How to trade currency pairs

Currency pairs are an instrument, which, as a rule, the people that study financial markets come across for the first time. It happens because we all see currency exchange rates in the currency exchange booths and it is easier for us to understand this financial asset. However, it is not that simple.

Currency pair quotes play an important role in the world economy.

- They influence export, import, GDP and development of some countries.

- Currency pairs are key instruments of exchange trading for traders.

- Currency pairs could be a part of diversified portfolios for investors.

We will speak in this article about currency pairs and it is addressed, first of all, to beginner traders.

Read in this article:

- Currency pair definition.

- Best currency pairs for trading.

- How to select a currency pair for trading?

- Currency pair types.

- Analogues of currency pairs in the futures market.

- The EUR/USD currency pair forecast.

- How to trade profitably the selected currency pair?

Currency pair definition

What does a currency pair mean?

Currency pair is a relation of the currencies of two countries expressed in the quote.

What does the explanation of a currency pair look like? For example, the EUR/USD currency pair is explained as the relation of the European Union currency (EUR) to the United States currency (USD). The EUR/USD currency pair identifies the value of EUR denominated in USD.

For example, EUR/USD = 1.12 means that EUR 1 is more expensive than USD 1 in 1.12 times. In other words, 1 euro costs 1 dollar and 12 cents.

Any currency has its designator consisting of 3 letters.

- EUR – euro,

- USD – American dollar,

- GBP – British pound sterling,

- AUD – Australian dollar,

- JPY – Japanese yen,

- NZD – New Zealand dollar,

- CAD – Canadian dollar,

- RUB – Russian rouble,

- CNY – Chinese yuan.

How to understand the currency pair chart?

Let’s assume that you look at the currency pair chart (for the purpose of discussion – XXX/YYY). The chart goes up. How to understand what currency becomes more expensive and what currency becomes cheaper?

Use the ‘weight scales rule’.

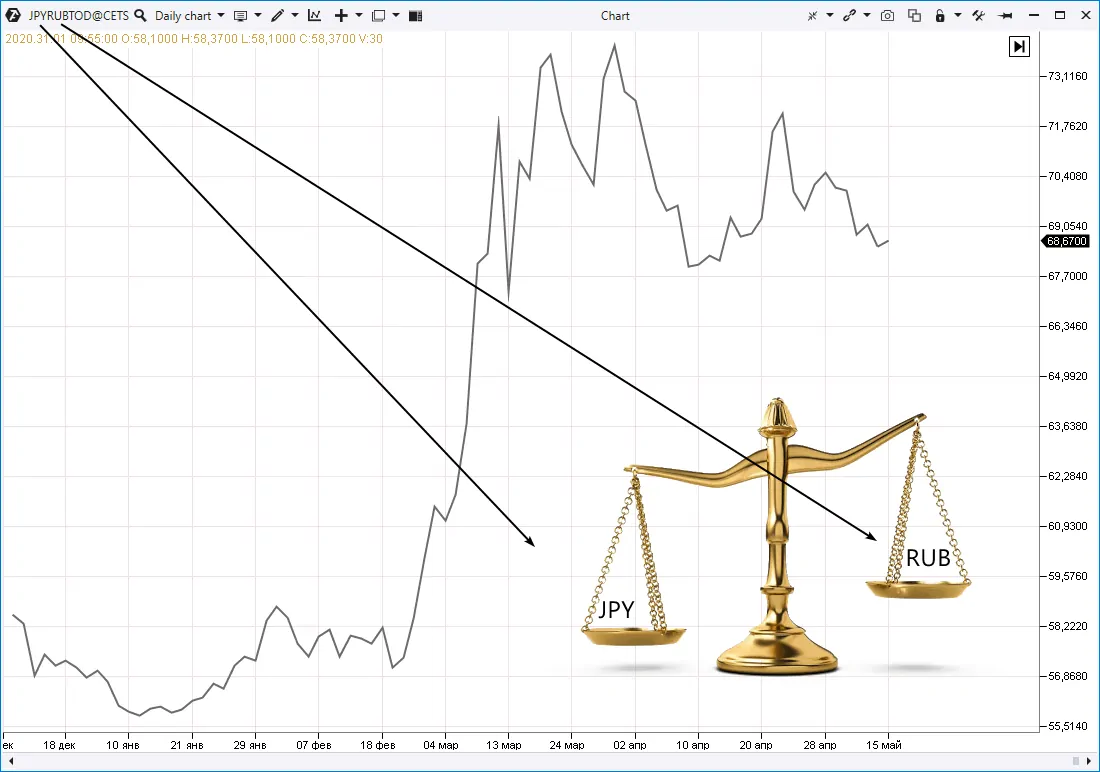

For example, the chart above shows dynamics of the JPY/RUB (Japanese Yen / Russian Rouble) currency pair. The chart shows the upward fluctuation. What does it mean?

Imagine the weight scales. Take the currency from the left part and put it on the left scale. Put the currency from the right part on the right scale. And imagine that the weight scales moved in such a way so that they repeat the chart dynamics. From bottom left to top right. The conclusion is associative – the currency on the left scale became ‘heavier’, which means that it is more expensive. In our example, it is the Japanese yen. Consequently, the Russian rouble is ‘lighter’, which means it became cheaper.

Best currency pairs for trading

What are currency pairs which are the best for trading?

In order to answer this question, it is important to understand what financial instrument could bring a stable profit to a trader.

What car a driver can drive faster and safer? The car he knows well. He knows all control devices, dimensions, optimum speed rate and other parameters of this car. The car, which the driver drove many times.

The same is true about the currency pair. Only that currency pair will bring you profit, which you know well.

- You know the state of economy of those countries, the currencies of which form the currency pair.

- You know during what hours of a trading session this currency pair is active.

- What the average trading volume is.

- What the average volatility of the currency pair is.

- The character of daily movement.

- What the nearest important news would influence this currency pair movement.

- What important price levels (for example, historic) exist for this currency pair.

If you, as a trader, possess this information on the currency pair, then this pair would be the best one for you. Any financial instrument has its ‘character’. If you monitor the chart of a certain currency pair for a long time, you may start to ‘feel’ it and remember the patterns, which are formed most often.

An important recommendation could be drawn out of it:

One beginner trader – one currency pair – one system.

You should select the currency pair you know well or ready to study.

When to trade the currency pair?

It should be traded when it is more active and when traders are citizens of the countries, the currencies of which form the currency pair. That is why it is important to select the currency pair, which is active during the hours when you are active, from the very beginning.

If you trade one currency pair for some time and everything goes well and you have strength and time for mastering a new currency pair, you can add one more instrument into your trading arsenal. However, do not overload yourself with information, monitors, currency pairs and systems. A trader should think in cold blood and make decisions fast.

Currency pair types

Currency pairs could be divided into several categories:

- Basic or main currency pairs (major).

- Cross rate currency pairs (cross).

- Exotic currency pairs (exotic).

Major currency pairs are pairs of the developed countries’ currencies with the US dollar. These are the following currency pairs: EUR/USD – euro / US dollar, GBP/USD – pound / US dollar, USD/CHF – US dollar / franc, USD/CAD – US dollar/ Canadian dollar, USD/JPY – US dollar / yen, AUD/USD – Australian dollar / US dollar and NZD/USD – New Zealand dollar / US dollar.

The EUR/USD currency pair is the most popular one among traders.

Cross rate currency pairs are pairs of the developed countries’ currencies, which identify the relation of the currencies between themselves without the US dollar. Examples of cross rate currency pairs: EUR/GBP, EUR/AUD, GBP/CHF, EUR/JPY, AUD/NZD, AUD/CAD, GBP/AUD and so on. There are much more currency pairs of this type.

Trading cross rate currency pairs is popular among more experienced traders. For example, you analyzed macroeconomic data and actions of the EU and Japan central banks and realised that the yen should become stronger and euro – weaker. Then, you open a EUR/JPY short on the basis of the conclusions made.

Exotic currency pairs are pairs of developing countries with respect to the US dollar and other currencies of developed countries. Examples of exotic currency pairs: USD/MXN, GBP/SEK, USD/ZAR, USD/RUB, USD/HUF, USD/TRY and so on.

Exotic pairs are the domain of experienced and very experienced traders, since there could be sharp exchange rate fluctuations, high trading commission fees, low liquidity, etc. On the other hand, there could be strong movements, especially when news are published, which could bring significant profits.

Analogues of currency pairs in the futures market

Currency futures, which completely coincide with currency pairs in the Forex market by their movement dynamics, are traded on the Chicago Mercantile Exchange (CME). The quote could differ a little bit but the movement character is the same. It gives a possibility to analyze real data about volumes, which are not available in the Forex market, and, in such a way, to improve forecasts of the currency pair movement dynamics.

| Currency pair | Futures | Name |

| AUD/USD | 6A | Australian dollar |

| GBP/USD | 6B | British pound |

| USD/CAD | 6C | Canadian dollar (the futures has an indirect quote) |

| EUR/USD | 6E | Euro |

| USD/JPY | 6J | Japanese yen (the futures has an indirect quote) |

| NZD/USD | 6N | New Zealand dollar |

| USD/RUB | 6R | Russian rouble (the futures has an indirect quote) |

| USD/CHF | 6S | Swiss franc(the futures has an indirect quote) |

| EUR/GBP | RP | Euro / British pound |

Also, a letter is added to the futures name, designating the month, and number, designating the year. These symbols point to the date when the futures contract will be executed (expiration date).

Letters that designate months: F – January; G – February; H – March; J – April; K – May; M – June; N – July; Q – August; U – September; V – October; X – November; and Z – December.

Numbers that designate years, for example: 0 – 2020; 1 – 2021; 2 – 2021 and so on.

For example, the 6EZ0 futures means that it is the EUR/USD futures contract with expiration in December 2020.

How to make the currency pair forecast?

How to make the forecast on EUR/USD or other currency pairs?

Usually, when building forecasts on currency pairs, fundamental factors are taken into account.

In principle, fundamental analysis of currency pairs is the subject, which fits for multi-year study in a higher educational establishment and further practice for several years. Only then a trader will approach understanding of how to make forecasts.

The reason is that there are a huge multitude of factors, which influence the EUR/USD currency pair movement, since we speak here about two largest world economies. Any detail in these huge and complex mechanisms influence the current quote one way or another. Namely that is why so much time is required to study the operation of this mechanism and, of course, we cannot describe everything in one article.

We would just briefly note that the highest qualification is required for building a forecast on fundamental data. If a trader compares unemployment levels in the US and Europe and also GDP correlation and makes his forecast on the basis of these data only, such a forecast is far from taking into account other important factors and, consequently, has a low value.

That is why beginner traders should study more efficiently:

- technical analysis,

- cluster analysis (Footprint),

- capital and risk management methods,

- trader psychology management methods.

These directions allow making faster progress.

How to trade profitably the selected currency pair?

Of course, you should start with the currency pair chart. It is preferable to study the currency pair chart every day, so that your eyes and brain would remember the currency pair movement dynamics. It would become easier for you to analyse and forecast the currency pair after you gain some experience.

Then you need to get acquainted with the Footprint theory, which studies interconnection between trading volumes and price movements.

Volume analysis is applicable not only on classical instruments but also on exotic currency pairs, such as RUB/USD.

How to analyse the currency pair?

We will show it through the example of the USD/RUB futures (Si) chart.

- Open the chart in the ATAS platform.

- Add the Market Profiles indicator from the trading ATAS platform to the currency pair chart and it would provide you with a possibility to make more accurate forecasts.

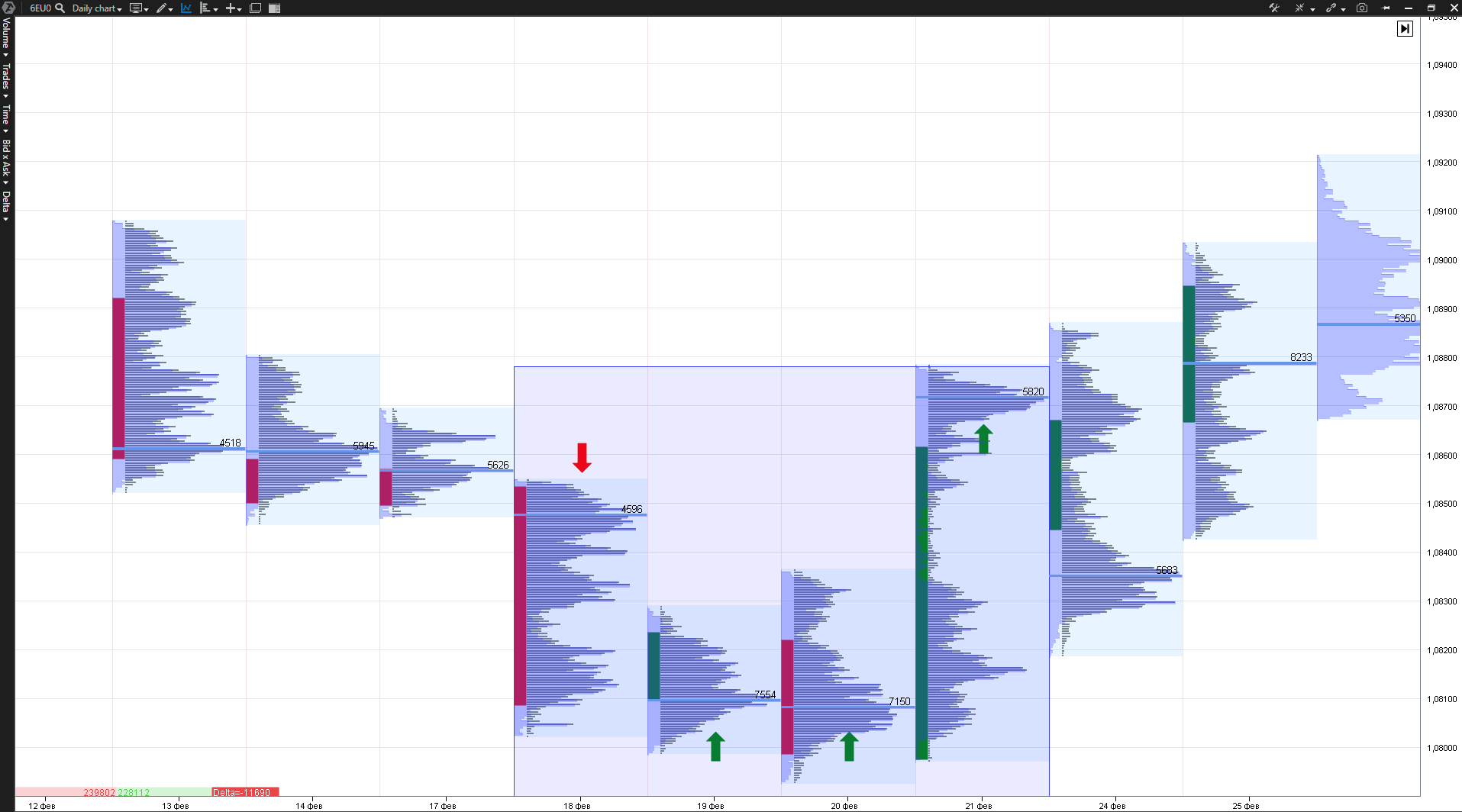

Let’s consider a simple strategy on the basis of the Market Profiles indicator and analyse the EUR/USD currency pair. The chart example:

- We analyse the daily time-frame. We conduct analysis in the morning before the European session starts.

- If the maximum daily volume (POC) moved down with respect to the previous day’s maximum volume and the price is below the previous day’s maximum volume – most probably, the market would continue to move down and it makes sense to search for points of entry into sells.

- If the maximum daily volume (POC) moved up with respect to the previous day’s maximum volume and the price is above the previous day’s maximum volume – most probably, the market would continue to move up.

- In such a way we continue to monitor price and volume dynamics every day.

This simple approach will not take more than 5 minutes a day but will move your chances to make a profit into the positive direction.

Summary

- Select the currency pair which fits you best of all. Selection of the currency pair and trading instrument is like selection of your favourite car. You should like it and it should fit you. The same is true for the currency pair – you will spend a lot of time analysing your working instrument chart. After some time, you should learn to feel and understand, analyse and forecast your currency pair. It should fit you by the time of activity and temper. If you have a calm temper, select less volatile instruments. If you are inclined to take risks, more volatile instruments with an intensive news publication schedule would fit you better.

- Learn your currency pair deeply. Become an expert in it.

- Do not spread yourself too thin. Build your trading strategy. Learn to trade profitably one instrument, then take another one.

- Master volume analysis with the help of the trading ATAS platform. It gives a possibility to trade together with major players and, consequently, make money.

- Study macroeconomic analysis and economies of the countries, the currencies of which you trade. It will give you a possibility to understand global trends of your currency pair.

- Use the Market Profiles indicator and other advanced indicators from the trading ATAS platform for building a profitable trading system.

We wish you profitable investments and trades!