Take profit: FAQ for beginners.

This article is mainly for beginner traders who still have gaps in their knowledge, including about take profits. We tried to objectively answer their multiple questions, that is why the article format looks like FAQ.

Read in this article:

- What profit registration in trading is.

- How does the take profit activation on the exchange look like?

- Where is it better to post take profits?

- What indicators should be used?

- Chart examples.

Everything you need to know about a take profit

What is a take profit?

In exchange trading, it is an order, with the help of which a trader wants to register a profit. This is the main goal and intended purpose of a take profit.

Quite often ‘take profit’ and ‘goal’ are used as synonyms in trading.

What is profit registration on the exchange?

In simple words, it is an exit from the current profitable trade. While a trade (position) is open, its profit is floating and changing depending on quotation fluctuations. The profit is registered when a trader closes a trade.

Profit registration in trading is the most pleasant process, when your balance increases after the trade closing due to the fact that the floating profit is deposited to your account as the financial result of the trade. This scheme is similar in different markets. The process of profit registration is the same for stocks, futures and cryptocurrencies.

Besides, it is important to note that a trader can register the floating profit both with the help of a take profit order (automatically) and manually.

What is a take profit in trading?

It is a pending order, which should be executed when the market price reaches a certain level. When it happens, a market order, which is directed against the open position and closes it, is sent to the exchange.

For example, you have a long open position in the oil market, which you bought yesterday at 40.00. The price fluctuates today around 41.00. You send a take profit to your broker at 42.00. It means that if the quotation reaches 42.00 tomorrow, a market sell order will be sent to the exchange. Thus, a take profit will be activated, your contracts will be sold, your position will be closed and you will register your profit from this trade.

What is a pending order and market order? What is the difference?

There is a separate article about order matching.

Read it if you don’t know the subject. Order matching is an important part of the exchange process. It helps to understand how trading mechanics works in reality.

How to calculate a take profit?

In the most general case, there are 2 methods:

- Mathematical. In this case, a take profit is calculated by formulas and proportions. For example, a trader posts a stop loss at 10 ticks. Then he can post a take profit at 15 or 20 ticks. Then the reward:risk ratio would be 1:1.5 or 1:2 (net of commission). This is a rational ratio and you may work with it.

- Discretionary. In this case, a trader conducts analysis, the aim of which is to determine the place where it is better to post a take profit.

One of the efficient ways is to use volume analysis and functionality of the ATAS platform in order to track activity of major market participants and then to arrive at a logical conclusion where to post a take profit.

What is the difference between a take profit and stop loss?

These two are very similar pending orders, because both are waiting for their time to come. One condition is required for activating them – the price should reach a certain level. If it happens they are triggered and send market orders to the exchange, which are opposite to the open position, which leads to its closing.

The important difference is that a stop loss registers a loss (so that it doesn’t reach a catastrophic size) and a take profit registers a profit.

There are some other differences between take profits and stop losses. It is believed that:

- Take profits slow down the market, while stop losses accelerate it.

- Take profits are often posted before significant levels, while stop losses are posted after significant levels.

Why is a take profit important?

For whatever reason, the profit registration is an undervalued part of trading. Books about trading or training courses pay little attention to the exit from a position. In fact, the market exit point is as important as the market entry point.

The market exit point has to be clearly described in the trading plan, as well as all other items of the trading system. Because when a trader is in a trade, fear, greed and other emotions turn on and they seriously influence the decision-making process. As a result, the profit might not be registered in time and a profitable trade may turn into a loss-making one.

So, we do not recommend you to enter the market if you have no understanding where to exit from it.

How to post a take profit?

A take profit could be posted:

- when you open a position or after you open it;

- manually or automatically.

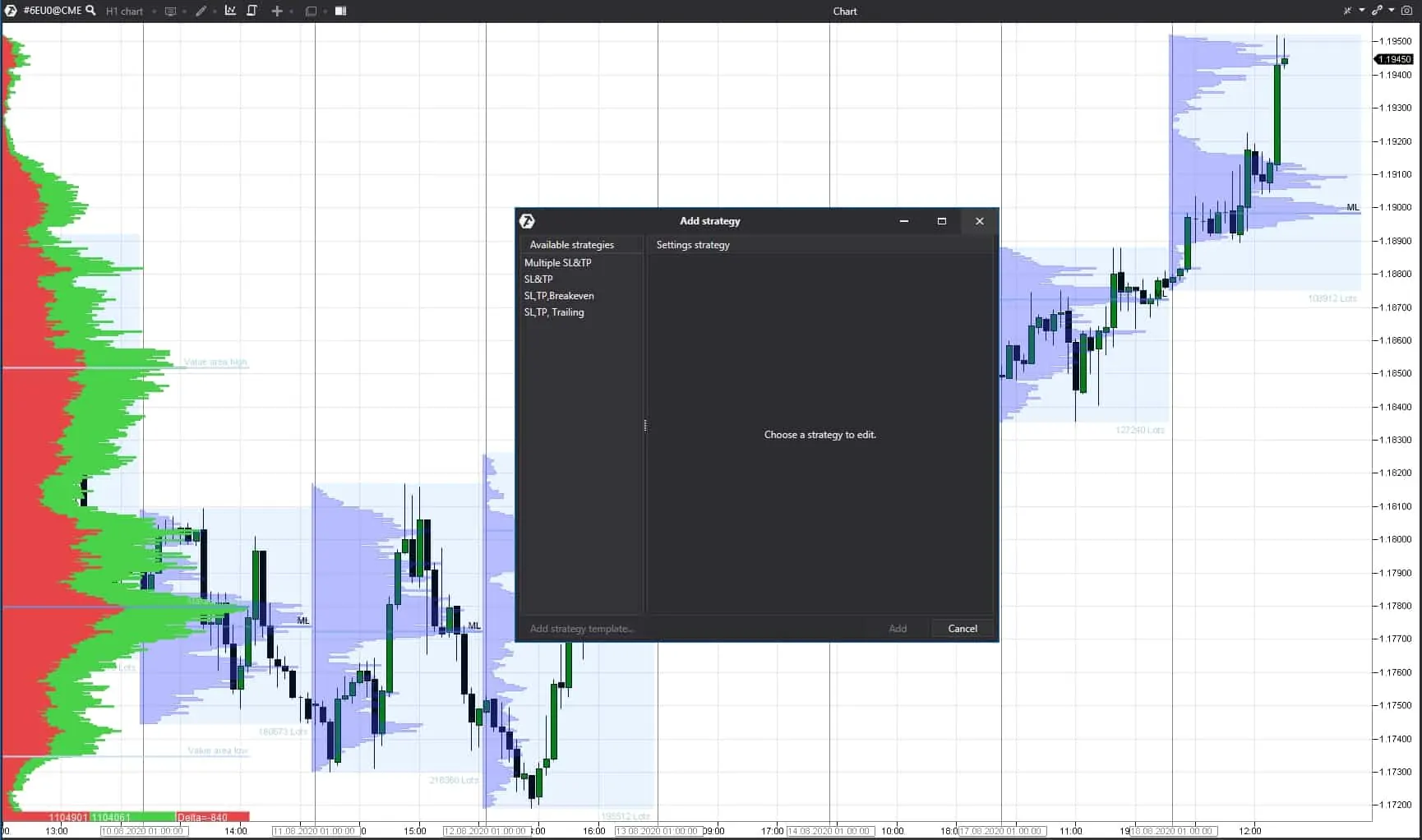

There are protective strategies in the trading ATAS platform. A take profit could be adjusted in such a way, that it will be posted automatically with the position opening at a set distance.

What happens when a big number of take profits are activated?

The market slowing down takes place at the points of activation of a big number of take profits.

For example, major traders are buying. They posted take profits below a significant peak. When the price reaches the take profit level, sell orders start to come to the market in order to close earlier opened buys. As a result, the uptrend may slow down or even reverse. Due to this, a price ‘shortfall’ to the previous significant levels is sometimes observed.

Why is a take profit not activated?

A condition should be executed for a take profit to be activated. If the price reached the set level and the order is still pending, contact your broker.

Where are take profits posted?

A popular place for posting take profits is the price area, located near some significant level but not reaching it.

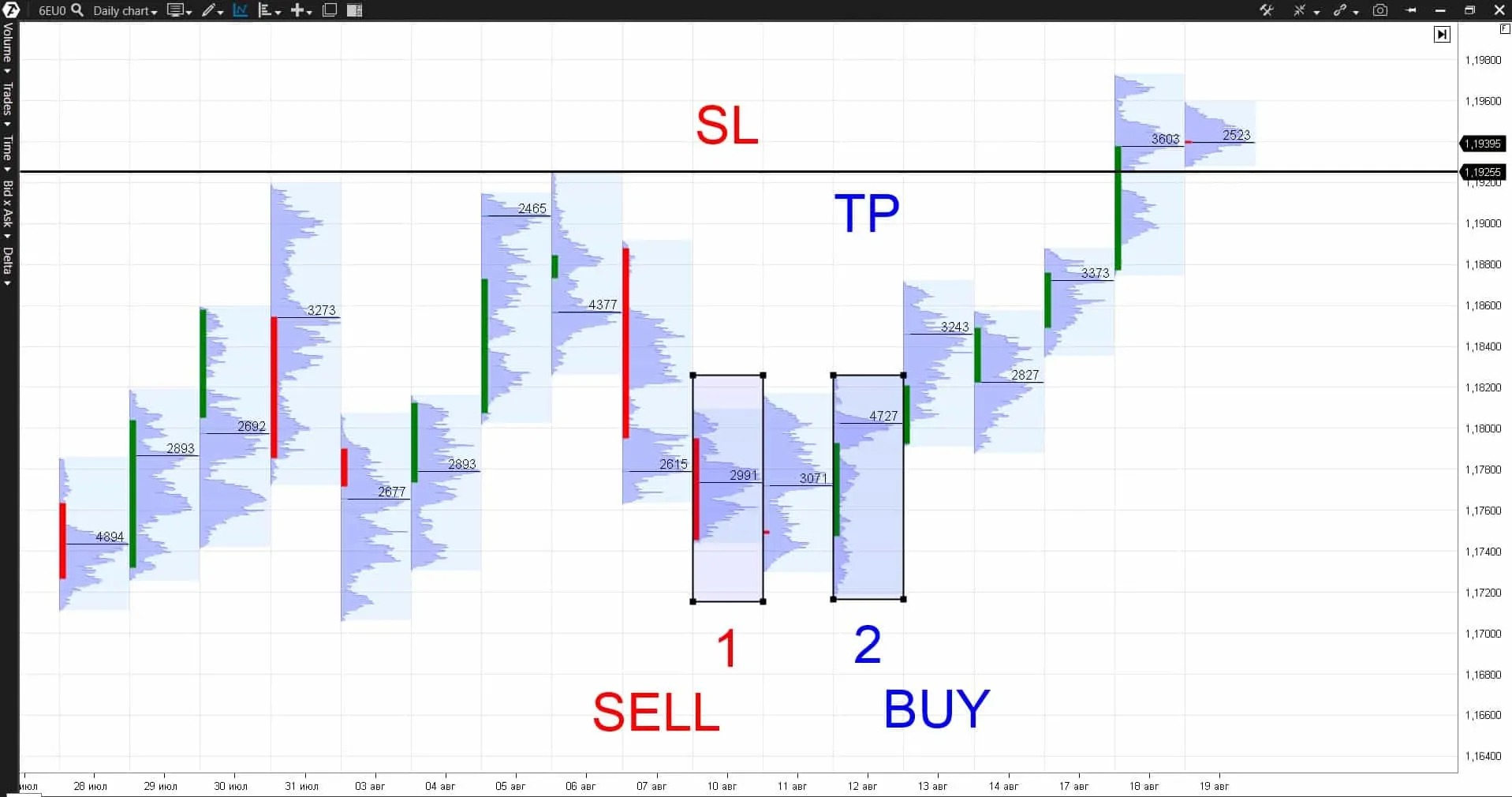

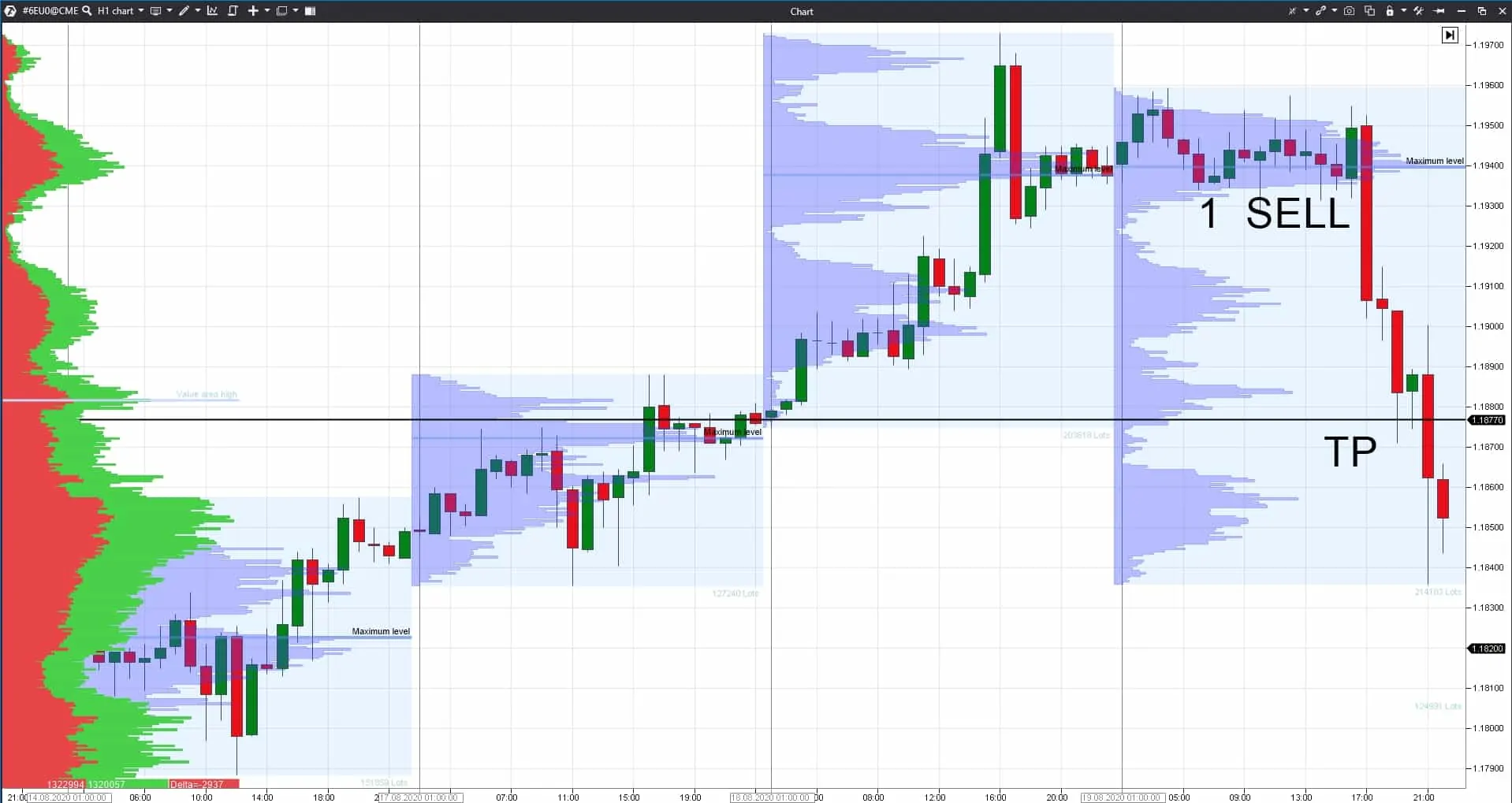

Sellers in point 1 would, most probably, post their stop losses after the previous high. And buyers in point 2 would, most probably, post their take profits before the previous high.

One more place of take profit posting could be the levels, where stop losses are presumably posted. Then stop losses will be matched with take profits.

Take profits, which are placed in such a way, have a higher profit potential, although a lower probability of execution.

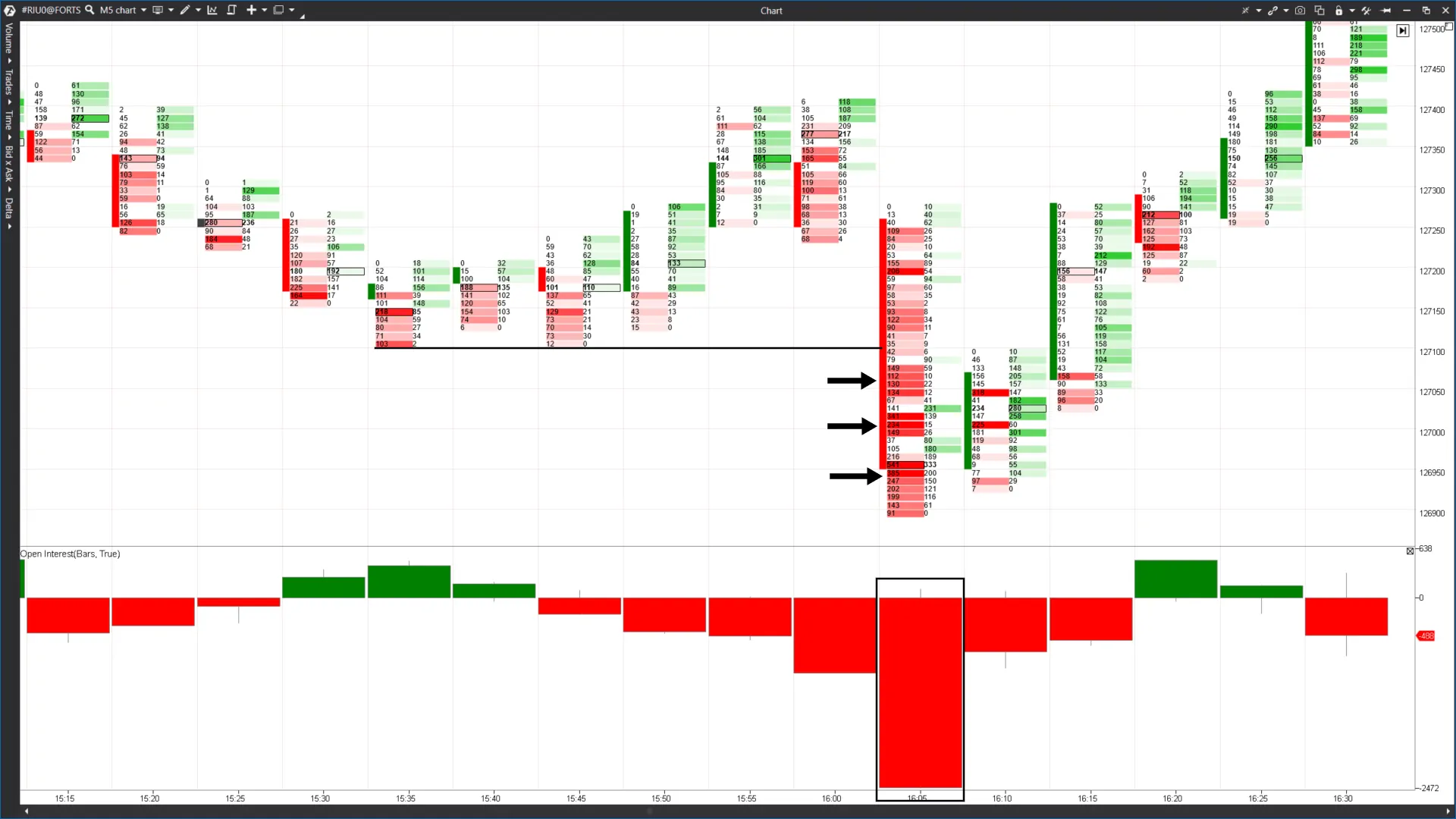

Open Interest could be a good take profit activation indicator for the Moscow Exchange instruments. You can see a significant fall of the Open Interest when take profits and stop losses are activated en masse.

What do we see in the picture above? A big number of market sells were sent to the market at the moment of breaking the previous low (red clusters testify to it). Perhaps, there was activation of multiple stop losses of buyers. Some of them were matched with take profits of sellers.

As a result, we observe a sharp fall of the Open Interest, which tells us about the exit of a big number of traders from the market.

Posting stop losses with the help of indicators

Let’s consider several indicators for posting take profits from the functionality of the trading ATAS platform. It is important for us that a take profit is activated with a high probability and the price doesn’t meet strong resistance when moving towards the take profit. And the advanced volume analysis indicators are designed specifically to help us to find such areas.

The Maximum Levels indicator displays the maximum volume levels for the current and previous days, week, month and contract.

Consequently, these levels could be resistance levels for the price and possible reversal points, that is why it is more logical to post take profits before these levels.

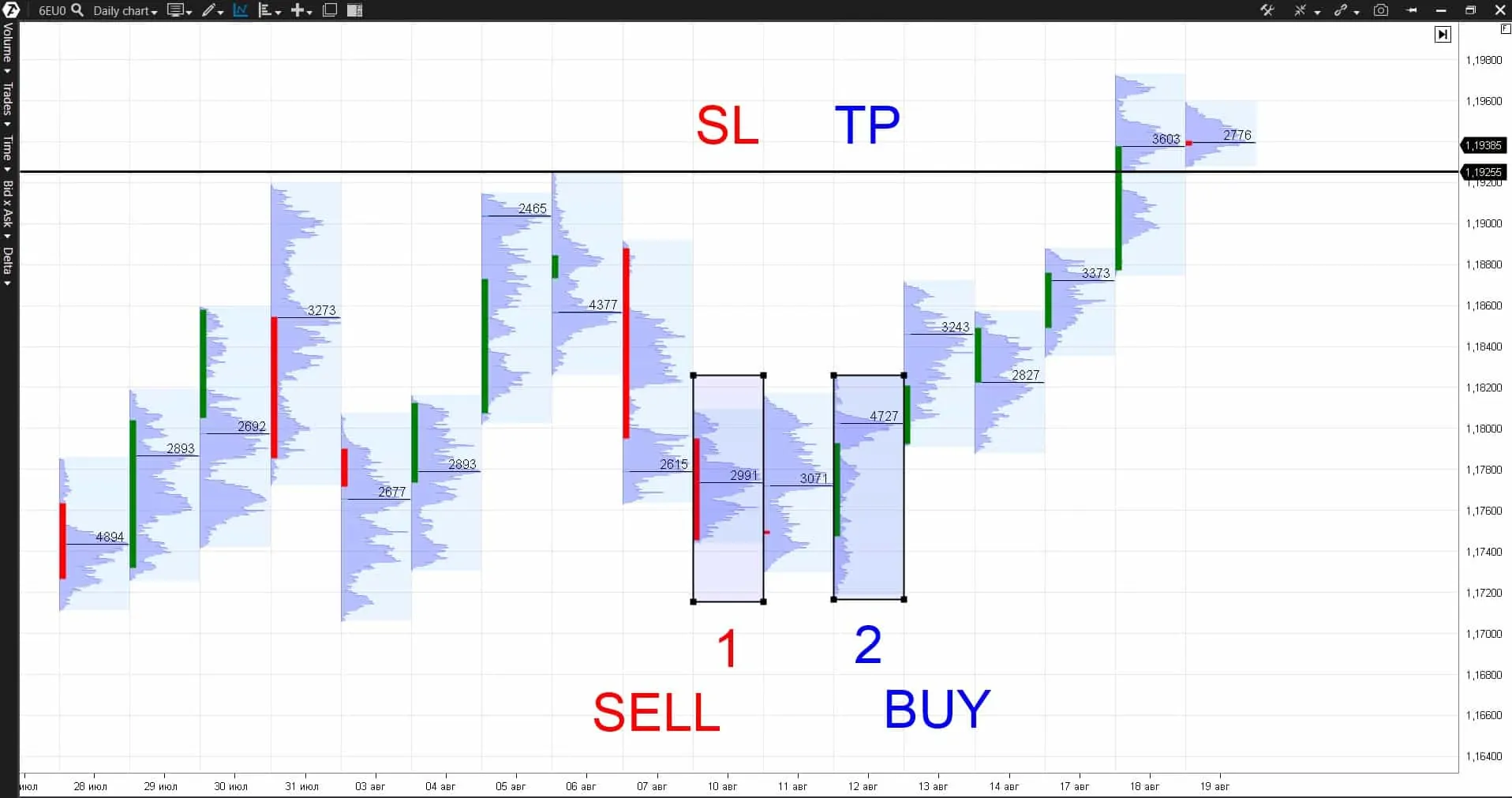

The Dynamic Levels indicator shows the area, in which 70% of the traded volume is concentrated (Value Area), and the boundaries of this area could also be good targets for posting take profits during intraday trading.

The picture above shows an example of posting a take profit. A take profit could have been posted at the Value Area High (VAH) in the event of buying in point 1 and it could have been posted at the Value Area Low (VAL) in the event of selling in point 2.

By the way, we have a separate article about the Dynamic Levels and Maximum Levels indicators.

The TPO and Profile indicator, apart from everything else, shows the day’s maximum volume level. These levels are often important for major market participants and the price may reverse at these levels. That is why it makes sense to analyse the Market Profile in order to take into account the previous days’ maximum volume levels and post take profits before them.

If a sell is executed in point 1, a take profit could be posted near the maximum volume, which was formed two days ago.

The Margin Zones indicator displays the estimated area, in which different market participants may register loss-making trades. We already wrote about it in the article about the market margin.

That is why, these areas are capable of stopping a trend and traders better register their profits before these areas.

If a trader executed a buy in point 1, it is better to post a take profit before the nearest area of the Margin Zones indicator.

Principles of take profit posting

The general principle, which would help to use a take profit efficiently is: ‘Cut your losses and let your profits run’.

The first part of this principle refers to the take profit’s ‘brother’ – a stop loss.

A stop loss should be clearly limited and if the market moves against your position, losses should be cut without regret, closing the loss-making trade. To wait for the price return or to emotionally average the open position, even increasing the volume, is the straight way to lose your deposit. Losses should be cut at the minimum possible level.

The second part of this principle directly refers to a take profit.

Post a take profit in such a way, so that the profit has a possibility to grow. You should provide the market with a possibility to move in the direction of your trade.

Preferably, a take profit should exceed a stop loss several times. Give the market time to bring you a significant profit – post a take profit at rather distant levels.

Study the trailing stop technique. This is a successful trade accompanying method, under which a trader shifts the stop loss after the price, which moves in its direction. By doing so, the trader protects the profit made but doesn’t restrict a potential for its further growth.

Of course, there are various trading systems for exiting from trades, but the main principle ‘cut your losses and let your profits run’ has withstood the test of time and has been used by many famous traders.

Conclusions

Correct profit registration is very important in trading. That is why do not forget that:

- A take profit (exit from a trade with a profit) should be clearly described in the trading system and its efficiency should be tested on historic data.

- Volume analysis indicators in the trading ATAS platform help to find levels for efficient take profit posting.

- It is desirable to post take profits under the general principle: ‘Cut your losses and let your profits run’.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.