To quit employment in order to become a profitable trader? Or to become a profitable trader in order to quit employment? Whatever is the way you formulate your goal (the second variant seems more rational), its execution is often unrealistic for the majority of people.

However, there are certain steps which could help you to improve results of your trading without quitting your employment and finding time for your family and physical activity.

Problems which interfere with the beginners to become a professional trader:

- Absence of the system. The majority of beginners change their approaches, every trade seems different, they change time-frames, experiment with indicators and chase the price spontaneously.

- Absence of the mood. It demotivates a lot if trading results discourage and it seems that whatever you do – nothing works. Then comes the period of hope and gambling and the respective consequences.

- Absence of reporting and responsibility for the result. Trading could be a difficult undertaking if there are no people around you who help you to grow. And even if you communicate with other beginner traders, it does not necessarily support your development.

What to do? Read this article to get acquainted with 8 ideas for making a choice between professional trading and employment.

Idea 1. Find a trading style which fits you

It is important that the trading style corresponds with your individual style and your lifestyle. If we generalize all trading styles, beginner traders would have to choose one out of two main styles: investing and intraday trading.Usually, investing fits better to those people who do not have much time and have limited access to the charts during the day. As an investor, you manage positions and conduct chart analysis during week-ends or before / after working hours. You do not need to monitor the markets during the whole day long and this could free up even more time.

In the event you prefer active trading, you can devote several hours to trading on fast time-frames. For example, you can do it at night after work. A wide selection of active platforms would allow you to select that market, which would be sufficiently volatile (what volatility is) during your off-work hours. Cryptocurrencies are a universal variant. They are traded non-stop.

Advice: You need to decide whether you want to be an investor or intraday trader. Conduct an audit of your schedule and analyze your character in order to understand what style fits you better and then select respective instruments. It would become easier to find a combination of the hired work and market activity after you understand your style.

You can find more information about trading styles in our following articles:

- Advantages and disadvantages of 6 trading types;

- Schedule of trading sessions;

- Pros and cons of online trading.

Idea 2. Do not jump off the learning curve

This ‘trap walking’ refers to traders who change trading methods far too often. They may change methods every several weeks or months or even days. Such traders, as a rule, never see real improvements in their results until they start acting in a systematic and disciplined manner.In the event you always change your approach and violate rules, all your trades would look differently and you would not be able to analyze them in order to find meaning in your actions. The only thing which becomes evident is that you constantly lose your capital. But you would not be able to:

- find out the reasons of it (except for the absence of systemic approach);

- understand what you need to improve and what already works.

You need to use a consistent approach and even if your results do not inspire you at the beginning, at least you could start to develop your vision and understanding of the market and slowly work over the progress.

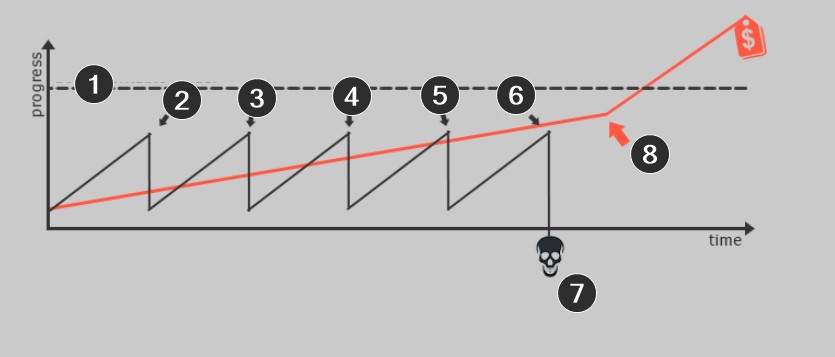

Think over the picture below where the red line shows the curve of results.

- 1 – The line of stable profitability.

- 2…6 – The moments when the trader changes the system.

- 7 – “Well, I’ve had enough!”

- 8 – “Aha! Now I see!”

Advice: choose one system during the period of the next 6 months and promise yourself that you would not change it during trading. No matter what happens.

Do not quit your employment work while your red line is below line 1.

Idea 3. Money is made on expectations. Plan your trading

Your days-off should be the most important days of the week. Try to spend 80% of your market analysis during your days-off and then you would have to do less during working days. Just follow your trading plans from Monday until Friday and introduce corrections into them, say, every 1-3 days.Jesse Livermore expressed it in a beautiful way:

After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!

The majority of traders easily lose because they do not have a plan and they do not know what to look for in the cluster chart. Formulate your rules and you will be able to develop trading plans, after which you can just wait for the price to come to you. Say ‘no’ to impulsive trades!

Advice: Setting up alerts saves time and efforts when you monitor markets. Use alerts after you’ve conducted your analysis during a week-end.

Articles which would help you:

If you conduct the market analysis on week-ends, you could better combine trading/investing and hired labour on working days.

Idea 4. How to get out of the series of misfortunes

We mentioned that you should avoid a jump-like trading from one system to another. But a natural question arises: “How to convert my current (loss-making) trading method into a profit-making one?”Here are 2 advice, which you should focus on in such a case:

Advice 1. Identify your biggest problems and take responsibility for their elimination. Traders often mistakenly assume that absence of success in trading is caused by the trading method and this usually results in ‘jumping’ from one system to another. However, failures are usually reduced to non-disciplined trading, lack of professionalism and purely gambling thinking.

If you do not trade automatically, YOU are the weak link in your trading system.

Thus, the first step you should do is to identify your biggest problems and mistakes you make most often. Traders, who always try to accuse their systems, avoid responsibility and look for excuses instead of improving their own qualities.

Look through your most recent 10-20 trades. Think about what caused your losses. Then draw a list of three most frequent mistakes and introduce methods of avoiding them.

Advice 2. Activate your process oriented thinking. The majority of people act on the basis of goal oriented thinking, when they automatically link profits with good trades and consider losses as failures. Such an approach demonstrates amateur thinking.

Professionals, on the other hand, act on the basis of process oriented thinking, where they look at how good is the plan they developed and how disciplined they are in following the plan. Thus, a loss is not necessarily the result of a wrong action for a process oriented trader if he did everything correctly.

| Goal oriented thinking | Process oriented thinking |

|

|

Try to avoid the goals, which are formulated in terms of money. Stop paying attention to your reward-risk ratio during the next 2 months. Perhaps, it would help you to form process oriented thinking.

Article, which would help you:

Idea 5. Think about - what do you really want from life?

Wall Street Journal published results of an interesting opinion poll, which show how people spend their working days. An average American (during a working day):- spends 7:45 hours at work;

- watches TV for 2 hours and 9 minutes;

- invests only 25 minutes into education.

Moreover, the average duration of a sleep is 8 hours 48 minutes, which exceeds the recommended 8 hours nearly by 1 hour.

If you plan to become a profitable trader, you should clearly understand your priorities and make sure that your actions correspond with your goals.

Are you ready:

- to get up every day one hour before the planned time?

- to stop watching random TV series?

- to refuse (sometimes!) partying with your friends and invest this time into trading?

You can easily free up several hours a week. Of course, these are strict rules and you may say ‘I do not want to waste my best years’. But if you start working now to reap the benefits in several years’ time, the quality of your life could be much higher then.

Advice: Conduct an audit of your recent week and identify the wasted time. Then just eliminate the reason of the time wasting and spend it for studying trading.

‘Ability to discipline yourself to put aside satisfaction in the short-term perspective in order to receive a reward in the long-term perspective is a precondition of success’. Brian Tracy

It will become easier to solve the problem of combining employment and trading when you understand how to optimize your time.

Idea 6. Do not make too much of when and how much

Beginner traders often ask such questions like:- how much it is possible to make on the exchange;

- how many percent I can make a month (day);

- how big my start-up capital should be;

- is it possible to trade from zero.

The wealth of a fool is his thoughts (Ukrainian saying)

Traders should not worry about how big their annual profit could be and what capital they need to stop working and travel all over the world especially at the beginning of their trading career.

Focusing on these fantasies distracts from the progress – it could also demotivate if you see how much hard work you should invest and how far the financial goal is.

Advice 7. Focus on the current problems and fights. Then you may start making small steps and slowly (but deliberately) become a good trader without any distracting factors.

Idea 7. Go easy on demo trading

If you want to learn to combine employment and trading, trading on the demo account is the right decision. It has obvious advantages. However, there is also a danger to stay on the demo account too long. The matter is that the demo account allows people to apply negative behavioural patterns, which later become very difficult to get rid of.If your actions do not have real consequences you, most probably, would repeat your mistakes in real trading. We agree with recommendations that a beginner trader should learn using the demo account during the first 6-12 months (maximum!) until a good understanding of the basic ideas is formed. And only then to start real trading.

Advice – Follow the next steps:

- Demo account.

- Small real account.

- Bigger real account.

- Account, which will make you a great winner.

Make sure that you learn the lessons from the first trading accounts, which you lost (it is a part of the process and it happens).

Idea 8. Understand what your trading advantage is

Think about maybe your real advantage as a trader lies in the fact that you trade in the market combining trading with employment?When trading is not the only source of income, you can eliminate a strong pressure, which often makes traders to commit errors. Moreover, you do not stay in front of the monitor the whole day long, which reduces a probability of your tiredness and making risky trading decisions only because you are bored since you haven’t executed a single trade during a long period of time.

Advice. Download and test the trading and analytical ATAS platform. It is a professional instrument which gives an advantage in making correct decisions.

Summary

The raw truth is that, in the end, not many people are interested in whether you become a trader or not. That is why it is so important to be honest to yourself and critically assess the current situation. Open your mind and analyze your approach to trading, your level of professionalism and achieved results. Are you sufficiently ready for serious changes in your life?Percentage of failures in trading is above 90%. Only a few continue to stay in the market in several years’ time. However, the percentage of failures is high not necessarily due to the fact that trading is very difficult in itself. It is high because the majority of beginner traders do not pay due attention to this ruthless business and see the exchange only as a place of fast and easy enrichment. Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.