Key news announcements

Enthusiasm again prevails in the world financial markets. The S&P 500 index reached maximum values from the beginning of March. One might think, when looking at quotations, that the economic crisis came to its end. However, it is not so. Promises of officials, which eased the feeling of fear of investors, dictate the rules again.

Read in this review how the US authorities frightened bears in the stock market. Facebook challenged Amazon, which brought the company stock to new historic highs. Crypto-enthusiasts discovered strange movements in the wallet of one of the first miners. Could it be Satoshi Nakamoto? We will also consider the prospects of oil, which price increased significantly after the April crash.

However, we will traditionally start with the calendar of economic events and expiration of futures contracts during the forthcoming week.

Read in the article:

- Calendar of economic events.

- Coronavirus pandemic: new anti-records and reasons for optimism.

- The US turns on heavy artillery of promises. Markets grow.

- Facebook goes into an attack. Bezos and Amazon, get ready.

- The oil prices increased several times. What to expect.

- Did Satoshi Nakamoto manifest himself?

- Chart of the week: USD/RUB.

Calendar of economic events

| Date | Event | Impact |

| Monday, May 25, 9:00 Moscow Time | Germany. GDP for the first quarter. | EUR. Statistics would exert moderate influence. Bad data are already in quotations. |

| 12:00 Moscow Time | Germany. Ifo Business Climate Index for May. | EUR. Expectations are 80 points. The previous value was 74.3. The indicator will help to assess how quickly the eurozone economy moves out of the crisis. The data at the level and above the forecast are a strong support for EUR. |

| Tuesday, May 26, 17:00 Moscow Time | United States. CB Consumer Confidence Index for May. | USD, S&P 500. Expectations are 85.5. The previous value was 86.9. Consumption is the basis of the US economy. Investors expect a small deterioration of the situation in May after the record-breaking fall in April. A positive surprise will support USD. |

| Wednesday, May 27 | Important economic events are not expected. | |

| Thursday, May 28, 15:30 Moscow Time | United States. Orders on durable goods for April. | USD. S&P 500. The fall by -15% is expected. Limited impact. |

| 15:30 Moscow Time | United States. Jobless claims. | USD. S&P 500. Main economic data of the week. Claims again moved above 2.4 million past week. Any significant improvement of the situation would result in the growth of stock and USD strengthening. |

| Friday, May 28 | Eurozone. Level of the consumer inflation. Preliminary data for May. | EUR. Growth by 0.1% is expected. Important data. Inflation below the forecast would result in the EUR growth. ECB may securely accumulate monetary stimulation. |

Summary: Next week, investors would pay main attention to the data, which would help to clear out prospects of the economy for the nearest 1-2 months. Moreover, the negative April statistics has already been taken by the market into account and would not exert significant influence. As before, significant attention is paid to the US COVID-19 statistics. Much depends on it when people may return to work.

Monday: attention should be paid to the Ifo Business Climate Index for May in Germany. The Economic Sentiment Index was published in Germany past week and it turned out to be much higher than it had been expected (51 points instead of 36). The data rendered support to the stock market and EUR exchange rate. Investors hope that the business activity is restored after completion of the most severe stage of the quarantine following the V-shaped scenario. The new statistics would either prove or disprove these hopes.

Tuesday: attention should be paid to the consumer confidence data from the US, which would show whether Americans started to recover from the economic shock of April. Even a small increase of optimism would support markets.

Thursday: attention of investors would be traditionally arrested by the weekly statistics of unemployment in the United States. If the number of jobless claims is not reduced significantly, this may trigger the stock market retracement. The crisis already deprived more than 40 million Americans of employment. This is the population of a big European country, such as Spain or Poland. The worst numbers in history.

Expiration calendar

Bitcoin futures approached yet another expiration. Splashes of volatility of the underlying asset are possible here. Risk management rules should be observed on the eve of expiration and margin trading should be avoided.

| Instrument | Contract (ticker) | Month | Expiration date |

| Natural gas | NGM0 | June 20 | May 27, 2020 |

| Bitcoin | BTCK0 | May 20 | May 29, 2020 |

| Heating oil | HOM0 | June 20 | May 29, 2020 |

Coronavirus pandemic: new anti-records and reasons for optimism

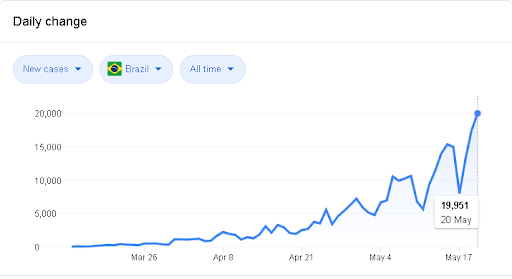

Attention of the majority of countries is focused again on the COVID-19 control. Unfortunately, the past week brought an unpleasant surprise. The new anti-record of incidence in the world – 112,637 new cases during one day – took place on May 19 after a certain stabilization of the situation. To a great extent it took place due to Brazil, India and some other developing countries.

Thus, Brazil becomes a new leader in daily incidence. According to experts, the real situation in this largest South-American country could be much worse – testing is carried out inactively there and the President Jair Bolsonaru blatantly ignores the danger.

Nevertheless, the majority of developed countries demonstrate good progress. Due to this, the market reaction to the statistics turned out to be rather limited. Europe returns to work more and more actively. At last, the US demonstrates a stable progress of the fall in the number of new cases, which, of course, delights inhabitants of Wall Street.

The US turns on heavy artillery of promises. Markets grow.

If you thought that the US authorities exhausted their possibilities in verbal interventions for the market support, you were wrong. The market was ruled again by officials during the past week, who demonstrated a luminous feat of generosity.

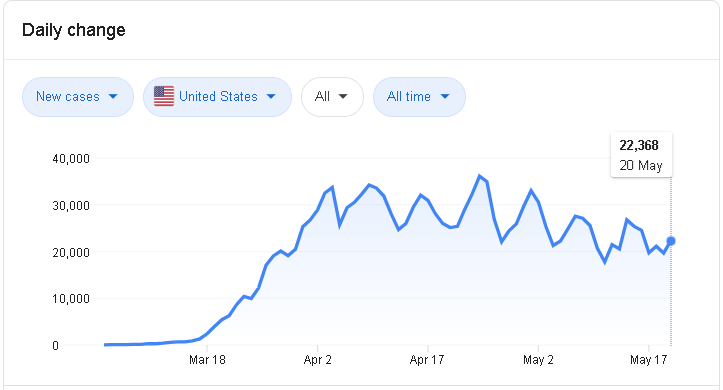

The FRS Chairman Jerome Powell gave an interview on May 17, in which he insistently recommended not to stake against the American economy. He supported his warning to bears with the promise of unlimited support measures on behalf of the Central Bank. FRS actually says to the markets: “There is no limit for the printing press and emission can exceed all forecasts”.

Besides, Powell states a real disaster in the real sector of economy. GDP will fall by 30% in the second quarter. Unemployment breaks all thinkable and unthinkable records.

Markets grow only due to emission and hopes for the bright future. The FRS balance has already grown by USD 3 trillion since the beginning of the crisis – from USD 4 to USD 7 trillion. Analysts say that this is just a midway and minimum USD 3 trillion would still flood the market.

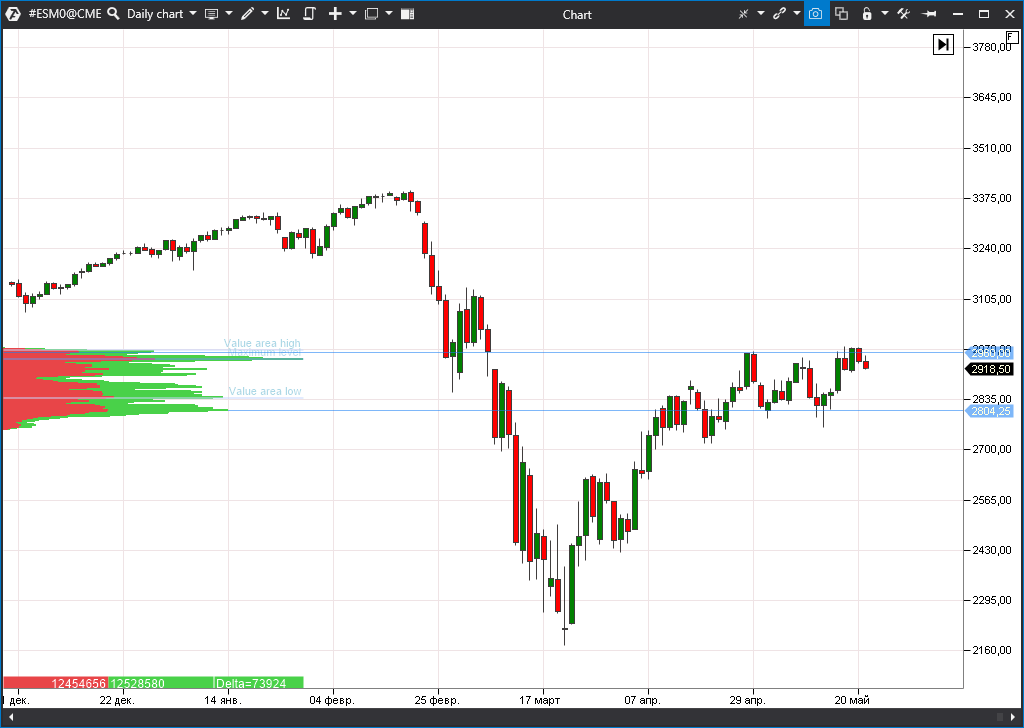

Verbal intervention of Powell worked perfectly again. The nerves of bears are on edge which leads to closing shorts. Besides, the active buys of the big market five – Facebook, Amazon, Apple, Microsoft and Google continued. The S&P 500 stock index jumped by 3% on Monday. Bulls managed to build on the progress during the week and bring stock indicators to new highs from the beginning of March. Only the Thursday retracement returned a bit of healthy caution to the market. As before, the chart looks bullish.

One more very interesting and ambiguous topic develops now on Wall Street – it is a spread between the yield of the American Notes and dividend yield of the S&P 500 index, which already reached 1.3%. 10-Year Treasury Notes produce 0.66% annual while stocks about 2%. Analysts of the Bank of America even made a loud statement that stocks have never been so attractive since 1940.

However, there is a wrinkle in that! The company profit should reach the pre-crisis one already in the 3rd quarter for the Wall Street scenario to work and it looks very doubtful at the moment. Taking into account the stock rate risks, a spread might not make the difference in the market.

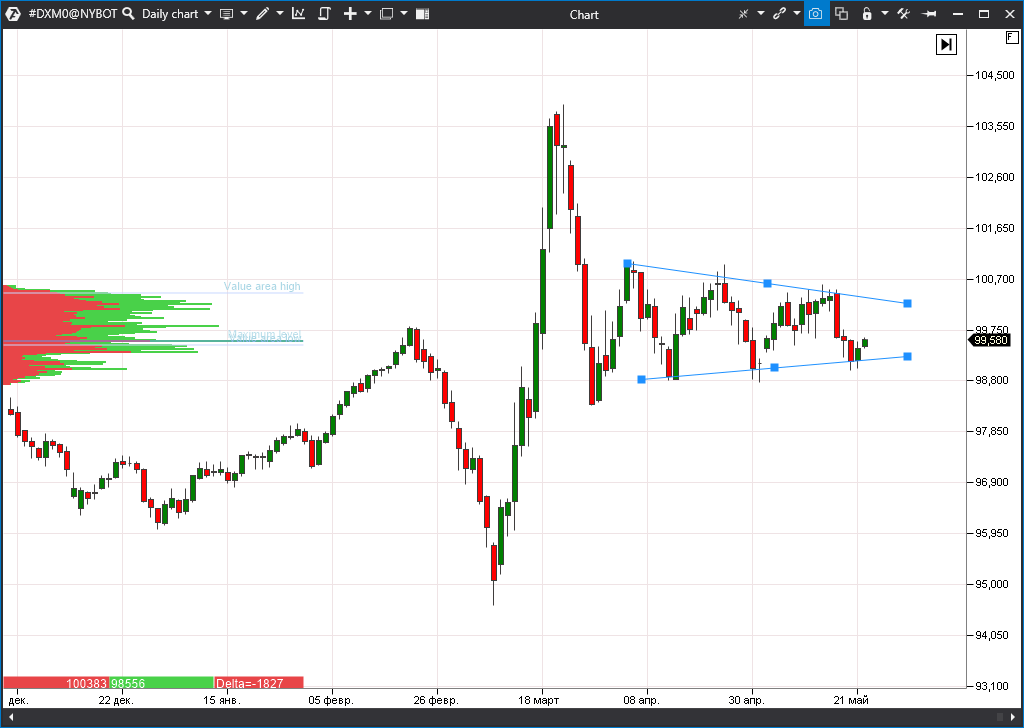

As regards the USD Index, it feels itself less confident from the prospects of unlimited emission. The greenback lost about 1% during the week. It could have been even worse if it were not for ECB and other central banks which pursue the same policy as the FRS does. Meanwhile, a triangle was formed in the chart, the exit from which would bring clearness with the USD direction in the nearest weeks and maybe even months.

Facebook goes into an attack. Amazon, get ready!

The most widely discussed news in the corporate sector was the launch of a new online shopping service, called Shops, by Facebook and its Instagram subdivision. A buyer can select a product on a special web-page and go to the seller’s web-site. Owners of business accounts of social networks would be able to use this new service. Also, Facebook and Instagram would offer their customers traditionally wide advertising possibilities.

They explained in the company that they move the new product to the market in a fast mode – in response to the corona-crisis challenges. “If you cannot open your shop or restaurant physically, you will have a possibility to accept orders online and deliver products to people. We look at a multitude of small businesses, which have never provided online services – for the first time they can go online”, – stated Mark in the course of his video conference.

Since the demand on online solutions for business increases, analysts favourably assessed this new option. It will be free to open a shop, however, Facebook will monetize this direction by means of additional services – advertising, payments, consulting, etc. The company stock responded to the news with new historic highs.

Meanwhile, experts assume that the business of the leaders of e-commerce (Amazon and eBay) could be among the affected parties.

The oil prices increased several times. What to expect?

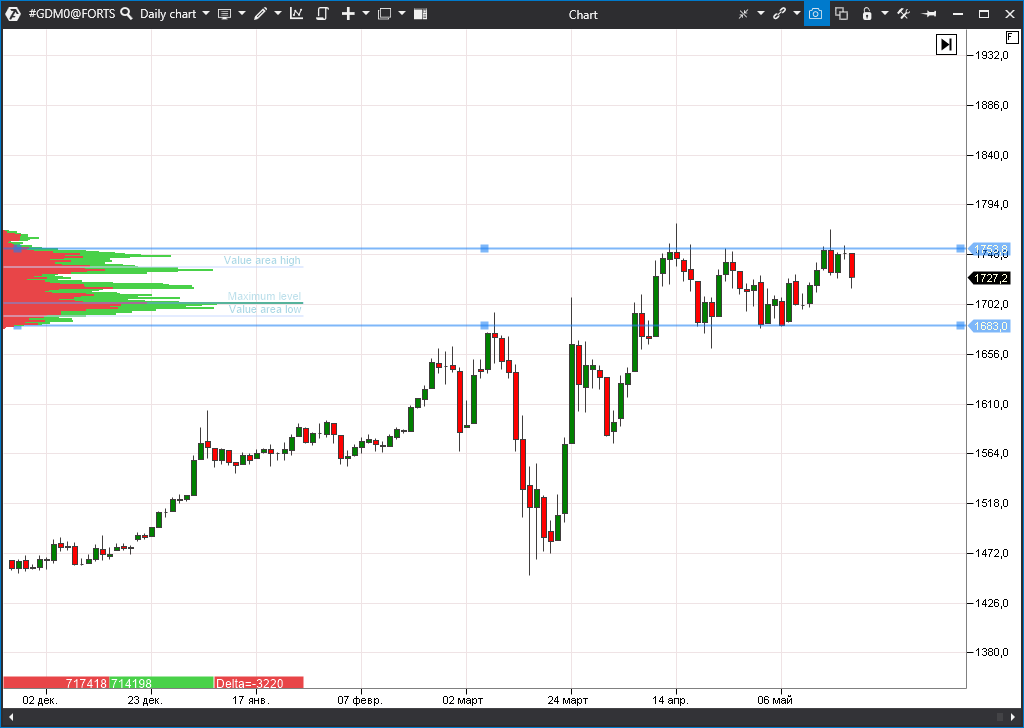

The dropping dollar and hopes of investors for new monetary stimuli have a favourable impact on the commodity prices. Demand on gold, which, as it seems, nothing might prevent from renewing historic highs this year and reach USD 2,000 per ounce, continues to be stable. Global support measures create risks of asset inflation, while gold serves as a traditional insurance against such phenomena.

All retracements were bought out and an overtrading area was formed in the chart, a breakout of which could give quotations a necessary acceleration.

Optimism came back to the oil market. The black gold price increased thrice after the lows of the end of April. There are several reasons for such a quick restoration.

- OPEC countries and Russia stick to earlier reached agreements in reduction of oil production by record-breaking 10 million barrels a day.

- Demand in China returned to the pre-crisis levels earlier than experts expected.

- Some countries used the oil price fall for replenishment of strategic reserves.

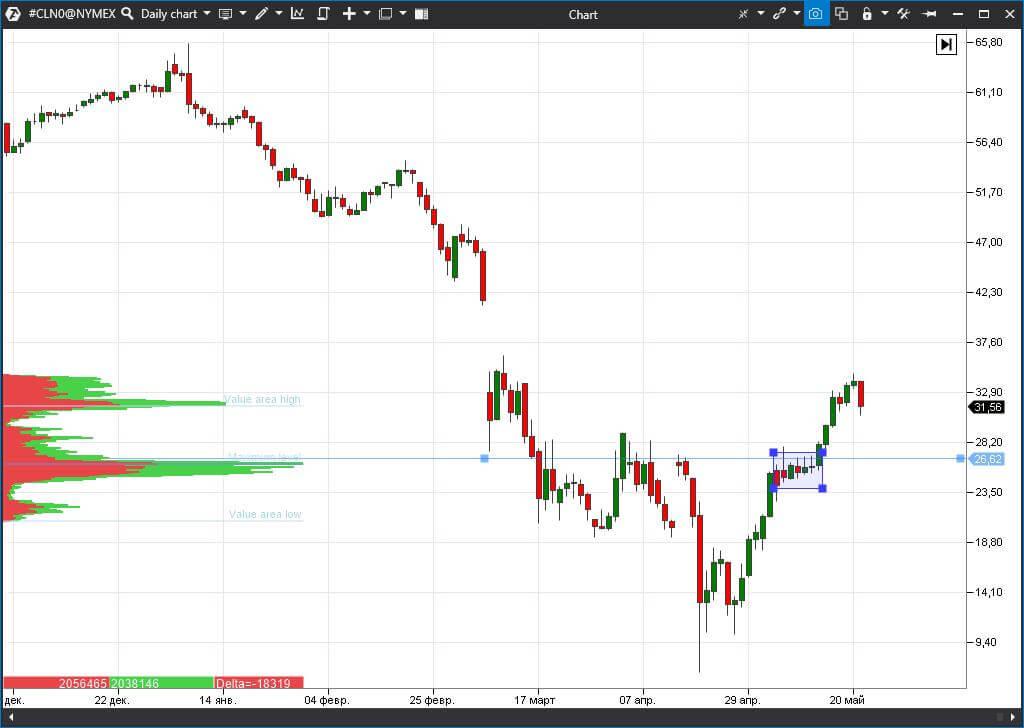

The WTI oil chart (CLNO) shows that the price passed through the key resistance areas and maximum volume levels. A probable goal of today’s growth is the closure of the gap of March 5 in the area of USD 42 per barrel. At the same time, we should remember about a very strong volatility and manipulative characteristic of this asset. Any strong negative piece of news may again reduce the price to the April lows.

Stability will not come soon to the market of energy resources since the storage capacities are full all over the world. This fact will exert pressure on quotations for months. Quite a lot will depend on how long it would take the world to put coronavirus under control.

Did Satoshi Nakamoto manifest himself?

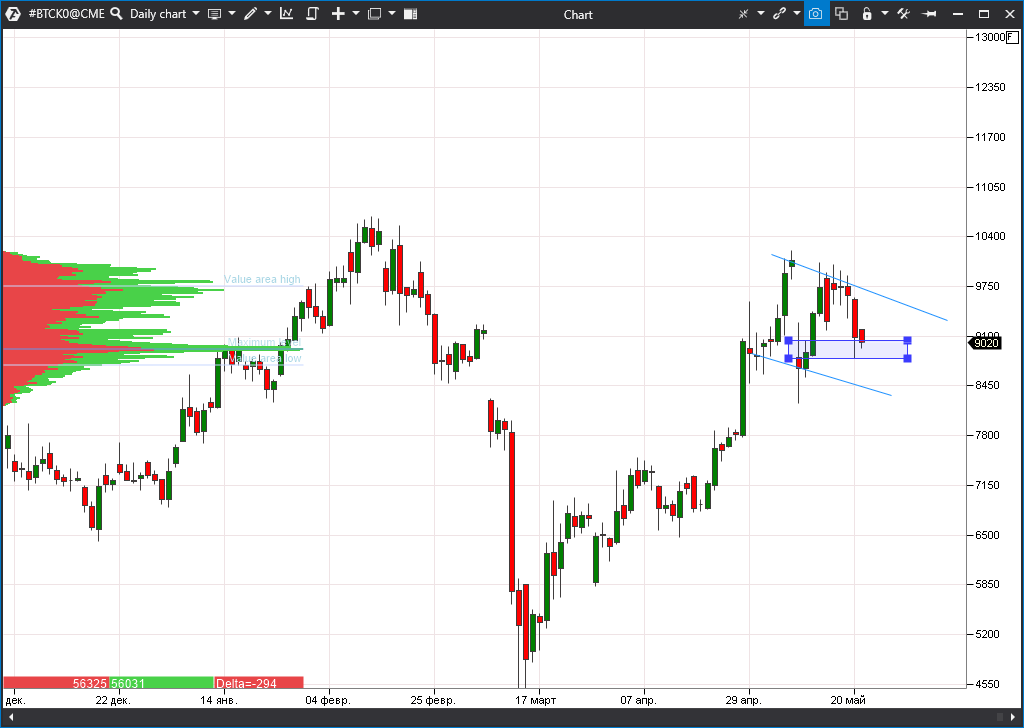

Bitcoin ‘hung around’ the key resistance level of USD 10,000 at the beginning of the week. The test was unsuccessful and the coin sharply retraced to 9,000 in the second half of the week. Only a splash of buys on big volumes stopped the fall. The main support will be played out in this area.

The prospect of bitcoin growth still looks strong. A bullish pattern is formed in the chart. Bloomberg Agency also reminded about the record-breaking open interest in the futures and growth of the number of used addresses. Twitter, in its turn, provides the statistical data, which show that the interest in bitcoin in the social network breaks all records. All these things tell us that consolidation above 10,000 is a probable scenario. Nevertheless, we want to remind you that expiration is expected on May 29 in the current bitcoin futures. Taking into account a high open interest, real wars could be started for the ‘required’ exchange rate.

While cryptocurrency bulls gain strength, crypto-enthusiasts again started to speak about the legendary bitcoin father Satoshi Nakamoto. The matter is that 50 bitcoins were transferred from a wallet of one of the first miners. These coins were developed at the very beginning of 2009, when only Satoshi himself and several first developers were engaged in mining. Some of the primary holders already repudiated the transaction. Does it mean that Satoshi made that transfer? A real mystery.

We want to remind you that Nakamoto is the main mystery of the world of cryptocurrencies. He hasn’t manifested himself for more than 10 years already. Nevertheless, it is believed that he owns about BTC 1 million, which are spread across hundreds of wallets. Their current value is about USD 1 billion.

Chart of the week: USD/RUB

The Russian Rouble continues to become stronger from the record-breaking (for the past several years) lows in the area of RUB 82 per 1 USD to RUB 71 per 1 USD as of May 21. The breakout of the support level in the area of 73.5 gave a boost to the USD/RUB (Si) currency pair. Moreover, the prospective target for the currency strengthening is 67.3, which is the level of the autumn USD highs and 200 MA.

Traditionally, the Russian currency preserves a high correlation with oil prices. Favourable external market situation would be required for continuation of the restoration to 67.3.

“Only when the tide goes out do you discover who’s been swimming naked”

Warren Buffett