Beginner traders often neglect capital management. It is a big mistake. They are more often interested in ‘when to enter into the market’ and less often ‘when to exit from the market’. In other words, the trading system rules are in the first place. More experienced traders start to pay due attention to risk management beginning to understand its importance. Deep study of capital or money management starts when you apply a professional approach.

This article is written in order to underline the importance of capital management. Read in this article:

- Why it is important.

- What capital management is.

- Conservative methods of capital management.

- Aggressive methods of capital management.

Importance of capital management

Ideal situation is when a trader from the very beginning starts to study and understand importance of three unshakeable components of successful exchange trading:

- Trading system.

- Capital management.

- Risk management.

Neglection of any apex of this triangle would lead to instability in trading and, as a result, losses. It is also important to understand that capital management and risk management are not the same. Each of these knowledge fields has its own clear purpose in trading. And if you still do not understand the difference between the risk management and capital management, perhaps, it’s too early for you to start trading.

The successful portfolio manager Edward Thorp many a time showed in his ‘A Man for All Markets’ book that if your system gives you at least several percent of probability of advantage in your favour, then you may consistently make profit if you add proper capital management to it.

What capital management is?

Capital management is a system of rules, which describes selection of the trading position size depending on the trading system and capital size. In simple words, it is an algorithm of the trading lot selection in every new trade.

The capital management goal is to maximize profit in the event of controlled drawdowns.

Trading in the financial markets has a serial nature, which means that a series of profitable trades is followed by a series of loss-making trades and vice versa. So, capital management should facilitate relatively small losses within risk management during a series of loss-making trades and maximize profit during a series of profitable trades in order to cover the previous losses and bring the capital curve to new heights.

Due to this, the capital management method cannot be selected randomly or ‘which looks better’.

How to manage capital

Which capital management method should be applied to a specific trading strategy?Answer to this question could be received only from:

- Statistics.

- Testing.

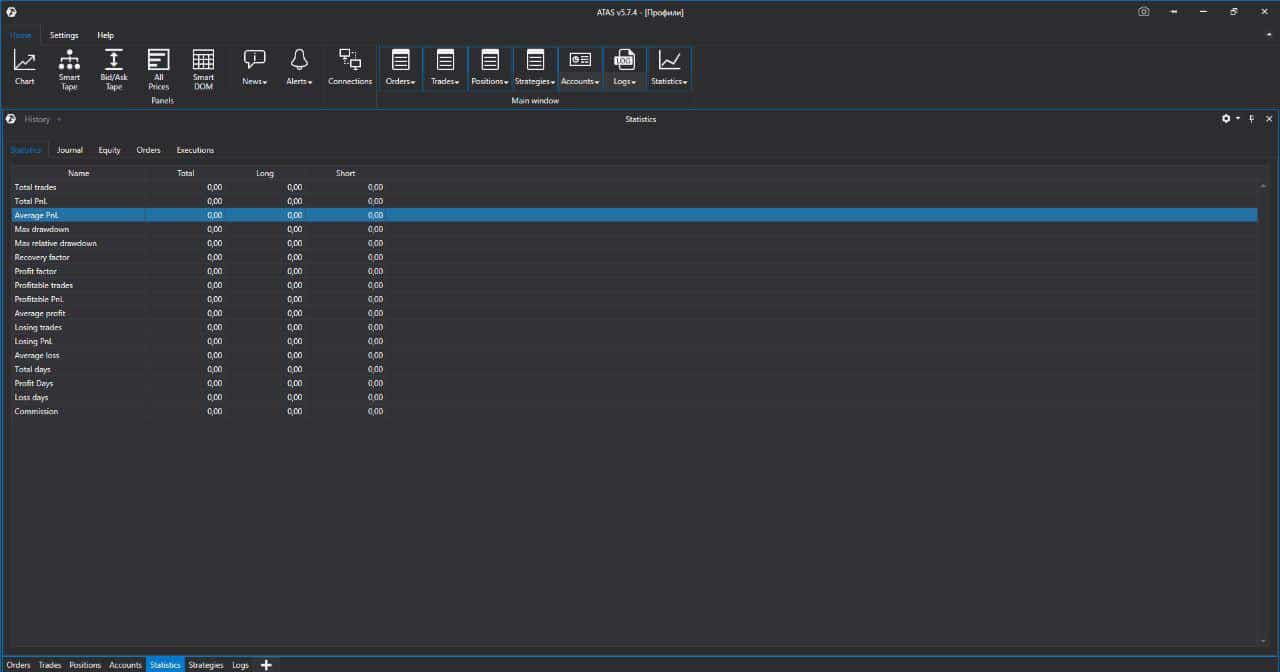

If you use the ATAS platform for trading, you can get all your trading history statistics visually in the main window selecting the statistics tab.

These data will help you to analyse your trading system. You need to:

- analyse data about not less than 100 trades for several months;

- enter these data into an Excel table;

- and start selecting the capital management method, which will help you to achieve the best result for your trading system.

Conservative capital management methods

So, what circulating capital management methods could be applied in practice? Let’s consider 4 main conservative methods:

- Standard lot.

- Multiple lot.

- Fixed risk amount.

- Fixed capital percentage.

Standard lot is the circulating capital management method, under which trades are executed with one standard lot. A standard lot doesn’t change if there are no strong deposit changes. One lot trading could be conducted for a long time. More often, traders use the minimum possible lot.

It is an excellent method for beginner traders who acquire experience of working in the financial markets. This method could also be used for testing the trading system in the real market and identifying the system profitability in ticks with minimum expenditures. This possibility of testing “in field conditions” without unjustified risks is provided, for example, by:

- CME micro futures;

- Moscow Exchange instruments.

You can get access to trading these securities through the ATAS trading platform.

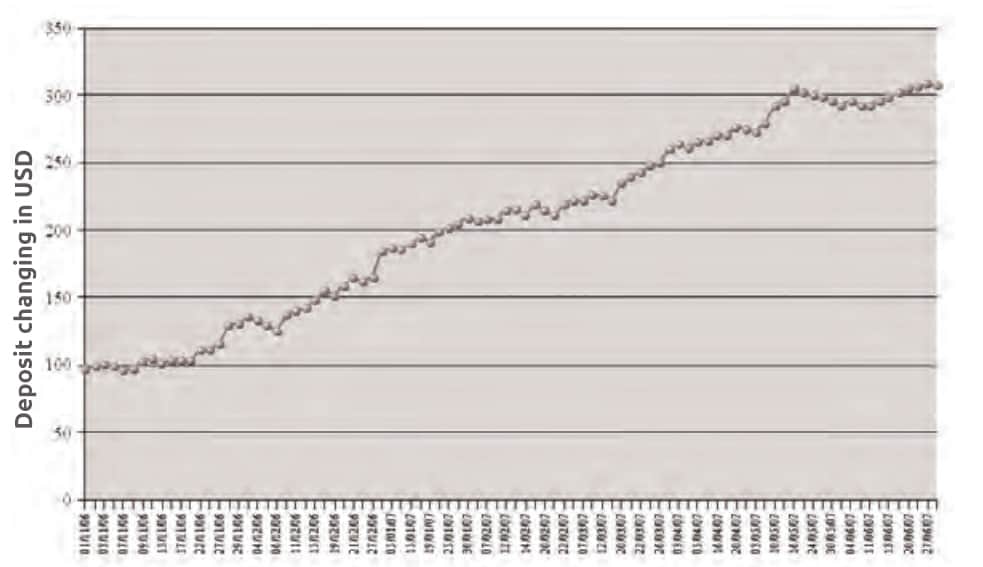

Let’s take, for example, a trading system with the known trading statistics and build the capital curve with a standard lot:

You may see from the chart that the profit grows slowly (conservatively). The system works with profit, so you may apply more complex capital management methods to increase your profit at a faster pace.

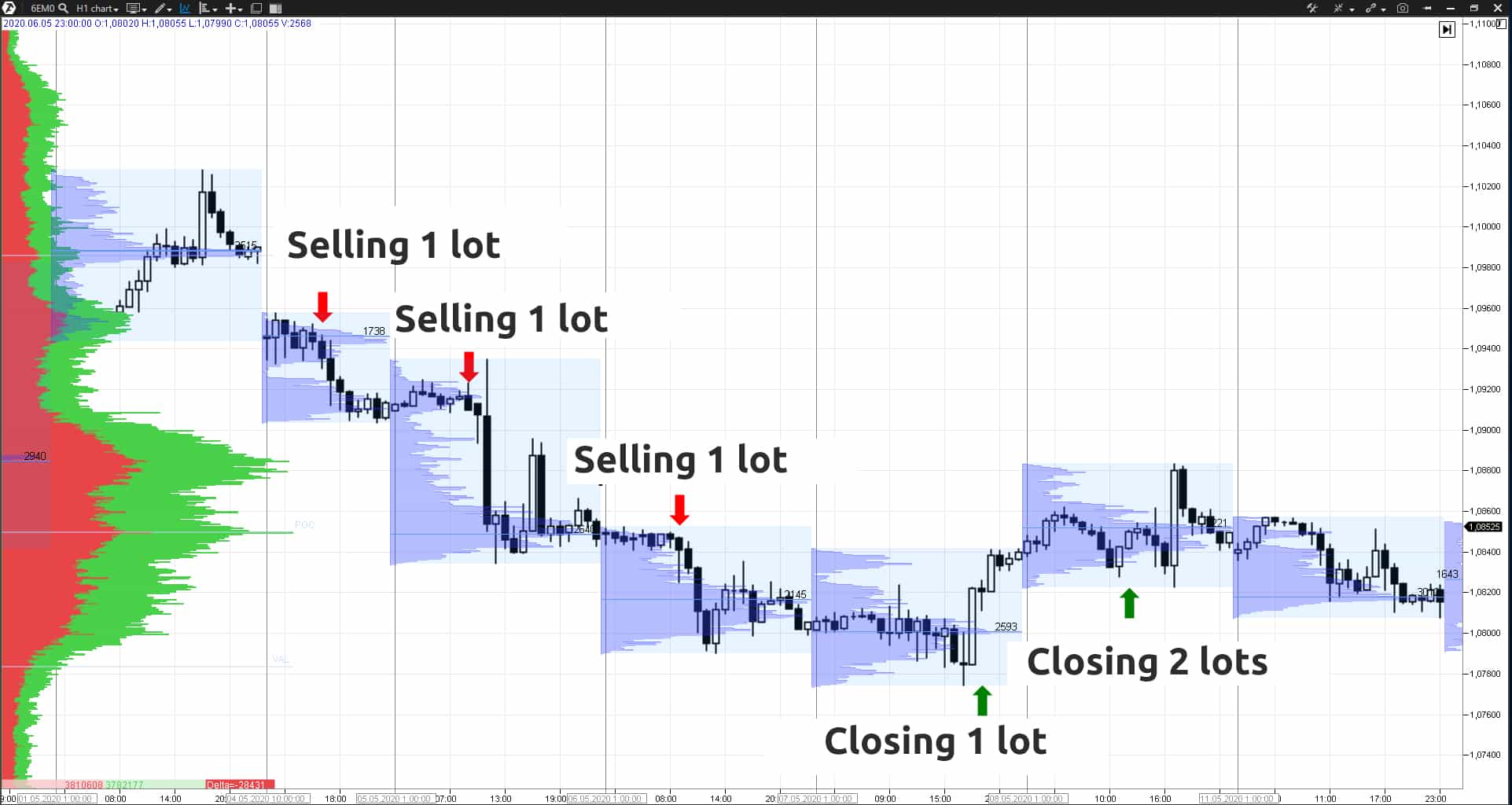

Multiple lot is the method, under which trading is conducted not with one position but with several. It is applied in order to increase the trading system profitability.

We can underline two approaches in applying multiple lots:

- several trades are executed in response to one trading signal;

- new trades are executed as the profit grows and trend develops.

In the first case, several trades are executed in response to one trading signal, since different trades have different targets. For example, the strategy gave an instruction to buy. A trader opens 2 positions 1 lot size each. The first trade target is to register the initial price impulse and get a fast profit. After the first trade is closed, the second one could be moved into break-even in order to get profit from a long-term trend. Then the second trade is accompanied with the stop loss movement behind the price extreme points or is closed when new levels are achieved. This method is applied for increasing the system profitability.

The second approach is not in decreasing but in increasing the position in the course of the trend development. If the trend reverses the position in the market may decrease. This method is well applied in the markets with prolonged trends.

For example, the deposit is USD 30,000 and the fixed risk amount is USD 500.

1st trade on the 6E futures(EUR/USD):

- stop loss = 20 ticks,

- one tick price = USD 6.25, then

- risk of the 1 lot position – 6.25 * 20 = USD 125,

- working lot = USD 500 / USD 125 = 4 lots.

2nd trade on the 6E futures(EUR/USD):

- stop loss = 40 ticks,

- one tick price = USD 6.25, then

- risk of the 1 lot position = 6.25 * 40 = USD 250,

- working lot = USD 500 / USD 250 = 2 lots.

You may change the fixed risk amount when the deposit size changes, say, once a month in the event of active intraday trading. Then the risk amount will be adapted to the current deposit and changes will not take place too often, in doing so smoothing possible capital curve fluctuations.

This method could be considered the optimum capital management method after you acquire due experience.

Fixed capital percentage is the method, which identifies the lot size that would be equal to the set deposit percentage.

First, you identify the optimum risk for a trade in the deposit currency as a percentage of your capital. It is believed that the optimum risk is 0.5%-2% depending on the trading system and personal inclinations of a trader. Further on, a lot is calculated before every trade depending on the current deposit and stop loss.

For example, the deposit is USD 30,000 and risk is 1% of the deposit or USD 300.

A trade on the 6E futures (EUR/USD):

- stop loss = 16 ticks,

- one tick price = USD 6.25, then

- risk of the 1 lot position = 6.25 * 16 = USD 100,

- working lot = USD 300 / USD 100 = 3 lots.

This method is good in capital and risk management. Under this method, a lot will decrease during a series of losses and increase during a series of profits.

Consequently, the period of time for exiting from the drawdown may increase. This method could be considered conservative, since the trading position size would decrease in the event of losses.

Effect of applying various methods of capital management

Which effect could be achieved if you properly use the capital management rules?

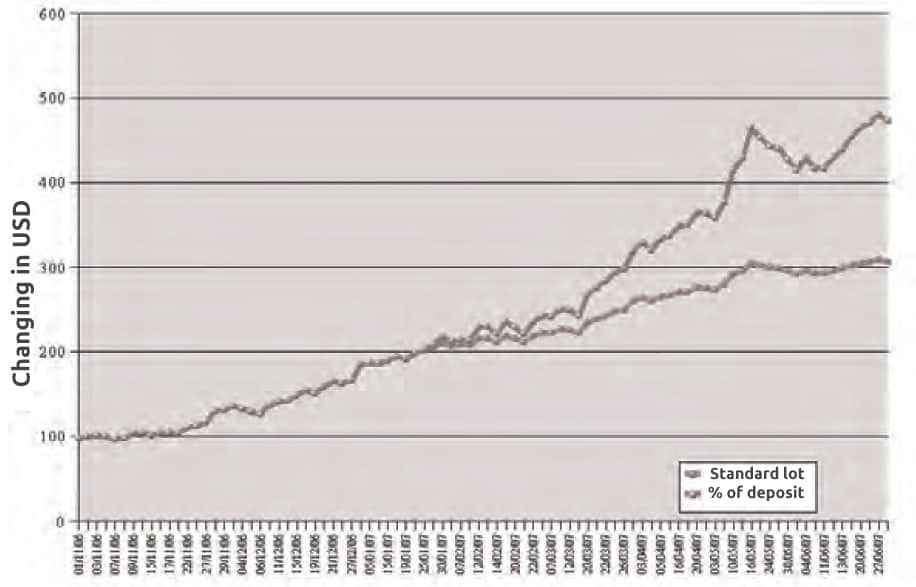

The chart shows two capital curves of two methods:

- the lower capital curve is a standard lot;

- the upper capital curve is a capital percentage.

This chart shows that the ‘capital percentage’ method allows increasing the trading system profit, however, at the same time, the loss size and capital curve amplitude also increase, which could be unacceptable under certain conditions.

That is why, capital management is an important instrument for profit maximization, but only the long-term testing of the trading system can show which method it is better to apply.

Aggressive capital management methods

Aggressive circulating capital management policy could be applied for a fast and significant increase of the profit. Aggressive capital management methods are extremely dangerous.

Martingale: this method envisages two-fold increase of the position size in the event if the previous trade was loss-making. At first, it might confuse you as a seemingly profitable trading. However, a period of losses leads to big drawdowns and, as a rule, loss of the deposit.

Pyramiding: this method envisages opening a two-fold size trade if the previous trade was profitable. This method is the safest one out of all aggressive methods. It could be used if you have a big experience of trading under your trading system. The logic of this method is based on the serial nature of profit-making and loss-making trades. If this serial nature is constantly observed in the operation of your trading system, then this method could actively increase the profit. Advantage of this method is that a possible loss from the increased trade size is partially covered by the previous trade profit.

Locking: this method envisages opening oppositely directed trades and further closing a loss-making trade – the so-called ‘lock’. This method, for example, could be used on futures contracts with different expiration dates. It is an extremely complex method in practical application, since it allows ‘freezing’ the floating loss but gives no guarantee that you will be able to avoid it later after ‘the lock is unlocked’.

Averaging: this method envisages opening new positions in the direction of the existing loss-making position by an increased or working lot and closing all positions simultaneously, when the general result reaches the desired value. This method may provide positive results for a long time, but one averaging series of trades against a strong trend could lead to the loss of the whole profit made and, maybe, to the loss of the deposit. It could be used only with a limiting stop loss in the deposit currency, reaching which the whole position should be closed.

All aggressive methods of capital management are extremely dangerous and they are not recommended for beginner traders. Some experienced traders may apply these methods but only with a strict limitation of losses.

Conclusions

Capital management is an important trader knowledge field along with trading system and risk management.

If you want to become a successful trader you need to:

- collect statistics under your trading system – not less than 100 trades;

- select the optimum capital management system based on these statistical data;

- formulate your own capital management system in the form of an algorithm, plan or a strict set of rules;

- test your system using the standard lot method;

- achieve a stable profitable result.

After that, you may combine the ‘multiple lots’ and ‘fixed risk amount’ methods, which would help you to maximize the profit with controlled risks.

Aggressive capital management methods (especially at the initial stage) should be avoided at all accounts.