How to identifity the Trading Edge on the exchange?

Что такое trading edge?

A Trading Edge is a trading advantage, which allows traders and investors to make money in the financial markets.

The Trading Edge concept is widely used in English-language sources when a trader’s way to success is discussed. We will tell you in this article:

- why it is so difficult to achieve stable profitability in trading;

- what a Trading Edge consists of;

- how to identify your personal advantage;

- the Trading Edge formula.

What a Trading Edge means

In principle, a Trading Edge is a profitable setup or strategy, adapted and adjusted to a certain trading style. In order to identify your own Trading Edge, you need to keep a detailed statistics of every trade and understand why some specific trade works well. Your feelings or intuition are not good for identifying a Trading Edge, since there should be clear profit/loss amounts for every setup or strategy.

It seems at first sight that a Trading Edge is a setup.

However, there are differences:

- A Trading Edge is formed in the process of how a trader works with a setup or strategy at a certain time in certain markets.

- A Trading Edge makes every trader different from others, which means that it is unique and depends on personal trader qualities. You can compare it with a suit, which should fit perfectly. A good suit shouldn’t hinder your movements but should allow you to run, sit and wave your arms.

- A setup could be studied and completely copied. But, in this case, you will get only a statistical advantage if you trade every setup, which corresponds with the rules. As a rule, statistical advantage is insufficient, since you need to take into account commissions and reward:risk ratio. If a person puts on somebody else’s suit, it will not be as comfortable as a tailored one.

- A Trading Edge appears in the result of a deep understanding of the market situation and how markets move. A Trading Edge increases your confidence that a certain setup will work in a specific market environment.

- A Trading Edge could be found in any trading style – position trading, scalping, trading by Market Profile or by Cumulative Delta.

Thus, a Trading Edge is the setup execution under a previously developed plan and with deep understanding of the market situation and with calculated probabilities of reward and risk.

Chart example

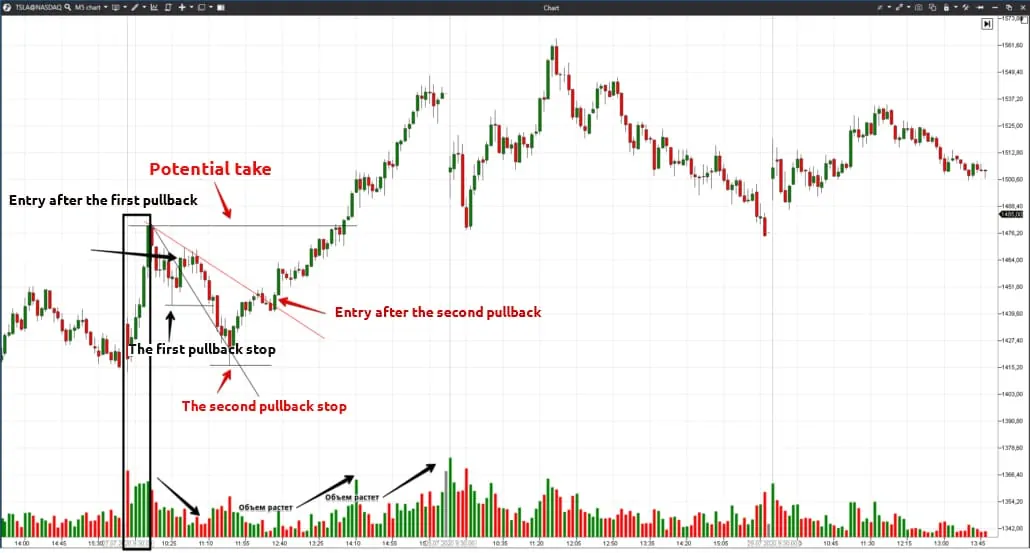

Let’s consider an example in the 5-minute Tesla stock chart.

Let’s assume that a trader trades pullbacks. He customised these trades as follows:

- A setup could be traded if there was a clear focused Open Drive movement on high volumes at the opening of a trading session.

- A pullback should last 4 bars minimum on low volumes.

- The reward:risk ratio should be more than 2:1.

- You can enter a trade after the bar is closed outside the trend line.

- A stop is posted behind the pullback low and the first take – on the previous high. If a position consists of several lots, the first lot is closed when reaching the take, but the others hold on. The stop is moved to the break-even or remains in place.

- It is possible to enter the same setup twice if the second pullback was formed after the first one. The reward:risk ratio increases after the second pullback and the potential profit grows.

- Trades open in the direction of the main trend, which is identified preliminarily on a longer time-frame. See Picture 1.

The trading session of July 27, 2020, opens not with a classical focused movement. The price first falls but then sharply reverses on high volumes. A pullback starts after the price growth and the volumes start to decrease.

The first pullback lasts for 7 bars. Two conditions are met during the first pullback but the reward:risk ratio is approximately 1:1, that is why it is not profitable to trade this setup, especially taking into account the stock value.

The trader builds a new trend line after the second pullback and the reward:risk ratio becomes bigger than 2:1. That is why this trade could be potentially more profitable. The price growth is accompanied with the volume growth after the second pullback, that is why you may hold your position above the first take or close it in parts.

In order to be successful in trading this setup, the trader ‘disassembled’ it and identified why it works and what additional conditions would improve the results. There are three main user conditions:

- Open Drive;

- 4 pullback bars on low volume;

- a possibility to enter the trade twice. The trader, allowing the second attempt, minimizes disappointments and distresses caused by a loss-making trade.

How a Trading Edge ensures resulting success

A trader doesn’t need to trade profitably every trade to make a stable profit. Even less than 50% of profitable trades would allow making money, taking into consideration the correct reward:risk ratio.

A Trading Edge should have a positive mathematical expectation or probability. If the reward:risk (or Profit/Loss = P/L) ratio is more than 2:1, even 33% of profitable trades would be sufficient for covering expenditures and making money. See Picture 2.

The Trading Edge formula looks, approximately, as follows:

Trading Edge = setup + unique personal filter

How to identify your Trading Edge. 7 advice

You can identify a Trading Edge by experiment and by studying statistics.

Ideally, already in as little as 6 months after starting to trade, a trader should understand how he makes money. However, traders, more often, just do not see their Trading Edge and they need some re-adjustment, for example, adding a filter, changing a time-frame, instrument or day time.

The following advice should help you to identify your Trading Edge. They are rather standard but, nevertheless, they have a profound meaning:

- Trade patterns, which fit your personality. Do not trade what doesn’t fit you. For example, too active markets (splashes after news publications) are not good for a slow and cool-minded individual. Brett Steenbarger, one of the most famous psychologists that worked with traders, wrote an article on this subject.

- Trade at the proper time of the day and on proper days of the week. It could be that you always have more loss-making trades on Mondays than on Fridays.

- Follow professionals and you will have a confirmed Trading Edge. For example, our channel has a series of webinars, in which successful traders describe their strategies. You may adapt their working strategies for yourself. The first 15-20 trades might be insufficient for feeling your Trading Edge because any strategy should be ideally adjusted to yourself, like it is with a suit.

- Note down setups, which make sense to you. Keep your own trader’s log. Analyse your trades every day – this is how you can identify your Trading Edge.

- Check setup profitability on historic data, changing details. For example, adding your own filters.

- Automate and develop your own alerts and trading strategies. It is important to use technologies for your best setups since technologies are the future.

- Do not allow anyone to influence your Trading Edge. It is unique. Your Trading Edge will not work for others.

Profitable trading = mastership + Trading Edge

Conclusions

Mastership comes with experience and knowledge. Successful traders know exactly ‘how to trade’, that is where to enter, where to exit, where to increase the size and where to trade more aggressively. They make the best of their advantages.

Download the ATAS platform. It contains many unique indicators and chart types, which will help you to identify your Trading Edge.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.