Read in this article:

- how to leave a series of loss-making trades;

- how to continue trading despite permanent doubts in own abilities;

- 7 practical advice, which proved their efficiency.

Advice 1. Temporarily stop trading.

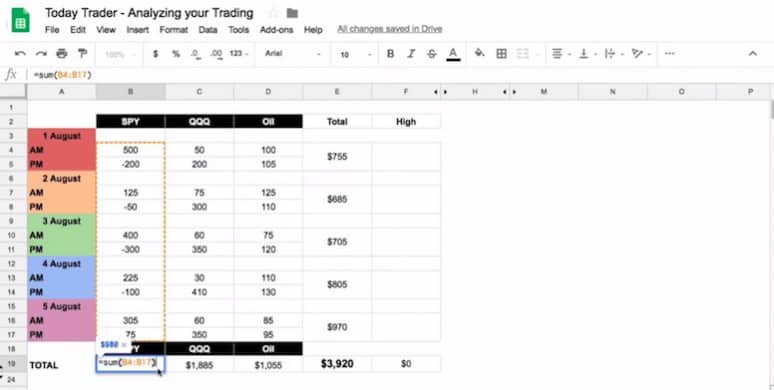

You should determine limits of loss-making trades in a row, after which you bind yourself to stop trading, beforehand. These could be 2-3 trades a day on one or several instruments. You should determine allowable money losses apart from a number of loss-making trades.An example of strict capital management is shown in the table. As soon as you reached your limit, turn off your terminal and go away, for example, for a stroll in order not to yield to temptation to recover your loss. One of specific features of human behaviour is that we consider accidental events as non-accidental. This is the reason why we think that the next trade (after 3-4 loss-making trades) will be profitable for sure. Surely, the market cannot be against you all the time.

Example. A tick USD/RUB futures (SIM9) chart.

Advice 2. Analyze trades during a certain period of time.

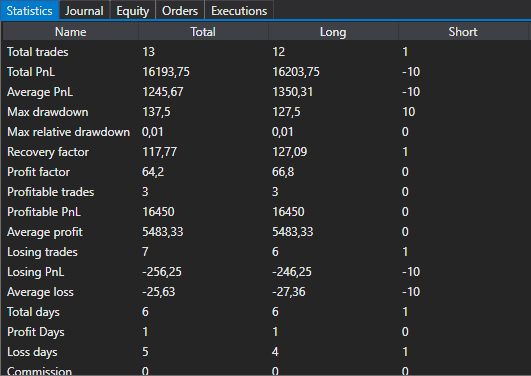

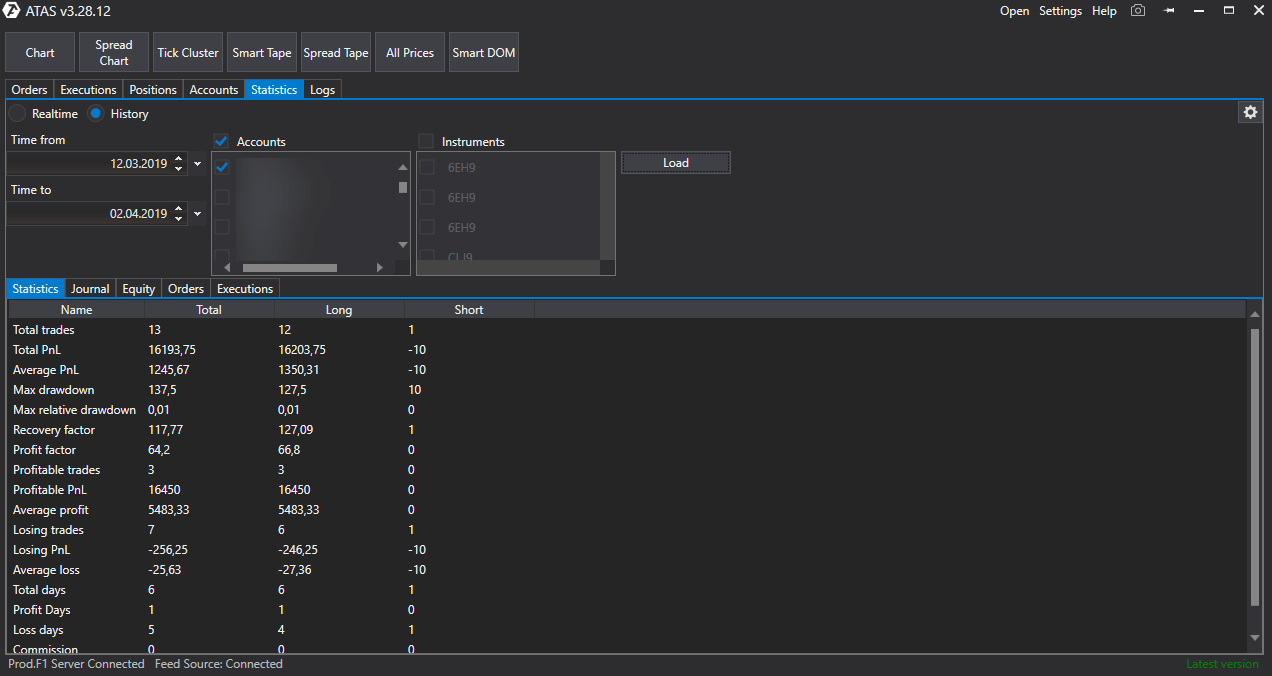

The trading and analytical ATAS platform automatically analyzes your trades. You can load data for a certain period of time in a table or chart form.

- recovery factor is a relation of absolute profit to the maximum drawdown. It is an attribute of success of a trading system – a good result is above 3;

- profit factor is a relation of the general profit to the general loss. The higher this indicator is, the better. If it goes below 1, there are more loss-making trades than profit-making ones.

You can also load statistics on any instrument for any period of time.

- Payoff ratio is the average profit/loss. This indicator should be above 1;

- Expectancy is an expected amount of money/ticks, which you can get in the next trade based on your previous results.

Advice 3. Identify problem areas.

There are several global problems in trading:- Absence of a trading system. If you trade intuitively, first, find your trading system, test it on the demo account and then start improving it. In order to increase your efficiency, try advanced software with such unique indicators as unfinished auction, Weis Waves, cluster search, big trades, and oi analyzer. Your competitive advantage lies in what other traders do not see and cannot do. Response time is very important for intraday trading, that is why it is more efficient to work with footprint and not with delayed sliding averages or “triple screen” method.

- Loss-making trading system. A trading system is profitable if a number of profit-making trades is bigger than the number of loss-making ones. It is a Hit-rate indicator in our table. Everything is fine with the system if it is higher than 0.6. If the indicator of your trading system is below 0.6, try another trading system and test it on historical data. When looking for a new trading system, try to find a competitive advantage in it and correspondence with that style of trading, which fits you.

- Small initial capital. Trade small lots or a limited number of instruments. Find such a size of a trading position, which, on the one hand, does not bear an excessive emotional load and, on the other hand, makes you feel responsibly and monitor the open position.

- Violation of rules of a profit-making trading system. If a trading system proved its profitability, but your trading account decreases anyway, the problem is, definitely, in your discipline and not following the rules. The majority of traders face namely this problem in most cases.

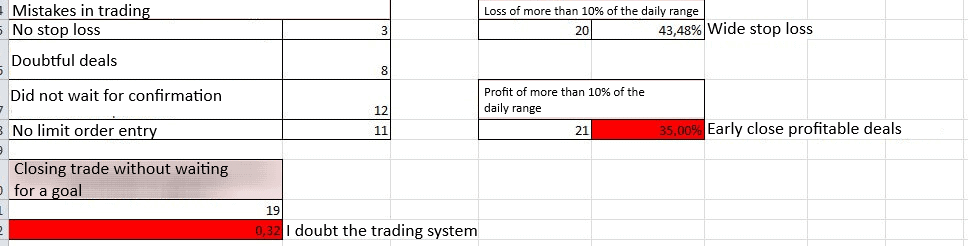

Analysis of the previous table detected mistakes connected with discipline and realization of a trading system:

- strange trades that do not correspond with trading setups;

- wide stops;

- fast closing of profit-making positions;

- doubts in the success of a trading system.

Advice 4. Build a correction plan.

The correction plan in our case will be about discipline and execution of trades:- Reduce the number of traded lots;

- Clearly identify setups, which you would trade, and put ideal examples for comparison in front of your working space. Every time you have a wish to sell or buy a futures, ask yourself: “why do I open this position?”, “do I follow requirements of this trading setup?” and “do I rush things?”;

- Reduce stops if possible;

- Reduce the number of daily and weekly trades. If you restrict yourself in a number of opened trades, you will face a necessity to select only strongly pronounced setups.

Advice 5. Conduct psychological work

-

- Separate yourself from failed trades. Loss-making trades do not influence opinions of your friends and relatives about you. Friends and relatives will continue to love you even if you cannot make money by trading at this stage;

- Write down useful quotes about the market randomness and uncertainty. For example,

“It is not necessary to know what happens the next moment of time in order to make money” Mark Douglass. Pronounce aloud these phrases before a trading session. Psychologists call it positive persuasion. Your subconsciousness will accept it even if you do not believe in what you pronounce;

- Keep away from forums and discussions of trades during a trading session. We look for confirmation in the outer world and in actions of other people when we are not sure in ourselves;

- Check your trading system and your ability to reach success with it. Test it using historical data and calculate the number of profit-making trades;

- Meditate or relax your brain regularly. This would help you to concentrate and make less mistakes.

Advice 6. Test your correction plan on a real trading account.

- Focus on execution and not on profit. Forget about profit and your desire to make living from trading. Your goal is to follow rules of your trading system. Automatic opening and closing of trades by received signals;

- Reward yourself for correct execution of the trading setup. It could be anything: stickers, candies, a new film or computer game. Iron discipline during a week might be rewarded by a trip to cinema, restaurant or sauna. Never connect rewards with profits. Your goal is discipline – profit follows automatically;

- Accurately follow all correction measures and rules of the trading system;

- Restrict the trading time to several hours a day during the most productive time. It would be easier to focus this way and to avoid temptations to open improper trades;

- Find yourself a “boss”, who will not allow you violating a trading plan. This could be a spouse, grown-up child, brother or sister.