What you should know about The Auction Market Theory

The market profile trading becomes more and more popular among traders nowadays. The Auction Market Theory (AMT) lies in the basis of the market profile. We already discussed the market profile subject when we wrote about horizontal volumes and about how to improve trading using the market profile.

Let’s continue elaboration of this subject.

Read today:

- What AMT is;

- Main principles of AMT;

- Responsive and initiative trades;

- Basic trading model of initiative trades, based on AMT;

- Example of a trading strategy of initiative trades in the footprint chart;

- Example of a trading strategy of initiative trades in DOM;

- What to read about AMT and Market Profile.

What AMT is?

According to Donald L. Jones, the author of the “Value-Based Power Trading” book, the traders use AMT to find out why and how exchange prices move both on short-term and day timeframes. The Capital Market Theory (CAPM) is used for analysis of exchange prices on long-term (annual) timeframes.

Market auction

The main goal of the auction market theory is making a trading decision about the asset buy or sell on the basis of analysis of all elements of the current situation – price, time, worth, risk and volatility. The analysis is conducted empirically, that is exclusively by way of observation.

The main AMT axiom

It is impossible to forecast the future movement of market prices, but it’s quite possible to make a logical assumption on the basis of behaviour of the market players.

Peter Steidlmayer could be considered the founder of AMT. He laid the basis of the market profile and shifted the accent from the price to the worth in unit time. Steidlmayer tried to forecast the future price movement with the help of the market profile and various types of days but finally had to confess that it was impossible.

Other authors developed AMT after Steidlmayer. We marked the most significant moments below. Some principles do not cohere with the original ideas of Steidlmayer.

Influence of buyers and sellers on prices

- One cannot predict the price movement. Traders work under conditions of uncertainty and use competitive advantages for increasing the chances for getting a profit.

- Market prices are formed in the process of trading between sellers and buyers.

- Some price levels, such as highs and lows, do not attract traders. There are no traders who wish to sell low and buy high. The price flees from these levels. An example is in the 5-minute E-mini S&P 500 futures (ESM9) chart. We marked the low, from which the price sharply bounced back, with point 1. The volume is minimal on the day profile near number 2. Traders perceived the minimal prices as unfair and didn’t want to trade there.

Volume profile in the auction theory

- Traders are more active at some levels than at others. Balance areas between sellers and buyers are formed at them. Such areas have a bell-shaped form of profile. They are called Value Areas in the sources on the market profile. We will use the term ‘balanced area’ or ‘balance area’ in this article.

- Interrelation between various types of days is insignificant – we cited the Jan Firich statistics in the article about the market profile.

- The market moves from the balance to trend and vice versa. The market spends more time in the stage of balance and less time in the trend movement. According to statistics of Jan Firich, we observe the trend movement of the price in the market in 9.5% of cases.

- Some traders look for a fast profit and trade during a day. Some traders develop long-term strategies and hold positions for some days/months/years.

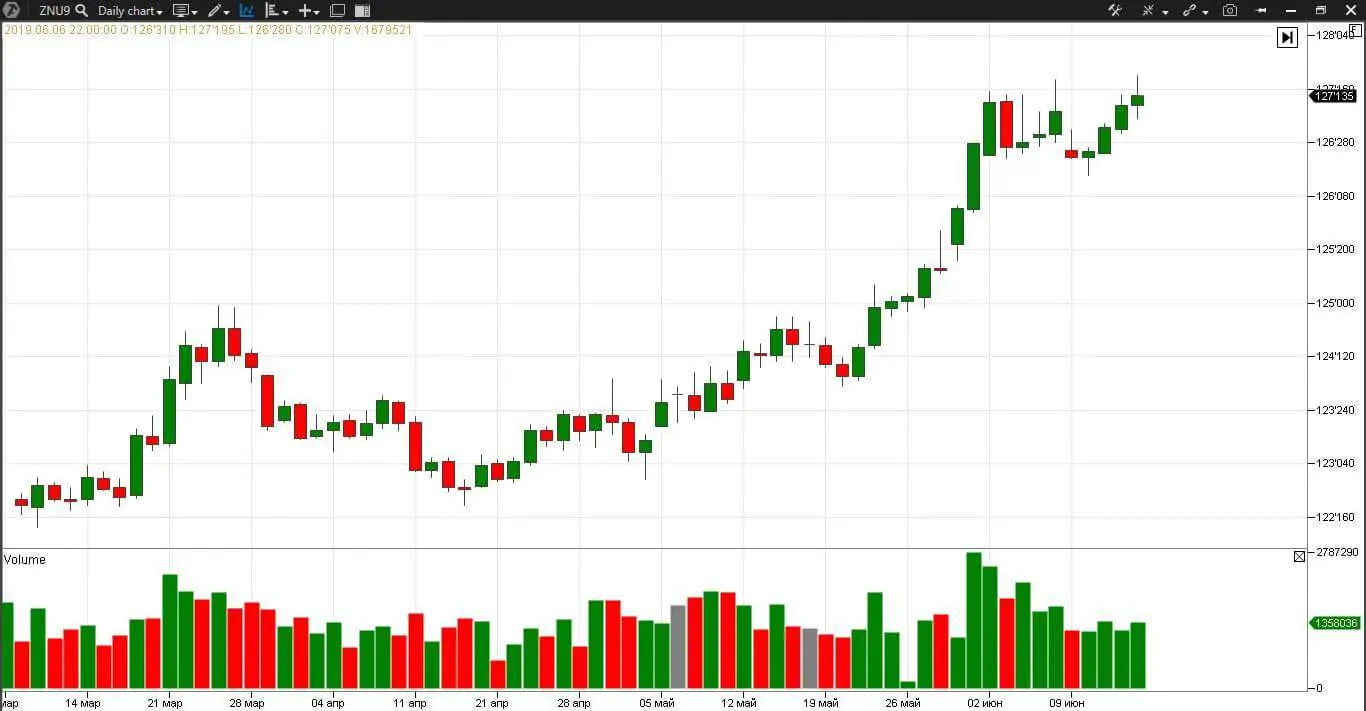

- Sometimes, trading volumes are higher during the day, sometimes – lower. The volume measures success or failure of the focused price movement. We see increased volumes in the day chart of 10-year Treasury Notes (ZNU9) on May 30 and June 2.

Auction Market Theory and volumes

- Some markets move in a wide range of prices and some in a narrow one.

- The biggest volumes are traded during the first and last hours of regular trading sessions from the point of view of intraday trading. The biggest activity in the global markets falls at the moment of the news and reports issue.

- The market could be balanced and then it can move in a certain direction during various periods of time. For example, the trend takes 3 hours and the balance takes 15 days. Let’s look at the 30-minute WTI oil futures (CLM9) chart and check for how long the market stays in a balanced state and for how long in a trend state.

Trends and balances

We marked a trend movement after a breakout with number 1. The price moved in a certain direction only during 2 candles or 1 trading hour. The rest of the time on June 9 the market traded in balance, that is, the price moved up and down within a range, which we marked with a bell.

We marked the next trend movement, which also lasted for only 1-2 candles or 1 trading hour, with number 2. The market again traded in balance the rest of the time of June 10.

We marked the trend movement that lasted for 3 candles or 1.5 trading hours with number 3.

The considered examples took place at the end of the trading session.

And the trend movement marked with number 4 fell on the middle of the trading session. The price broke the current balanced area and entered the trend phase in a search for a new balance. This movement covered 3 candles or 1.5 trading hours.

Specific features of trades in AMT

- The global electronic markets are traded much more active than before.

- The demand and supply changes result in the price changes. Demand and supply change in the course of a trading session.

- Market profiles change every day.

- Traders look for the value. The value is identified by the price, accepted by the parties. Or, in the formula language, Value=Price*Time.

- Long-term traders move the markets and accumulate positions. They look for a big trend movement.

- The majority of traders look for balanced markets for entering into a trade.

The majority of traders trade during a day – we provided statistics on various types of traders in this article.

Responsive and initiative trades

As we already mentioned before, traders analyze the market situation with the help of AMT and make a balanced decision to buy or sell a contract/asset. The market profile is a visual reflection of the auction market.

Responsive

Let’s mark two main types of trades:

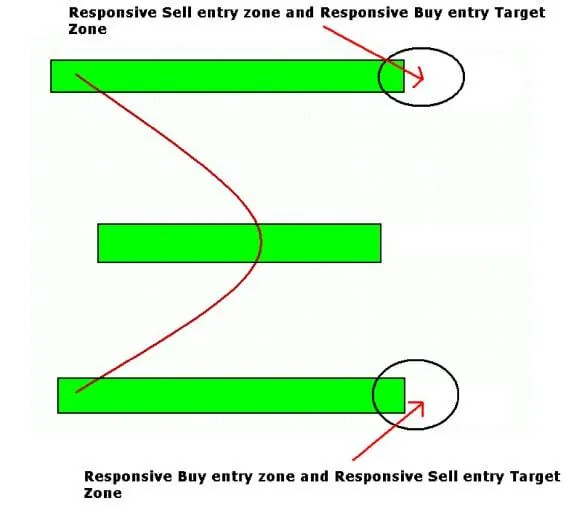

Responsive – from the upper and lower boundaries of the balanced area to the Point Of Control (POC) – the maximum volume level. And vice versa, from the POC to the high or low. You can calculate a take profit and stop beforehand in these trades. Here we show a scheme of a responsive trade from the Tom Alexander’s book “Trading Without Crutches”.

Initiative

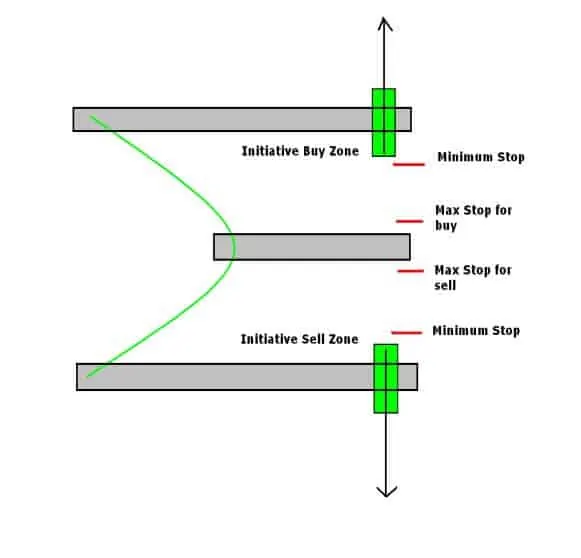

Initiative – trades for a breakout of the upper and lower boundaries of a balanced area in search for a fair price. It is impossible to calculate the take profit in such trades, you need to wait for a new balance area formation. These trades are more risky, because false breakouts and insignificant extensions of the balanced area often happen. However, trades in the direction of a breakout are potentially more profitable, because they are intended to catch a sharp and strong trend movement. Look at the scheme of an initiative trade from the Tom Alexander’s book “Trading Without Crutches”.

Basic trading model of initiative trades, based on AMT

Let’s discuss in detail how to trade initiative trades. We will use the basic model of Donald Jones, another famous follower of Steidlmayer.

Trading rules

- we enter a trade with limit orders only;

- we buy 1 tick higher than the breakout of the upper boundary of the balanced area;

- we sell 1 tick lower than the breakout of the lower boundary of the balanced area;

- we use the trailing stop of ⅛ of the balanced range;

- if we didn’t exit by a stop, we exit at the closure of the next day.

We will try this model on real trading examples in the next sections.

Example of a trading strategy of initiative trades in the footprint chart

Let’s consider an example of breakouts of the value area in the 5-minute E-mini Euro futures (E7M9) chart.

Interpretation of the market situation in the chart

We marked the balance area, which was formed in the first half of the day, with number 1. We marked the breakout level with a black horizontal line. The probability of a breakout at this place is very high, since the profile step sharply changes. The profile step is a significant difference between volumes at neighbouring price levels. Volumes fluctuated from 100 to 200 contracts in the middle of the upper marked part of the profile. And the price formed the balance and moved now up, now down. The number of contracts sharply reduced from 73 to 33 closer to 12:30 and then to 11 – we marked the reduction of the profile step with number 2. The price nearly rushed to the day’s low after the breakout, where a new balance area was formed.

We open a trade in point 3. We cannot accurately follow the basic trading strategy of Jones here. We would post a limit order at the level of the profile step change from 73 to 33 contracts. The stop level is marked with number 4 – this is the ⅛ of the range from the day’s high to the breakout level. We close this trade in point 3.

Take profit calculation

It is difficult to calculate a take profit in breakouts beforehand. There are several variants:

- we wait and monitor the development of events, but there is a danger to lose a part of the profit in this case;

- we calculate a take profit beforehand – for example, a half of the previous price movement;

- we close a trade at the end of the trading session;

- we wait for formation of the middle of the next balance area – we selected this variant.

Extension of balanced ranges

We already mentioned that breakouts are the most profitable and, at the same time, the most risky trades, because sometimes the balanced ranges extend with the help of false breakouts and the price comes back to the middle of the value area. There are signs of a true breakout in our chart:

- A lower new price high after 07:45;

- There are three consecutive red candles just before the breakout, which means that the trading moved down.

Risks in trades

You shouldn’t look for these signs before each breakout. It is sufficient to understand the logic of the market movement. Remember that there is risk in each trade, namely that is why we use protective strategies.

Example of E-mini Euro E7M9

Let’s check the same setup in the hourly E-mini Euro futures (E7M9) chart, using the volume digital histogram footprint. We selected this variant of the footprint because we want to concentrate on the shape of bars and number of contracts, traded at each price level.

It is much simpler to close a trade in this chart. Coinciding POCs of two neighbouring bars at the day’s low create the support level and allow exiting with the maximum profit in point 3. It is also simpler to post a stop – you don’t have to calculate and you can just look up to the POC of the breakout bar in point 2. The footprint makes the market situation clearer and simpler even with such a relatively long time range as the hourly period. The better the understanding is, the more nerves are saved and the higher the profit is.

Example of a trading strategy of initiative trades in DOM

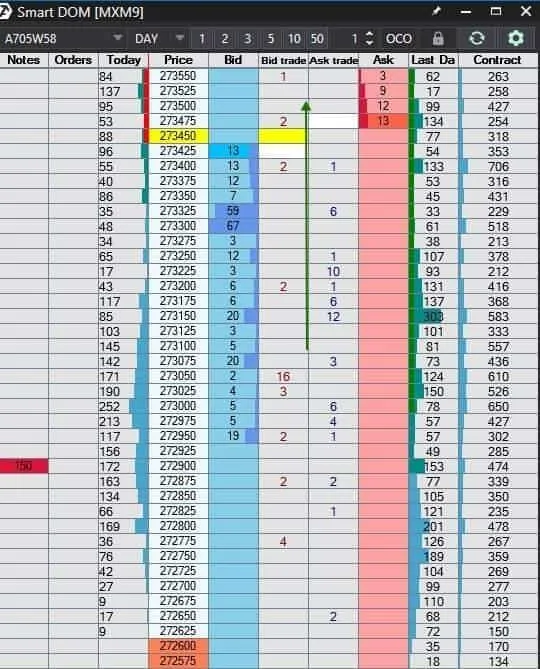

Now, let’s see how to trade a breakout in the order book on a Moscow Exchange index futures (MXM9).

Auction Market Theory and the order book

This is not the most vivid example, because the trading activity is, as a rule, lower than usual on Fridays at the end of the main trading session. The price of a Moscow Exchange index futures smoothly went down starting from 11:00. The traders who sold during the whole day would wish to buy at the end of the day to register profit. It is an important moment since the buys would push the price up.

What did happen in the tape?

A major sell of 150 contracts at the price of 272,900 took place at 17:01. About 100 of these contracts were new positions – it can be seen from the increase of the open interest in the marked part of the tape (red rectangle). Despite the big volume, the price fell insignificantly. A balanced area started to form near the day’s low, that is the price sequentially moved up and down. We marked this area with number 1. There are no strict rules for identifying such areas. We just monitor the price movement and see how the number of contracts, traded in this range, increases, the area itself consolidates and a projection is formed on the profile.

Thin ranges

Gradually the price moved to the upper boundary of this small balanced area – we showed this movement with black arrows. We estimated the upper boundary of the balance area of 273,100 visually by reduction of the profile step from 89 to 49 contracts. The probability of a breakout increases when the price moves as a wave to the boundary. Note that above, in the range of 273,100-273,525, a very small number of contracts (-4,17,31) were traded earlier at each price level. Such ranges are called ‘thin’. The price here moved very fast and volumes just had no time to be formed. Perhaps, the price would also run very fast upward in this range now if there is a breakout.

Let’s assess correctness of our considerations in the next chart. The price broke the level of 273,100 and reached 237,450 fast – we marked this movement with a green arrow. Here we have a good example of a scalping and initiative trade.

Trades by the order book

It is difficult to catch this movement without DOM and tape. Compare the 5-minute candle chart and order book.

Our trade is marked with number 1. But it is difficult to catch a small upward bounce in this pattern without additional indicators. And it was possible to make RUB 350 per contract (from 273,100 to 273,450) during 5 minutes through analyzing DOM.

What to read about AMT and Market Profile?

Top books on the auction market:

- Donald L. Jones “Auction Market Theory”. What we briefly discussed in this article is in this book in detail and with examples.

- “A Six-Part Study Guide to Market Profile” textbook for CBOT members. It is the main book of a trader who wants to use the market profile. Some chapters are about CME only.

- “Steidlmayer on Markets: Trading with Market Profile” by J. Peter Steidlmayer and Steven B. Hawkins. This book would have been more complex and dull if it would had been written by Steidlmayer only. It contains many parenthetical remarks about life and experience of Steidlmayer.

- “Mind Over Markets” by James F. Dalton. Dalton developed and improved the Steidlmayer theory, however, you will not find something principally new in this book.

- “Value-Based Power Trading” by Donald L. Jones. The book contains readymade trading systems based on the market profile.

- “Trading Without Crutches” by Tom Alexander. The book is written in a clear language and it has many pictures relating to initiative and responsive trades.

Summary

Study the market using the modern software and your chances to make profit will increase. Each instrument has its character and specific features. The better you are equipped, the more you are focused and the better you understand the logic, the simpler it would be for you to move together with the market, rather than standing on its way.

Try ATAS free of charge. This platform provides the most valuable exchange data in the most comfortable form.