STUDY TO READ FOOTPRINT

This article is mostly for those traders who have just started to study trading by cluster charts. A beginner should develop own understanding of how to read footprint correctly. We speak here both about training of visual perception, that is, how to find necessary information in the chart, and about training of analytical skills in order to understand what it means. Material in this article is not unique and might not be the best approach – it is just a recommendation. That is why each of you can modify it depending on your needs.

It is assumed that the reader already has some basic understanding of what a cluster chart (footprint) is and how it is built in the trading and analytical ATAS platform. If you are not yet acquainted with this type of presentation of stock exchange information, please, read some of our articles before continuing reading this one: “Cluster Chart (Footprint) Anatomy” and “Cluster Charts (Footprint) Types. Part 1”.

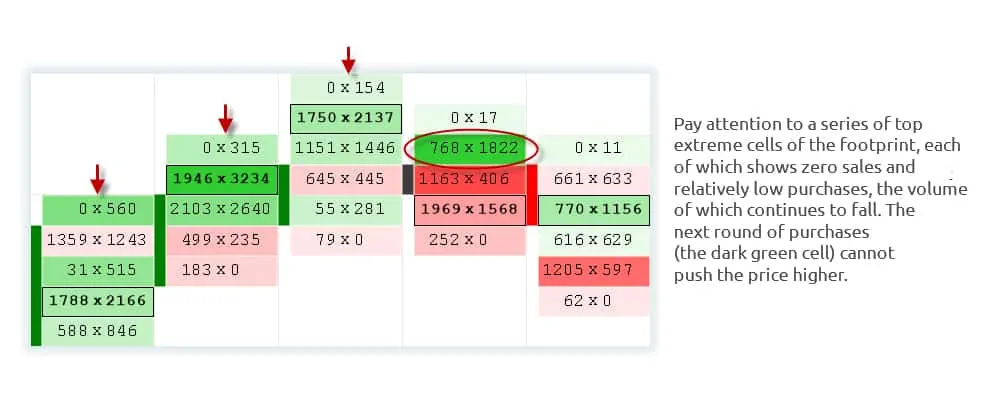

Tapes data are traditionally displayed in the table form with the help of the Time and Sales window. The old concept of tape reading refers to the ability to read and interpret permanently changing data in the Time and Sales window in order to get an idea of the order flow. Tape reading is a process that brings a trader to mental strain when it is easy to overlook something important. A few traders have the ability to notice patterns hidden in these data. Interpretation of information, which is provided by Footprint, can significantly simplify reading the tape in its pure form and even help to identify the market dynamics and price behavior, which is not easy to do when reading the tape.

In this article: