Morgan Stanley believes that bitcoin will replace the dollar

The week after the Presidential election in the United States has passed as usual in the financial markets. Stock indices move up, although with minor disruptions, on expectations of new budget incentives and optimism with respect to the beginning of coronavirus vaccination. Super-successful IPO and a record-breaking inflow of institutional investors into bitcoin also didn’t miss our attention. Let’s discuss these and other sensitive issues in our new review.

- Calendar of economic statistics

- Beginning of vaccination: investors buy up raw materials and value stocks

- DoorDash and Airbnb IPOs break records

- Institutional investors go into Bitcoin

- CME launches water futures

Calendar of economic statistics

| Date, Time (GMT +3:00) | Event | Impact, forecast |

| Tuesday, December 15 5:00 | China. Industrial production. | Oil. CNY. Previous value – 6.9%. |

| 10:00 | Great Britain. Claimant Count Change. | GBP. FTSE 100. Forecast – 50K, previous value -29.8K. |

| Wednesday, December 16 16:30 | United States. Retail sales in November. | S&P500. USD. Forecast -0.1%, previous value – 0.3%. |

| 18:30 | United States. Crude oil reserves. | Oil. |

| 22:00 | United States. FRS meeting. Interest rate decision. | All markets. Forecast – 0.25%, previous value – 0.25%. |

| Thursday, December 17 | Great Britain. Retail sales. | GBP. FTSE 100. Previous value – 1.2%. |

| 13:00 | Eurozone. Consumer inflation. | EUR. Forecast -0.3%, previous value -0.3%. |

| 15:00 | Great Britain. The Bank of England interest rate decision. | GBP. FTSE 100. Forecast – 0.1%, previous value – 0.1%. |

| Friday, December 18 | Germany. IFO Business Climate Index. | EUR. DAX. Forecast – 90.1, previous value – 90.7. |

| Tuesday, December 15 5:00 |

| China. Industrial production. |

| Oil. CNY. Previous value – 6.9%. |

| 10:00 |

| Great Britain. Claimant Count Change. |

| GBP. FTSE 100. Forecast – 50K, previous value -29.8K. |

| Wednesday, December 16 16:30 |

| United States. Retail sales in November. |

| S&P500. USD. Forecast -0.1%, previous value – 0.3%. |

| 18:30 |

| United States. Crude oil reserves. |

| Oil. |

| 22:00 |

| United States. FRS meeting. Interest rate decision. |

| All markets. Forecast – 0.25%, previous value – 0.25%. |

| Thursday, December 17 |

| Great Britain. Retail sales |

| GBP. FTSE 100. Previous value – 1.2%. |

| 13:00 |

| Eurozone. Consumer inflation. |

| EUR. Forecast -0.3%, previous value -0.3%. |

| 15:00 |

| Great Britain. The Bank of England interest rate decision. |

| GBP. FTSE 100. Forecast – 0.1%, previous value – 0.1%. |

| Friday, December 18 |

| Germany. IFO Business Climate Index. |

| EUR. DAX. Forecast – 90.1, previous value – 90.7. |

The US Supreme Court decision could become a real killer if it goes back this weekend on the vote of the Presidential election in several US states under the lawsuit of Republicans. A political chaos, inevitable in such a situation, will be extremely negative for stocks. Although, the majority of experts estimate chances for such a development of events not too high. It is better not to roll over open marginal positions to Monday.

Markets will also sensitively react during the week to the news on the new US economy support package in the amount of USD 1 trillion, which should be approved by the Congress very soon. The FRS meeting on Wednesday night will be the main event in the middle of the week. Investors do not expect the rate change, however the accompanying forecasts and comments could cause volatility jumps both in the currency and stock markets. Forex traders should also pay attention to the Bank of England meeting on Thursday.

Beginning of vaccination: investors start to buy up raw materials and value stocks

The news about the Great Britain inhabitants, who were the first in the world to receive the COVID-19 vaccine, circled the globe at the beginning of the week. This fact supported the proper level of investor optimism. Vaccination in the US and other leading countries will start in the coming days. However, the buys didn’t move in a wide front – they were rather selective instead.

The Brent oil (BRF1) price is not a bad indicator of recovery of the world economy real sector. The barrel price moved above the psychological level of USD 50 for the first time from the year beginning.

Major investment funds are, in general, optimistic with respect to the raw material markets and believe that they will continue to grow in 2021. This fact is favourable for the developing country economies and currencies and also for raw material exporters, such as Russia, RSA, Brazil and Australia.

The growing demand on stocks of traditional economy companies with stable dividends (they are also called value stocks) point to the real sector recovery along with raw materials.

DoorDash and Airbnb IPOs break records

Meanwhile, the speculative fervor is still very high among investors. IPO results of the Airbnb vacation rental marketplace and DoorDash food delivery service testify to this in particular.

The organisers initially took pleasure in the record-breaking demand and increased the price of the initial offering several times. As a result, the Airbnb capitalization reached impressive USD 45 billion and DoorDash – USD 35 billion.

However, that was just the beginning. The Airbnb stock (ABNB) has jumped by 113% on the very first day of trading. The stock skyrocketed to USD 114 after offering at USD 68. The DoorDash stock (DASH) grew in value ‘only’ by 86% the day before!

The investor behaviour resembles euphoria more and more, which usually ends with pain and tears in the market. However, before pain and tears come, we may see births of a multitude of impressive speculative surges, since nobody is going at the moment to stop the FRS printing press.

Institutional investors go into Bitcoin

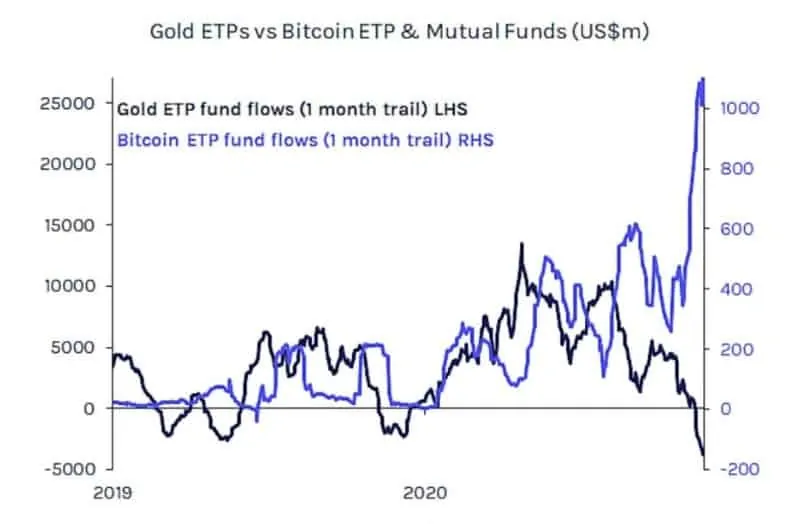

Meanwhile, the recent data confirm that massive dollar printing undermined the trust into the US national currency. Inflow of institutional investors into the funds that invest in bitcoin is close to the record-breaking level. The Bloomberg data show that cryptocurrency, as the main alternative to the dollar, started to replace gold.

A number of major investment banks from Wall Street recommend their customers to stock up on cryptocurrency. Thus, the Morgan Stanley (MS) announced an embarrassing forecast of one of its leading analysts, which says that bitcoin may replace the dollar as the world reserve and international payment currency.

Meanwhile, the BTC price consolidates near its historic high. The retracement potential still exists but the general picture is bullish.

CME launches water futures

The world is changing right before our eyes. Water, resources of which (on the planet covered with oceans) were considered to be non-exhaustive several decades ago, is increasingly becoming a deficit commodity. Aggressive intrusion of people into the environment and global warming produce effects.

A futures contract on fresh water supply will be launched for the first time in the United States history. The leading derivative trading marketplace (CME Group) plans to invest USD 1.1 billion in this instrument.

The company believes that two thirds of the planet population will suffer from the water shortage by the year 2025. The problem is very urgent in the California’s Dust Bowl, for the inhabitants of which the new product has been developed. The company believes that this futures contract will be very popular among local farmers and enterprises because it will allow them to be insured against water supply interruptions in the future.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.