10-year growth has been broken, US GDP anti-record

The week has been very rich for important market events. The main troublemaker was the dollar, which accelerated fall created a stir in the majority of markets. Gold and bitcoin turned out to be the main winners. Apple and Amazon surprised with their quarterly reports and the US Congress initiated a large-scale investigation against these technology giants. Read in our review about these and other important events of the week. As usual, we will start with an announcement of important events for the next week.

Calendar of economic events

Dollar loses support: what threatens the greenback

Gold renewed its high and bitcoin keeps pace with it

Amazon and Apple reports: not without surprises

The US Congress called Bezos, Cook and Zuckerberg ‘on the carpet’

Calendar of economic events

| Time (Moscow Time: GMT+3:00) | Event | Impact/Forecast |

| Tuesday, August 4 7:30 | Australia. Reserve Bank of Australia’s decision about the interest rate and statement about the monetary policy. | AUD. Previous value – 0.25%, forecast – 0.25%. |

| Wednesday, August 5 11:30 | Great Britain. PMI in the service sphere for July. | GBP. FTSE 100. Previous value – 47.1, forecast – 56.6. |

| 17:00 | United States. PMI in the service sphere for July. | USD. S&P 500. Previous value – 57.1, forecast – 55.0. |

| 17:30 | United States. Crude oil reserves. | WTI. Brent. Previous value -10.612 M, forecast -0.357 M. |

| Thursday, August 6 9:00 | Great Britain. Bank of England’s decision about the interest rate and statement about the monetary policy. | GBP. FTSE 100. Previous value – 0.1%, forecast – 0.1%. |

| 15:30 | United States. Jobless claims for the previous week. | USD. S&P 500. Previous value – 1.434 K. |

| Friday, August 7 15:30 | United States. Nonfarm Payrolls changes in July. | USD. S&P 500. Previous value – 4.800 K, forecast – 2.260 K. |

| Tuesday, August 4 7:30 |

Australia. Reserve Bank of Australia’s decision about the interest rate and statement about the monetary policy. |

| AUD. Previous value – 0.25%, forecast – 0.25%. |

| Wednesday, August 5 11:30 |

| Great Britain. PMI in the service sphere for July. |

| GBP. FTSE 100. Previous value – 47.1, forecast – 56.6. |

| 17:00 |

| United States. PMI in the service sphere for July. |

| USD. S&P 500. Previous value – 57.1, forecast – 55.0. |

| 17:30 |

| United States. Crude oil reserves. |

| WTI. Brent. Previous value -10.612 M, forecast -0.357 M. |

| Thursday, August 6 9:00 |

| Great Britain. Bank of England’s decision about the interest rate and statement about the monetary policy. |

| GBP. FTSE 100. Previous value – 0.1%, forecast – 0.1%. |

| 15:30 |

| United States. Jobless claims for the previous week. |

| USD. S&P 500. Previous value – 1.434 K. |

| Friday, August 7 15:30 |

| United States. Nonfarm Payrolls changes in July. |

| USD. S&P 500. Previous value – 4.800 K, forecast – 2.260 K. |

The currency market will wait for the Reserve Bank of Australia’s and Bank of England’s decisions about interest rates. Nobody expects surprises. However, the officials, in the accompanying statements, may cast light on the future of the quantitative easing programs and give important economic forecasts.

The players will pay a special attention to Nonfarm Payrolls on Friday. If the data confirm fast economic recovery, it will support the stock market. Otherwise, a strong retracement may start.

Dollar loses support

We already wrote several times that more and more experts become sceptical in relation to the USD future. They predict its significant devaluation (up to 20-30%) due to the huge emission volume and trade wars of Donald Trump with China. The USD index confirms negative expectations and it confidently broke the support of the 10-year uptrend. Technically, nothing interferes now with its fall.

The legendary Wall Street billionaire Ray Dalio believes that the largest risk for the dollar is the trading confrontation between the United States and China. Big problems will not be avoided if this confrontation transforms into the ‘war of capitals’.

Meanwhile, the scale of economic losses due to coronavirus became known. The US GDP fell by 32.9% during the second quarter in relation to the similar indicator of the previous year. And this is the record for the whole history of observations. The problem is that the epidemic doesn’t give up and the recovery slows down. However, the stock market bulls are still confident in the fast recovery and didn’t react to the statistics.

Gold renewed its high and bitcoin keeps pace with it

The dollar weakness makes investors look for alternatives. The most obvious variant is precious metals. Gold, in fact, is not just a protective asset, but also a quasi-currency, which competes with the dollar. The yellow metal continued its growth during the previous week and renewed its historic high. For the time being, the futures bumped into the resistance in the area USD 2,000 per ounce. Retracement is possible but not inevitable.

As regards the gold ‘younger brothers’ from the noble metal family – silver, platinum and palladium – they were traded with volatility after a powerful growth shortly before.

The physical gold, with respect to its growth, had a company of the digital one – bitcoin cryptocurrency. It broke the resistance in the area of USD 10,000, which led to a leap by more than 10%. It could be just the beginning, taking into account the crypto ability to grow.

Although bitcoin is still far from its highs, it is quite possible that it may renew them. More and more major investors take it seriously and are ready to add it into their portfolios. Even the conservative investment giant Fidelity with the amount of assets in management around USD 7 trillion called bitcoin ‘an aspirational store of value and an insurance policy’.

Amazon and Apple reports: not without surprises

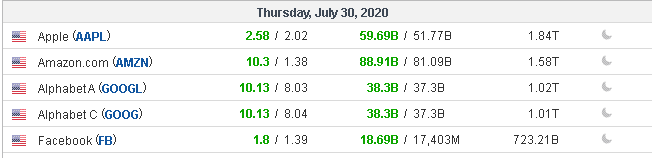

Meanwhile, stocks of technology giants keep the lead in the US stock market. Amazon, FB, Apple and Google published their reports for the second quarter 2020 on Thursday. The results pleasantly surprised, significantly exceeding the analyst forecasts.

Thus, in spite of the crisis, Apple’s net income increased by 11% and the earnings per share by 18% – up to USD 2.58. The apple giant’s value skyrocketed by 10.5% immediately after publication of the data, renewing the historic high. The Apple capitalization doubled from the March lows and approaches astronomic USD 2 trillion.

Amazon showed a similarly impressive result – the revenue grew by 40% with respect to the analogous quarter of the previous year. Google, Microsoft and Facebook showed better results than forecasted.

The main phase of the US quarterly reporting season has finished. About 80% of companies show better results than forecasted. Besides, technology giants not only surprise analysts but also demonstrate an excellent resistance to the crisis.

The US Congress called Bezos, Cook and Zuckerberg ‘on the carpet’

The biggest threat to the technology giant stocks lies now in the political plane. The US Congress initiated a large-scale anti-monopoly investigation with respect to Google, Facebook, Apple and Amazon. Heads of these corporations answered questions of the Congress Legal Committee during the 5-hour conference on July 29.

The Wall Street Journal points that the congressmen managed to dig up some dirt and their general attitude was hostile. A congressman and democrat David Sicilline stated: “Their (corporations’) ability to dictate terms, destroy whole sectors and induce fear looks like the private government authority”.

The Congress accused the big four in non-market methods of operation. Thus, the Google CEO Sundar Pichai caught it bad for suppression of competition and manipulation with ads. Jeff Bezos and Amazon were accused of collecting information about competitors and copying their products. Mark Zuckerberg (FB) was criticised for buying up competitors (Instagram) for market monopolization and for refusing to censor manipulative posts.

Socialist rhetoric and desire to punish technology capitalists gains momentum among democrats in the Congress. Huge money and influence on the US economy play in favour of the former.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.