Bitcoin. What you should know about the main cryptocurrency

Bitcoin (BTC) is the first cryptocurrency, which was invented in 2008. The Bitcoin inventor is an unknown person (or a group of people) under the name Satoshi Nakamoto.

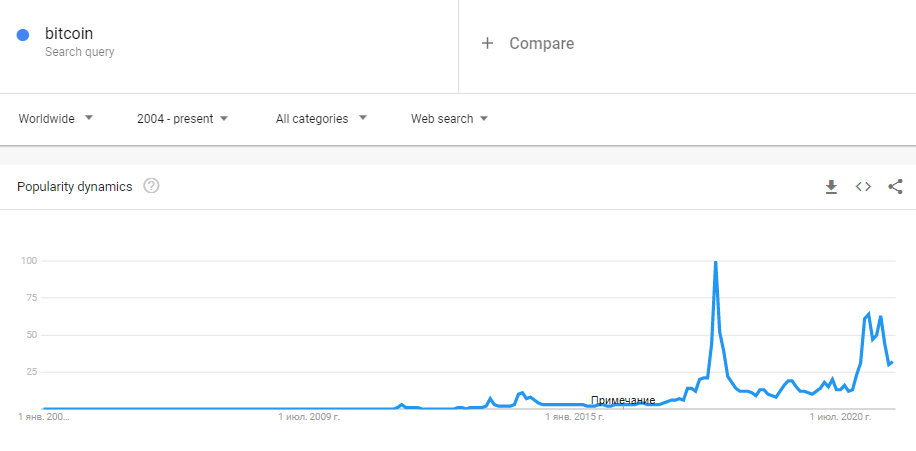

Very few people knew about cryptocurrency in 2009, but the Bitcoin popularity grows every year. More and more people get interested in it, financial mass media cover every new rise and sharp fall of the BTC/USD exchange rate with enthusiasm, and the coin itself becomes an integral part of the modern financial world. Thus, the Bitcoin futures have been traded on the CME since the end of 2017, more and more companies accept payments in cryptocurrency and El Salvador became the first country in the world in June 2021, which officially declared Bitcoin as a payment instrument.

The present article is for novice traders and it will answer the most popular questions about the main cryptocurrency in simple words:

- what Bitcoin is;

- what blockchain is;

- what mining is;

- where to learn the current Bitcoin rate;

- what Bitcoin capitalization is;

- where to take Bitcoins free of charge;

- where to buy or sell Bitcoin;

- how to use Bitcoin;

- how to invest in Bitcoin;

- how to trade Bitcoin.

If some of your questions are not answered, you can ask them in the comments. One more thing. You will find names of various resources and companies in the article. We do not impose any products or services on you. While reading the article, you agree that you make your own decisions about cryptocurrencies and take full responsibility for them.

What Bitcoin is

Bitcoin is a decentralized digital currency, which you can buy, sell or exchange directly without intermediaries, such as banks. When inventing Bitcoin, Satoshi Nakamoto noted the existence of a need for ‘an electronic payment system, based on cryptographic proof’.

Every coin transaction, which was conducted once, exists in a publicly available book, which makes its cancellation and forgery difficult. The inventor’s idea was that Bitcoin has a decentralized nature, which means that the coins do not depend on governments or any issuers.

It means that:

- Bitcoin uses the peer-to-peer (P2P) technology – a computer network, based on equal rights of participants;

- nobody controls Bitcoin;

- the system has an open source code and its architecture is known to all;

- transactions are executed without intermediary banks;

- the issue is carried out by all network participants, but the total number of Bitcoins is limited to 21 million of coins;

- any person can become a part of this network.

Usually, the Bitcoin symbol is letter ‘B’ with two vertical strokes.

What the blockchain technology is

Bitcoin is built on a distributed digital registry, which is called ‘blockchain’.

As it is clear from its name, blockchain is a bound data array, consisting of elements (called blocks), which contain information about every transaction, including date and time, amount, information about a buyer and a seller and also a unique identification code for every transaction. The information is grouped in chronological order, forming a digital chain of blocks.

After a block is added to the chain, it becomes available to all who want to look through it, serving as a public registry of cryptocurrency transactions.

It is like a Google Doc, which anybody can work with. Your copy is refreshed while different people renew it.

The idea that anybody can edit blockchain may seem risky. However, in fact, this feature makes this technology reliable and safe. For a block of transactions to be added to the chain, first of all, it must be checked by network participants, and unique codes, used for identification of wallets and transactions, should correspond with a correct encryption template.

These codes look like long random numbers, that is why it is difficult to generate them by illegal means. It was calculated that a forger, who tries to find out your wallet access code, has approximately the same chances as a person who wants to win the Powerball lottery nine times in a row. Such a level of statistical randomness of block chain verification codes, which are required for every transaction, significantly reduces the risk of somebody carrying out fraudulent transactions with Bitcoins.

What mining is

In simple words, mining is the network support.

Miners:

- keep copies of the blockchain network making it more reliable;

- confirm and check transactions.

In order to make miners perform their work, the code envisages a reward. This is how new coins appear. Besides, the Bitcoin mining complexity increases and reward decreases in the course of time.

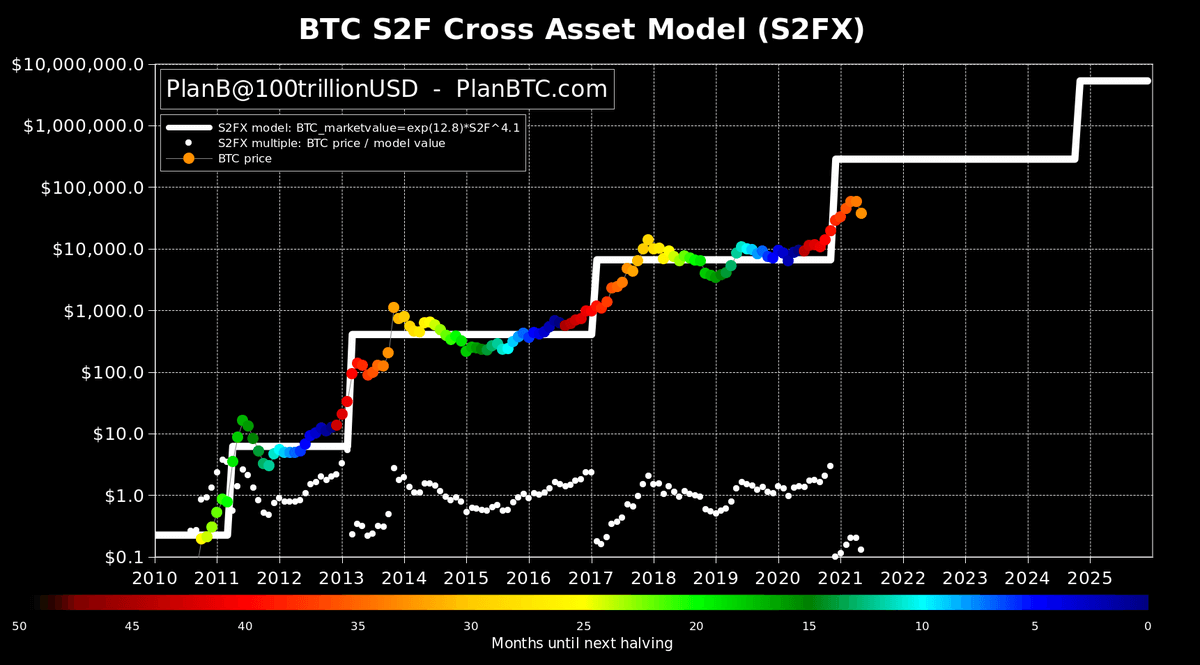

Decreasing the miner reward size for adding a new block into blockchain is called ‘halving’. The first halving took place on November 8, 2012, and the second one – on July 9, 2016. The third halving (the last one at the moment of writing the article) took place on May 11, 2020. It was noted that approximately 1.5 years after each halving the BTC/USD rate set a new record. The chart below clearly shows it.

Today, successful Bitcoin mining requires powerful computers and access to a huge amount of cheap electrical energy. Mining activity can even influence energy consumption at the country level. For example, the State Grid Corporation of China made an official demand on all its customers in July 2021 not to use electricity for mining any cryptocurrency in all country regions.

Huge mining farms (see the photo above) were forced to move to other countries.

According to some estimates, all Bitcoins will come into circulation by the year 2140, which means that miners, probably, will have to rely on a transaction commission only.

Where you can learn the Bitcoin exchange rate

Our article Useful resources for crypto-traders contains a link to a historical BTC/USD chart, where you can view the Bitcoin rate for 10 years and see its lowest value in December 2009, when USD 1 was worth approximately BTC 1,600.

The Bitcoin value hugely increased since then. The BTC/USD rate exceeded USD 60,000 per one coin in 2021, making the investment in Bitcoin the best one of all time.

In order to find out the current BTC/USD exchange rate, you need just to google the search query like ‘current Bitcoin value’ and you will see the current rate immediately.

The search engine allows getting the current BTC/USD rate data immediately but they are insufficient for a high-quality assessment of the Bitcoin rate dynamics and application of some methods of market analysis.

In order to get actual data about the current Bitcoin, Ethereum and other digital asset current prices directly from cryptocurrency exchanges, you can download the professional ATAS platform. You can use it free of charge for working with cryptocurrencies and it allows you not only to receive quotations, but also to analyse the market with the help of cluster charts and execute Bitcoin and other asset buy and sell transactions.

What Bitcoin capitalization is

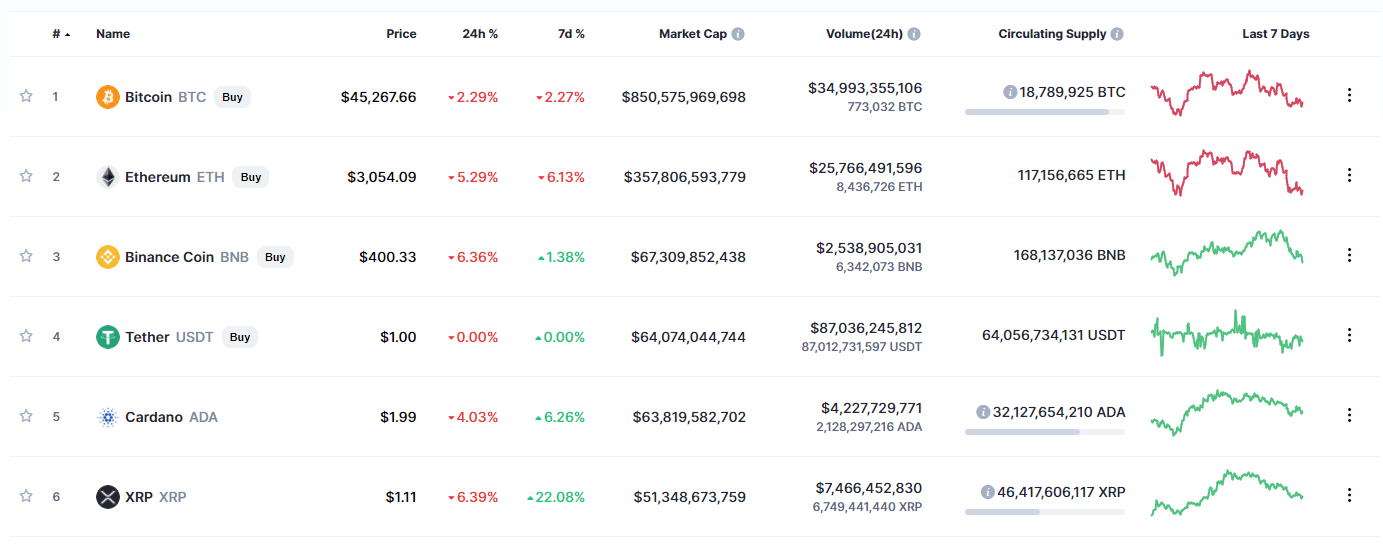

The Bitcoin capitalization changes every minute. In order to learn the current value, you can visit the coinmarketcap.com web-site, which stands for Coin Market Capitalization. It shows capitalization data for Bitcoin, other 6,000 cryptocurrencies (available at the moment of writing the article) and also for the whole crypto-market.

Bitcoin is the first one in this list but, quite possible, it will not be like this all the time. The chart below shows the degree of Bitcoin domination in the general cryptocurrency market. The BTC share was close to 100% before 2017.

However, the industry development and ICO boom in 2017 put a significant competitive pressure on Bitcoin, the share of which was in the range of 40%-70% during the following years. The main Bitcoin chaser is Ethereum.

Where to take it free of charge

We described 10 methods of making cryptocurrencies in our Making cryptocurrencies article. However, is it possible to get BTC free of charge? We mean – absolutely free.

Probably, it is not possible.

However… in some cases you can get a cryptocurrency, which can be converted into Bitcoin, without much pain.

Here are some variants in brief:

- Connect your computer to a mining platform. Your computer will be performing some calculations when you do not use it. The mining platform will put some reward for this in the form of cryptocurrencies into your wallet, located on the mining platform.

- Participate in promotions. You can share relevant news and distribute information about the companies, which are connected with cryptocurrencies, in social networks and get a reward for this. It includes airdrops – activities, when new cryptocurrency projects hand over their coins trying to gain recognition.

- Receive bonuses from cryptocurrency exchanges. Competition among exchanges is high, that is why you can get money just for registration and/or replenishment and you can increase your reward through attracting referrals.

- Lend money. If you have the cryptocurrency, you can lend it and make 7% annual.

Be careful. There are many forgers in the cryptocurrency industry and if you try to make a cryptocurrency free of charge, you can be involved in a fraudulent action.

Trying to get Bitcoins free of charge, you can be disappointed and waste a lot of your time and effort. That is why, it is quite possible that you will decide in the end that the best way to have BTC is to buy it.

How to buy Bitcoin

There are several common ways to buy Bitcoin:

- Through a currency exchange office.

- Through a cryptocurrency exchange.

- Through a broker.

- Other ways are: fintech startups and payment services.

Before you consider these variants, it’s necessary to understand that you will need a digital wallet for keeping Bitcoins. It can be a so-called hot or cold wallet:

- Hot wallet (it is also called an online wallet) is provided by an exchange or another organization, which provides cryptocurrency services.

- Cold wallet (or a mobile wallet) is an offline device, which is used for keeping Bitcoins without connecting to the Internet. This variant is considered to be more secure.

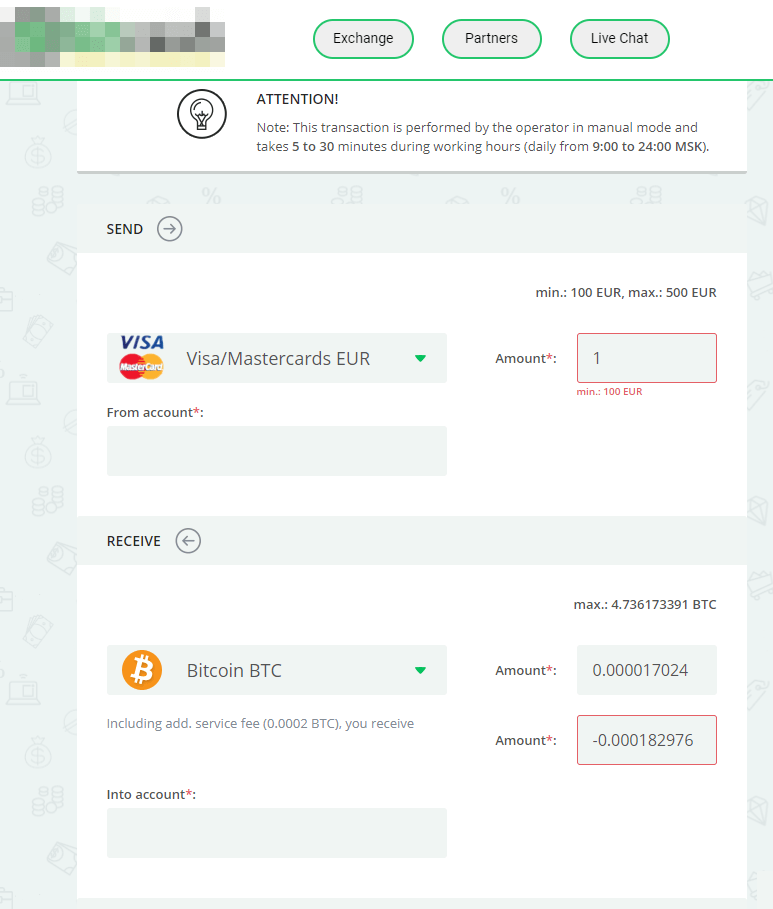

Variant 1. In order to buy Bitcoin through a currency exchange office, you just need to spend some time in the search engine. You can google currency exchange aggregators, which compare BTC/USD rates in various currency exchange offices for you to find the most profitable one. An example of a currency exchange office interface is in the picture below.

The advantage is that these exchange offices provide profitable rates for buying Bitcoin and many exchange directions, while the disadvantage is in high risk, since it may happen that an exchange office, which has worked for many years and has a big number of positive comments and reviews, will turn into a scam (fraudulent project) one day. By the way, exchange offices can also be used for selling Bitcoins for Roubles or another currency easily and quickly.

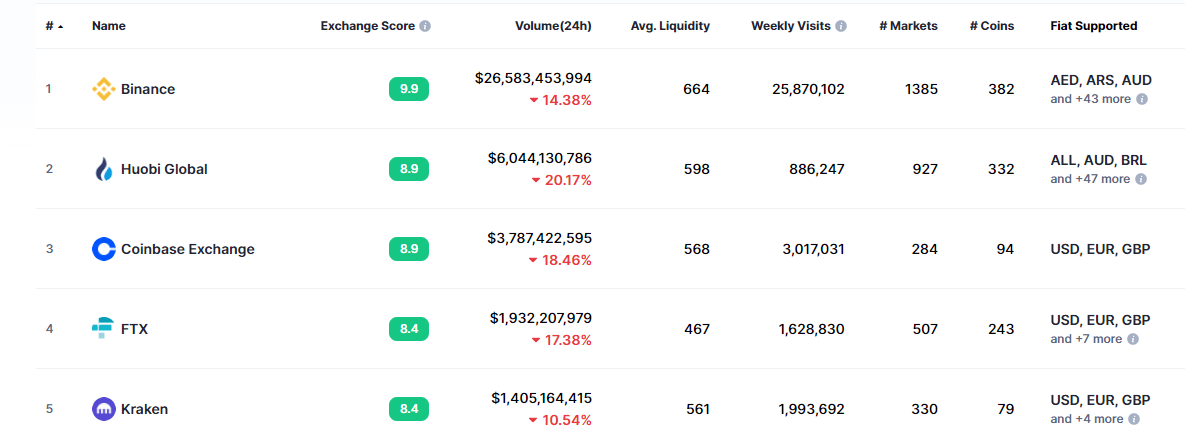

Variant 2. Buying Bitcoins through a cryptocurrency exchange is less risky, since a cryptocurrency exchange is a more reputable organization than a currency exchange office. The Coinbase cryptocurrency exchange stock, for example, is even traded on Nasdaq. Exchanges provide a possibility to buy, sell and keep a cryptocurrency. Creating a personal account sometimes is similar to opening a brokerage account – you will have to identify yourself and provide some source of financing, for example, a banking account or a debit card.

According to Coinmarketcap, the most popular (at the moment of writing the article) cryptocurrency exchange in the world is Binance. Operations with cryptocurrencies are performed for more than USD 20 billion every day and you can buy Bitcoins there for more than 40 fiat currencies (the currencies we are used to, issued by central banks in different countries – Dollars, Euro, Roubles, Yens, etc.).

Buying Bitcoin through an exchange not only has a low risk but also many benefits (bonuses, promotional programs and a wide selection of assets; you do not need to look for places where you can sell Bitcoin). The only difficulty you may face is that cryptocurrency exchanges have complex interfaces.

Variant 3. Buying Bitcoins from a regular broker – it is an unobvious but safe variant. Example of such a broker is Robinhood.

If you have a brokerage account for trading stocks and futures, you can ask your broker about the possibility of buying a cryptocurrency. This practice is becoming more and more popular.

Variant 4. Buying Bitcoin through a payment service or fintech company

Fintech is an industry of financial technologies aimed at improving and automating financial services. For example, the Revolut fintech company from London allows buying Bitcoin and other cryptocurrencies. The company was founded in 2015 and submitted a request for a banking license in 2021.

Fintech companies also provide a possibility to buy Bitcoin through a bank transfer.

Works on cryptocurrency introduction were started in 2021 by Mastercard and Visa. The PayPal web-site also contains an offer to buy Bitcoin.

It was announced in August 2021 that PayPal opens about 100 vacancies for positions connected with cryptocurrencies. Dan Schulman, the PayPal CEO, said:

We are still happy with the dynamics, which we see in the cryptocurrency sphere and, obviously, we introduce additional functions into it.

It seems like we are at the threshold of the future when we can buy Bitcoins as easily and routinely as we pay for the Internet today.

In our ATAS team, we do not claim the completeness of the overview of all possibilities, which are available for buying Bitcoin. And, before we finish this section, we will present a brief FAQ about buying Bitcoins:

- Is it possible to buy a part of Bitcoin? Yes, it is. The coin is expensive but you can buy a Bitcoin fraction. The smallest Bitcoin fraction is Satoshi. It is named after its inventor, which is quite symbolic and, sort of, resembles portraits on fiat banknotes and coins. Satoshi is a one hundred millionth fraction of Bitcoin (SAT 1 = BTC 0.00000001). Use the BTC to USD calculator to find out how many Bitcoin fractions you can buy for your money.

- Do you pay a commission when you buy Bitcoin? Yes, you do. A commission is usually a small percentage of a big transaction, but it can be really higher when a transaction is small.

- How much time does it take to buy Bitcoin? It is not a momentary process like, for example, buying stock. Since Bitcoin transactions have to be checked, you will need at least 10-20 minutes to see Bitcoins in your wallet.

- How to buy Bitcoin profitably? This requires patience, knowledge of financial market analysis and a bit of luck. Then, perhaps, you will be lucky to plan and obtain a Bitcoin purchase result at one of the lows.

How to use Bitcoin

Main variants of using Bitcoin:

- payment for goods and services;

- international transfers;

- means of investment;

- market for speculating.

We will discuss how to trade and invest into Bitcoins, but, first of all, we will focus on Bitcoin as a means of payment for goods and services.

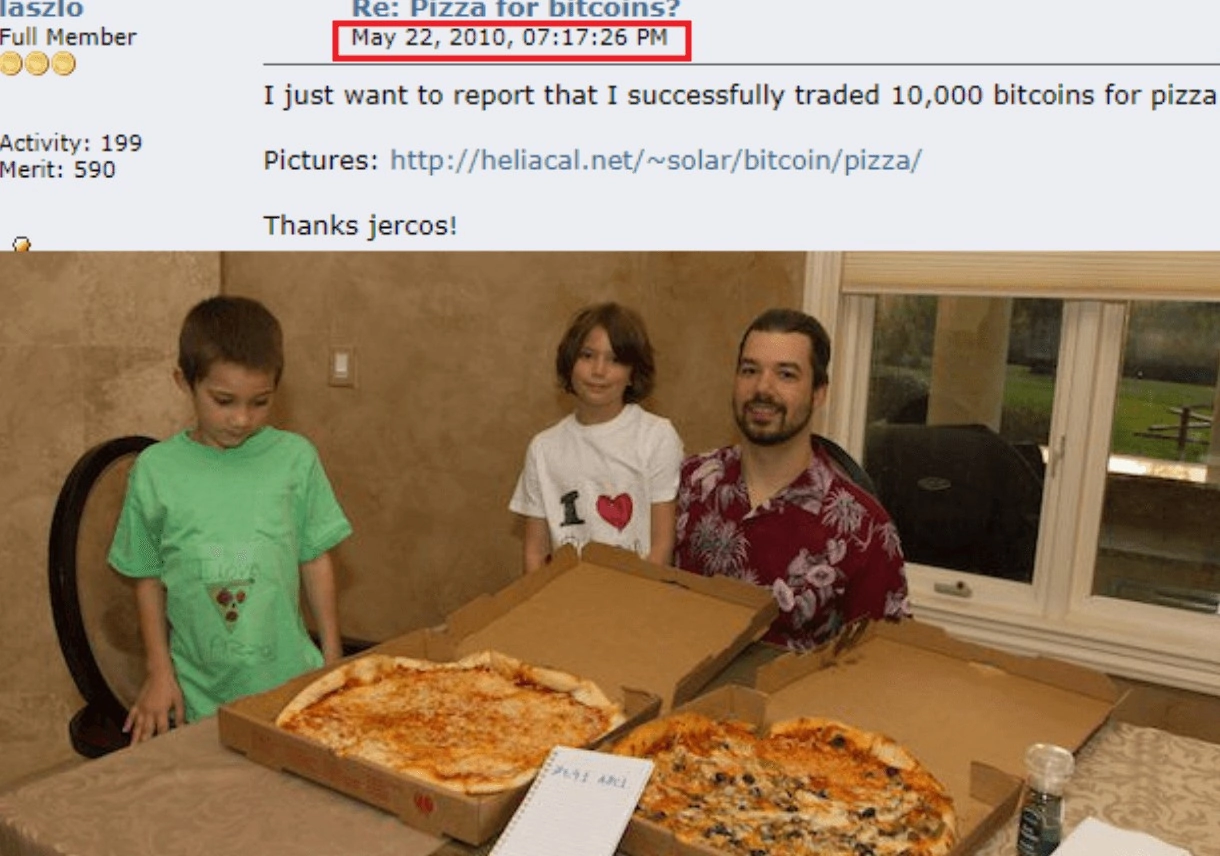

Indeed, by default Bitcoin is a money unit, for which you can buy something. It is believed that the first (in history) real purchase of real goods for Bitcoins was performed by Laszlo Hanyecz on May 22, 2010. It happened in Jacksonville, Florida. Laszlo bought 2 pizzas for BTC 10 thousand (see the photo below).

Despite the fact that relatively high interest rates and low speed of transfers are significant shortcomings of Bitcoins, more and more companies are ready to accept them as payment for goods.

Overstock, AT&T and Twitch belong to those big companies, which accept Bitcoins. We cannot fail to mention Elon Musk, who, at first, approved selling Tesla cars for Bitcoins and then halted it, promising to renew sales for Bitcoins when Bitcoin mining will be of less harm to the environment.

PayPal announced in 2021 that it will allow using cryptocurrency as a source of financing purchases through converting cryptocurrencies automatically into a fiat currency. It was a big breakthrough, since PayPal had 346 million users and 26 million connected sales points at the moment of making that announcement.

You can use two services, which are regulated in the United States – Crypto.com and CoinZoom – in a similar way. They allow you to connect a debit card to your cryptocurrency wallet, which means that you can use Bitcoin the same way as you use your funds on the card. Moreover, an intermediary converts your Bitcoins into Dollars instantly.

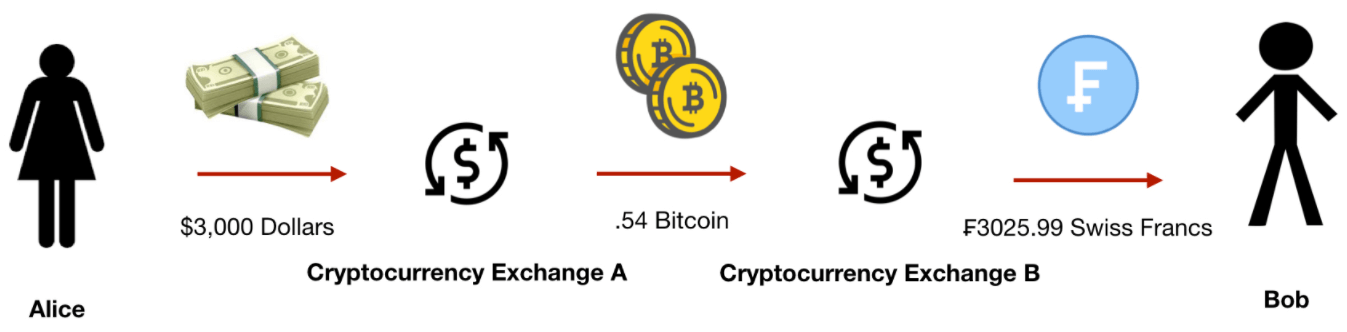

Bitcoins as a means of money transfers

International Bitcoin transfers are simple and cheap, because the coin is not connected to any country and not regulated. Small businesses and people who go abroad to earn money may be interested in such transfers.

If you send your money abroad through TransferWise or MoneyGram, you comply with their rules and regulations. Bitcoin and other cryptocurrencies bypass this centralized control. If you use BTC, you can send money to any part of the world 24 hours a day 7 days a week.

When Bitcoin was approved as the official money unit in El Salvador, the President Nayib Bukele noted that a big number of El Salvador citizens who work in other countries will benefit from using Bitcoins when making money transfers to their country of origin. We should note that this initiative was criticized by the IMF, which sees Bitcoins as a means of criminal money laundering.

How to invest in Bitcoin

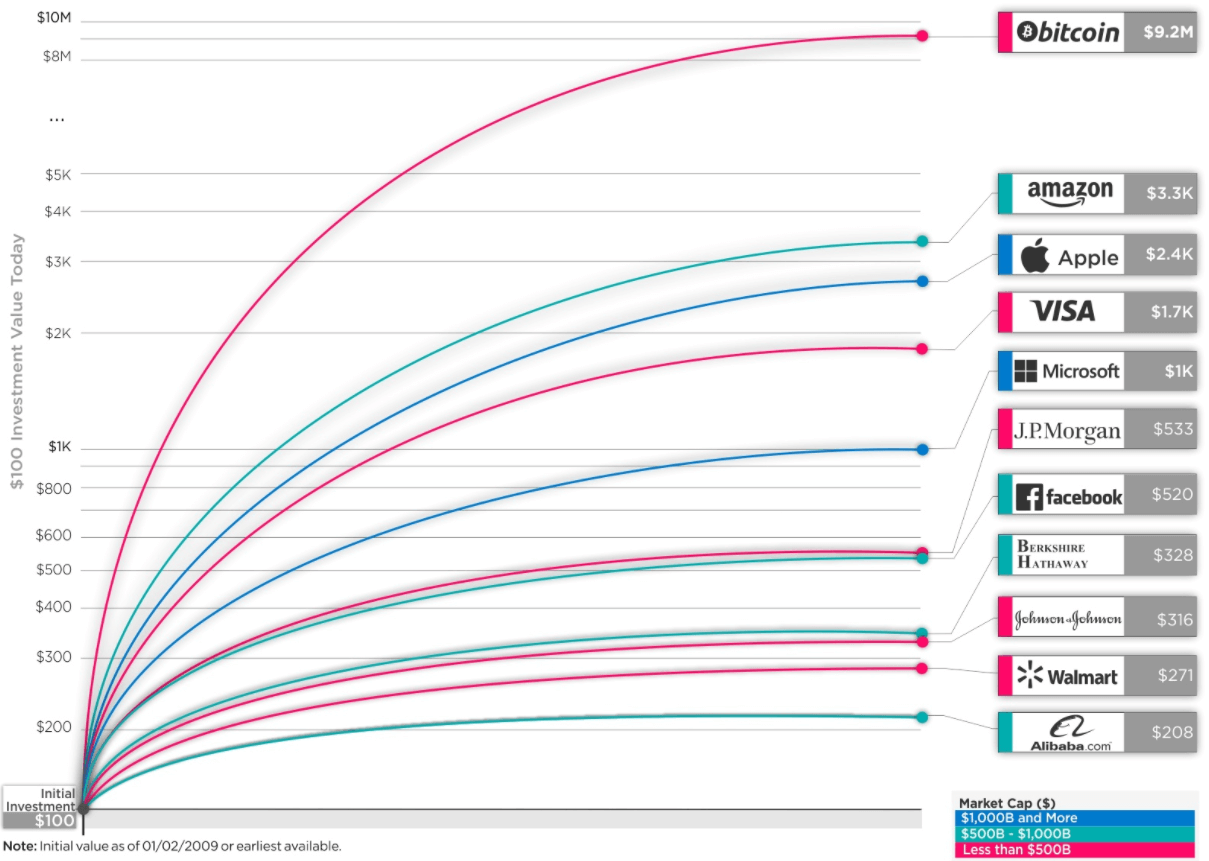

An important advantage of investing in Bitcoin is that its supply is limited to 21 million of coins. Due to this, many people expect that the BTC rate will only grow in the course of time, especially because major institutional investors more and more often consider it as a sort of digital gold for protecting against market volatility and inflation.

The progressive Bitcoin growth made it the best investment of the past decade, but will it be able to preserve this status during the next decade?

The popular Stock2Flow mathematical model from an anonymous developer under the PlanB nickname, which calculates the Bitcoin value based on its supply, assumes that the Bitcoin value will exceed USD 1 million by 2025.

Multiple hopes for continuation of the Bitcoin growth result in the growing demand for investing in the coins. Some US brokers even offer special pension accounts, which are called Bitcoin-IRA.

Retail investors can also make investments in the exchange ETF funds. The first Bitcoin ETF, named Purpose Bitcoin ETF (BTCC), started to be traded in Canada in February 2021, and Evolve Bitcoin ETF (EBIT) was also approved by the Ontario Securities Commission. Similar ETFs are also available in Europe, while applications for opening ETFs based on cryptocurrencies in the United States are still under consideration of the US Securities and Exchange Commission (SEC).

Such famous investors as Paul Tudor Jones, Katy Wood, Elon Musk, Barry Silbert, Mike Novogratz and others own Bitcoins. Twin brothers Tyler and Cameron Winklevoss became the first billionaires in the world who made their fortune on Bitcoins. They owned 1% of all Bitcoins at some moment of time and they planned to build up their portfolio.

Warren Buffett opposes investments in Bitcoin, because he doesn’t see the internal value of cryptocurrencies.

The shortcoming of Bitcoin as an investment asset is its volatility. For example, a tremendous fall of the Bitcoin price took place in May 2021. In this article, we discussed the reasons for the Bitcoin fall when one coin price was around USD 43 thousand at the May 19 high and around USD 30 thousand at the May 19 low. Price fluctuations, when all mass media are looking for the reason why Bitcoin fell by 30% during one day, are too much for a reliable investment instrument.

On the other hand, significant Bitcoin (and other cryptocurrencies) price fluctuations open wide opportunities for intraday scalping and middle-term speculations.

How to trade Bitcoins

In order to trade Bitcoins on the exchange, you need the following:

- Startup capital. At the beginning, you will need USD 100 and even less, since trading small Bitcoin fractions is available with leverage. Moreover, you can trade on your demo account without putting your real capital at risk.

- Registration on a cryptocurrency exchange.

- Professional trading terminal for quick trade execution and situation analysis. Download ATAS – this platform is free for trading cryptocurrencies and has a lot of advantages.

In order to succeed in the complex trading business, you will need to gain understanding of what the Bitcoin growth depends on and what are the reasons for its fall. There are a great many factors that influence cryptocurrencies and all of them are summed up into the forces of demand and supply.

The ATAS platform shows activity of buyers and sellers in real time with the help of user-friendly cluster charts. Read our blog and subscribe to our YouTube channel to learn about useful indicators of the ATAS platform and various cryptocurrency trading strategies.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.