Do you want to open:

- A real account on the exchange for real trading?

- A demo account for training?

- A PAMM account for passive income?

In any case, to open an account you need to contact a broker.

In this article we will tell you:

- How to open an account with a broker?

- What you should pay attention to?

- About a step-by-step instruction for opening an account.

What you need a brokerage account for?

First you need to understand what you need a brokerage account for.

- If you want to invest, to create a pension capital or make savings for your child’s education, select stock exchanges – Russian and foreign. Investors buy stock, bonds, ETF (Exchange Traded Fund) shares and other securities with low risk in the stock market. As a rule, investors are not intraday traders, they keep securities in their portfolios from several months to several years.

- If you want to make money speculatively on fluctuations of the exchange rates of currencies, securities and derivatives, select the Russian or foreign markets of derivative financial instruments, for example, forward market. Traders buy and sell futures and options in the forward market. Active traders execute many trades during one trading session. Turnover of their accounts may exceed millions of roubles.

Do you want to open a MetaTrader account for trading in the off-exchange Forex market with the use of CFD (Contract For Difference)? This is the way where risks increase. Here’s an interview, in which one of our clients – a professional trader – explains why he stopped trading CFD and started to trade futures. You can find more information about CFD in this article.

Why you need a broker to open an account?

If a private person wants to trade on any exchange, he can do it through a broker only. Brokers are legal firms which provide intermediary services. They execute client orders, conduct training and analyze securities and currencies. We wrote about it in our article about the stock exchange structure.

Contacting a broker a private person can open a brokerage or Individual Investment Account (IIA). A trader can have a number of brokerage accounts but only one IIA.

What a PAMM account is?

PAMM (Percent Allocation Management Module) account is a special format of a trading account for the off-exchange Forex market.

Theoretically, it is a good idea to open a PAMM account. It is a simplified mechanism of the money trust management. At first sight everything looks simple:

- You select a trader with the highest profitability and rating;

- you deposit your funds to his account;

- he trades all deposited funds and gets a commission for his work.

But not all that glitters is gold. Forex companies, which provide services on opening PAMM accounts, are often registered offshore. And it will be quite difficult to protect your rights in case of disputes. These are non-trading risks, which you should take into account (we will speak about licensing in this sphere a bit later).

That is why it is more reasonable to open an account with access to an official exchange (MOEX, CME, Euronext and other) in order to increase chances for the resulting success on a long run.

How to select a broker?

So, you decided what you need a brokerage account for. Let’s discuss how to select a broker for opening an account.

There are several criteria for selecting a broker:

- by licence availability;

- by tariff plan and commissions;

- by trading terminal and applications;

- by minimal size of the start-up capital;

- by operation of the support service.

Let’s consider in brief each criterion for opening an account with a broker.

By licence availability. Many Internet resources recommend to find out first whether a broker has a licence. We recommend you to select a broker directly on the exchange website and you will not need to check the licence and bother about it. We will give you links to the exchange websites and explain an approximate algorithm of actions.

By tariff plan and commissions. There could be many commissions:

- for each trade;

- for software for different markets;

- subscription fee;

- for transferring money in and out;

- for depository storage of securities and others.

You need to find out what the maximum size of the commissions would be and compare it with your start-up capital. Let’s assume you selected a brokerage account with a monthly subscription fee of RUB 250, while your start-up capital is RUB 50,000. You will lose RUB 3,000 or 6% of your capital during one year just on the subscription fee. And this is still without exchange commissions and possible losses! With such a rate, your brokerage account will eat itself in 16.5 years without a single trade.

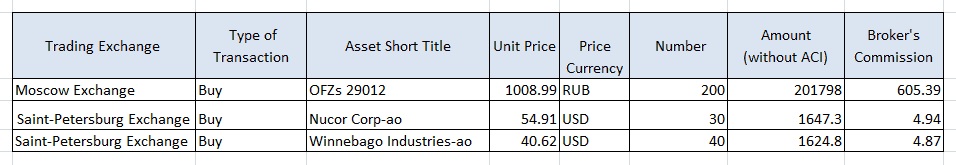

Here’s an example of commissions for Russian and American securities:

The broker’s commission is nearly 0.3% both for Russian and American instruments. An exchange commission and payment for depository storage of securities will also be written off your account. If you buy securities several times a year, such commissions will not reduce your account significantly, but if you trade every day, it might seem ‘exorbitantly’ expensive.

By trading terminal and applications. You need to select a terminal or application for trading and find out whether you need to pay for them. If you are an investor and do not plan to trade every day, perhaps, you do not need a terminal and an application would be sufficient. If you plan to become an active intraday trader instead, you would have to choose a trading terminal. Roughly, the most simple one is Quik, the most famous one is MetaTrader and the most efficient one is ATAS. Trading terminals could be free or otherwise.

By minimum size of the start-up capital. The minimum size of the start-up capital has an influence not only on what broker you can open an account with but also on what instruments and securities you would be able to trade. To buy American stocks and derivatives you would need several thousand or even dozens of thousands of dollars. To buy Russian stocks or derivatives you would need just several dozens of thousands or roubles.

By operation of the support service. It is important for beginner traders and investors to understand whom they may ask questions to and how fast they would receive answers. Moreover, if you have an open position without stops and the Internet suddenly took a leave, you will have to close the order by phone. It is better to check how fast the support service responds before you open an account.

Pay attention to:

- whether the broker performs functions of a taxation agent or you would have to file a tax return and report about income from exchange trading independently;

- whether there is a protection of investors and insurance coverage;

- how fast the money could be transferred out;

- how much you would need to pay to transfer the money out.

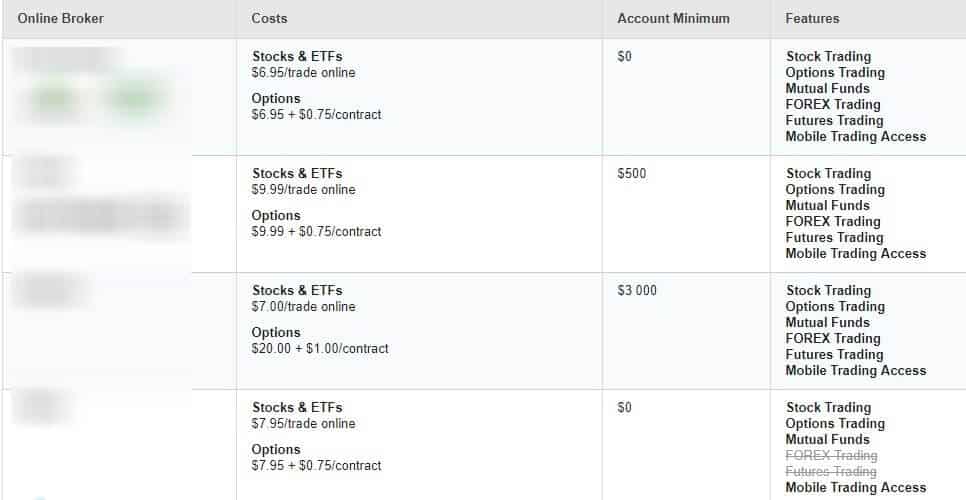

There are comparative tables of brokers in the Internet. Such tables simplify the initial selection but you need to visit the broker’s website and contact him to get more detailed information.

Step-by-step instruction

Now, after you have selected a broker, we will tell you about the next step – opening an account and transfer money in.

There are three ways to open a brokerage account:

- online;

- in the broker’s office;

- through sending the required documents by mail.

You can find lists of licensed brokers on official websites of exchanges. Many Russian brokers work in several markets, that is why they provide the Single Account service. You open one account but can trade on the Moscow Exchange, CME and NYSE. In spite of the fact that there is only one account, commissions for access to different exchanges could be different. Find out this information from your broker before opening a Single Account.

If you open an account on the Moscow Exchange or on the Saint-Petersburg Exchange, the algorithm of actions is the following:

- you select a broker on the exchange website;

- you contact the broker to specify all details we described above;

- you sign a contract and open an account online or in the broker’s office;

- you deposit your account through a banking transfer or a card;

- you download software, install it and register your personal account;

- you buy securities or trade derivatives.

You can buy not only Russian securities but also American stocks on the Saint-Petersburg Exchange. But the liquidity is much lower than on American exchanges. That is why some investors and traders prefer to open a trading account with a foreign broker.

If you open an account on CME, NYSE or NASDAQ, the algorithm would approximately be the following:

- select a broker on the exchange website;

- contact him by email or skype, since phone communication is expensive;

- register your account with a consultant. You will need to have all necessary documents at hand – passport, residence permit, driver’s licence or lease agreement;

- find out from the broker what price quotes you will be able to get;

- get an accompanying letter from the broker for the money transfer;

- print out the agreement, take the accompanying letter and go to the bank to transfer the money;

- the transfer would take 3-5 days, which is more than a transfer to a Russian account;

- buy securities or trade derivatives.

How to open a demo account

Brokers, as a rule, recommend to trade on the demo account before starting to put real money at risk. To open a demo account:

- register at the broker’s website;

- specify during registration that you want to trade on demo;

- download the trading platform;

- insert data (you will receive them by email) in the platform;

- and start.

You do not need to execute a contract and insert real data for trading on demo.

How to open a demo account

Try ATAS free of charge after you opened a brokerage account and became familiar with the exchange a bit. We prepared 19 instructions in our knowledge base for you to connect ATAS to your broker’s software.

There are video instructions on our YouTube OrderFlowTrading channel in the Settings for Connecting Accounts and Price Quotes section, for example, how to connect ATAS to Quik. You will find the cluster analysis, footprint and unique indicators, which will show you what takes place in the market inside a candle, in ATAS. What to work in the darkness for if you can turn on the light immediately.

Summary: how to open an account

Do everything step-by-step if you are a beginner. Trading on the exchange is a highly risky business. Apart from the fact that a trader himself can make mistakes, he also could be helped in making a mistake.

- Do not try to trade on all exchanges with all instruments, which you find in the Internet, at once.

- It’s quite probable that you forget to ask your broker about something or a commission you’ve never heard of will be written off your account.

- Read the brokerage contract attentively.

- Assess your emotional state when you open an account with a broker. Are you blindly chasing a fast and big profit promised by ads?

Be prepared to face the development of your business not in the way you expected. It shouldn’t seriously change your way of life. Mistakes increase your experience.

A journey of a thousand miles starts beneath one’s feet.

Good luck!