What Are Bid and Ask on the Stock Exchange?

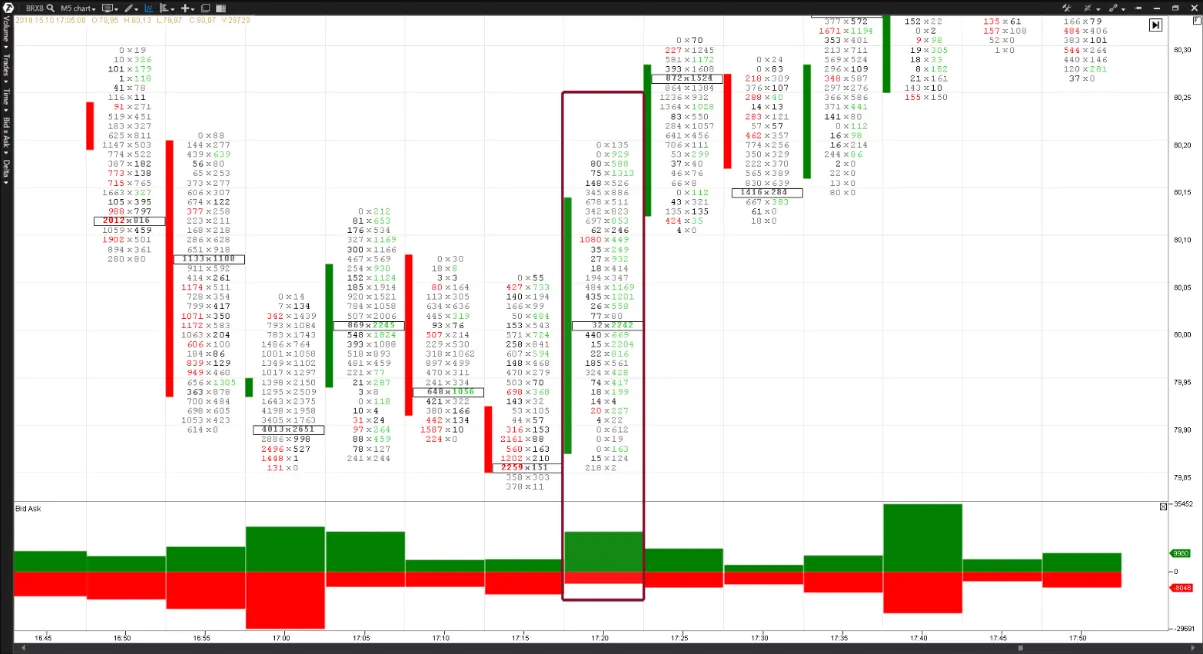

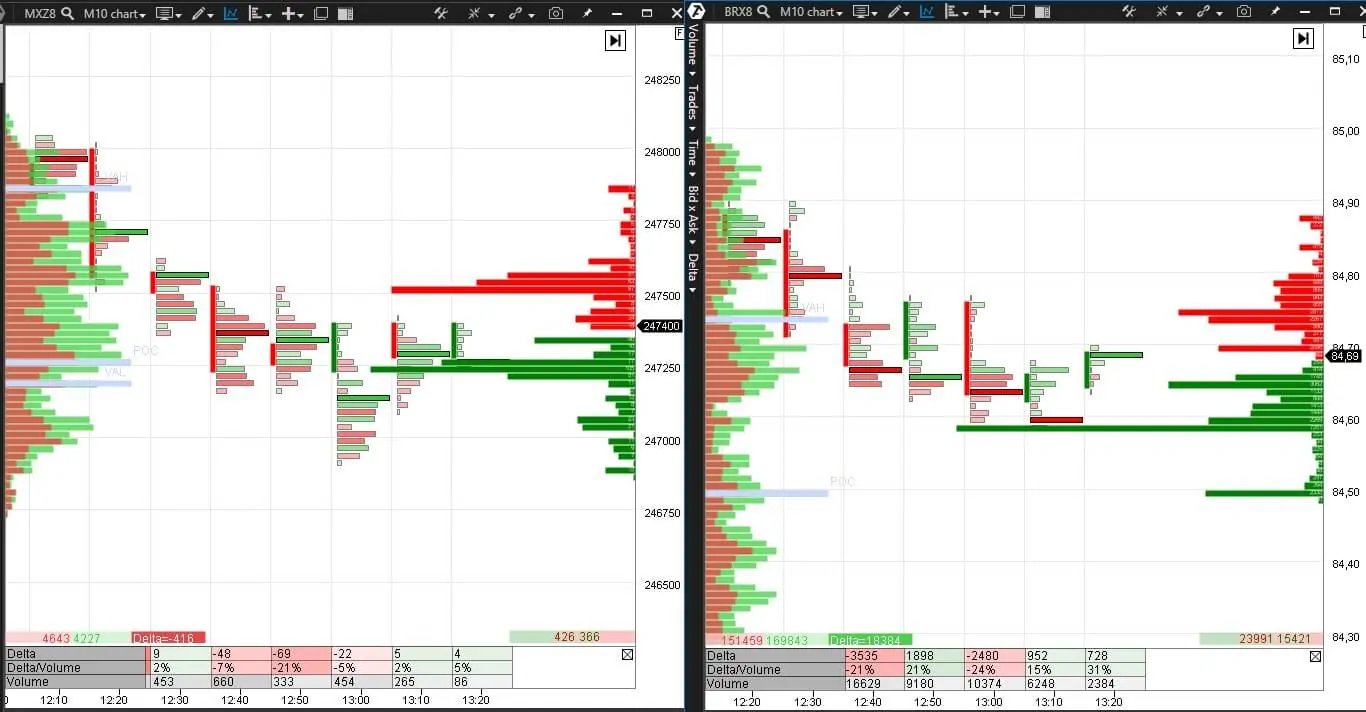

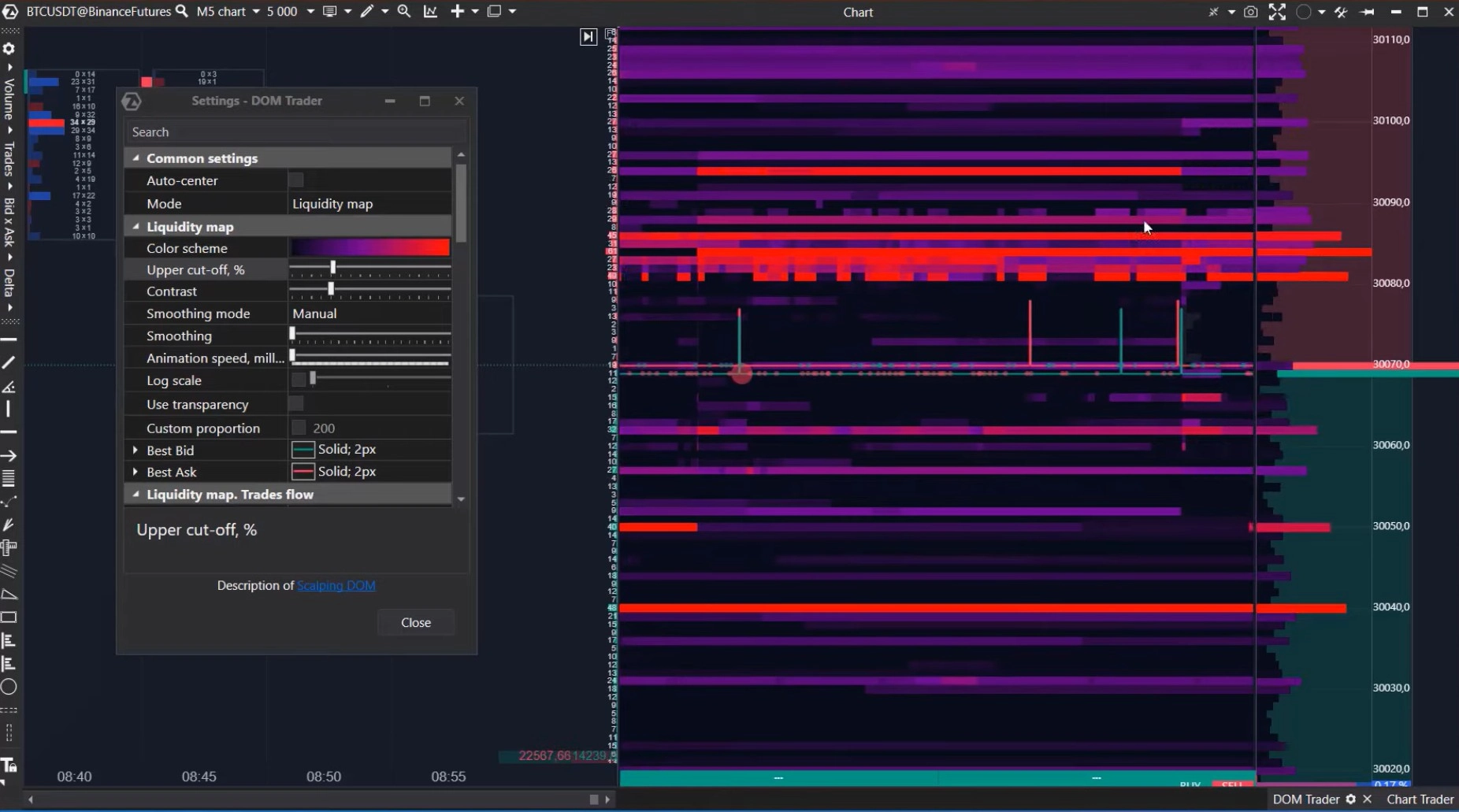

Analyzing bids and asks can be very useful in identifying price reversals. However, before delving into these concepts, let’s revisit the fundamental principles:

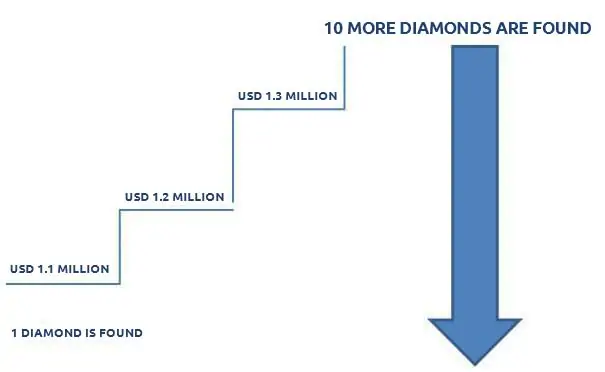

Supply is a quantity of goods a seller wants to sell.

Demand is a quantity of goods a buyer wants to buy.

The supply and demand law: “all other conditions being equal, the lower the price, the higher the effective demand is and the lower the supply is”.

In this article: