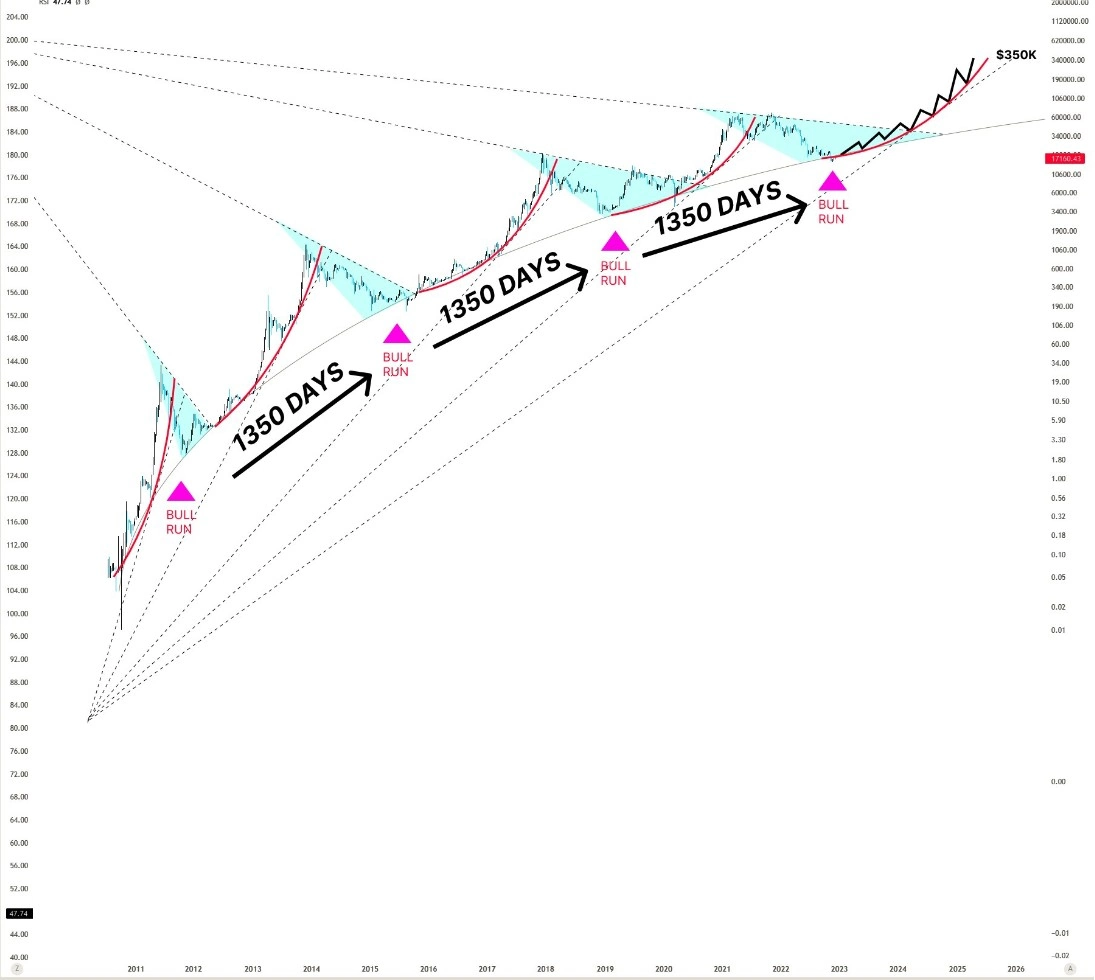

Bitcoin Price Prediction for 2023

At the end of 2021, we noticed that after skyrocketing in 2017-2018, the price of Bitcoin went into a long-term bear market for two years. Unfortunately for the “holders”, this scenario played out in the worst variation.

Read more: