Biden’s fantastic generosity, bitcoin fall and others

Main financial markets revive after holidays. Majority of commodities break records one after another, while cryptocurrencies underwent severe retracement after a phenomenal growth just before. Read in our review what stocks to buy in view of the raw material price growth, how Biden will give away USD 1 trillion to Americans, why wheat and corn prices skyrocketed and whether we should expect new bitcoin growth.

Calendar of economic statistics

Biden will give away USD 1 trillion

Bank of America published a forecast on raw materials

Wheat futures break records

Should we expect yet another bitcoin growth

| Date, time (GMT +3:00) | Event | Impact, forecast |

Monday, January 18 | United States. Martin Luther King Day. Markets are closed. | |

| 05:00 | China. GDP for the 4 quarter of 2020. | Oil. Commodities. Forecast – 6.1%, previous value – 4.9%. |

Tuesday, January 19 | Germany. ZEW Economic Sentiment Indicator in January. | EUR. Dax. Forecast – 45.5, previous value – 55.0. |

Wednesday, January 20 10:00 | Great Britain. Consumer Price Index (CPI) in December. | GBP. Forecast – 0.6%, previous value – 0.3%. |

Eurozone. Consumer Price Index (CPI) in December. | EUR. Forecast -0.3%, previous value -0.3%. | |

| 18:00 | Canada. Interest rate decision of the Bank of Canada. | CAD. |

Thursday, January 21 15:45 | Eurozone. Interest rate decision of the ECB. | EUR. Dax. |

| 16:30 | United States. Building permits. | USD. S&P 500. Forecast – 1.600M, previous value – 1.635M. |

Friday, January 22 10:00 | Great Britain. Retail sales. | GBP. FTSE. Previous value -3.8%. |

| 11:30 | Germany. Industrial PMI. | EUR. Dax. Forecast – 56.4, previous value – 58.3. |

| 18:00 | United States. Real estate sales in the secondary market. | USD. S&P 500. Forecast – 6.53M, previous value – 6.69M. |

Monday, January 18 |

United States. Martin Luther King Day. Markets are closed. |

| 05:00 |

China. GDP for the 4 quarter of 2020. |

Oil. Commodities. Forecast – 6.1%, previous value – 4.9%. |

Tuesday, January 19 |

Germany. ZEW Economic Sentiment Indicator in January. |

EUR. Dax. Forecast – 45.5, previous value – 55.0. |

Wednesday, January 20 10:00 |

Great Britain. Consumer Price Index (CPI) in December. |

GBP. Forecast – 0.6%, previous value – 0.3%. |

Eurozone. Consumer Price Index (CPI) in December. |

EUR. Forecast -0.3%, previous value -0.3%. |

| 18:00 |

Canada. Interest rate decision of the Bank of Canada. |

| CAD. |

Thursday, January 21 15:45 |

Eurozone. Interest rate decision of the ECB. |

| EUR. Dax. |

| 16:30 |

United States. Building permits. |

USD. S&P 500. Forecast – 1.600M, previous value – 1.635M. |

Friday, January 22 10:00 |

Great Britain. Retail sales. |

GBP. FTSE. Previous value -3.8%. |

| 11:30 |

Germany. Industrial PMI. |

EUR. Dax. Forecast – 56.4, previous value – 58.3. |

| 18:00 |

United States. Real estate sales in the secondary market. |

USD. S&P 500. Forecast – 6.53M, previous value – 6.69M. |

The week will be rather poor in terms of significant macroeconomic statistics. Statements of the ECB and Bank of Canada on interest rates may spark activity on Forex. As regards the stock market, players will pay special attention to publication of quarterly reports of some major US companies. We recommend you to take note of them for proper trading activity planning.

Tuesday, January 19: Bank of America (BAC), Netflix (NFLX) and Goldman Sachs (GS).

Wednesday, January 20: UnitedHealth (UNH), Procter & Gamble (PG) and Morgan Stanley (MS).

Thursday, January 21: Intel (INTC) and IBM (IBM).

Biden will give away USD 1 trillion to Americans

The elected US President Joseph Biden published details of the plan of Democrats on the economic recovery after the crisis. The total volume of support will constitute USD 1.9 trillion.

The major portion of these funds – USD 1 trillion – will be spent on individual support to Americans in the amount of USD 1,400. So, taking into account the amount previously approved by the Congress, the total amount of support will be USD 2,000 per person. Biden plans to spend USD 400 billion on fighting coronavirus. The rest of the funds will be spent on assistance to business.

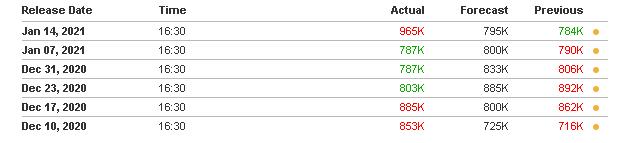

This support package will be very handy, since macroeconomic data disappoint. Dreadful Initial Jobless Claims statistics was published on January 14. It showed a significant growth of jobless claims. The US labor market is still in the state of crisis.

Nevertheless, many economists believe that such massive inflows into the economy would result in the inflation growth and would facilitate the price growth on stocks, real estate and other assets.

Bank of America published forecasts on raw materials

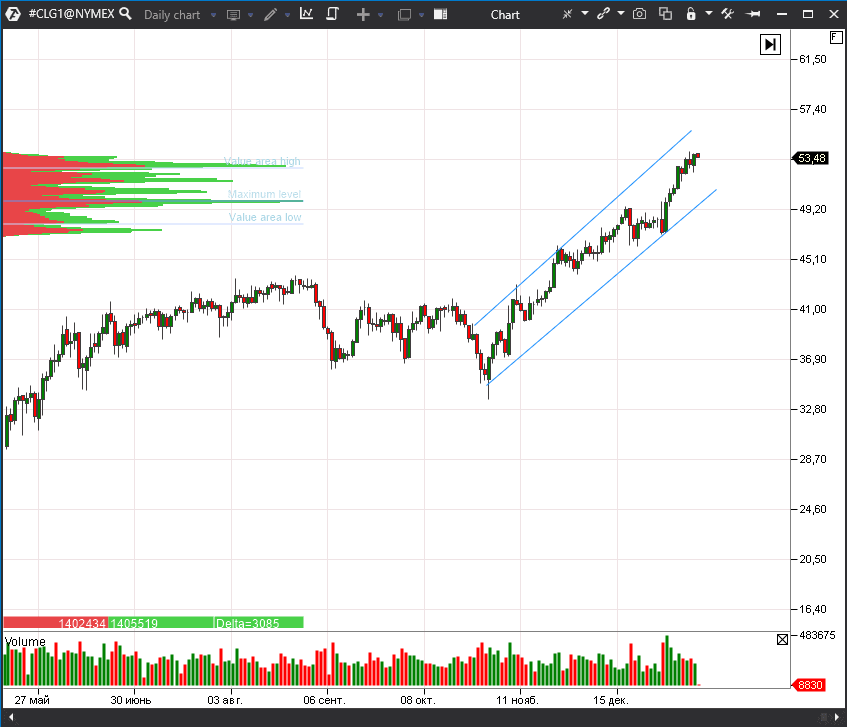

Prices on the majority of raw materials have been constantly growing during the recent months. Quotes of the WTI oil futures (CLG1) renewed its highs since February 2020. Prices on iron ore, copper and other industrial metals are close to their multi-year highs.

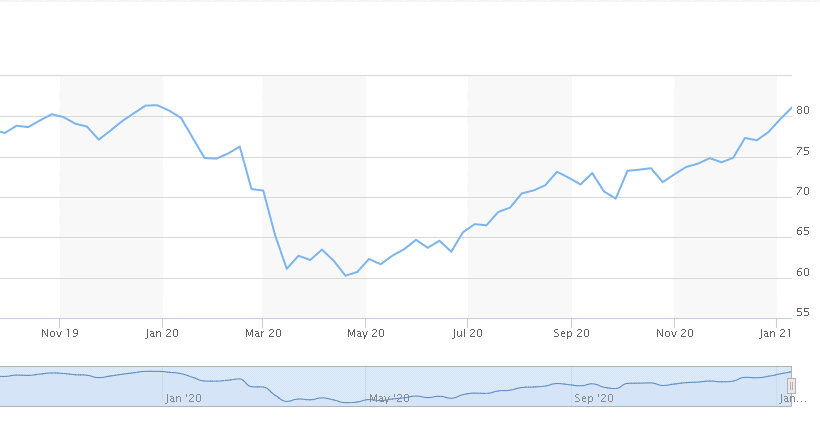

Bloomberg Commodity Index recovered to the pre-crisis levels.

Analysts of the Bank of America (BAC) believe that the raw material price growth will continue in the coming quarters. Experts believe that inflation will accelerate and the dollar will become weaker against the backdrop of ultra-soft monetary policy of the key central banks of the world. This is positive news for all commodities. A stable demand against the backdrop of the world economic recovery will support this trend.

They also note in the bank that there could be problems with sufficient coverage of the raw material deficit due to a long period of underfinancing. A combination of these factors may lead to a boom in the market, similar to the one that was in the first half of the 2000s. They believe in the Bank of America that this creates a potential for a breakthrough growth of extracting companies compared to a wide index. A good opportunity for investments.

Grain crop futures break records

Futures on basic agricultural commodities also show impressive rates of growth – record-breaking for the past 10 years. Wheat and corn futures reached the local multi-year peak on January 13, after which they underwent retracement.

The main reason for this trend is the growth of demand on behalf of the largest countries of the world, which decided to form food reserves for the nearest 1-2 years. Lessons of the 2020 crisis, which the United States, for example, approached with the grain crop reserves for 2-3 months only, were well learned.

Although the year 2020 was record-breaking in terms of production of wheat and corn, it was still insufficient for covering a strongly increased demand. Unfavourable forecasts of the United States Department of Agriculture (USDA) also added fuel to the fire. Dry weather is expected in the main American agricultural regions caused by La Niña. Corn production forecasts are also reduced for Brazil and Argentina.

Another major grain crop producer – Russia – plans to introduce export quotas, which would also reduce supply in the world market.

Should we expect yet another bitcoin growth

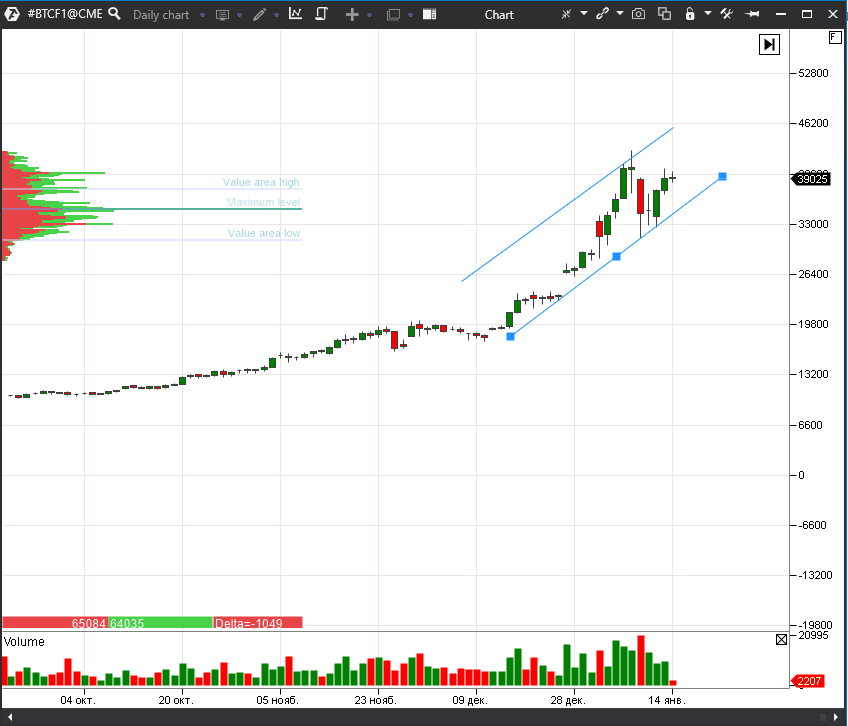

Meanwhile, a wave of sell-outs covered the cryptocurrency market. The deepest fall took place on Monday, January 11. Retracement of the bitcoin futures (BTCF1) took place on volumes, which were record-breaking in the market history. Bulls bought out a bigger part of the fall during the rest of the week, but retracement potential still exists.

The most evident reason for retracement is profit registration by major players after a double bitcoin futures growth in less than a month. The CoinShares fund noted in its report that after a record-breaking inflow of funds of institutional investors in December, the inflow crashed by 97% during the first week of January – to USD 29 million.

The negative information background should also be noted. Christine Lagarde, President of the ECB, declared a necessity of global regulation of bitcoin, and the British Financial Conduct Authority (FCA) warned investors about a risk of investing into cryptocurrencies. All these things could mean that monetary authorities started to be seriously concerned with the growing bitcoin popularity, which is not a good sign for this market.

Branch analysts from JPMorgan Chase believe that retracement would last some time due to the capital outflow from the world largest Grayscale fund. However, most probably, it would be a temporary phenomenon. In general, the bank is positive with respect to bitcoin and forecasts USD 50,000-100,000 per bitcoin in 2021.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.