Learning to hedge currency risks

What does hedging currency risks mean? In simple words, this is when a financial market participant performs an operation to insure himself against a possible negative influence, which can be exerted on his other operations by the currency exchange rate change.

For example, when a US investor buys stock of an American company, denominated in USD, his risks are not subject to the EUR/USD or other exchange rates influence. However, if he invests abroad, he needs to take the exchange rate influence into account.

Example 1. Let’s assume you are a US citizen and your broker allows you to invest into stocks of companies all over the world. You admire products of one European fashion clothes company and want to invest USD 10,000 in its stock, quoted on a European exchange. The company stock is traded at EUR 100, the EUR/USD exchange rate is 1.1, which means that you can buy 90 shares (there will be some change left, which you can spend on exchange and broker commission fees).

However, important economic news, which pushes the Euro rate up, is published while you study fundamental data about the company. And although the clothes manufacturer stock value stays the same (EUR 100), you can now buy not 90 but 83 shares due to the changed currency exchange rate. In order to hedge the currency risk in this example, you should open a position, which will bring profit in the event of the EUR/USD exchange rate growth and will allow you to buy as many shares as you planned at the beginning.

Example 2. You are a European businessman and plan to spend your savings in Euros for buying real estate in London, the value of which is measured in Pound Sterling (GBP). However, due to the current circumstances (for example, coronavirus pandemic), the EUR/GBP rate moves down. That is why you need more and more Euros. And this disappoints you since you have to look for real estate not in the London downtown but in the outskirts.

Example 3. You are a programmer from Singapore and make money online. Your regular customers from all over the world pay you in US Dollars. However, the decreasing USD/SGD exchange rate reduces the purchasing power of your salary when you buy something in your local market. Managing currency risks of receiving salary abroad can be more difficult since it always exists for a long period of time.

These 3 situations show that every time you deal with assets denominated in a foreign currency, a risk arises, which can play against you. You need hedging to manage currency risks.

Specific feature of hedging currency risks

An important feature of hedging currency risk, as it is with any other financial plan element, is absence of some common golden rule about how to hedge currency risks.

It is just impossible to have it. There are too many unique variables, which have to be taken into account in order to find an acceptable variant of hedging in accordance with specific financial goals of any investor.

However, there are certain instruments, which are applied for hedging currency risks. They can be really useful, although they were developed for other purposes.

Instruments for hedging currency risks include:

- Specialized ETFs.

- Forward contracts.

- Options.

An important consideration, which should be taken into account when managing currency risks, is that when an investor opens currency positions for balancing currency risks, he also undertakes the risk of these additional positions.

Hedging currency risks with the help of specialized ETFs

One of the ways to hedge the currency risk is to invest in a specialized fund, which trades on a currency exchange (Exchange-Traded Fund – ETF).

We have an individual article, which explains what an ETF is.

In principle, a currency ETF functions the same way as any other ETF, but, instead of holding stocks and bonds, it holds money deposits or derivative instruments, which are connected to the underlying currency and which reflect its movements.

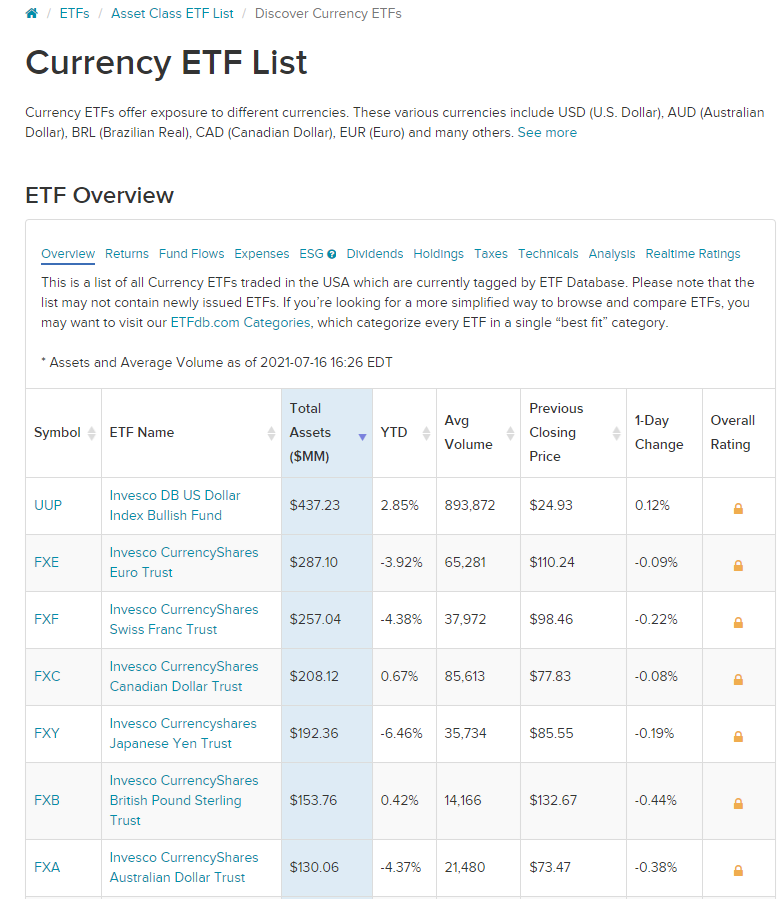

For example, you can go to any web-site, which has an ETF catalogue, and get acquainted with the funds, which are classified as Currency ETFs.

A trader can open a long or short position by these ETFs, depending on a situation and in order to protect investments from currency (or several currencies) volatility.

Hedging currency risks with the help of forward contracts

Forward contracts in the currency market are derivative instruments, which allow a market participant to register the current exchange rate on a pre-established date in the future.

Methods of hedging currency risks with the help of forward contracts envisage buying/selling:

- Futures contracts;

- Forward currency contracts (Forward Exchange Certificate – FEC).

Advantage of forward contracts lies in the fact that they can protect assets against exchange rate fluctuations by registering an exact price right now.

Moreover, forward market trading volume analysis allows making justified forecasts about the future currency exchange rate movements. The analytical ATAS platform (download it free of charge) and its volume analysis indicators will help you in it (example: the screenshot below shows a cluster chart with market profiles for the GBP futures contracts).

Hedging currency risks with the help of options

An option gives the right, but not obligation, to exchange a currency at a pre-established exchange rate on a pre-established date. There are two option types: put and call. A put option protects the option buyer against the currency exchange rate fall, while a call option protects him against the currency exchange rate growth.

Advantage of hedging currency risks with the help of options lies in the fact that a trader can protect himself from unfavourable movements for an additional fixed payment, which reminds what is called an insurance premium.

Options trading becomes more and more popular. According to the Chicago Mercantile Exchange (CME), the daily options turnover increases every year by 5% and the average daily turnover exceeded USD 3.5 million in 2018.

We recommend you to study the wide topic of options by reading specialized articles. Methods of hedging currency risks with the help of options are discussed in the following publications:

Conclusions

The currency risk can quickly undermine your profit, especially during the periods of high volatility.

Some traders can feel themselves more comfortably and ignore exchange rate volatility risks. Others want to take volatility advantage for speculations. Conservative investors, especially those who work professionally with big amounts, prefer to avoid uncertainty and use various types of hedging currency risks.

Every investor needs to make some steps in order to start hedging currency risks:

- Pass currency risk hedging training courses to study hedging strategies on examples.

- Understand the foundation of his financial goals and tasks.

- Identify where currency risks exist and how they can influence achievement of the goals.

- Analyse various scenarios and assess his attitude to risks.

- Calculate cost of various methods of currency risk hedging.

- Select hedging style and strategy, which correspond with his attitude to risks and financial goals.

- Select relevant hedging products for this strategy.

- Open positions.

- Monitor, assess and adjust his hedging strategy according to changing circumstances.

In any case, we recommend you to bring your risks to a minimum, that is why if you want to test hedging strategies in action, try to do it on your demo account first.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.