beforehand. Since we’ve already found the levels, we will use the indicator for confirmation. There was a downtrend until October and it was less risky to join sells than to catch reversals.

- The second one looks for Asks from 30,000 items in the lower candle shadow. The excess of Asks over Bids should be minimum 80%. The value in the ‘additional filtration’ field should be 80% for a correct setup. We want to find the entry of buyers at local lows with the help of this indicator. We try to find confirmation of the reversal for opening long positions. The price already bounced from the low in October, but it was risky to start accumulating long positions immediately.

Anything may happen in the market at any time. A trader should assess the probabilities of whether the price would continue to move towards the current trend or whether the price would reverse or would go into a flat. Chances will never be 100%.

“If you are good, you are right six times out of ten. You are never going to be right nine times out of ten.” Peter Lynch

If a trader estimates the probability of a reversal higher than the probability of continuation of a trend movement, it is worth opening long positions. If the probability of continuation of a trend movement is higher than the probability of a reversal , it is worth opening short positions. That is why we added two indicators in order to avoid drawing a firm conclusion at an early stage.

We identified the price low still in October and marked it with a black horizontal line. The price bounced from the low and reached point 1 where Cluster Search showed us aggressive sellers. This level also could have been identified beforehand (because the price already slowed down here before) and the indicator could have been used for confirmation.

- Cluster Search in point 2 sends a signal that aggressive buyers emerge. Thi is the level of the previous local high. Buyers decided that the price would go up after a small bounce but they were wrong.

- Point 3 at the previous low is the point where many buyers enter. They accumulate positions during two days. The risk:reward ratio in this point is much bigger than 1:3. Cluster Search confirms a bigger probability of the price growth.

- Point 4 shows the emergence of sells. It could be the profit registration (because the price reached the visible level) and/or new sells. It is important that buyers failed to consolidate under the level. Buys appear again in point 5 and 6.

Cluster Search very clearly showed actions of the market players. We didn’t follow the indicator signals blindly, but analyzed the probabilities of the price growth or fall. Understanding of what takes place inside every bar is a competitive advantage of a trader.

Due to the flexibility of settings, the Cluster Search indicator could be used with any time period and for any instrument. Download the free test version of the ATAS platform in order to experience the power of the Cluster Search indicator.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.