Tasks of financial markets

The main task of financial markets is attraction and redistribution of the capital and economic development.Investors also receive additional income in financial markets and learn about the state of economy – whether there are problems and difficulties.

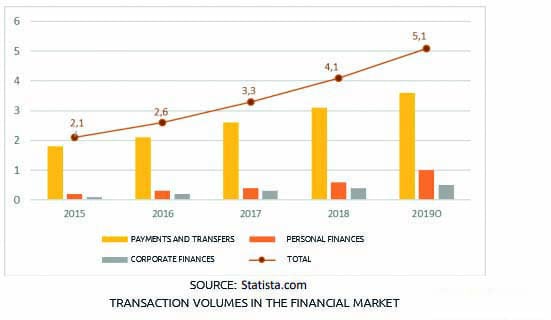

Financial market transaction volumes grow every year. See Picture 1.

Types of financial markets

Most often the financial market is divided into the following functional types:- Securities market or stock market. It could be roughly split into the debt and equity markets. Bonds and bills of exchange are analogous to borrowings for a certain period of time. Sometimes, the bond market is treated like a separate type and is called the fixed-income market. Debt market: not only organisations but also state and municipal structures actively operate in this market. Equity market: companies issue common and preferred stocks in this market. Investors become owners of a part of a company and can keep stocks for a very long period of time.

- Forward market. This is the secondary securities (or derivative) market. Derivative instruments have no value by themselves – they are linked to the underlying assets. The derivative instrument price changes after the underlying asset price changes. Derivative instruments are used for speculation and hedging. Moreover, it is convenient to work with them when it is impossible to work with underlying assets – for example, weather futures contracts.

- Forex or currency market is the most liquid and ‘alive’ part of the financial market. The majority of trades are executed in this market. Forex is a decentralized market, which includes brokers, banks, commercial companies, hedge funds, investors, etc. Trading is carried out in the electronic form. It is very difficult to regulate Forex, that is why you may come across bad-faith participants, who deceive investors.

- Crypto-market has appeared quite recently. As of today, cryptocurrency cannot replace the money, issued by the state. However, the cryptocurrency market capitalization grows and you cannot ignore it. Moreover, investors are interested in investing in this market as an alternative to investing in the stock market.

- Precious metal market. Main trades in this market are executed between banks and enterprises.

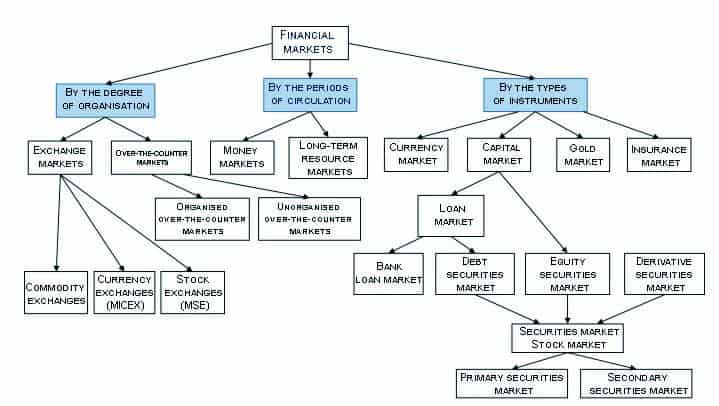

- Insurance market. Specific products, connected with reducing all possible risks, are traded here. See Picture 2.

In terms of circulation, financial markets could be roughly divided into two big groups:

- Money market: you may take a loan for the period up to 1 year. It could be physical money, monetary market mutual fund shares, deposit certificates and securities with less than a year maturity. The money market revenue is low, but liquidity and reliability are high.

- Capital market: instruments with more than 1 year maturity are traded here.

In terms of organisation of trading, financial markets are divided into:

-

- unorganised or over-the-counter market represents decentralized platforms, where they, most often, trade without brokers, that is why buyers and sellers reach agreements directly between themselves. As a rule, there are no standard conditions in the over-the-counter market. Quite often, significant amounts of money are involved here. There are less regulations and requirements in the over-the-counter market than on exchanges, that is why you can buy stocks here, which are not available on exchanges. Many companies start to attract money in the over-the-counter market and then they move to the exchange market;

- organised or exchange market represents platforms where everything is regulated and subject to strict rules. Investors work only through brokers on the exchange. Exchange operations are regulated by the state or special committees. All trades are registered and their execution is guaranteed, that is why there are much more investors here. See Picture 3.

Financial market participants

Financial market participants are hedge funds, brokers, investment funds, state, investors and many others.The bond and stock market participants could be divided into:

- those who need money;

- those who are ready to borrow money;

- intermediaries.

As regards other types of financial markets, participants, as a rule, are divided into buyers and sellers.

Financial market development

Popularity of financial technologies started to grow since 2008, when financial companies had to save money due to the global economic crisis, while the mobile market was quickly developing.The number of financial technology users increases by 15-20% every year – this is one of the fastest growing branches. Due to financial technologies, the market competition increases and the quality of services for final users grows. Moreover, operating costs decrease – for example, cost of electronic transactions and customer servicing. See Picture 4.

- mobile technologies gave birth to mobile banking and mobile investment applications and also started to replace physical banking cards with virtual ones. Mobile technologies bring the financial market closer to the end user and develop the economy;

- big data processing allows financial companies to find a required piece of information in huge data stores, develop new consumer categories and make personalized proposals to customers;

- artificial intellect allows companies to improve customer service, launch advisor bots and increase customer loyalty;

- digital currencies are already being developed by some countries as national currencies, while some countries try to restrict circulation of cryptocurrency. In any case, the number of projects, which are based on the blockchain technology, are growing in the world;

- virtual reality is used by fintech companies for remote operation with customers, their training and loyalty increase;

- non-contact technologies provide the financial sphere with an ability to conduct payments with the help of smartphones, smartwatches, smart wristbands, etc. All these things simplify and accelerate payments and, consequently, increase the number of transactions;

- biometry also accelerates and simplifies conducting banking operations and use identification in the event of working with various marketplaces.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.