Vaccine testing for COVID and a threat for the USD 10-year trend

The main ‘newsmaker’ of the stock market of the past week was the corporate reporting season commencement. The published reports are ambiguous, which leads to higher volatility. It makes sense to take heed of the USD index, which is close to a multiyear trend change. A piece of good news is that there are significant signals in the sphere of the coronavirus vaccine development.

Read in our review what the reporting season commencement showed, should we expect the dollar crash and when coronavirus will be defeated.

Content:

- Calendar of economic statistics

- Reporting season commencement: main disappointments and surprises

- A sharp splash of stock volatility: reversal or retracement?

- The USD 10-year trend is under threat

- First coronavirus vaccines have been tested: when salvation comes

Calendar of economic statistics

| Time | Impact | Impact |

| Tuesday, July 21 4:30 Moscow Time | AUD. | AUD. |

| Wednesday, July 22 17:00 Moscow Time | S&P 500. Forecast – 4.5M, previous value – 3.91M. | S&P 500. Forecast – 4.5M, previous value – 3.91M. |

| 17:30 Moscow Time | WTI. Brent crude oil. | WTI. Brent crude oil. |

| Thursday, July 23 17:00 Moscow Time | S&P 500. Previous value – 1.3M. | S&P 500. Previous value – 1.3M. |

| Friday, July 24 9:00 Moscow Time | FTSE 100. GBP. Forecast – 9%, previous value – 12%. | FTSE 100. GBP. Forecast – 9%, previous value – 12%. |

| 10:30 Moscow Time | Germany. Industrial PMI in July. | DAX. EUR. |

| 11:30 Moscow Time | Great Britain. PMI in the service sphere. | FTSE 100. GBP. |

| 13:30 Moscow Time | Russia. Interest rate of the Bank of Russia. | RUB. Previous value – 4.5%, forecast – 4.25%. |

| Tuesday, July 21 4:30 Moscow Time |

| Australia. Minutes of the Reserve Bank of Australia meeting. |

| AUD. |

| Wednesday, July 22 17:00 Moscow Time |

| United States. Sales of new houses. |

| S&P 500. Forecast – 4.5M, previous value – 3.91M. |

| 17:30 Moscow Time |

| United States. Crude oil reserves. |

| WTI. Brent crude oil. |

| Thursday, July 23 17:00 Moscow Time |

| United States. Primary jobless claims. |

| S&P 500. Previous value – 1.3M. |

| Friday, July 24 9:00 Moscow Time |

| Great Britain. Retail sales for June (month to month). |

| FTSE 100. GBP. Forecast – 9%, previous value – 12%. |

| Germany. Industrial PMI in July. |

| DAX. EUR. |

| 11:30 Moscow Time |

| Great Britain. PMI in the service sphere. |

| FTSE 100. GBP. |

| 13:30 Moscow Time |

| Russia. Interest rate of the Bank of Russia. |

| RUB. Previous value – 4.5%, forecast – 4.25%. |

The next week is not expected to have important events. The only exception is Friday. Publication of PMI in the EU countries and Great Britain is expected on that day, due to which a splash of volatility is quite probable. Markets grow for a long time waiting for a very fast economic recovery. If things become worse in reality, it might seriously undermine the confidence of investors.

Reporting season commencement: main disappointments and surprises

The corporate reporting season entered the active phase. Traditionally, major banks were the first ones to publish reports. They were accompanied by PepsiCo (PEP), J&J (JNJ), Netflix (NFLX) and Delta Air Lines (DAL). And although the profit and revenue results turned out to be better than the forecasts, the devil, as usual, is in the detail.

Thus, after investors got acquainted with the bank reports, they found out that Wall Street gets ready for a wave of borrowers’ bankruptcies more and more actively. The Wells Fargo stock fell by 4.5% on the day of report publication. Investors are worried that the bank made reserve provisions in the amount of USD 8.4 billion. However, the bulls managed to buy out ‘spillage’ during one week.

Netflix (NFLX) media giant published an ambiguous report.The stock increased nearly twice on expectations that the quarantine would result in a sharp growth of a number of subscribers. It is true, the number of subscriptions increased by 10 million during the second quarter. However, the company informs that the exponential growth has ended. Only about 2 million new users are expected in the third quarter, which is three times worse than the previous year result. And the stock shows miracles of volatility against this background.

Next week, investors expect reports of the following blue chips:

Monday: IBM (IBM).

Tuesday: CocaCola (KO) and Texas Instruments (TXN).

Wednesday: Microsoft (MSFT) and Tesla (TSLA).

Thursday: Amazon (AMZN), Intel (INTC) and AT&T (AT).

Friday: Verizon (VZ) and Chevron (CVX).

Watch out! These stocks may show non-standard movements.

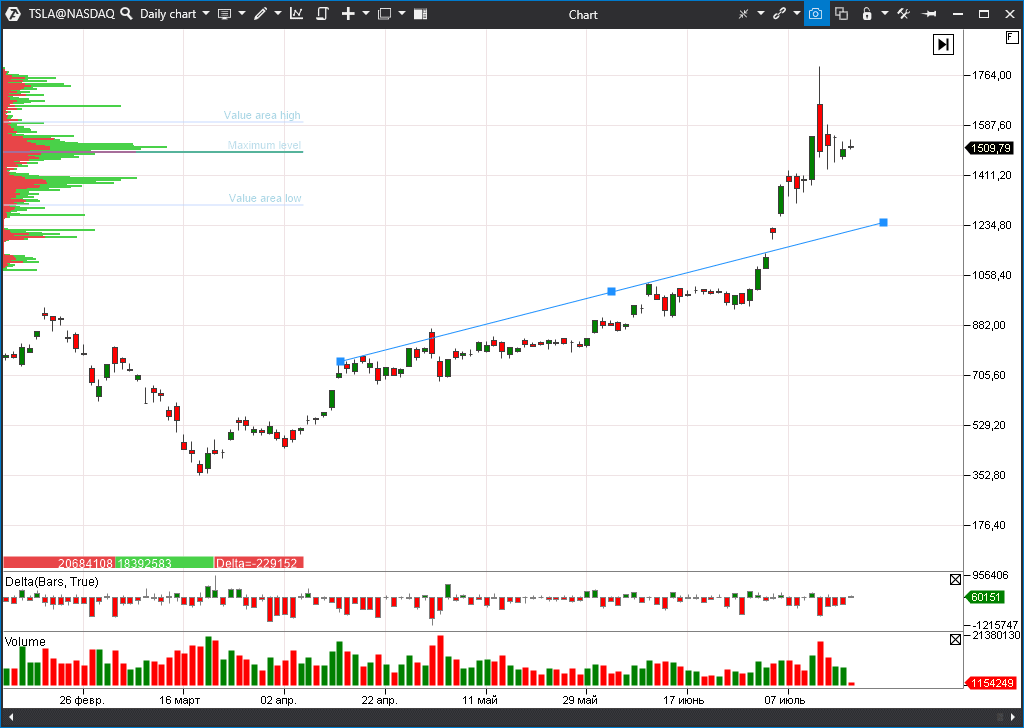

A sharp splash of stock volatility: reversal or retracement?

In general, the week was volatile not only due to report publication. The stocks of recent growth leaders – Tesla (TSLA) and Amazon (AMZN) – went into retracement.

Thus, the stock of the electric car manufacturer showed a real roller coaster ride on Monday, July 13, first, jumping to USD 1,794 and then falling to USD 1,471. Intraday fluctuations exceeded 22%.

It seems that Amazon, which was a source of easy money for the bulls for a long time, also started to run out of steam. The stock comes back to the previously broken channel.

Buyers of this stock have to be careful. Quite often, such movements are a sign of a trend reversal. Moreover, both companies publish reports this week. And, no doubt, it will add nervousness in the players’ behaviour.

The USD 10-year trend is under threat

Meanwhile, analysts continue discussing the USD prospects. More and more experts expect the end of the multiyear uptrend of the greenback. The main reasons are the record-breaking inflow of liquidity from the FRS, huge trading deficit of the United States and trading war with China.

Deutsche Bank analysts vaguely suggest that if the 10-year trend is broken, we may observe some kind of a ‘free fall’. Although, it’s too early to buy EUR while support is topical.

First coronavirus vaccines have been already tested: when salvation comes

We complete our review with a piece of good news. More and more companies declare successful completion of the first stage of the coronavirus vaccine clinical testing. The American biotech company Moderna (MRNA) made an optimistic statement this week. Volunteer testing results raise hopes – the vaccine produces a stable immune response.

Earlier, Pfizer (PHE) announced its readiness to produce its vaccine already this year. If everything goes well, people would start to get the life-saving remedy in winter, which would produce a huge relief.