VSA: shakeout & upthrust patterns.

- This is yet another article on VSA and cluster analysis. Earlier we spoke about:

As you can see, each of the articles speaks about two patterns, which, to a large extent, are mirror reflections of each other.

The current article is also about two patterns: Shakeout and Upthrust. Someone can say that Spring is the mirror reflection of Upthrust. Sounds reasonable. However …

There is no Spring pattern in the classical VSA terminology. Tom Williams, the Volume Spread Analysis founder, new the Spring term, but never used it.

That is why, for the sake of integrity of our approach, we chose Shakeout, which has similar features with Upthrust, but in the upside-down form:

- both signals reflect market manipulations of major players;

- they are aimed at taking as many stop losses as possible from traders, who opened positions at the right side of the market;

- they are aimed to carry traders, who do not have positions, in the wrong direction.

Read today:

- 3 Upthrust examples;

- 3 Shakeout examples;

- the reason of emergence of Shakeouts and Upthrusts;

- how to trade VSA Shakeout and Upthrust.

Let us start with Upthrustы. But, first, a small question: what is the origin of the word ‘fake’? This word has an interesting story. The answer is in the end of the article. You will be surprised.

VSA Upthrusts and cluster analysis

The word ‘Upthrust’ consists of two words: Up and Thrust.

So, it could be understood as ‘a hit directed upward’.

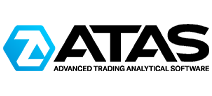

Here is a classical Upthrust, which is given as an example by Gavin Holmes in his book Trading in the Shadow of the Smart Money (Gavin is a VSA expert and the successor of Tom Williams).

How the specified bars are described:

- Note the high volume on that bar. A session has not yet started. It is pre-market. The next bar was closed with downward movement, which confirms weakness. Tom Williams used to say that the market does not like up-bars with a very high volume.

- Bars B and C are Upthrusts. An effort of buyers to break to upper levels, but the closure is at the low. Such Upthrusts, with the weakness noticed on bar 1, provide reasonable places for entering into shorts.

Let us consider a cluster chart in order to understand the Upthrust nature better.

Upthrust in the cryptocurrency market

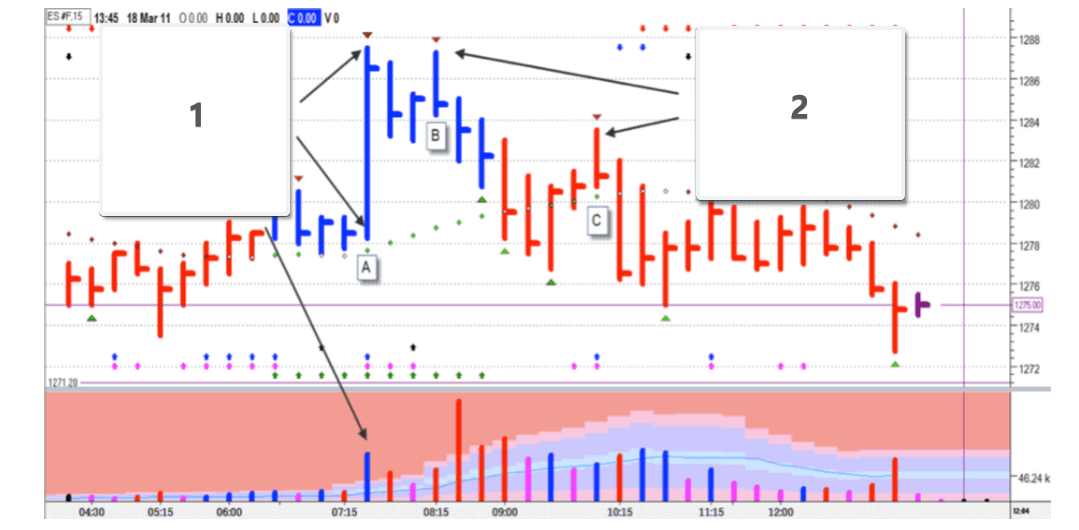

Let us take the cryptocurrency market and a fresh peak of the ETHUSD pair (BitMEX data).

This is a tick chart. One horizontal bar (column) reflects 10 thousand trades. This chart type allows expanding volatility periods and compressing inactivity ranges. Horizontal red and green lines are signals of the Stacked Imbalance (what imbalances are) indicator. The grey bar chart in the lower part is the indicator of volumes with the overlaid delta (pink-green bars).

April 8 was an active day. Perhaps, thanks to positive news, the price broke the level of USD 180 for ETH in the very beginning of the session. A splash of buying activity reflects critical excess of demand over supply at the market peak or, in other words, unhealthy turmoil. Stacked Imbalance indicator activation and green cluster predominance testify to it. However, the whole bullish progress was levelled out by the selling wave (red cluster predominance) by the end of the session (note: trading in the cryptocurrency markets is going on day and night and division into sessions is conditional; each session in the chart lasts from 00:00 until 23:59).

April 9 was a day of uncertainty. It allowed forming the wedge pattern (blue lines in the chart), specific for a short-term balance of supply and demand.

Interesting (from the point of view of the subject of the article) events took place on April 10:

- The false breakout of the resistance level. Note the splash of executed buy orders. The buyers’ activity increase reflects:

a) stop-outs of sellers with close protective orders;

b) entry of buyers into a trap at breakouts. - Pressure of sellers. True strength of supply after fake demand. The trap for bulls was closed and only a small number of survived bears can see profit on the accounts.

When comparing this chart with the reference standard of Gavin Holmes, we can see that the first half of April 8 was bar 1, which started to form the weakness area, and the combination of cluster bars 1+2 of April 10 was the Upthrusts, which correlated with the bars (number 2) in the Gavin’s chart.

Clusters helped us to see the inner structure of this phenomenon better. Understanding of the Upthrust nature will help you to notice them when they emerge in the right side of your chart.

Upthrust in the oil market

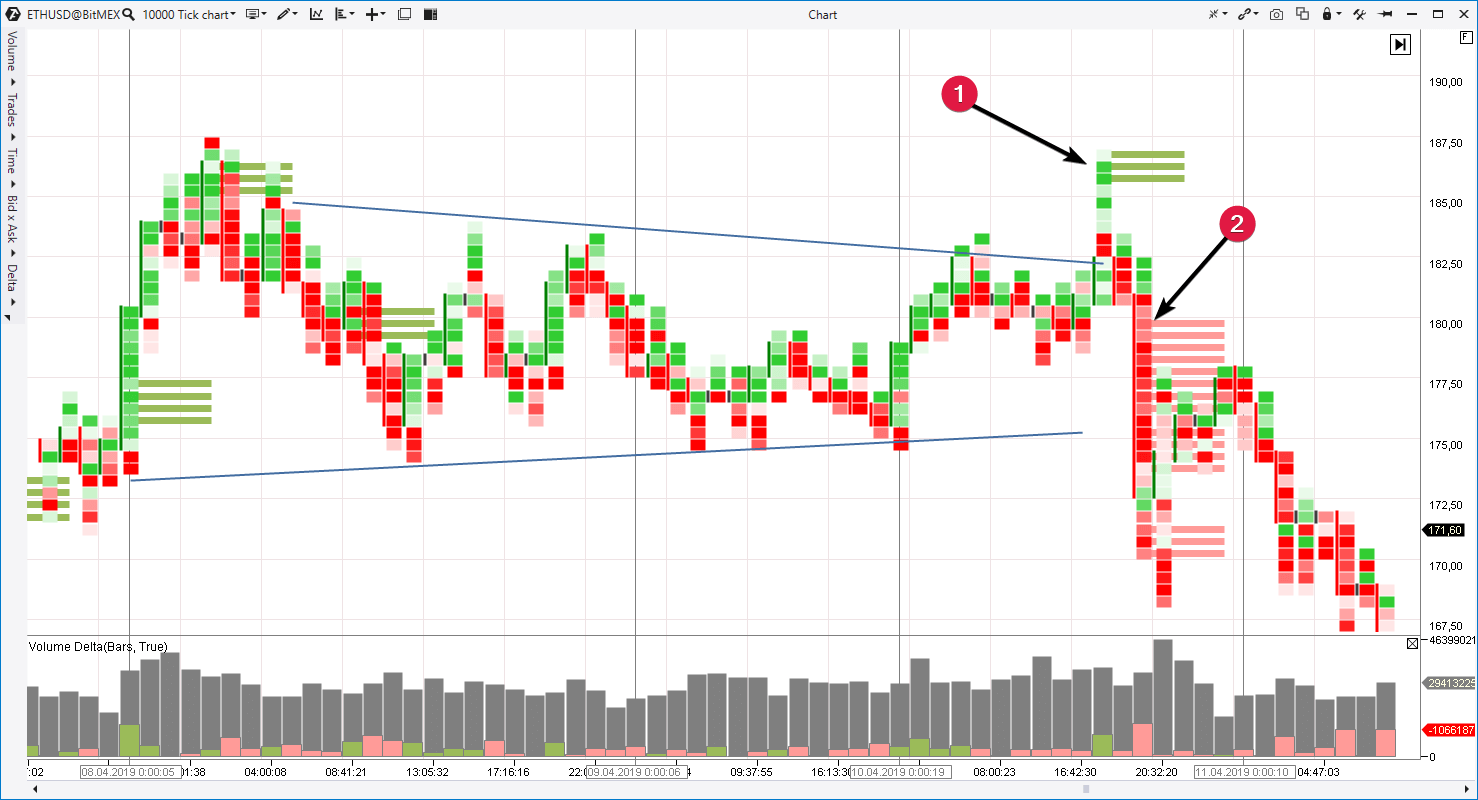

Let us consider one more Upthrust example, this time from the WTI oil forward market. Below is a cluster chart of the Range type (how to analyze Range charts) on CL futures – NYMEX data (what you should know about oil futures).

Imbalance, Volume, Delta and Cluster Search indicators are activated in the intraday chart of April 9.

- Buyers pushed the price to the peak of about 64.75 at the beginning of the session, however, the further selling wave showed that sellers have strength to completely level out the increase progress.

- The market tried to take the previous peak by storm after two bounces from the level of 64.35. Note that:

a) Imbalance indicator was activated;

b) red clusters on the next bar show that sellers appeared immediately. And the price (when the general volume increased) rushed down and formed Upthrust or false breakout of the previous peak. - This is yet another Upthrust, but VSA experts call it ‘hidden’. A specific feature of a hidden Upthrust is that it does not make a false breakout over a local peak, but can be formed at the resistance level without renewing the high. Cluster Search showed buyers activity at this point. Perhaps, these were sellers who exited from shorts and who had opened positions at the breakout of the level of 64.35.

How to trade Upthrusts?

Unfortunately (or fortunately), there is no uniform and single approach. Upthrust is just one more instrument at hand of a professional trader. You yourself decide how to apply it. It depends on your trading style, personal risk-profile, markets and other factors.

To avoid empty talks, let us consider a specific idea.

Let us assume that an oil trader registered Upthrust formation, consisting of two bars, over the level of 64.75 in point 2. He enters into short after closure of the second bar, say, at price of 64.67. And posts a protective stop over the Upthrust peak at the level of 64.84 (17 points).

Where to put the take? The trader thinks that if he registers a false upward breakout, the price is not ready to move above the resistance. Then he should expect the support breakout. There is a concept in the classical technical analysis that, after the range breakout, the price is ready (with a high level of probability) to pass a distance equal to the value of the broken range.

Then, the take-profit level TP = 64.35-(64.75-64.35) = 63.95 or 72 points from the point of entry into short of 64.67. Risk-reward relation is 1:4. Not a bad plan, isn’t it? By the way, the oil price in this specific case reached the take in 4 hours after the Upthrust.

Such setups are not rare and, as a bonus, below are 2 charts from the GBP futures market without detailed comments.

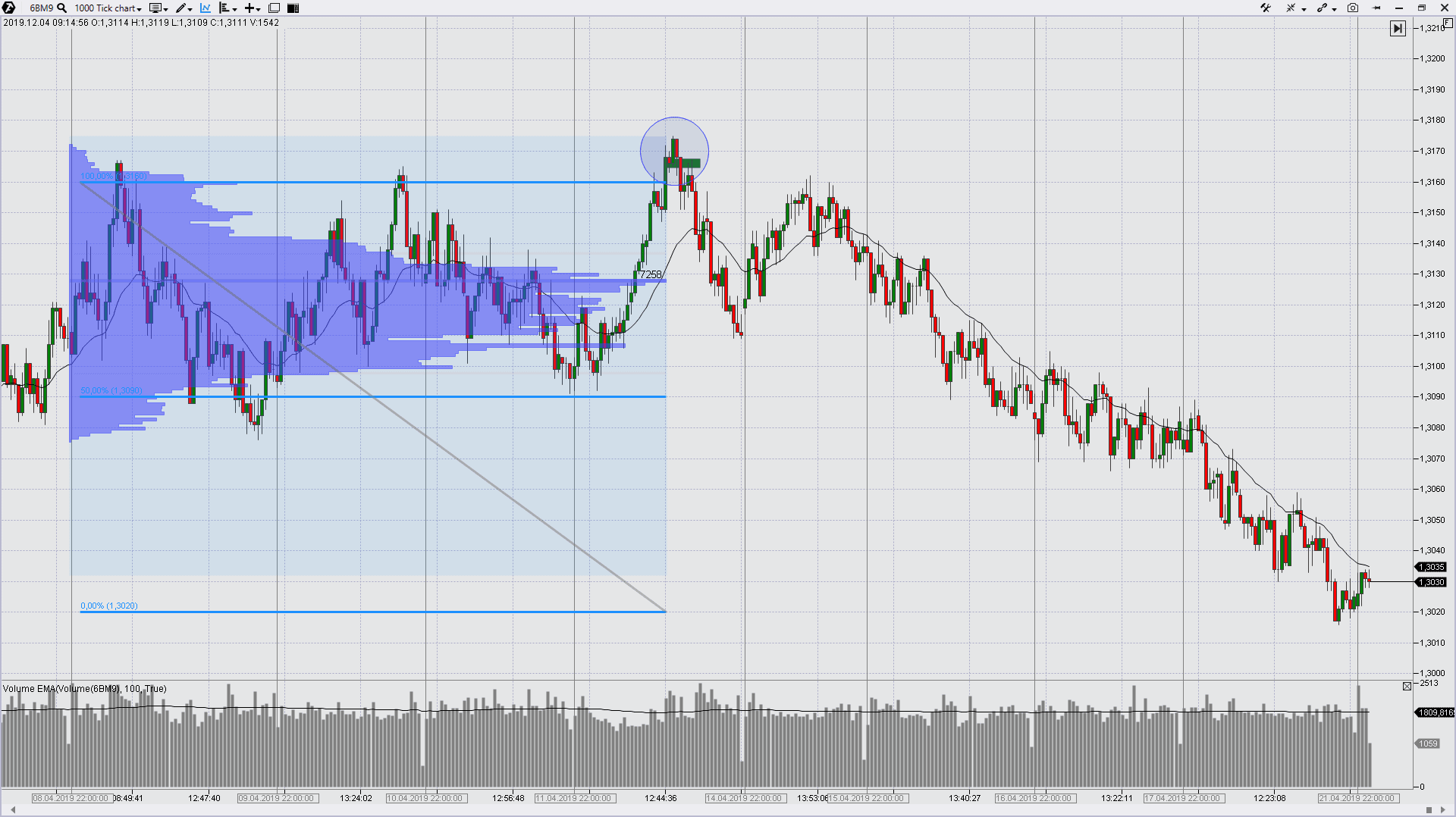

The first chart shows the general picture:

- formation of the range of 1.3160-1.3090;

- false breakout – Upthrust (note the Imbalance indicator activation);

- bearish breakout of the range;

- achieving the aim of 1.3020. The aim is calculated by the principle described above.

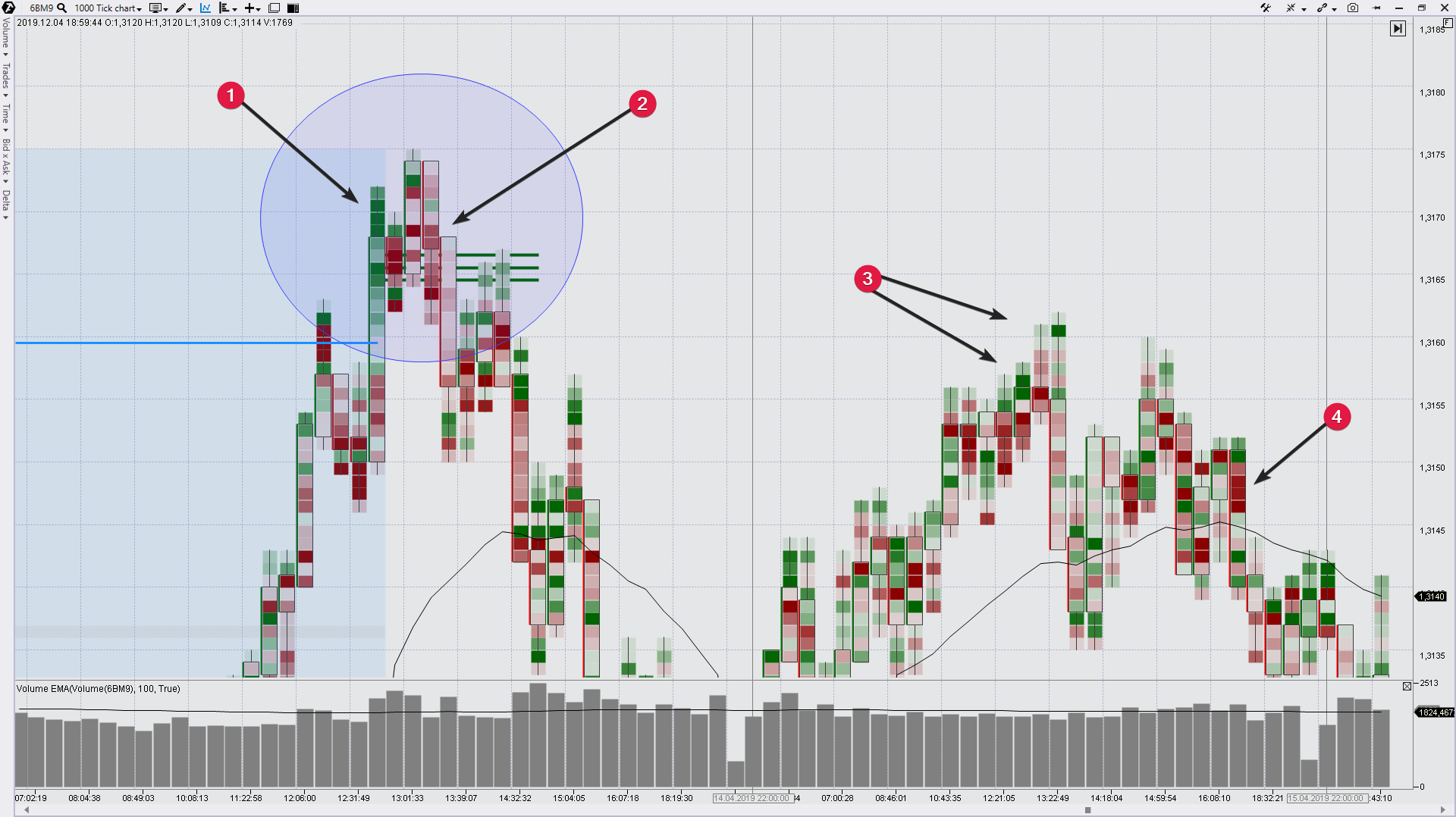

The second chart is a moment of Upthrust in details in the cluster chart:

- Activation of stop losses of bears and entry of bulls that trade breakouts;

- Professional sells. Impulses 1+2 form an Upthrust;

- Upthrust test on the next day;

- Professional sells.

Figure out where an entry into a short could be and calculate the risk-reward relation. You should like it. Download ATAS. Maybe, a profitable setup on the basis of Upthrust is formed right now.

Upthrust. Summary.

Let us draw a brief summary. Upthrust – what is it?

- The price rushes up, but falls afterwards in order to close the bar at lows or near them. The bar looks like a telegraph post.

- Upthrust usually has a wide or medium spread.

- Upthrust is a profitable maneuver of market makers aimed at catching stops of those who are in shorts and putting a trap for those who are not careful in buys.

- Prices often go up at the session opening or after good news.

- Big volume means professional sells, while small volume shows absence of their interest to price increase.

- True Upthrusts emerge when there was weakness on the previous bars. For example, logical places for Upthrust are the final phase of the distribution stage or test of the resistance level.

- Upthrusts can be found in charts of any type, different timeframes and markets.

And, by the way, Upthrust is one of the most favourite signals of a VSA expert Sebastian Manby.

We hope everything is clear about Upthrusts. Let us proceed with Shakeouts.

VSA Shakeouts and cluster analysis.

he term Shakeout consists of two words:

Shake and Out.The term is self-explanatory. It reflects what takes place behind candle formations. Major players often use Shakeout to shake weak holders out of the perspective bullish market.

Shakeouts, like Upthrusts, can be found in charts of any type, different timeframes and markets. The classical VSA pays a lot of attention to Shakeouts, since they are so specific for stock markets, in which Tom Williams, the Volume Spread Analysis founder, traded.

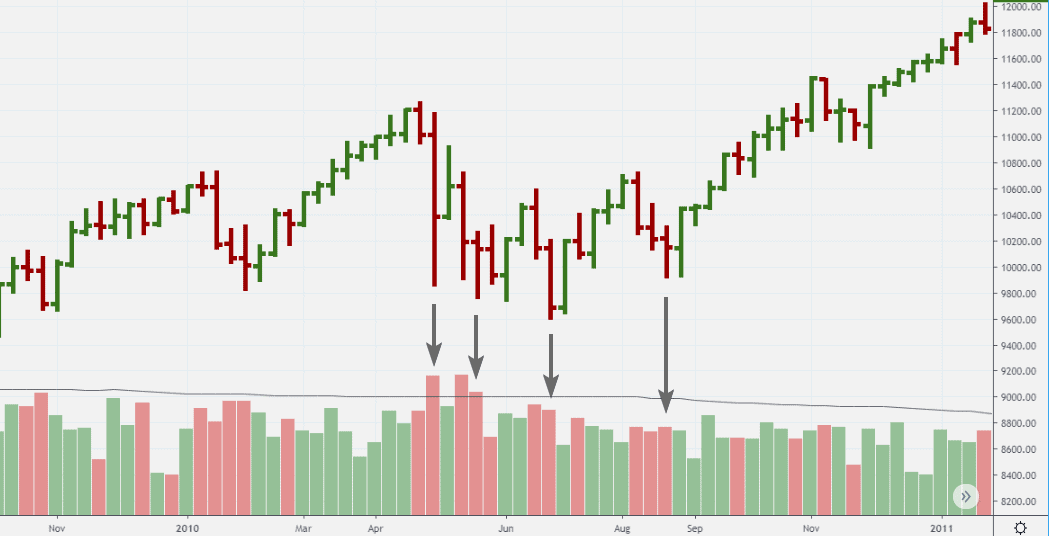

Below is the weekly Dow Jones index chart and a classical Shakeout example. Shakeout is marked with the first arrow.

On that day, May 6, 2010, the stock price in the American stock market started to fall rapidly. There were no fundamental reasons for that fall. Experts and analysis of financial media just made assumptions.

“What does it mean?” – Gavin Holmes asked Tom Williams showing the price and volume chart. “Gigantic Shakeout” – the VSA founder answered. He saw a lot of Shakeouts during his career.

That fall was called Flash Crash and the term became common. If you search for images in Google using the query ‘Flash Crash’, you will find a library of potential Shakeouts.

Idea of the VSA Shakeout. Shakeout is formed in a strong market in order to reduce the number of the followers who make money on the asset price increase. Unexpected and rapid price fall, like a bolt from the blue, stimulates many small traders to sell out their positions in panic. Plenty of stop losses of buyers are added to the flow of sells. This avalanche of orders for selling assets, which fall in value, is a good chance for professional traders who know that the current situation is a temporary manipulation.

An asset moves from weak holders to strong ones during a VSA Shakeout. Note the volume and bearish progress on the bars marked with arrows. The sellers’ pressure consistently reduces after the Shakeout on the first arrow. It can be seen from reduction of volume on red down bars and reduction of breakouts (each new low is just a short-term penetration under the previous local low).

This drying out of the selling pressure testifies to the completion of the process of change of securities owners. Majority of minor traders passed over their assets into the hands of professional players in panic.

Let us consider several Shakeouts using the cluster analysis instruments of the trading and analytical ATAS platform.

Example. Shakeout in the market of gold.

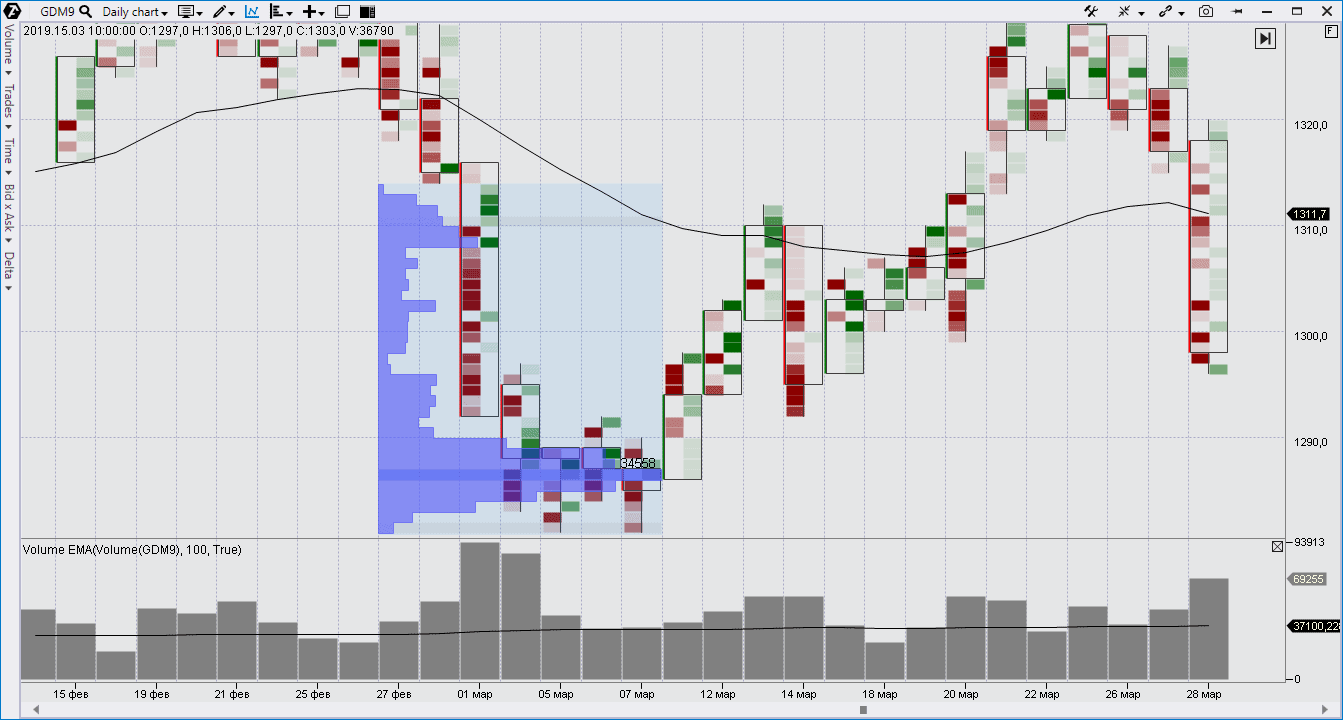

Let us take a gold futures cluster chart (5 things you should know about a gold futures); day period.

Rapid fall of gold started on Friday, March 1. Practically during the whole fall from 1,310 to 1,290 there were no buys. Analysts decided that the fall was connected with the strong dollar, growth in stock markets and ISM report.

Such a rapid fall against the negative information background formed psychological pressure on traders, which lasted the whole week-end. And on Monday, having seen the signs of continuation of the fall, traders gave up and started to:

- sell gold opening shorts;

- close longs.

However, what we see in the chart.

The trading volume was 2 times bigger than the average one on Monday, although the bearish progress was not that dramatic (what bag holding is). Clusters show emergence of buys (green bricks under the level of 1,290). This hidden force was confirmed by absence of down movement on March 5 and 6. And the effort of bears to renew the downward dynamics on Thursday, March 7, showed absence of supply (what No Supply is). And on Friday, March 8, gold started to compensate the fall on the growing (but not extreme) volume, which is the bullish indication.

Note that the profile shows a splash of activity under the level of 1,290. For certain, these volumes reflect transition of golden contracts from weak holders into the pockets of professionals.

The growth continued the next week from March 11. Thus, the overall behaviour of the market in the first half of March gave us one big Shakeout with a false breakout of the psychological level of USD 1,300.

And, by the way, the bar on March 14 has all grounds to call itself an intraday Shakeout.

Example. Shakeout in the cryptocurrency market.

The cryptocurrency market is growing starting from the end of 2018. We are not ready to state that this is a flight to the Moon, but still: plus 70% from the December 2018 low to the current April 2019 high is a bullish fact, which cannot be discarded.

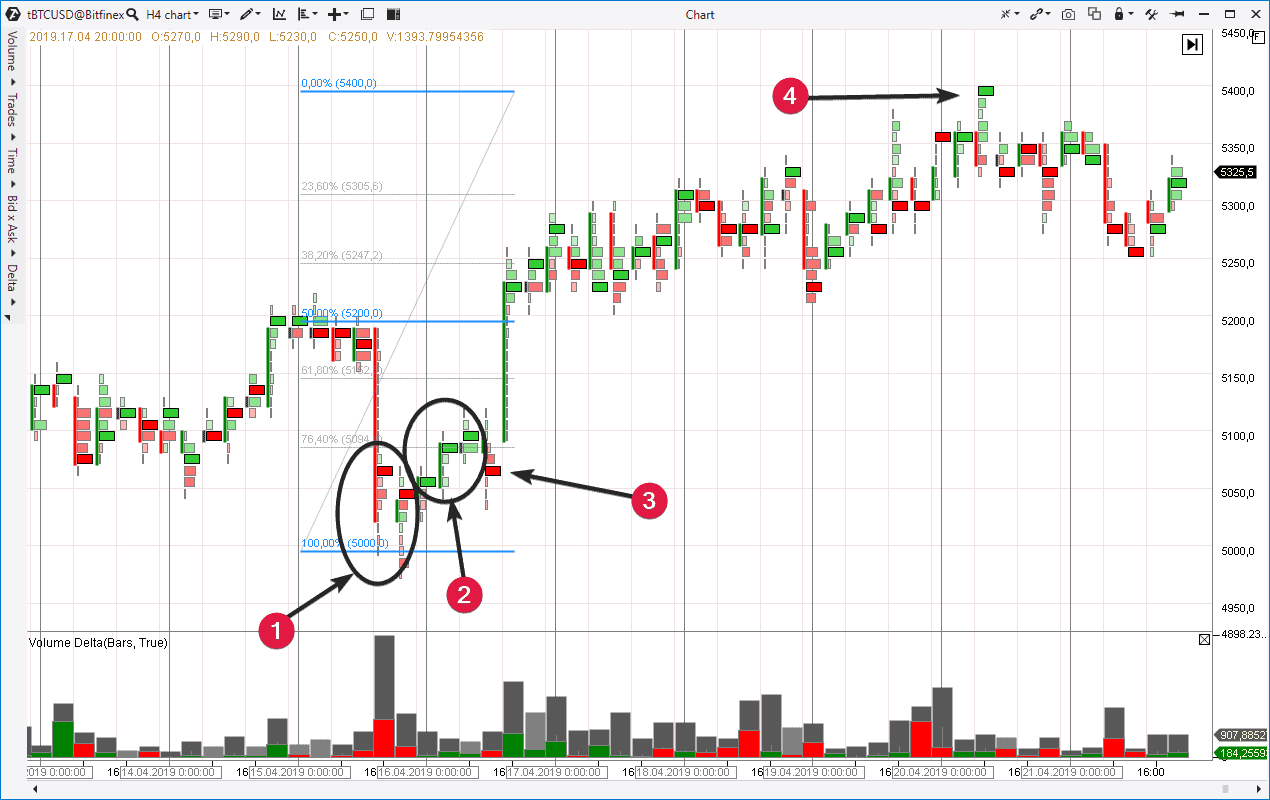

A VSA analyst will, with a high degree of probability, find Shakeouts in small timeframes within this rally. Let us take a fresh 4-hour BTC chart. Middle of April demonstrates the pattern, which we have the right to consider as a Shakeout example.

The price started to move down rapidly from the level of 5,200 on April 15 (perhaps, against the negative news background). This caused a splash of sells (1). On the one hand, executed sell orders reflect activation of stop losses of buyers. On the other hand, they reflect entry of emotional bears into shorts.

However, the next day, after a false breakdown of the round level of 5,000, which marked the Shakeout bottom, the clusters turned green. We can see predomination (2) of executed buy orders. It is a true demand on behalf of professional traders, who see growth potential in the short-term perspective. We have a VSA Shakeout, which covered 2 days.

Really, the coin price rapidly exceeded the Shakeout high and settled over the level of 5,200 after a small trap for bears (3).

How to trade Shakeouts.

We do not provide guaranteed recommendations that Shakeout trading will make you rich in a couple of days. Trading is a highly competitive business and to make profit here is not easy. Nevertheless, in order to increase practical value of this material, we will make conclusions, which are rational from the point of view of common sense.

If you feel that the panic dried out and the chart confirms entry of buyers, you have new opportunities for entry into longs in harmony with professional traders.

Say, if you bought at the level of 5,050, your protective order can be set under 5,000 – this area was already cleaned up from buyer stops and a probability of a lightning strike into the same place is not big.

The aim is the Shakeout size laid up from its high. It is the same logic as was described for Upthrust, but in a mirror reflection. We get the take level 5,200+(5,200-5,000)=5,400 and risk-reward relation of 50:150 or 1:3. which is acceptable in trading as a classically recommended proportion.

Note that the Take Profit was reached (4) on April 20.

Download ATAS and analyze the following Shakeouts:

- oil market in the middle of February 2018;

- bitcoin market in the middle of September 2017;

- fake breakout of the level of 1,400 in the AMZN stock market in the end of March and beginning of April 2018. And also a separate day – June 22, 2018.

Summary

Before we complete the article, we will give you the answer to the question asked in the beginning: what is the origin of the word ‘fake’?

According to Western linguistic resources, there is a version that the word ‘fake’ originated from the medieval slang word ‘feague’. It was related to a situation when a horse seller put ginger or a live eel up a horse’s anus to make it appear more sprightly. Later, the buyer discovered that he spent money on ‘fake’.

Why did we use this frivolous excursus? Because Upthrusts and Shakeouts, in fact, are meant to demonstrate a fake direction of the market movement.

Upthrusts start as seemingly strong upward rushes – fast and on high volumes. Later, however, buyers discover that they entered into longs at the market peak.

The opposite is similar for Shakeouts, when sellers understand that they threw away a really strong paper at a low price under the pressure of emotions and news.

Do not let the cunning market deceive you. Download ATAS and use clusters.

Volume analysis and application of VSA patterns become more efficient with them, because the platform provides you with trading activity data in a convenient form with division into buys and sells at each level. Using ATAS you will be able to build your strategy of making profit where others exit by stop losses.