How to select stocks in the premarket. Finding trending markets

“A trader is only as good as the stocks that he trades”. Mike Bellafiore

Mike Bellafiore is one of the founders of a proprietary trading firm (what proprietary trading is) in New York. For more than 15 years he teaches traders how to select instruments for trading in order to increase their chances for success.

Traders in his firm prefer to trade stocks since they believe that the stock market movement potential is significantly higher than in any other market. We will tell you in this article about:

- specific features of stock trading;

- how to select the best stocks before a trading session starts;

- why the profit size depends on it.

Specific features of stock trading

The first specific feature is expenditures. As a rule, the stock trading commission is higher than the futures trading one.

The second specific feature is a number of markets. Stocks of 6499 companies are traded on NYSE and Nasdaq exchanges as of June 2020, which means that selection of instruments in the stock market is much bigger than in the forward and currency markets.

In order to maximize the profit in the event of intraday stock trading, they should be:

- sufficiently volatile;

- sufficiently liquid.

To do it, you need to narrow down the selection from more than 6 thousand stocks to, approximately, a dozen.

The easiest thing is to select stocks before a trading session starts with the help of special scanners, for example, by the following criteria:

- average daily volume > 1 million stocks. Such a volume is good both for beginner and experienced traders;

- relative volume, which was formed during premarket > 10%. It is a percentage from the average daily volume, which emerged before the trading session opening at 9:30. Major institutional investors start posting orders during the premarket. The higher the relative volume indicator, the higher the interest of major investors to the stock is and the more probable significant price movements after the opening are.

- gap size > 5% shows how high the market moved during the premarket from the previous day’s closing level.

Criteria could be different. The most important thing is that, according to these criteria, the selection would include stocks with a sufficient volume, big volatility and strong movement potential.

You can find many scanners on the Internet for selection of stocks. Usually, you have to pay for them:

- Trade-ideas.com is a popular scanner with artificial intellect.

- Finviz.com.

- Benzinga.com.

- StockFetcher.com allows development of your own formulas for selection.

- MarketChameleon.com.

- ChartMill.com.

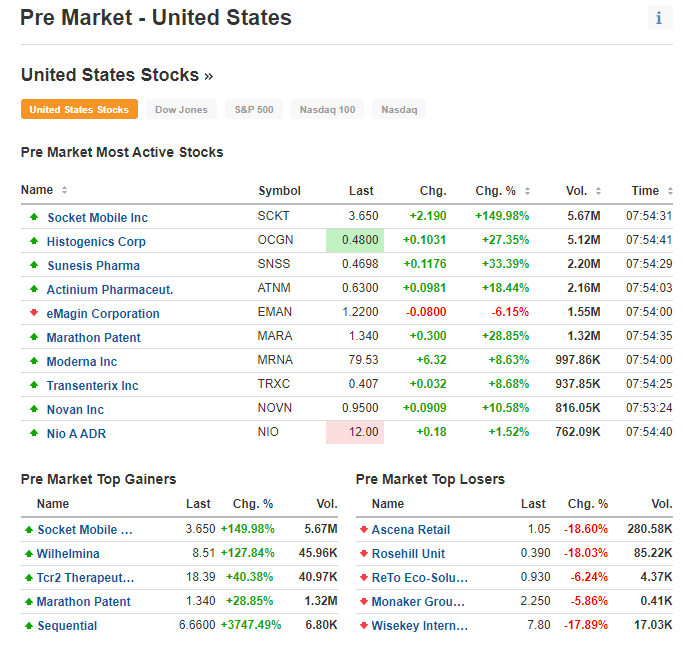

However, there are free variants, for example, the built-in scanner of TradingView, Hamaha or Investing.com (in the picture below).

Или на Marketwatch.com

Active stocks, selected by certain criteria, would have the following advantages compared to other securities:

- increased chances for trend movement during the day;

- a possibility to increase the position size in the course of the trading session development. Reversals do not take place during trend movements. The price only rolls back and consolidates, that is why it is possible to increase the position size with a lower risk than on non-trend days;

- risk:reward ratio is significantly larger than 1:3;

- clear understanding and limitation of the risk.

Active stock example

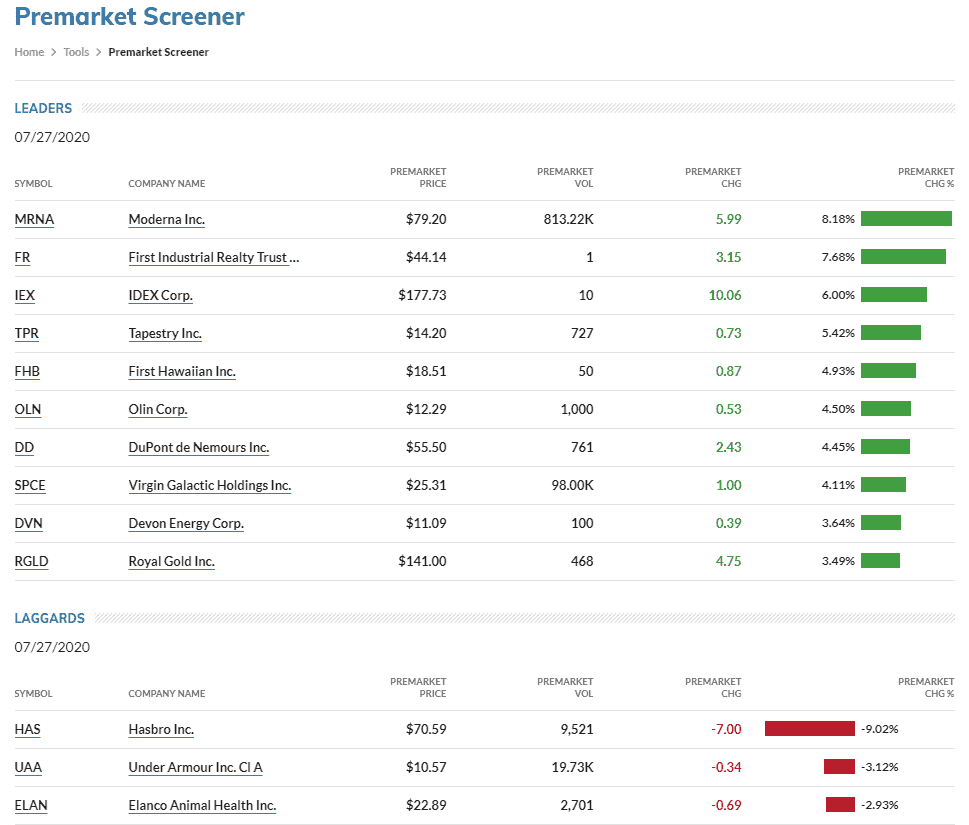

Let’s check how a trading session develops for the Hasbro company stock. The price significantly fell in the premarket, because the company published a report on July 27, 2020, which turned out to be worse than forecasted and expected.

And now let’s see how the trading session developed after these data and whether it was possible to make money on this stock.

The price moved down on July 24 still before the report was published and a trend sell day with two single prints of sellers developed. POC moved down to the day’s low and the trading session was closed not far from the low.

It is important to identify significant levels for opening and closing potential trades during a preliminary stock selection and preparation for trading. We marked several levels in the chart by previous local highs and lows. All traders can see these levels and the prices here would slow down with a high probability.

A trading session opened with a down gap on July 27. The price immediately fell below our first level, touched the second one and slowed down. Even if the traders failed to use the trading opportunity at the session beginning, the prices rolled back approximately to the middle of the first bar and provided those who were late with a possibility to sell the stock.

Short sells in Hasbro were trades with a low stress level and big confidence level, since they were in correspondence with actions of many market players. In other words, such trades come to the traders by themselves, you just need to learn to wait for them and find them.

Additional criteria of the active stock selection

Here are some criteria, by which the stocks in play could be selected:

- fundamental data;

- open position data.

Let’s consider them in detail.

External positive or negative data about the company usually exert significant influence on its stock quotation. These could be:

- quarterly or annual reports;

- investigations that have to do with the company or its top management activity;

- increase/decrease of the dividend size and many other things.

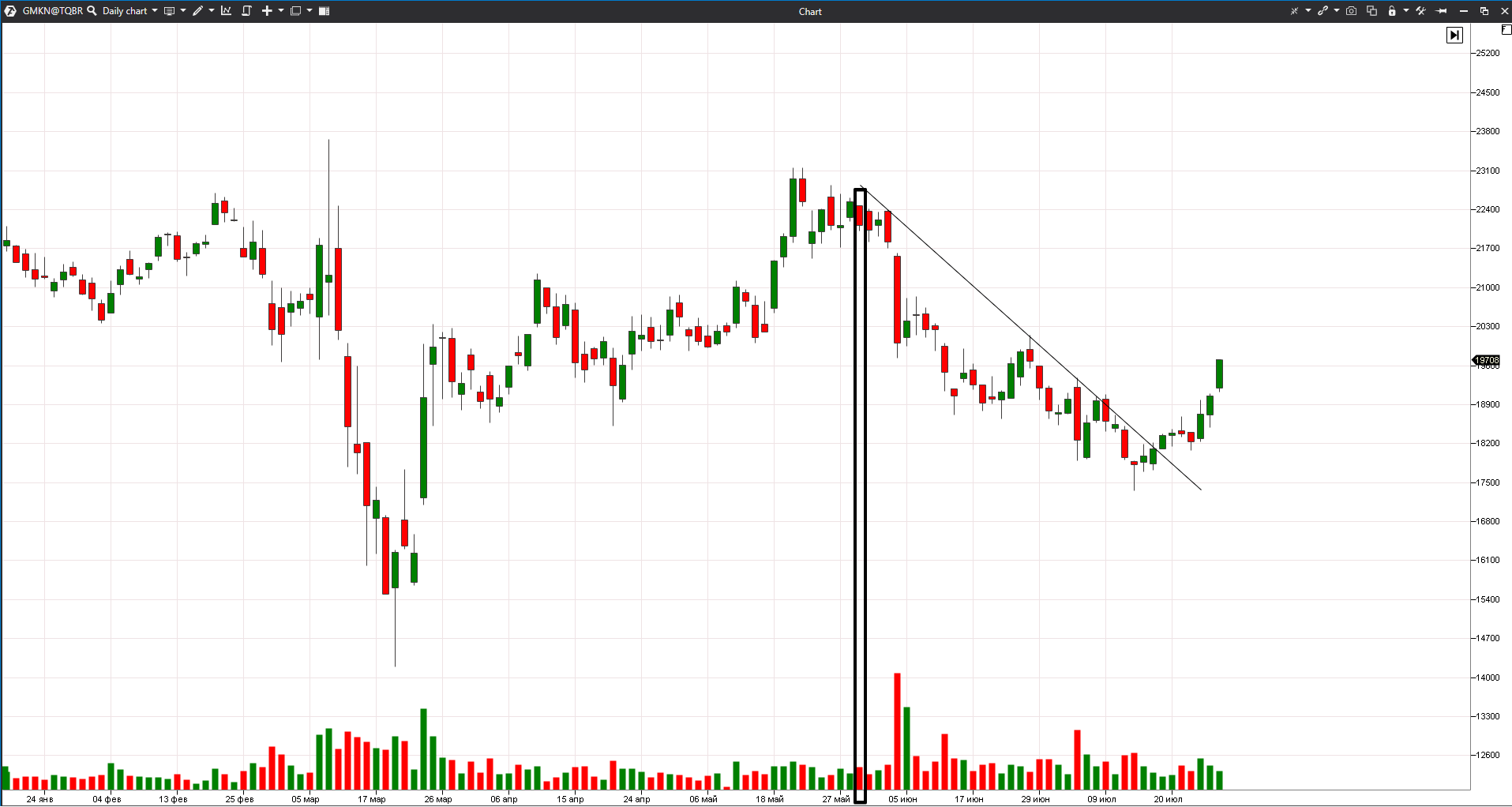

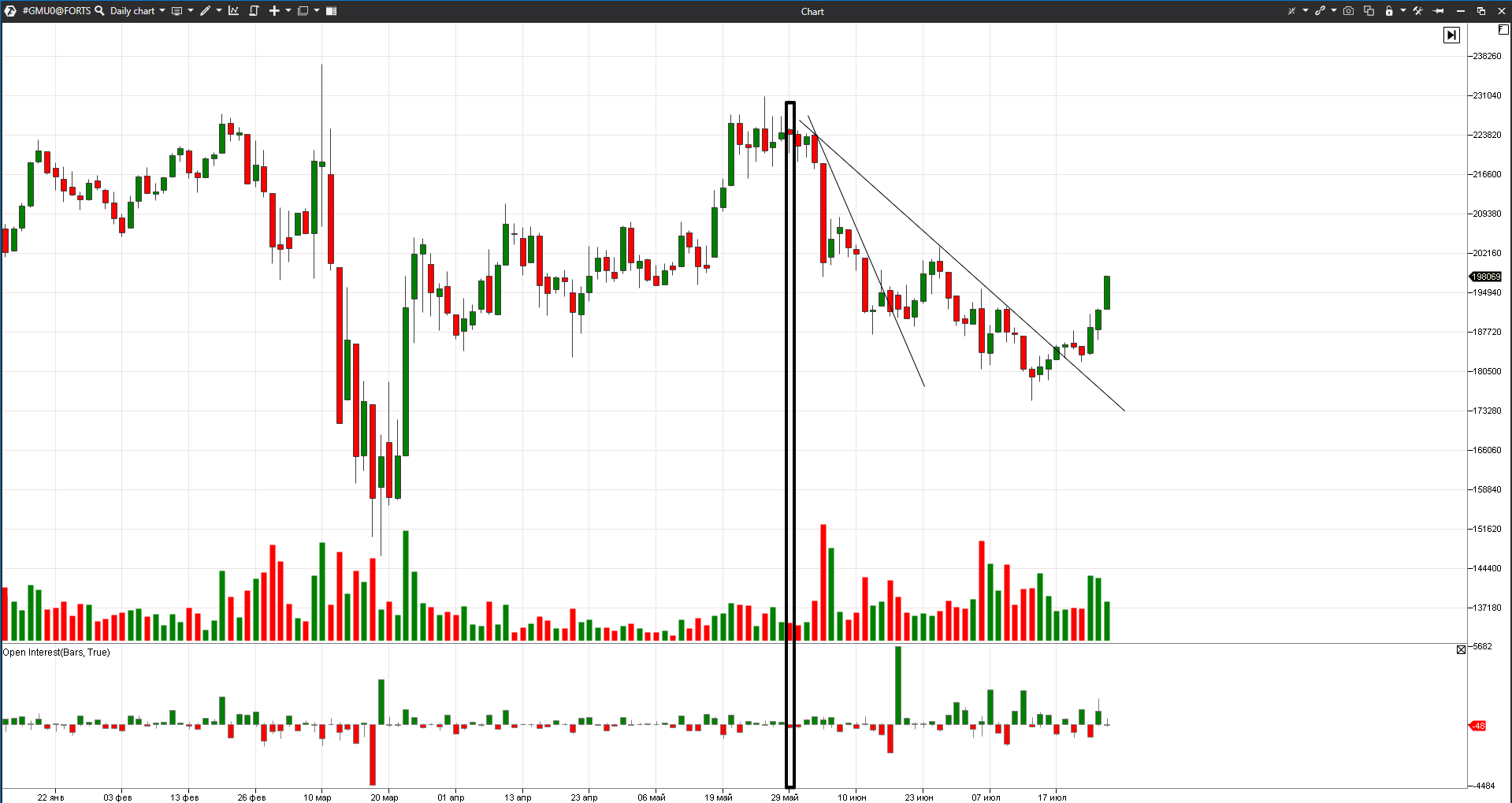

For example, a 20 tonne oil spill took place in Norilsk on May 29, 2020, flooding local rivers Daldykan and Ambarnaya. The spill resulted in an environmental disaster, responsibility for which lies on PAO GMK. Let’s see whether this piece of news led to increased volatility and volume of the security.

There was no special movement in the market on May 29. First, information about the catastrophe didn’t come immediately, second, it was difficult to assess its size all at once. However, the stock prices started to fall on June 3. Negative news about the oil spill reversed the uptrend and led to the stock price fall for more than 20%. The stock price moved down for more than a month with small rollbacks, which means that the stock was in play not for one day but for several weeks.

By the way, PAO GMK stock futures contracts are traded in the forward section of the Moscow Exchange, that is why it was possible to take advantage of the situation but pay smaller commission fees than for the stock trading – RUB 12.62 per contract + brokerage commission.

The news not necessarily could be directly connected with the company activity. For example, the sharp gold growth led to the gold-mining companies’ stock growth.

The number of open short positions could be yet another criterion for the active stock selection.

For example, Tesla stock had more than 10-20% of open short positions in different time periods, that is why, when the price moved up, investors closed loss-making positions pushing the price even higher.

Professional traders use short interest in their trading strategies. For example, the 3D Systems Corp stock price moves down for a long time already in our example, that is why the percentage of short positions simply confirms the existing trend.

Conclusions

Stocks in play allow traders to trade easier and make more money.

Advantages of trading active stock:

- Securities, which became active, could be traded not only during one day but during several days or weeks in a row and traders could make money in a stable fashion, holding positions along the trend.

- The number of stressful situations decreases. Traders do not speed up trades, that is why their trading activity is more comfortable.

- Every day offers a multitude of active stocks.

Disadvantages of trading active stock:

- It is extremely preferable to be able to use scanners and know fundamental analysis in order to correctly select active stock.

- This trading style with ‘jumps from one market to another’ might not be good for a trader in view of his personal qualities.