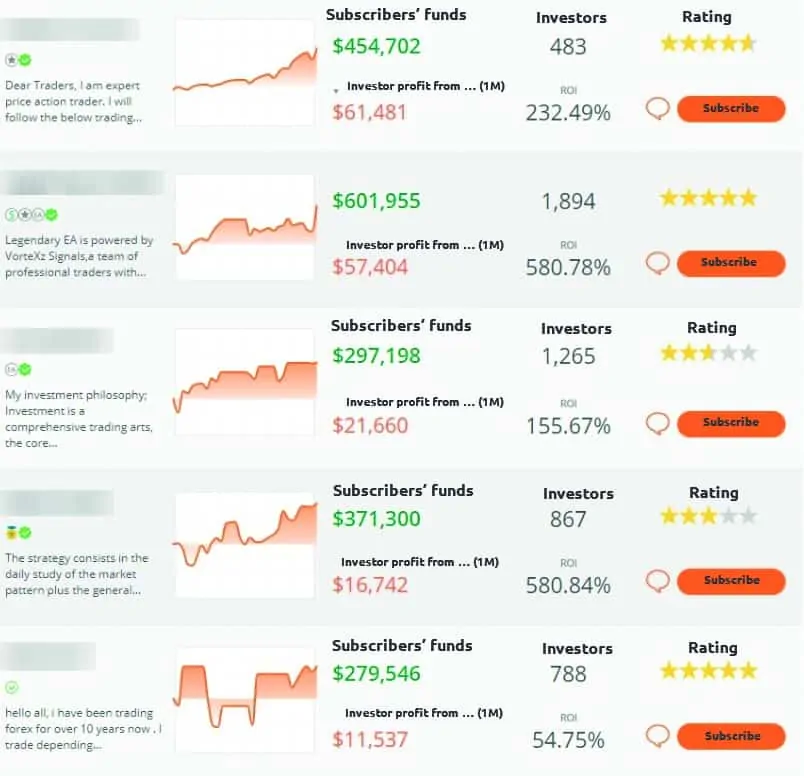

The first step, which you should seriously consider, is the principle of portfolio investing, which means investing in several traders.

Why is it important for any trader or investor to form a portfolio of trading systems for investing?

Seven arguments in favour of a portfolio investing:

Argument 1. Market variability constantly makes looking for new approaches for profitable trading and, due to this, any trading system has the market lifetime, during which it is in correspondence with the current market and can bring profit. If you have only one system in your portfolio, then, most probably, it would stop working after some time.

Argument 2. Trader psychology may influence trading stability. If there is only one trader in the portfolio, then, due to emotional load and errors of the trade supplier, the portfolio may go into drawdown even if the market hasn’t changed.

Argument 3. One trader is one system. A trader may trade with proper quality only a small number of trading systems, usually, not more than one. That is why it is important to have several traders in the portfolio, so that trading could be carried out with different trading systems and instruments and in different markets.

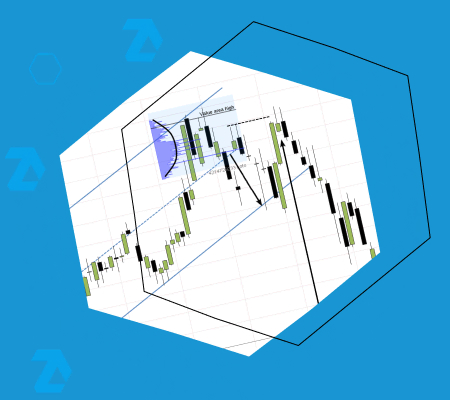

Argument 4. Absence of multi-month drawdowns. Any trading system may go into drawdown and stay there for several months, which might not be very easy for an investor from the psychological point of view. If there are several traders in the portfolio, drawdown of one system could be compensated by the profit of another trading system.

Argument 5. Diversification. In order to make profit in a stable manner, it is necessary to diversify your investments into various trading systems, instruments and markets. Trend movements could take place at different times in different markets and you need to monitor and trade different markets in order not to miss the opportunity to make profit.

Argument 6. A smoother capital curve.