Apple Disappoints, FRS Alerts and Buffett Surprises.

Retracement in the world financial markets gradually transformed into the volatile turbulence. Bulls still cannot find a new reason for buys and bears – for more confident sell-outs. We will speak in our new review about the signs of a split of opinions in FRS, ambiguous Apple presentation, super successful Snowflake IPO, in which Buffett himself invested, and an unexpected long-term forecast on oil prices from BP.

Content:

- Calendar of economic statistics

- FRS disappointed the markets

- Apple stock falls after presentation of new products

- Oil will stay in the past – the BP forecast

- Record-breaking Snowflake IPO: what you need to know

Calendar of economic statistics

| Date, time (GMT +3:00) | Event | Impact. Forecast. |

| September 21 and 22 (Monday and Tuesday) | Japan | JPY. NIkkei. Weekend. |

| Tuesday, September 22 17:00 | United States. Real estate sales in the secondary market in August. | S&P 500. USD. Forecast – 5.95M, previous value – 5.86M. |

| Wednesday, September 23 11:00 | Eurozone. Composite Purchasing Managers Index (PMI) in September. | EUR. Euro Stoxx 50, Dax. Forecast – 52.9, previous value – 51.7. |

| 17:30 | United States. Crude oil reserves. | Oil. |

| Thursday, September 24 11:00 | Germany. Ifo Business Climate Index in September. | EUR. Dax. Forecast – 92.2, previous value – 92.6. |

| Friday, September 25 | United States. Orders on durable goods in August. | S&P 500. USD. Forecast – 2%, previous value – 2.6%. |

- September 21 and 22 (Monday and Tuesday)

- Japan

- JPY. NIkkei. Weekend.

- Tuesday, September 22

17:00 - United States. Real estate sales in the secondary market in August.

- S&P 500. USD. Forecast – 5.95M, previous value – 5.86M.

- Wednesday, September 23

11:00 - Eurozone. Composite Purchasing Managers Index (PMI) in September.

- EUR. Euro Stoxx 50, Dax. Forecast – 52.9, previous value – 51.7.

- 17:30

- United States. Crude oil reserves.

- Oil.

- Thursday, September 24

11:00 - Germany. Ifo Business Climate Index in September.

- EUR. Dax. Forecast – 92.2, previous value – 92.6.

- Friday, September 25

- United States. Orders on durable goods in August.

- S&P 500. USD. Forecast – 2%, previous value – 2.6%.

Attention should be paid in the last but one week of the month on the PMI in the eurozone and Business Climate Index in Germany. They will point to the regional economy recovery rates. The real estate market data and orders on durable goods will become good indicators of the US economy’s health.

FRS disappointed markets

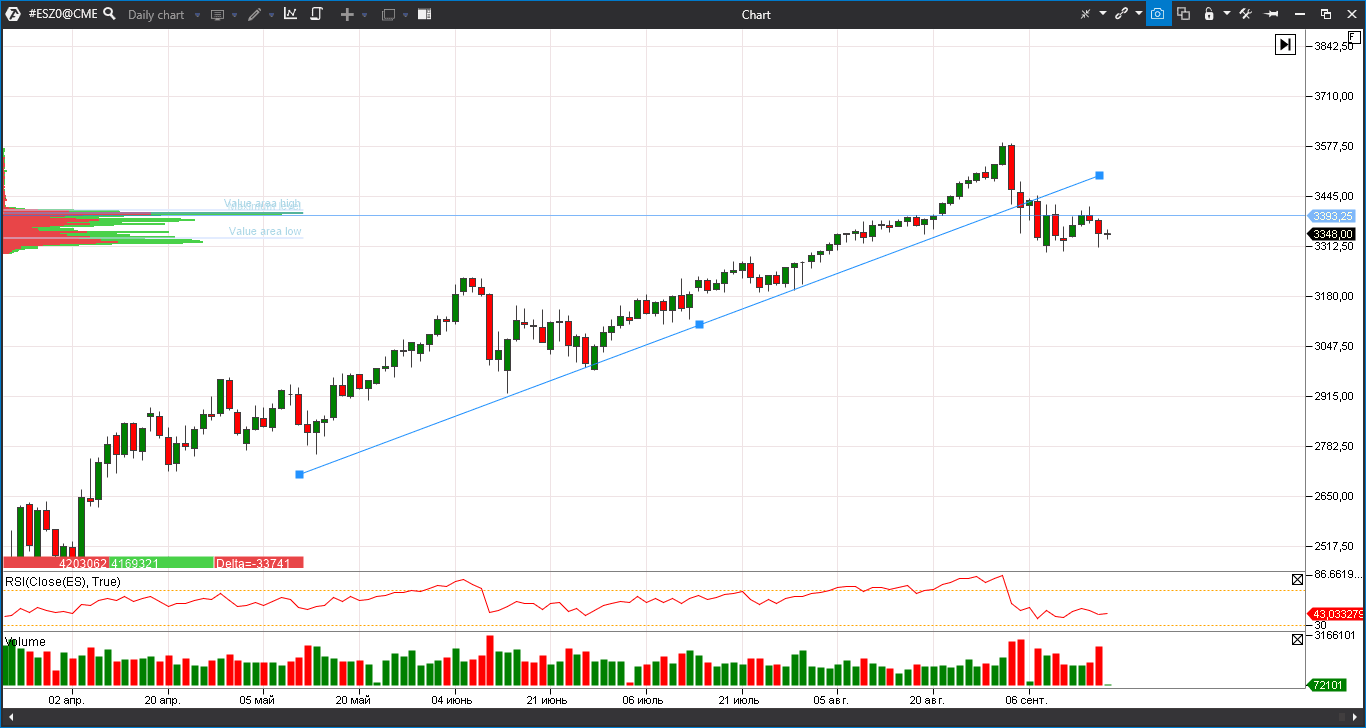

The previous week’s FRS meeting became the main driver of the markets. Bears took the lead after the stock growth the day before – the trading day on Wednesday, September 16, finished with the S&P fall by half a percent and by another 0.8% on Thursday.

In general, FRS wasn’t a surprise. The officials predictably reconsidered the US GDP recovery (3.7% fall instead of 6.5%) and 2020 unemployment level forecasts for the better. The key interest rate stays unchanged – around zero – and will stay at this level for several years to come.

A split of opinions within the walls of FRS disappointed the markets. Judging by the meeting minutes, 2 out of 10 voting members spoke against the current monetary policy. One of them even called for the rate increase after the inflation reaches 2%, which sounds like a riot for the markets, which are used to get cheap money. The ‘rioters’ are still in the minority but the FRS dove (advocates of the soft policy) positions are already not so rock-solid.

Apple stock falls after presentation of new products

The US company with the largest capitalization – Apple – conducted the main presentation of 2020 on September 15. Top new products are: a new generation of Watch Series smartwatch and updated iPad tablet.

Coronavirus continues to influence the world of technologies. Apple tries to swiftly react to the changes. Thus, the main feature of the watch is the function of measuring the oxygen level in blood, which is very important in the times of COVID-19. The watch can also remind you of a necessity to wash hands every 20 minutes. Some other upgrades: better parental control, sensors for asthmatic and diabetes patients and new colour schemes. The price of this technological wonder is around USD 400.

According to Apple, efficiency of the new iPad is 40% higher due to new software and hardware.

The company stock is steadily falling after the presentation. It is difficult to say whether it is a standard profit registration or investors were strongly disappointed by the absence of a new iPhone during the presentation. Nevertheless, the long-term uptrend is broken. Let’s see what happens next.

Oil stays in the past – the BP forecast

The Brent oil barrel cost again grew above USD 40 this week. The growth was facilitated by information about a sharp reduction of US reserves and about the faster than expected recovery of the China and Germany economies as well as economies of some other major consumers.

However, the long-term future of the ‘black gold’ is still vague. Thus, one of the biggest oil producers in the world – the British BP concern – renewed its long-term forecast of the world energy development until 2050.

According to all three BP scenarios, demand on oil will fall during the next three decades. Analysts just differ in opinions about what would be the rates of that fall. The basic scenario envisages 10%, however, more severe outcomes are quite possible – the fall of demand by 55% and even 80%. Coronavirus just accelerated the process of refusal from the hydrogen sulphide raw materials and transition to sources of clean energy.

Record-breaking Snowflake IPO: what you need to know

The appetite for risk is still very high in the world markets. Yet another demonstration of it is the overwhelming success of the Snowflake (a software developer in the field of cloud data storage and analysis) IPO.

A fuss over the IPO was stirred up by the information that even the conservative guru Warren Buffett, or rather the Berkshire Hathaway holding headed by him, invested in Snowflake. As a result, the stock value jumped by 166% (up to USD 310) at the beginning of trading and the general capitalization reached USD 70 billion. However, this level didn’t hold long and the stock closed on Thursday at the level of USD 227.54.

Sceptics have doubts in rationality of the Buffett’s step, who, as it seems, put aside the fundamental analysis and his principle not to buy overvalued companies. Thus, the company revenue constituted a modest USD 304 million for the past year. So, the price/earnings (p/e) ratio achieved the astronomical level of 175x. Reviewers even started to say that the Berkshire strategy change is connected with the retirement of the 90-year Buffett and devolution of controls to new managers with a more aggressive strategy.

Optimists, on the contrary, say that the purchase of Snowflake is not stupid at all. Not the current revenue is important but its dynamics. As regards this indicator, Snowflake stands firm – its revenue grew by 121% in one year.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.