In this article, we will focus mainly on the Dow Jones stock index and futures contracts on this index.

General facts about the Dow Jones index

The full name of the Dow Jones index is the Dow Jones Industrial Average (DJIA).This is a price-weighted index of 30 largest American companies – ‘blue chips’. The market capitalization of these companies, as of October 2020, is USD 8,350 billion. DJIA is considered to be the strongest success or failure indicator of the US stock market.

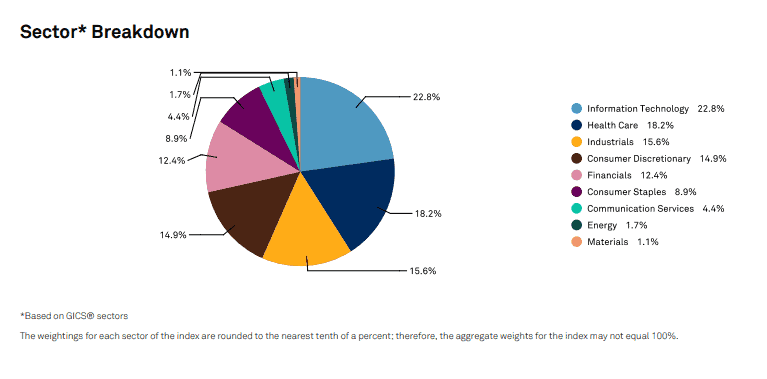

Although the index is called ‘industrial’, it represents all largest sectors. The index was calculated for the first time on May 26, 1896, and this is the second oldest American index. See Picture 1.

Dow Jones index calculation

DJIA is calculated not as a weighted arithmetic index of the stock market. It means that the company capitalization is not taken into account but the value of all included stocks are summed up. However, instead of dividing the resulting number into the number of companies, it is divided into a special ratio, which is called ‘divisor’. They started to use it to avoid confusion due to the stock split and consolidation.Specific features:

- Initially, there were 12 companies in total and there are 30 of them today.

- Stocks with the highest prices have a bigger influence on price fluctuations of the index itself.

- None of the companies can take more than 15% of the index.

The index has changed more than 60 times during the whole time of its existence. A special committee rebalances the index.

Rebalancing takes place in the event of:

- global economic changes;

- a sharp fall/growth of a company capitalization.

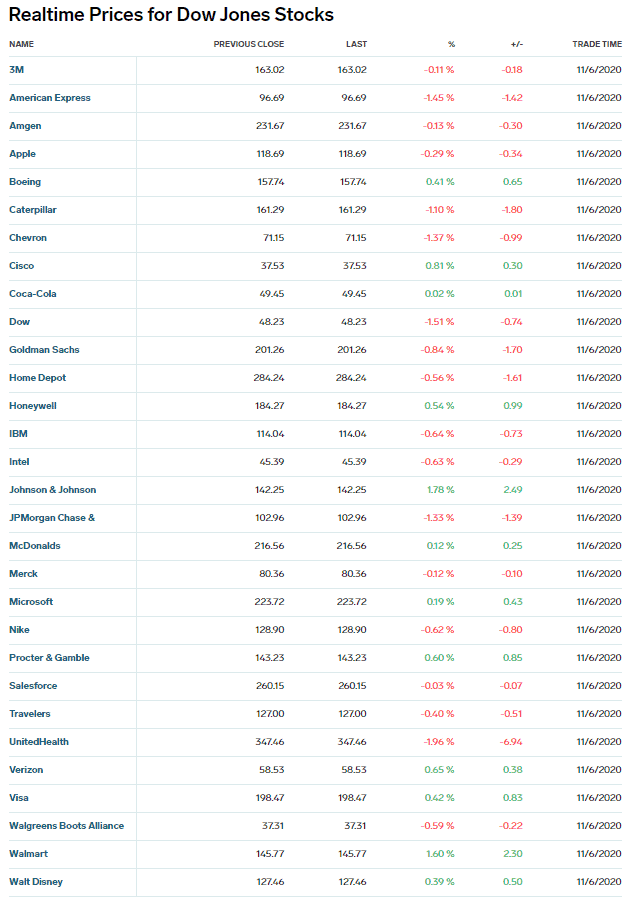

The next screenshot shows a list of companies, which constitute the index as of the end of 2020. See Picture 2.

Dow Jones index calculation

DJIA is calculated not as a weighted arithmetic index of the stock market. It means that the company capitalization is not taken into account but the value of all included stocks are summed up. However, instead of dividing the resulting number into the number of companies, it is divided into a special ratio, which is called ‘divisor’. They started to use it to avoid confusion due to the stock split and consolidation.Specific features:

- Initially, there were 12 companies in total and there are 30 of them today.

- Stocks with the highest prices have a bigger influence on price fluctuations of the index itself.

- None of the companies can take more than 15% of the index.

The index has changed more than 60 times during the whole time of its existence. A special committee rebalances the index.

Rebalancing takes place in the event of:

- global economic changes;

- a sharp fall/growth of a company capitalization.

The next screenshot shows a list of companies, which constitute the index as of the end of 2020. See Picture 2.

The index averaged year returns for 10 years is 3.02% and it is lower than, for example, the S&P 500 index has.

There is a rather high correlation between the Dow Jones and S&P 500 indices. As a rule, indices move in the same direction. See Picture 3.

The Dow Jones index derivatives

There are 5 Dow Jones index derivatives.All of them are traded on CME:

- Big Dow Jones DD futures has 25 indices in one contract. The minimum price step is USD 25.

- Dow Jones DJ futures (ZD in electronic variant) has 10 indices in one contract. The minimum price step is USD 10 per contract.

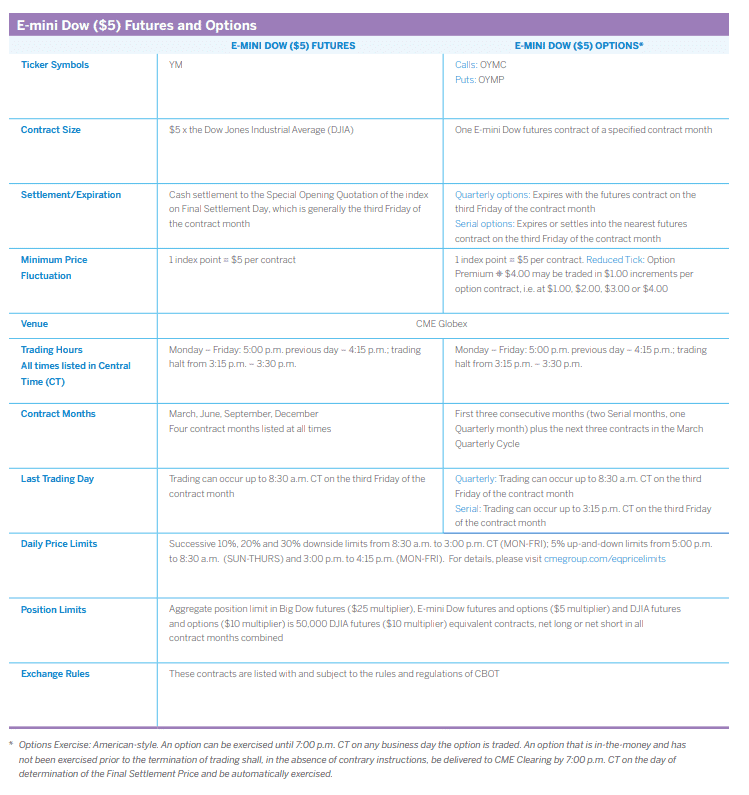

- E-mini Dow YM futures has 5 indices in one contract. The minimum price step is USD 5 per contract. The futures margin starts from USD 600. See Picture 4.

- Micro E-mini Dow MYM futures has 0.5 index in one contract. The price of one tick is USD 0.5. The futures margin starts from USD 150.

- There are also option contracts for all the above listed variants.

The YM futures

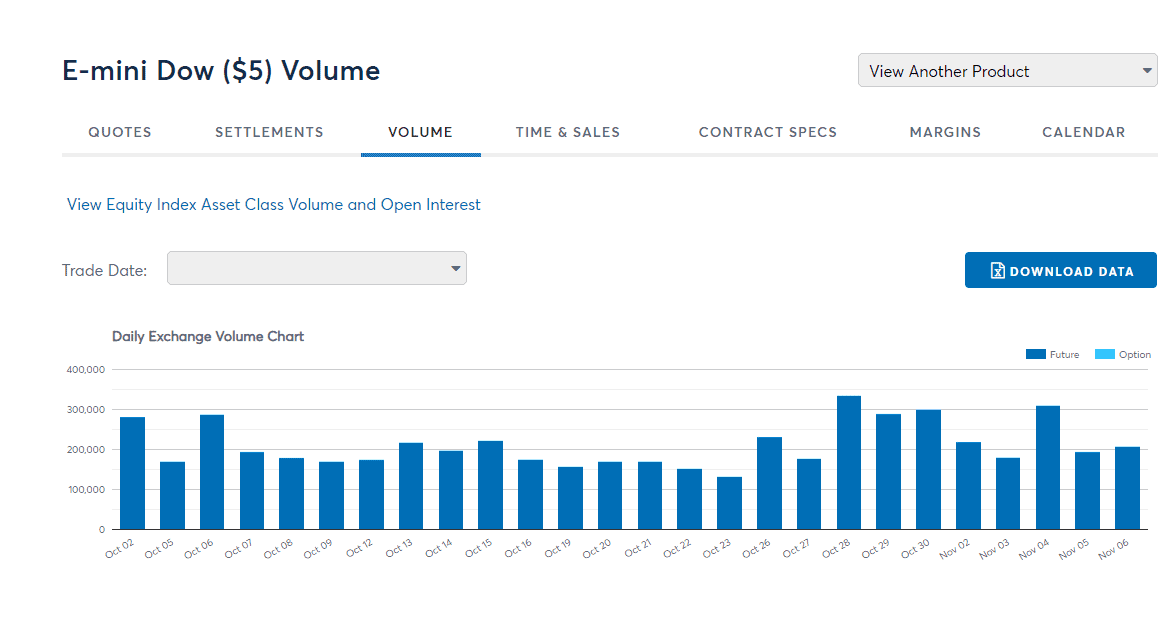

The YM futures contract is the most popular one among traders. About 200,000 contracts are traded every day. However, on some days the volume is much higher. See Picture 5.

Chart examples

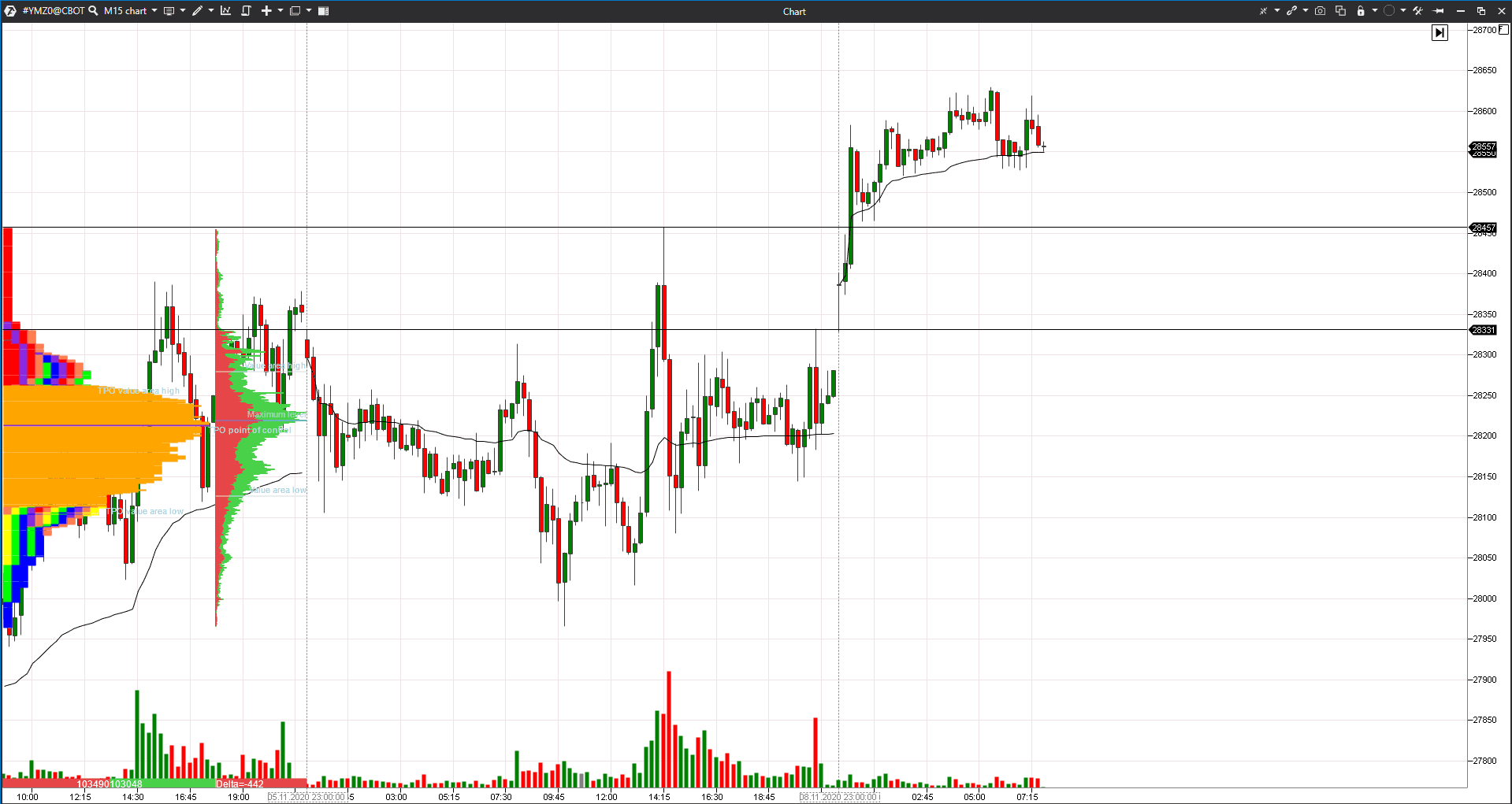

Let’s consider one of such examples in the 15-minute DJIA index YMZ0 futures chart. See Picture 6.

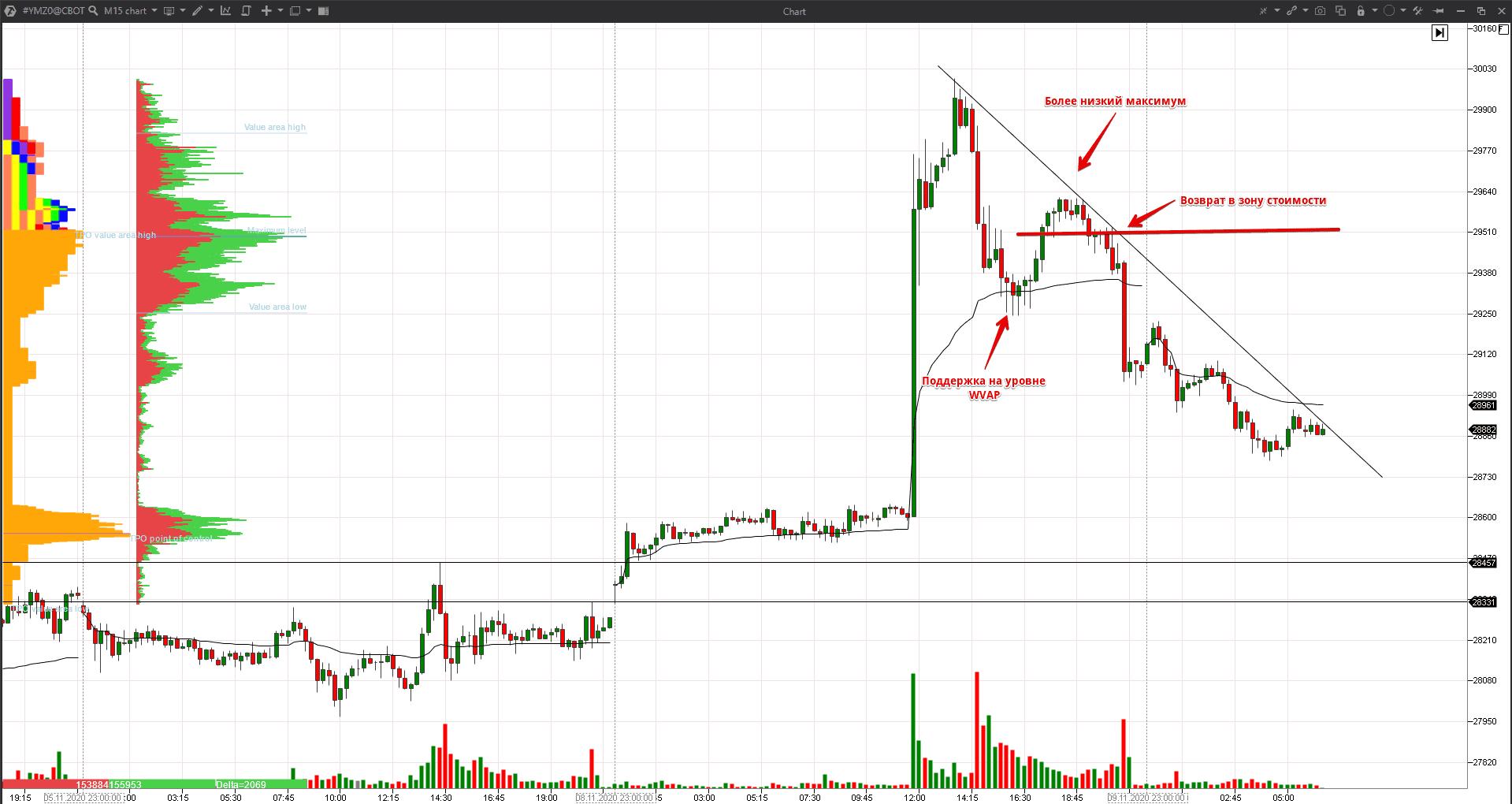

Markets extremely dislike uncertainty, that is why indices started to grow when the preliminary election results became clear. The Dow Jones index futures opened above the previous day’s value area and quickly exceeded the previous trading session’s high. Moreover, the news about the successful Pfizer company vaccine test was published on Monday and the index futures prices skyrocketed. See Picture 7.

The described price movements provided a lot of opportunities for intraday futures trading. Use professional software in order to identify them faster than others.

Conclusions

You can analyse futures in ATAS with the help of the most advanced instruments:In such a case, a trader receives more information from the market and can make efficient decisions quicker.

It is more profitable to trade futures than other instruments since commission fees are lower and the full contract value size is not required for trading.

Thus, the Dow Jones index futures includes only 30 companies (unlike the S&P 500 index, which includes 505 companies) and it is easier to analyse and predict its behaviour. It means that a trader has less risks and more opportunities to make money.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.