Expectations from the week.

Main events of the previous week took place in the currency market. Difficult negotiations of the European officials about saving Europe ended with a historic agreement, which radically changed all setups on Forex for the coming months. Turbulence in the currency market resulted in a chain of events, among which we can specify a powerful leap of precious metal prices.

Read in our review where to catch EUR futures and why silver becomes more expensive. We will also discuss development of the corporate reporting season, which was not without surprises.

Content:

Calendar of economic events

How EU officials saved Euro from a crash

Silver price leap: what is behind it

Reporting season: a surprise from Tesla and other results

| Time (Moscow Time) | Event | Impact/Forecast |

| Monday, July 27 15:30 | Germany. Ifo Business Climate Index for July. | EUR. Forecast – 85, previous value – 86.2. |

| Tuesday, July 28 17:00 | United States. Consumer Confidence Index (CCI) for July. | S&P 500. Forecast – 96.3, previous value – 98.1. |

| Wednesday, July 29 21:00 | United States. Decision about the interest rate and statement about the US FRS monetary policy. | S&P 500. USD. Forecast – 0.25%, previous value – 0.25%. |

| Thursday, July 30 10:55 | Germany. Employment level change in July. | EUR. Forecast – 120 K, previous value – 69 K. |

| 15:30 | United States. GDP level for the second quarter (quarter to quarter). | S&P 500. USD. Forecast – 32.6%, previous value – 5%. |

| Friday, July 31 | EU. Inflation rate for July. | EUR. Forecast – 0.1%, previous value – 0.3%. |

| Monday, July 27 15:30 |

| Germany. Ifo Business Climate Index for July. |

| EUR. Forecast – 85, previous value – 86.2. |

| Tuesday, July 28 17:00 |

| United States. Consumer Confidence Index (CCI) for July. |

| S&P 500. Forecast – 96.3, previous value – 98.1. |

| Wednesday, July 29 21:00 |

| United States. Decision about the interest rate and statement about the US FRS monetary policy. |

| S&P 500. USD. Forecast – 0.25%, previous value – 0.25%. |

| Thursday, July 30 10:55 |

| Germany. Employment level change in July. |

| EUR. Forecast – 120 K, previous value – 69 K. |

| 15:30 |

| United States. GDP level for the second quarter (quarter to quarter). |

| S&P 500. USD. Forecast – 32.6%, previous value – 5%. |

| Friday, July 31 |

| EU. Inflation rate for July. |

| EUR. Forecast – 0.1%, previous value – 0.3%. |

The main event of this week is a US FRS meeting. Nobody expects that officials would change the key interest rate, however, splashes of the USD and stock volatility are quite possible. Investors will pay attention to the FRS opinion about the future of the quantitative easing program and relation to the historic record-breaking stock market rally, which has bubble characteristics.

How EU officials saved Euro from a crash

It was reported early in the morning of July 22 that the greatest aid package to the economy in the EU history for EUR 1.82 trillion (USD 2.1 trillion) was agreed upon. Out of them, EUR 750 billion is the aid package to the countries due to corona-crisis. Plus more than EUR 1 trillion will go into the European budget for the nearest years.

The specific feature of the anti-coronavirus fund is that it will partially consist of irrevocable grants (EUR 390 billion) and partially (EUR 360 billion) of long-term loans practically with zero rates. For the first time in history, loans will be taken on behalf of the European Union rather than individual states. The main part of the aid will be granted to the most economically vulnerable countries that suffered from the pandemic more than others – Italy and Spain, while mainly rich countries of the Western and Northern Europe will serve as sponsors.

Experts point to the fact that the common EU could have had very hard times, down to disintegration, without this agreement. And now, on the contrary, the union moves to a completely new level of integration, which is extremely good for the European currency. It is not a surprise that the EUR futures skyrocketed having broken the spring high by 1.15. The trend continuation looks here as the most probable scenario. Deutsche Bank experts forecast that it has the growth potential of up to 1.2.

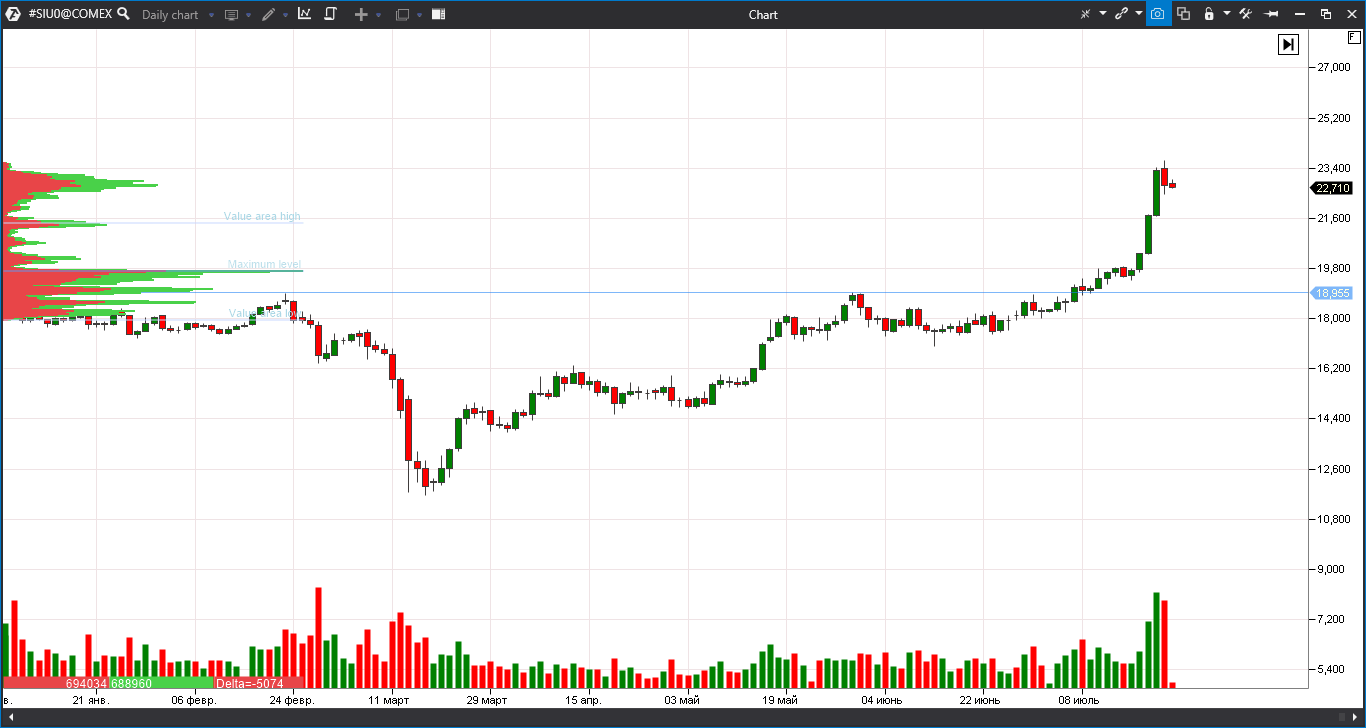

Silver price leap: what is behind it

After the EU summit results were reported, the dollar is under the pressure of sales, since it became less interesting in the capacity of a protective currency. Weakening of the greenback, in its turn, works in favour of bulls in commodities. Raw materials historically showed themselves excellently in times of a weak dollar.

Precious metals demonstrate especially intensive growth. Thus, the silver prices broke the multi-year highs during a couple of days and there is already a double growth from the March lows.

Apart from the fact that gold, silver and platinum group metals are quasi-currencies and rescue from the printing press, they are also valuable raw materials. Thus, demand on silver grows because it is widely used in the electrotechnical industry. In particular, it is used for 5G equipment manufacture and in the green energy industry.

Also, the fact that silver was very undervalued with respect to gold in the past year plays in favour of silver. The correlation is restored now. Perhaps, this advanced growth may last for some time, after which this metal would move again relatively synchronously with gold.

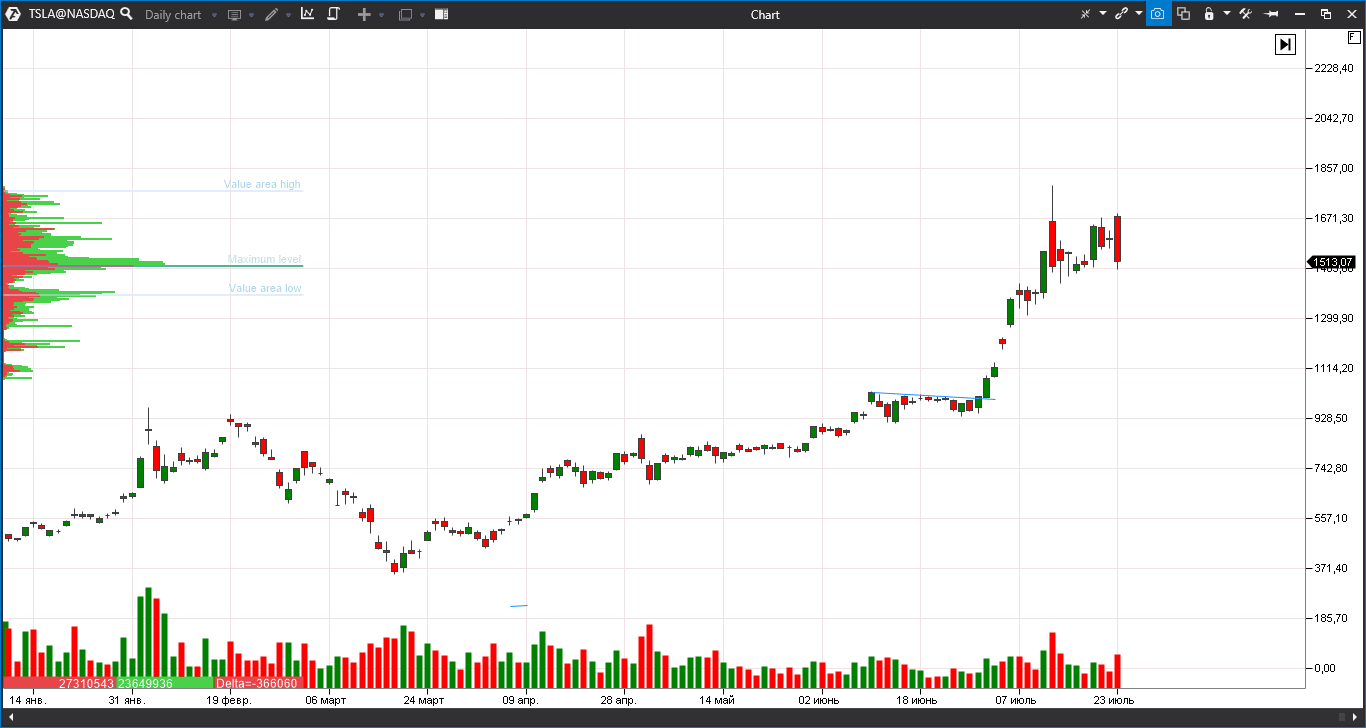

Reporting season: a Tesla surprise and other results

Leading US companies publish reports for the second quarter of 2020 at full steam. In general, the results cheer up investors. However, many players prefer to register profit on good news, which manifests itself in the volatility growth.

Thus, Tesla (TSLA) sprang a surprise. The Elon Musk company rather unexpectedly showed a small profit in the second quarter – USD 104 million (USD 0.50 per share). This fact opens the door for including the stock in the S&P 500 index, since it meets the selection criteria now. A splash of trading volumes could be expected after such a step. Fundamentally, the company is still very overbought and the chart shows volatility shaking with a typical range of 5-20%.

Microsoft (MSFT) published a traditionally strong report. The revenue exceeded not only analyst expectations but also pre-crisis levels. As regards fundamental indicators, the company is still one of the strongest in the market. And although the Microsoft stock reacted by profit registration, this technology sector flagship continues to trade near historic highs.

Investors will focus on the reports of the following companies next week:

Tuesday, July 28: Visa (V), Pfizer (PFE) and McDonald’s (MCD).

Wednesday, July 29: Facebook (FB), PayPal (PYPL), Qualcomm (QCOM) and Boeing (BA).

Thursday, July 30: Apple (AAPL), Alphabet/Google (GOOG) and MasterCard (MA).

Friday, July 31: Exxon Mobil (XOM) and Chevron (CVX).