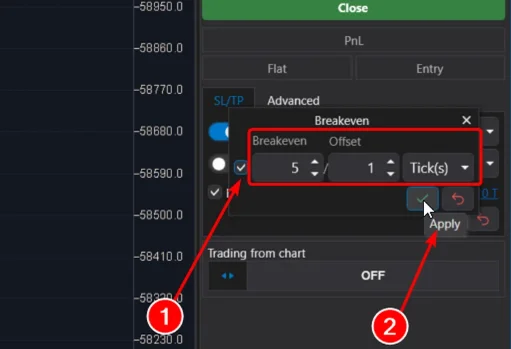

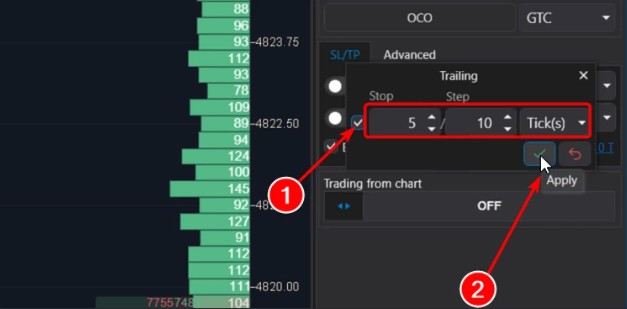

Can a trailing stop and breakeven be used simultaneously?

Technically, it is possible. ATAS will systematically execute commands embedded in both functions as conditions are met. However, it is not entirely logical, so we may recommend choosing one or the other. Otherwise, there is a possibility that with certain settings, these functions may conflict and disrupt the system’s consistency. When using both a trailing stop and breakeven simultaneously, it is important to have a clear understanding of why this is done and how the system will operate under different price behavior scenarios.

Is it necessary to set stop-loss orders?

A position can be opened without a stop-loss. Technically, when a position is opened, it does not have a stop-loss. Setting a protective order is not mandatory, but highly advisable, as it will prevent critical scenarios where capital may be either completely destroyed or irreversibly reduced.

What are mental stop-losses?

This is for experienced traders. They closely monitor the market while keeping in mind the levels of mental stop-losses. When these levels are reached, traders conduct an analysis considering new data and decide what to do next: either manually close (reduce/increase) the position, continue holding, or choose another option. This adds flexibility, eliminates the risk of stop-loss being triggered by a volatility spike, but leaves open the scenario with catastrophic consequences. Use mental stops only when fully aware of everything you are doing.

What are mathematical stop-losses?

In simple terms, this is when a trader sets a stop-loss not based on an extreme point, a level of significant volume, or any other element of the chart, but by using a formula. A simple example is a stop-loss set at 0.1% of the asset’s price from the entry point.

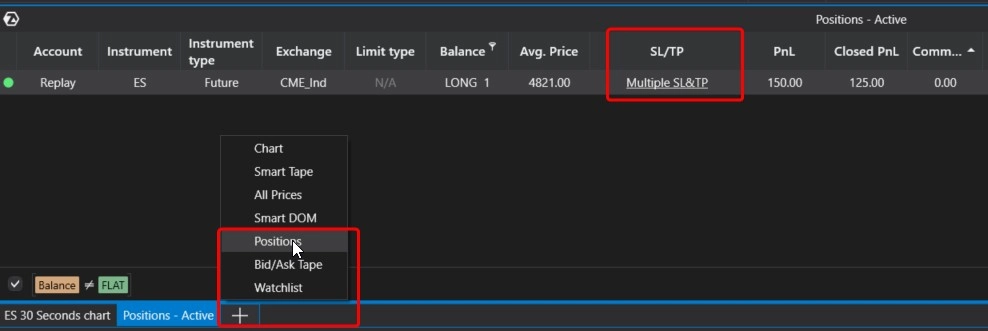

Can stop-loss and take-profit orders be saved when restarting ATAS?

Yes, since the beginning of 2024, SL/TP orders can be saved after restarting the platform.