Read in this article:

- The current situation in the oil market.

- Reasons for the fall in oil prices.

- Oil crisis of the past.

- Oil market forecast.

The current situation in the oil market

First of all, let’s briefly define the terminology in order to avoid misunderstandings.Modern exchanges trade several oil grades, which differ with their chemical and physical properties, composition, place of production and, as a consequence – the price. The main grades:

- WTI and Light Sweet grades are produced in the United States;

- Brent grade is produced in Europe;

- Urals grade is produced in Russia.

You can find more details about the difference between these grades in our article – “Strategy of using the footprint through the WTI oil example”.

Prices on these oil grades differ from each other, but dynamics and volatility of movement is similar. Further on we will consider the Light Sweet oil chart.

The ticker of the Light Sweet oil futures starts with CL and then goes a letter, which stands for a month, and a number, which stands for a year.

For example, CLV0 is the Light Sweet oil futures for October 2020.

Chronicle of events

The picture above shows the Light Sweet oil price movement chart for 2019 and 2020.January 2020: Minus 15%. The price reached the high of the year 2019 on January 7, 2020, and was USD 65.77. After that, quotations started to gradually move down. The coronavirus epidemic already actively developed in China which had an impact on the prices. According to Bloomberg, the demand on oil decreased in China from the beginning of the year by 3 million barrels per day or by 20%.

A military conflict between the US and Iran was yet another factor. American intelligence agencies killed the Iranian General Soleimani and Iran delivered a stroke in response at US bases in Iraq. The prices started to grow first, but, since the situation had no further development, quotations renewed their downward movement.

The situation might have seemed to be a normal correction to the level of USD 50, since the price stayed in the range between USD 50 and 65 practically during the whole 2019.

February 2020: Minus 9%. The coronavirus epidemic was the main driver of the fall in February since it started to involve more and more countries and transformed into the global pandemic. In February, the International Energy Agency made a forecast in its annual report that the demand on oil will fall by 365 thousand barrels a day down to 825 thousand barrels a day. This is the lowest forecast of demand for the past decade.

March 2020 (until March 24): Minus 57%. The market opened on March 9 with a record breaking fall of prices. It happened due to the absence of a deal between OPEC and Russia. Then the downfall accelerated to the low on March 18, 2020 – USD 20.52.

As a result, the general price fall constituted 69%! Dynamics and nature of the price fall of different oil grades were similar. Brent oil fell to the low of USD 24.52, CL oil – to USD 20.52, WTI oil – to USD 20.08 and Urals oil – to USD 23.48.

Reasons for the fall in oil prices

What were the factors that lead to such a sharp fall?There was an overlap of a series of factors, which brought the oil prices to such impressive lows. Let’s name these factors:

- The world financial and economic crisis is in the making. More than 10 years have passed after the previous financial and economic crisis, which was provoked by the Lehman Brothers bankruptcy in 2008. Could it be the time for a new one? There were a number of signs of a new crisis in the world economy even in 2019. For example, the fall of sea transportation prices, which is a sign of slowing down of the world economy, since the main volume of cargoes is delivered by sea. Also, the oil price, as a leading indicator, failed to renew the previous highs and started to fall when it seemed that there would not be a crisis in 2020.

- Coronavirus. The pandemic announcement strikes a blow against the world economy. The Bloomberg Agency states: “Prohibiting travels, remote employment, cancelled vacations and distorted supply chains – all these things mean reduction of demand on fuel. The demand on oil continues to fall in the course of the further reaction of the society to the virus”.

Coronavirus, as a trigger, initiated the process of ‘implosion’ of the markets, burst of ‘soap bubbles’ and excessive debts in companies and states. The domino effect has been launched.

- Fall of demand. Natural reduction of demand on oil took place due to the beginning of the world financial and economic crisis and coronavirus pandemic. According to the market laws, reduction of demand results in reduction of prices. Goldman Sachs predicts that the demand on oil may fall to the record breaking 4 million barrels a day by April 2020. Demand falls quickly and recovers slowly, which, perhaps, will lead to the further fall of prices.

- The energy war between OPEC and Russia. OPEC offered to reduce production down to 1.5 million barrels a day due to the crisis phenomena in the economy and fall of demand. Russia didn’t agree to this offer. Russia offered to prolong the current agreements for the second quarter of 2020. They failed to reach an agreement. There will be no obligations with respect to reduction of production and the companies can produce any volumes of oil. It is the war of prices, during which prices could be falling long enough until one of the sides agrees to sit down at the negotiating table and come to terms with the other side. According to the Bank of America Global Research, OPEC-plus countries may deliver additional 4 million barrels of oil to the market during the nearest months. Due to a low cost of oil production in the Middle East (about USD 5), the prices may reduce to USD 10 per barrel, however, in any case, it is a temporary situation and the prices cannot stay at such a low level for a long time from the point of view of the economic sense.

- Growth of supply. The growth of supply in the global oil market was a natural reaction in view of the fall of demand and beginning of the energy war. All storages are filled and oil tankers are used now as oil storages. Reuters informs that the Glencore company rented the biggest EUROPE tanker (of 3 million barrel capacity) for several months. Many companies may do the same. The United States continues to increase production volumes in this situation. According to the Energy Information Administration of the Department of Energy, production of tight oil would increase in April by 0.2% up to 9.075 million barrels. This situation will continue for a long time until the growth of production and world GDP starts. It seems like we’ve just entered the crisis period.

- Crisis of dollar liquidity. Big company loans and complex financial products, built on borrowed funds, resulted in a shortage of the dollar liquidity and fall of value of all goods, denominated in USD. Hedge funds and investment funds reduce portfolios for maintaining a sufficient margin in open positions. Naturally, this results in accelerated falls in all markets. USD is the most valuable asset at this stage. And this situation, of course, had an impact on the oil market.

The situation is even worse due to the fact that the above listed factors overlap each other. Such a synchronicity increased the effect, speed and depth of the fall in the market. And the situation continues to develop in the negative direction.

WeWe move towards the most oversaturated market in the oil history” – the Chief Analyst of the DNB Bank ASA Helge Andre Martinsen stated.

Oil crisis of the past

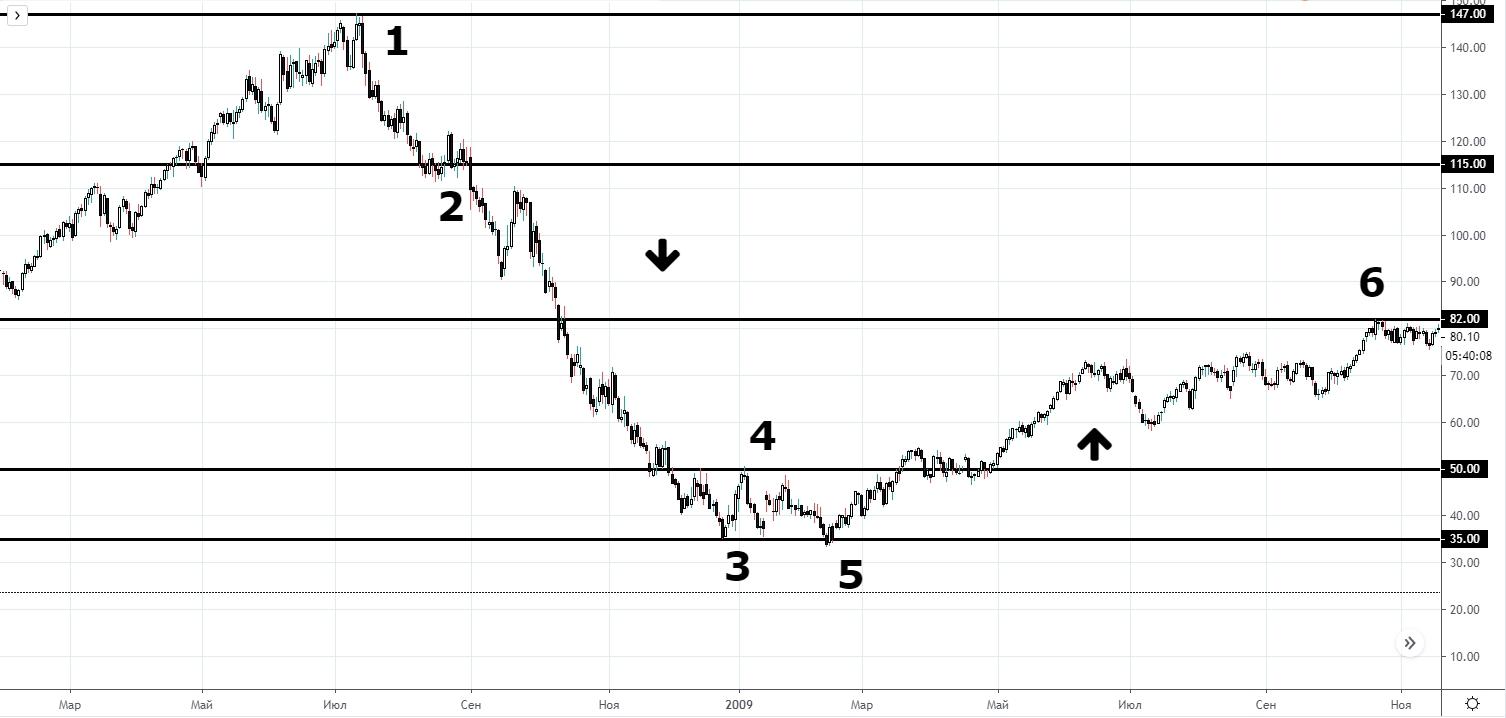

If we look attentively at the most recent oil crisis, we can specify several stages or phases. Let’s list them.Phase 1: Beginning.

This phase is characteristic of a small fall, which looks like a correction at the beginning and there are hopes for continuation of the growth, there is no panic yet but the main economic factors already start to influence the oil prices.

It might have seemed in August 2008 that ‘everything is still good’ and the growth could continue. But the price fell from USD 147 (point 1 in the picture below) down to USD 115 (point 2):

A sharp fall takes place in this phase. All people say that the crisis has begun, they look for a bottom and predict a reversal, panic starts in the market, demand falls and supply grows. The price fell from USD 115 (point 2) in August 2008 down to USD 35 (point 3) in December 2008.

A certain recovery of the market took place. Buys started to predominate in the market since the traders assumed that the bottom had been reached and the price would not go further down. Manufacturers couldn’t stop buying cheap raw materials. The news background became positive. The price increased from USD 35.13 (point 3) to USD 50 (point 4) in January 2009.

However, the price nosedived again and reached the real bottom. Everybody who hoped for the growth made losses. The majority already didn’t believe in fast market recovery. And real growth and price rise started under these conditions of total depression. The low of USD 33.55 (point 5) was reached in February 2009 after which the market established a rally up to the high of the year 2009 – USD 82 (point 6).

The previous crisis lasted for more than a year, that is why we are somewhere in the middle of the process judging by the time scale.

Oil market forecast

All the factors, which influenced the current downtrend, continue to be urgent, that is why there is a probability that the fall will go on until new historic lows.“This is the fourth price war for the past 35 years, in which Riyadh participates. All of them lasted for more than a year and the prices fell by not less than 50%” – Bloomberg states.

The market recovery may take a rather long period of time. That is why, it would be more expedient for traders to look for opportunities for short-term oil sells after upward corrections. Besides, they should strictly control risks due to a high market volatility.

Summary

We observe a historically quick oil price fall. It is caused by overlapping of a number of fundamental factors.How long would oil stay at lows? There could not be a clear idea of the date and extreme point price. It is necessary to analyze macroeconomic indicators of the world economy in order to identify the moment of exit of the economy from the crisis in time and get the facts, which would testify to the growing strength of demand on oil. However, this would take some time, probably – not less than several quarters.

How to trade oil? We believe it is risky to try to find the bottom with the aim to buy oil contracts at extremely low prices. Perhaps, the fall will continue until a renewal of the historic lows at around USD 10 per barrel. That is why, it would be more preferable in the current perspective to use the tactics of sells on corrections with a clear limitation of the size of potential losses.

Famous traders recommend to trade along the current trend, which is the bearish one. The ATAS platform and its indicators, which give hints about trades of the major market participants, will help you to find entry points with high accuracy. In case you trade along the current trend, you act in harmony with major participants and it is not crucial for you what happens with the oil price – whether it falls or grows. Trading in accordance with the market moods provides you with an opportunity to make a stable profit.