What Is ATAS?

ATAS is a powerful platform for analyzing market data and trading stocks, futures, and cryptocurrencies. It helps traders focus on key insights like order flow, volume, and liquidity in the order book, which reveal the balance or imbalance between buyers and sellers — key drivers behind price movements in financial markets.

ATAS enables you to:

- trade stocks, futures, and cryptocurrencies on 25+ top global exchanges;

- perform in-depth volume analysis using 70+ specialized tools;

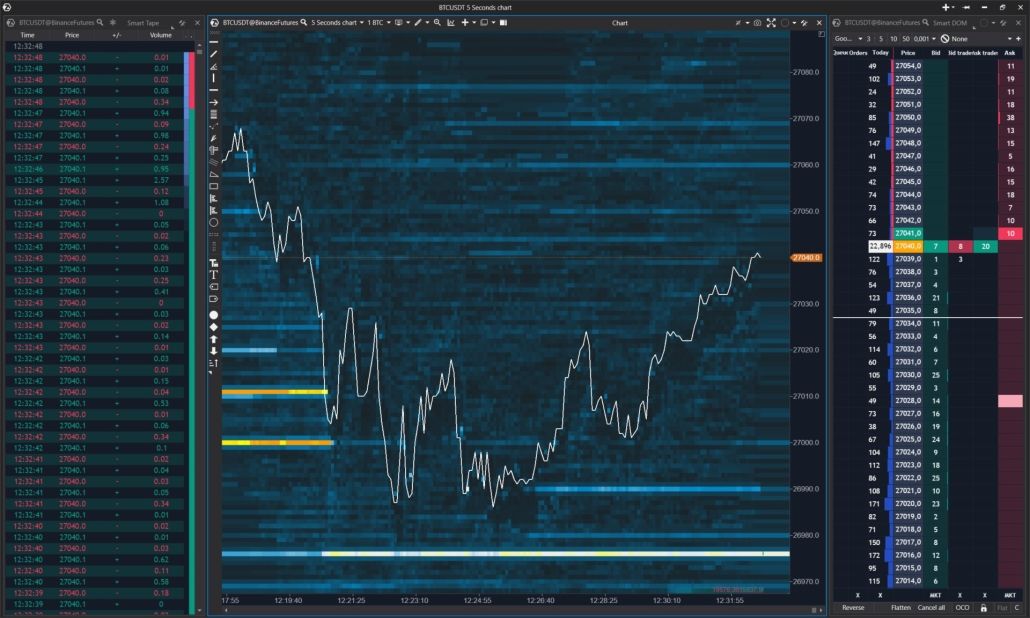

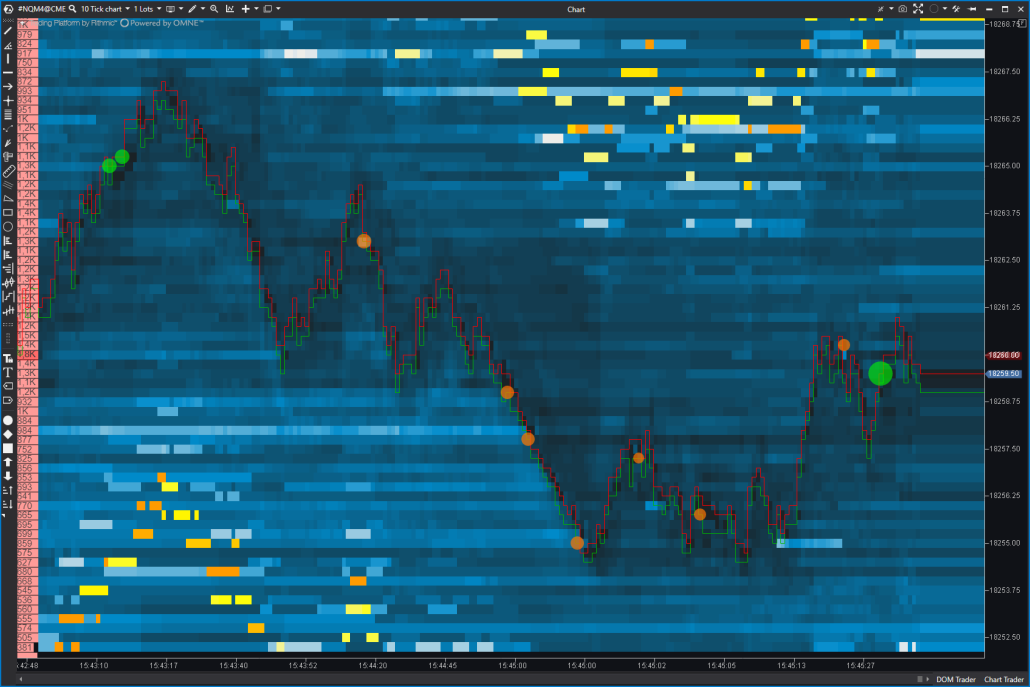

- use an advanced scalping software with a heat map;

- use both standard timeframes and alternative chart types to filter out market noise: Minute, Seconds, Tick, Volume, Delta, Range, Range X, Range XV, Range Z, Range US, Renko, Reversal, Order Flow, Cumulative Trades;

- combine 240+ indicators for technical and volume analysis to enhance the efficiency of your trading strategies;

- analyze historical data from 2012 for 2000+ instruments across 10+ exchanges;

- sharpen your trading skills with the Market Replay simulator.

The ATAS platform aggregates order flows from Time and Sales and Depth of Market, presenting the data in a clear, easy-to-understand format. You can apply different filters and customize your workspaces to fit your trading style.

The Quick Start page offers detailed instructions for beginners. By following this guide, you will be able to install the platform, connect your trading account, set up essential workspaces, and start trading in 6 simple steps.

Why Traders Choose ATAS

Charts without limits

ATAS offers unlimited possibilities for building and customizing charts:

- 400+ footprint configurations based on Volume, Delta, Trades, Bid x Ask data;

- 14 timeframes (including unique ones) for displaying price movements without market noise: Reversal, OrderFlow, Volume, Delta, Tick, Time, Renko, 5 types of Range, and more;

- 30+ drawing objects, including dynamic market profile, calculation of risk and position volume;

- trading directly from the chart, setting up exit strategies;

- full customization to your needs — colors, gradients, transparency, fonts, and more.

Unique indicators

240+ indicators for classic technical and volume analysis, with flexible customization and the option to set alerts:

- Delta, Cumulative Delta, Bid Ask, Cluster Statistic — for analyzing volumes in candles;

- Cluster Search – for working with clusters;

- Big Trades, Tape Patterns, Order Flow, Market Power – for working with order flow, tape;

- Dynamic Levels, Maximum Levels, Market Profile & TPO — for horizontal volume analysis, deep liquidity analysis;

- DOM Levels, DOM Power – to analyze the activity in the DOM and create heat maps of liquidity.

Connectors to major world exchanges

The direct connection ensures maximum speed and stability. Connect an unlimited number of accounts in one platform.

- connectors to CME Group, Nasdaq, Eurex and other US and EU markets;

- connectors for US shares;

- connectors to crypto exchanges, including Binance, Bybit, Bitget, and others;

- connections to leading data vendors: dxFeed and IQfeed;

- own ATAS demo server for risk-free strategy testing.

Your personal account information is entirely secure and stored in an encrypted form only on your PC.

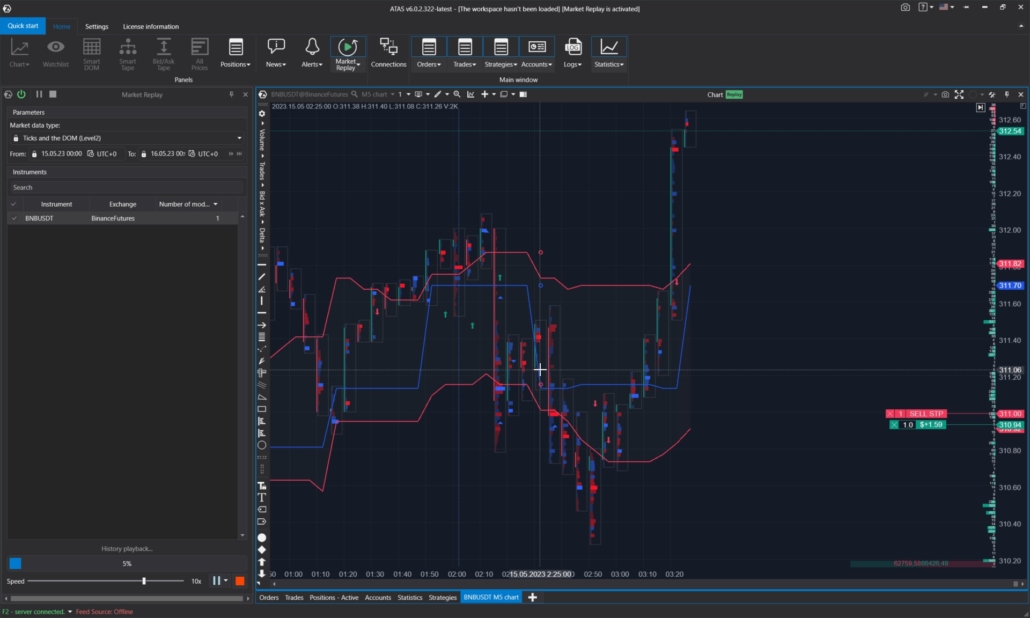

Market Replay

Market Replay is an emulator that recreates past trading activity in real-time. Figuratively speaking, this is a “time machine” in the trading platform with Play, Pause, Stop buttons:

- it replays the real flow of trades and DOM data, including cluster charts (Footprint) and non-standard timeframes;

- it replays a large number of instruments at the same time;

- it works with all indicators and modules of the platform;

- adjustable speed from x1 to x50 to save time;

- manual trading (or trading robots) on a demo account with results in the statistics module;

- it works even on weekends.

Learn to trade, test strategies or robots without risking real capital!

API

With the advanced ATAS API, you can enhance the platform’s tools with your own custom indicators, trading robots, or exit strategies:

- allows you to use all the possibilities of the C # language;

- gives access to unique categories of data, such as cluster content, aggregated trades, and volume profiles;

- provides the ability to manage access to your developments for other ATAS users through the personal account or a separate API.

If you have a well-thought-out concept for a new tool but lack programming skills, you can seek assistance from our developers to bring your ideas to life.

Caring technical support

The ATAS managers are ready to quickly assist with any questions you may have.

- A knowledge base with detailed instructions on how to set up and work with the platform’s tools;

- Live chat with support on the website, through Telegram, or via email for any inquiries;

- An active community of experienced traders on Discord and Telegram, where you can get advice;

- Regular blog posts and YouTube videos covering tool analysis and trading strategies.

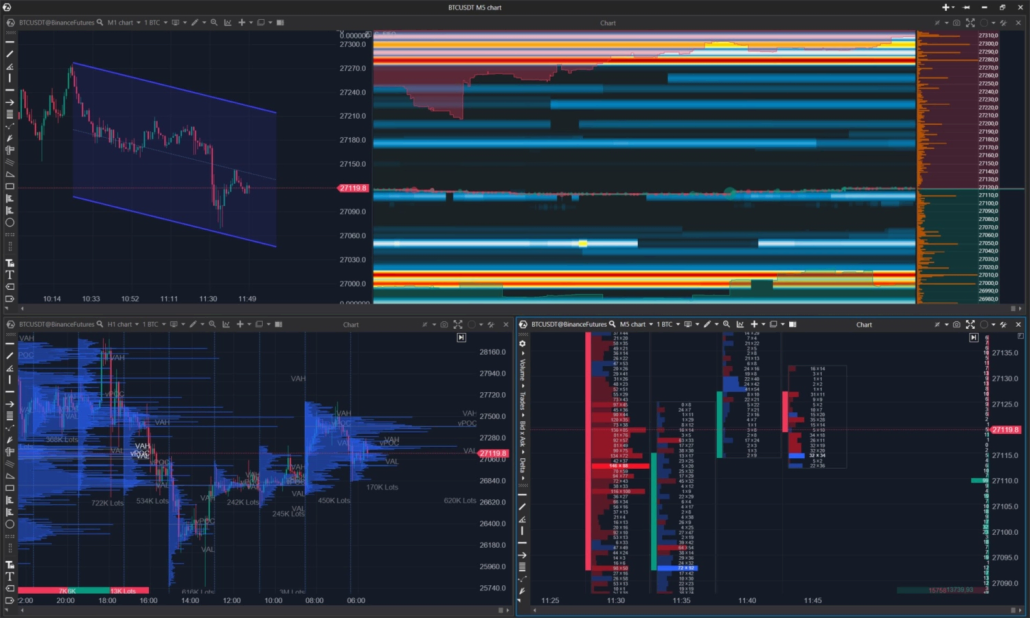

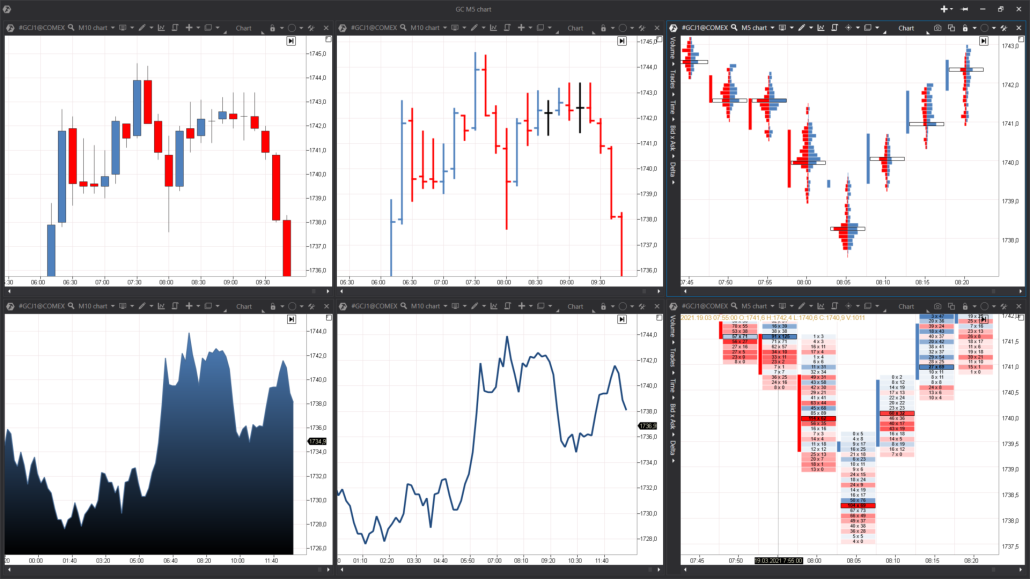

Charts, Frames and Convenient Workspace Organization

Get a trading advantage using the ATAS charts

Explore unparalleled flexibility of customization:

- charts in the bar and line format.

- candlestick charts – traditional and transparent.

- cluster charts – 400+ variations.

Study real-time and historical charts to understand in detail the dynamics between buyers and sellers.

Freedom of frame selection

Apart from standard time-frames, ATAS supports:

- various range types;

- renko bars;

- order flow charts;

- volume frames. For example, tick, Volume,Delta and others.

Efficient trading organization

You can work simultaneously with windows from different exchanges and multiple ATAS charts. No chaos in the workspace – Workspaces and Layouts will enable you to keep things in perfect order and quickly switch between instruments.

Keep respective charts, Time & Sales and order books in separate layouts. You can quickly switch between the layouts without waiting for the data to load from history.

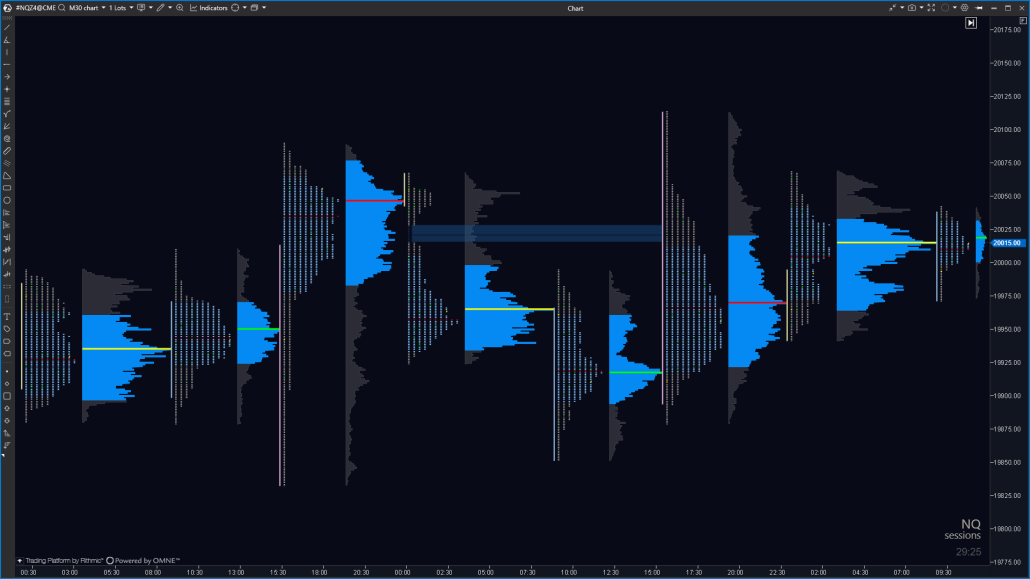

Universal profile

Market Profile is a unique way of organizing market data that reveals trends and price ranges. It shows where market participants have “agreed” on a fair price and where they have not, where an asset may be undervalued or overvalued.

Market Profile uses TPO Charts to display this data. Each TPO block represents the price and time when an asset was traded. Each time the price reaches a new level within the current period, a new TPO block is added.

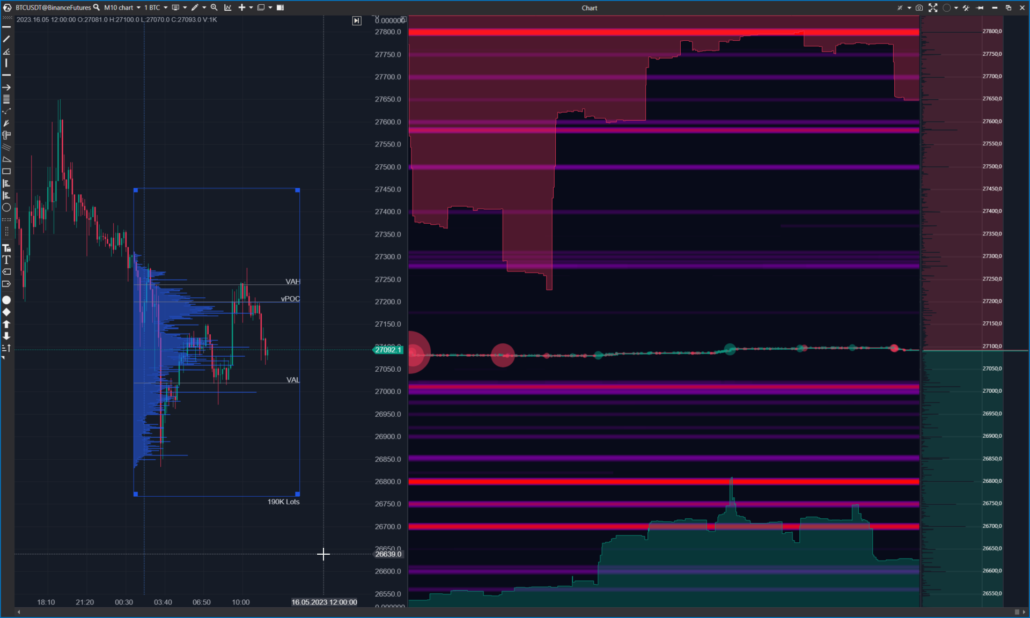

Volume Profile is a more advanced tool. It shows the volume traded at specific price levels, giving traders insights into when significant volume occurred and at what prices.

Drawing Objects

- 20+ classic drawing objects: trend lines, horizontal lines, Fibonacci, channels, and more.

- Graphical tools for advanced analysis: Anchored VWAP, Dynamic POC, CVD Correlation, Market Profile and TPO, Long/Short Position.

- Global Objects with the ability to add figures in a single click and manage them on all charts with the same instrument.

Volume Analysis Indicators

Indicators from the ATAS arsenal are reliable assistants for achieving success in the competitive exchange environment. Dozens of indicators are split into categories:

- BidAsk, Delta and Volume – for analyzing vertical volumes.

- Clusters, Profiles and Levels – for analyzing profiles (horizontal levels).

- Commitments of Traders – for analyzing COT reports.

- Order Flow – for working with the flow of executed trades.

- Technical – classical technical analysis indicators.

- Other.

The list of available indicators is constantly enhanced, and their functionality is improved with each update.

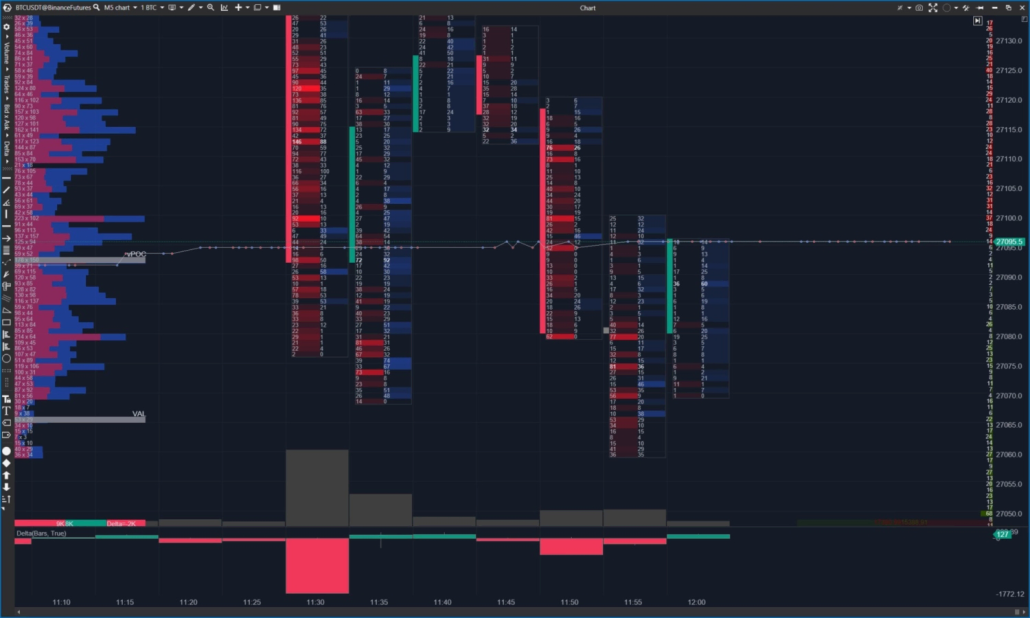

Cluster Statistics

Receive comprehensive information about the structure of vertical volumes for each bar.

Big Trades

All big trades are clearly visible due to the wide indicator’s functionality.

Volume

The volume histogram shows the activity of trade execution for every period.

Cluster Search

Analyze cluster data with a flexible filter system to identify breakouts/pullbacks, volume accumulation/distribution, and support/resistance level confirmations.

Market Profile & TPO

Use this powerful tool to build Volume and TPO profiles for specified periods, identifying value areas, single prints, initial balances, and much more.

DOM Levels и DOM Trader

Use effective scalping tools to identify liquid support and resistance levels. The heat map built into the indicators is created for visual analysis of price interaction with the levels of large orders in the exchange stack.

Dynamic Levels

Dynamic Levels show the changes in Volume POC and Value Area over time.

Track how volumes accumulate and how the value area shifts over any period.

Maximum Levels

Maximum Levels display the current day’s, week’s, month’s, and contract’s Point of Control (POC) as horizontal lines.

Tape Patterns

Process and filter raw order flows to identify patterns, algorithmic footprints, and trade chains based on various criteria.

Cumulative Volume Delta (CVD)

Analyze accumulated delta over a specific period. Unlike classic delta, which shows the difference between buys and sells for each bar, CVD reveals the overall dynamics of the buy and sell balance over the chosen period.

CVD pro / Market Power

Analyze the trading activity of traders dealing with specific volumes using the advanced cumulative delta indicator.

Monitor the correlation (or lack thereof) between the direction of trades of certain sizes and the price movements.

Speed of Tape

Analyze the intensity of trades on the exchange to find support/resistance points. This indicator highlights bars with high trade speed.

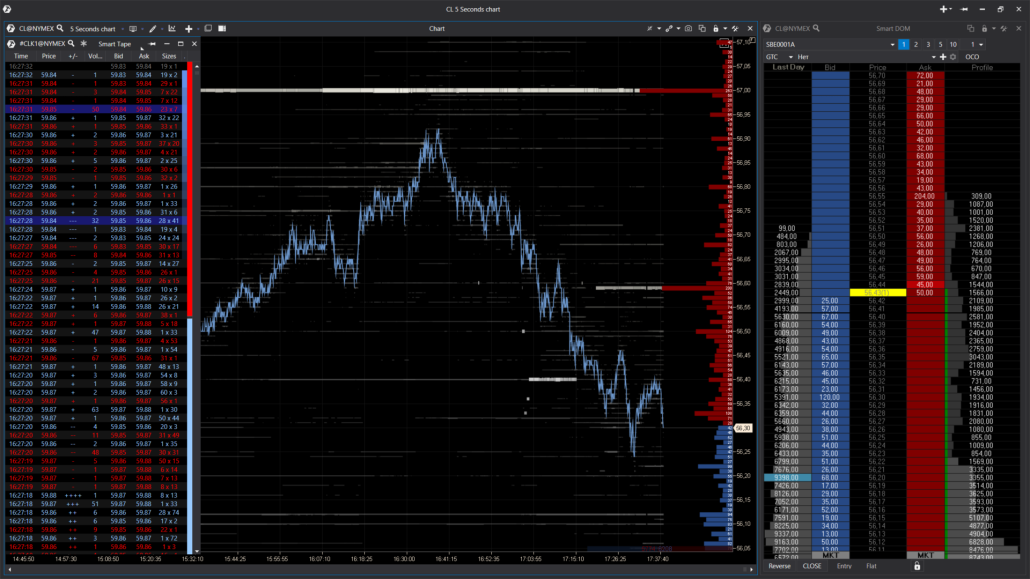

Liquidity and Order Flow Analysis

Algorithm of trade aggregation is a unique development of the ATAS team. You can see real big trades rather than a series of small transactions that come from the exchange.

Thus, the Smart Tape and Smart DOM are presented in a more user-friendly and clear format, making it easier for you to track the activity of major players. It helps you to ‘unveil’ the hidden motives of market leaders.

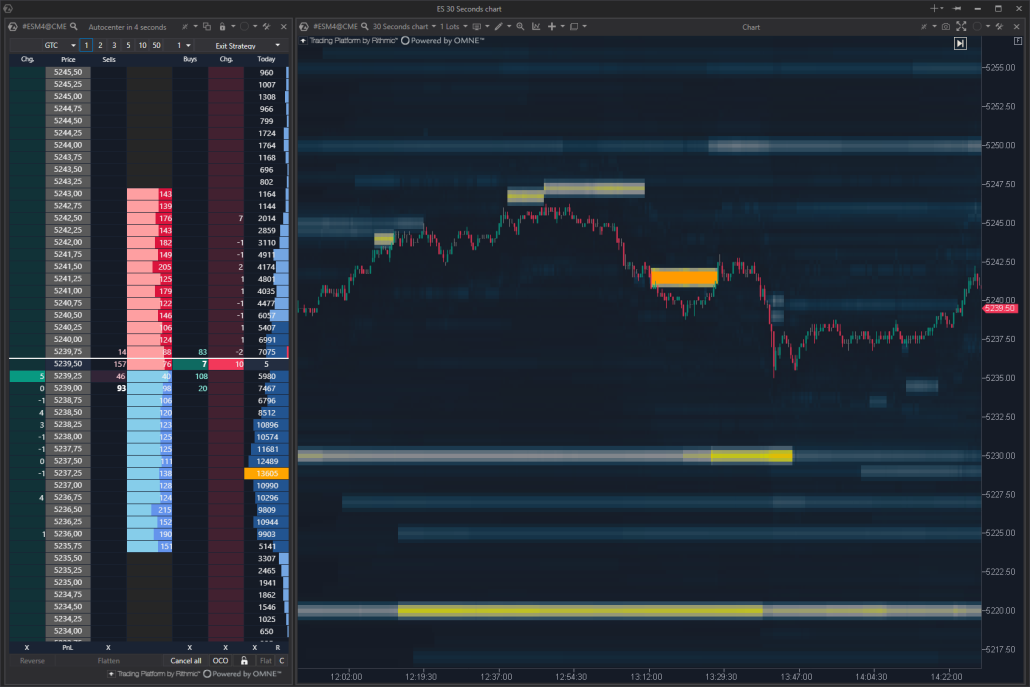

Smart DOM (Depth Of Market)

Smart DOM (Order Book) is not only a powerful scalping tool but also an instrument for analyzing limit orders.

Some advantages of the module include:

- working with the full depth of the order book and scaling for cryptocurrencies;

- displaying the placed order in the order queue;

- visualizing traded volumes at each level;

- spoofing detector (identifying order manipulation in the order book);

- innovative method for detecting high-frequency algorithms (HFT);

- template designer to create and save custom order book layouts for any purpose.

The platform also features our proprietary indicators that help assess the dynamics of the order book directly on the price chart: DOM Levels, Scalping DOM, and DOM Power.

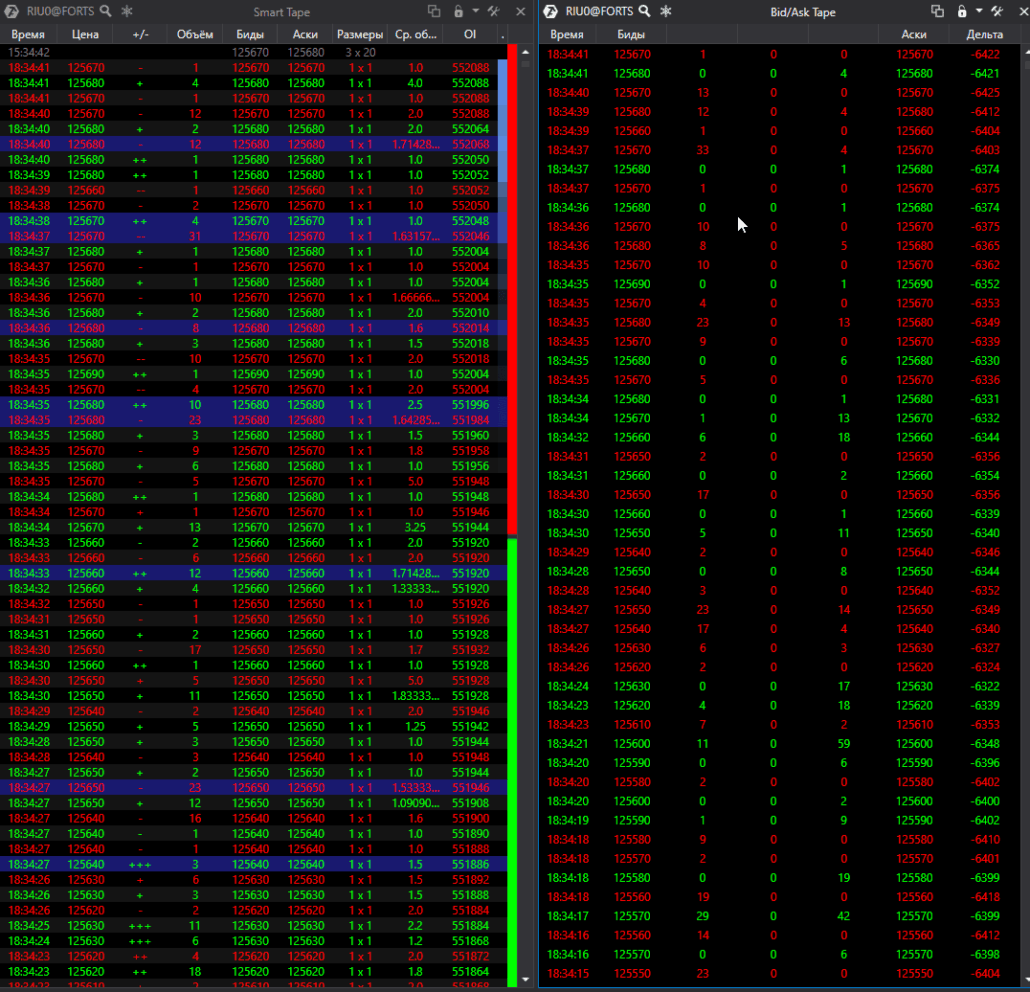

The unique Smart Tape algorithm

An enhanced version of the classic tape for order flow reading in the market:

- print aggregation — a unique proprietary algorithm that reveals the actual size of aggressive market trades;

- filter separates and tracks actions of large and small players;

- Open Interest (OI) indicates money inflows or outflows in the market;

- Buy/sell strength indicator shows the balance or imbalance between bulls and bears;

- Tape speed indicator displays surges of activity or lulls in the market;

- history mode enables you to analyze the trade flow at any specific time interval;

- templates for saving your favorite tape settings.

Use proprietary ATAS indicators to visually assess the order flow directly on the price chart: Orderflow, Speed of Tape, Big Trades, and more.

Heat Map

A heat map is a way to display activity in the DOM over time. The brighter the color of a price level on the chart, the larger the volume of limit orders placed at that level in the DOM.

Use the heat map in ATAS indicators for:

- scalping;

- finding more accurate entry points – minimize the risk.

Bid Ask Тape

The Bid/Ask Tape (Spread Tape) is a specialized tool that shows bid and ask volumes at each price level. It is organized in columns, where each line shows the details of a separate trades:

- the left column shows the precise time of each trade, down to the second;

- next, it lists the bid price at the trade time;

- the following column shows the volume of market sells (Bid);

- then, the volume traded within the spread (between bid and ask);

- the volume of market buys (Ask);

- the ask price at the trade time;

- the delta value.

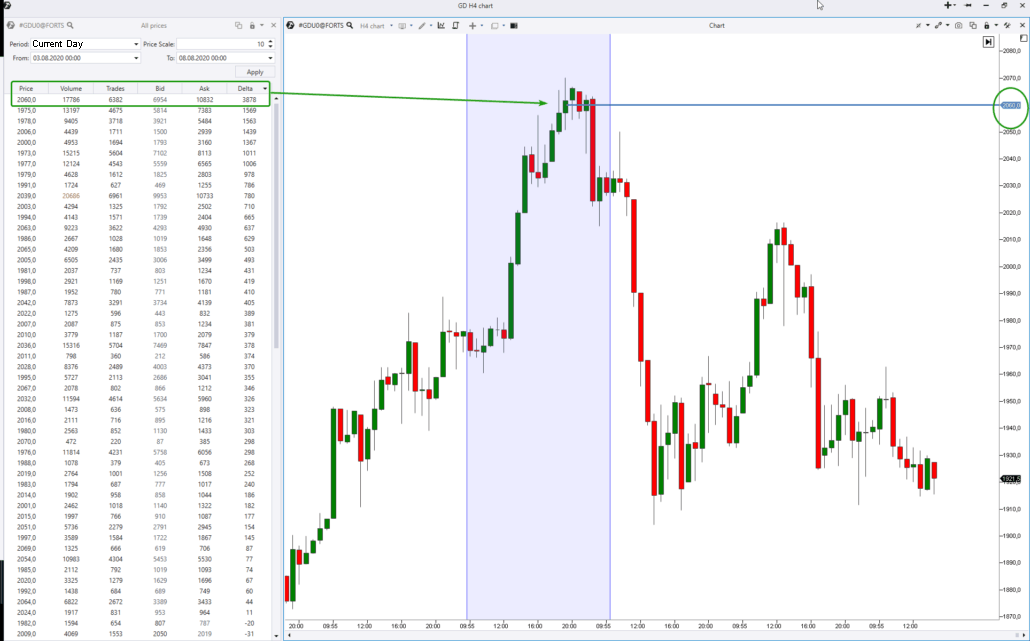

All Prices

All Prices is a module that displays horizontal volume levels based on the price scale for specified time intervals. These values typically serve as strong support and resistance levels.

The columns show:

- Price level;

- Volume – the number of contracts traded at this level during the selected period;

- Trades – the number of transactions completed at this level over the selected period;

- Bid – the number of market sell orders;

- Ask – the number of market buy orders;

- Delta – the difference between Bid and Ask.

МВО DOM

The indicator creates the order book using “Market by Order” data — information from the exchange about the volumes of individual orders. You could see the orders that make up each exchange level, including their volumes and the order in which they were placed.

You can analyze detailed information for each order:

- the price and volume;

- time of the last change for that order (regardless of the level)

- its ID;

- its execution priority in the queue.

Convenient Trading and Flexible Settings

All for efficient position management

- Open trades, manage positions, and orders directly on the chart.

- Enhanced DOM for quick trading and advanced analysis.

- Hotkeys and drag-and-drop modification of orders.

An advanced Chart Trader

- Send buy/sell orders.

- Selecting the order price – by market, Bids or Asks.

- Cancel available orders.

- Close/reverse available positions.

- The module for crypto enables you to manage the order currency, leverage, margin mode, etc.

Exit strategies

- Automate risk management and position management with flexible settings for Stop Loss, Take Profit, Breakeven, and Trailing Stop.

- Set and update Stop Loss and Take Profit directly on the chart using the position marker.

- Automatically cancel pending orders when a position closes or reverses.

Market Replay

Market Replay is a simulator that uses historical data, including Level II, to emulate the course of trading in cryptocurrencies, stocks, and futures:

- practice your skills of reading cluster charts;

- create new strategies and/or improve existing ones;

- practice until achieving automated precision in trade entry and exit;

- increase psychological stability, learn to control risks and manage capital more effectively;

- analyze errors and find ways to eliminate them;

- test trading robots.

Following Manager

Create a unified control center for your accounts within the ATAS platform. Regardless of brokers, exchanges, and trading style you choose, you can effectively control positions by collecting all accounts in one portfolio.

Trade on your primary account, and all your actions will be automatically replicated to other accounts — just activate the Following Manager to copy orders and positions.

Detailed Statistics

Visualize your performance, track your progress, and eliminate mistakes to trade profitably all the time. Evaluate your progress by various metrics:

- profitability;

- loss sizes (drawdowns);

- efficiency depending on periods;

- paid commission fees.

Custom Balance in ATAS SIM

- Demo server allows you to test trading strategies without risking real capital.

- You can set your preferred balance in ATAS SIM and practice trading with any starting capital, starting from $10,000.

Unlimited customization possibilities

Being different is an important concept for survival in the financial markets. Therefore, ATAS provides maximum flexibility of settings. You can customize:

- alerts;

- news background;

- hotkeys;

- time zones;

- platform language;

- light and dark modes;

- gradients of a heat map and chart’s background.

Customizable workspaces

A unique workspace that best suits your individual needs. You can easily customize:

- Workspace;

- Layout;

- Template;

- Combination of several charts and windows.

Learning

The “Learn” section of the platform offers a visual guide to the main modules and tools. You will also find free trading books that explain the basics of Market Volume and Profile concepts, cluster chart analysis, and tape settings.

For a more in-depth introduction to ATAS’s features and settings, check out the Quick Start section.

Additionally, ready-made chart and indicator templates are available to help you quickly set up the platform.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision.