REASONS OF ANY PRICE BEHAVIOUR

The price reflects the commodity value in economic theory. However, it is not always so on the exchange — it is rather an instrument for attracting investors and traders. An investor buys securities if he thinks they are undervalued and will become more expensive. Traders actively buy and sell assets, hoping for a speculative profit. Traders do not care whether the price falls or grows—they are interested only in making money.

You may often come across the following statement on the Internet:

The price grows because there are more buyers and falls because of more sellers.

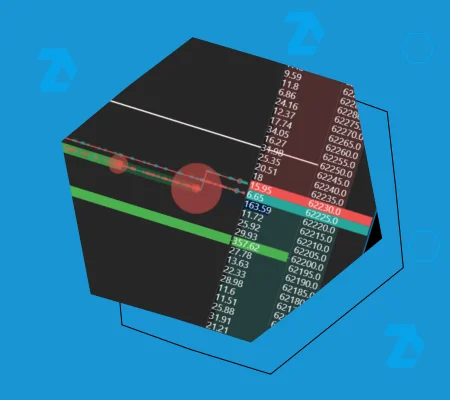

It makes no sense from the point of view of order matching. Financial assets are not taken from the thin air. For someone to buy futures or stock, someone must sell them. The laws of demand and supply are still true for exchange trading. However, the price movement mechanics on the exchange has its specific features.

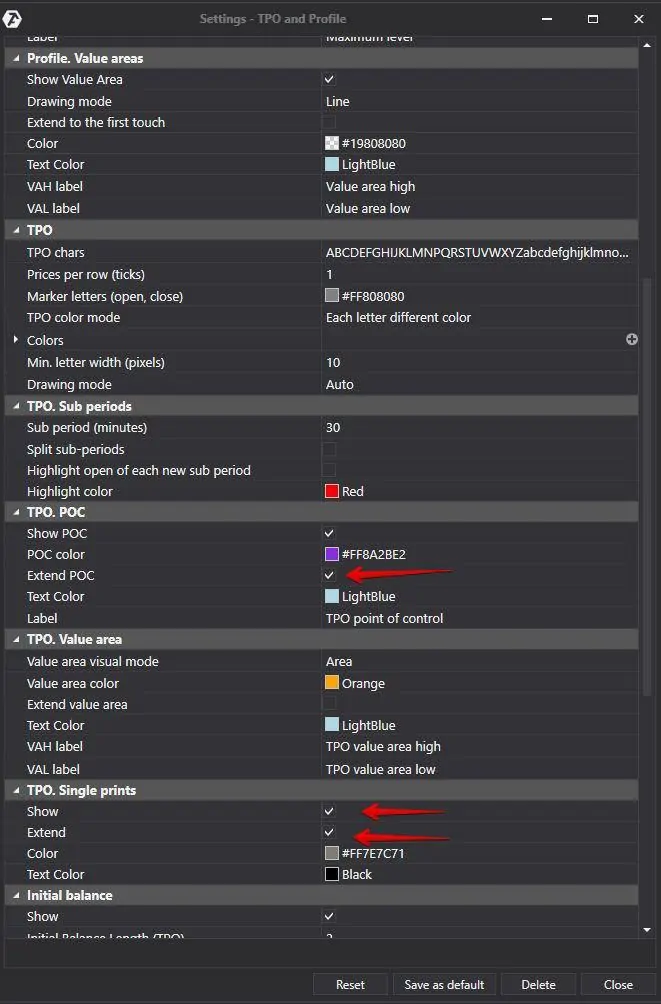

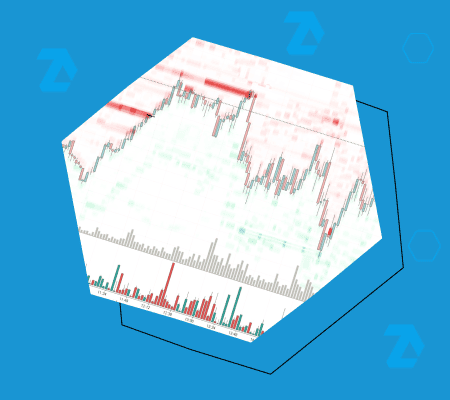

Stock and futures prices change every second. It is practically impossible to predict the price movement on the exchange with 100% accuracy. However, it could be forecasted with a certain probability using various instruments of technical and cluster analysis.

Read further in the article: