Trump scares the markets and the bitcoin demand has grown

The most interesting event of the past week was the rise of the S&P 500 index above the key resistance level. Meanwhile, the world financial authorities keep throwing money into the furnace of the locomotive, which is called ‘the market’. Economists say that there’s too much money and warn about risks. An unrestricted quantitative easing would result into a big disaster for an economy.

What surprise did the stocks bring during the past week and what’s bad in printing much money? And what has bitcoin, which may become an unexpected saviour of investors from the global financial catastrophe, to do in such a situation?

We will traditionally start with a presentation of the calendar of economic events for the next week.

Content:

- Calendar of economic events.

- Coronavirus pandemic: the United States are back at work while Brazil sets new anti-records.

- Farewell to the bearish market: is it for long?

- Trump punches the air: social networks and China had a lot to bear.

- Economists warn about the developing danger.

- Bitcoin becomes the investor’s favourite.

- Chart of the week: EUR/USD.

Calendar of economic events

| Date | Event | Impact |

| June 1, Monday, 4:45 Moscow Time | China. Industrial PMI (May). | Oil, Copper, CNY, RUB, AUD. Expected value – 49.6, previous value – 49.4. |

| 11:00 Moscow Time | Eurozone. Industrial PMI (May). | EUR. DAX. CAC40. Expected value – 39.5, previous value – 39.5. |

| 11:30 Moscow Time | Great Britain. Industrial PMI (May). | GBP. FTSE 100. Previous value – 40.6. |

| 17:00 Moscow Time | United States. Industrial PMI (May) | USD. S&P 500. Previous value – 39.8. |

| June 2, Tuesday 7:30 Moscow Time | Australia. Decision about the interest rate of the Bank of Australia (June). | AUD. Expected value – 0.25%. Previous value – 0.25%. |

| June 3, Wednesday 10:55 Moscow Time | Eurozone. Change of the unemployment level in Germany. | EUR. DAX. Expected value – 200K. Previous value – 373K. |

| 11:00 Moscow Time | Eurozone. PMI in the sphere of services. | EUR. Expected value – 28.7. Previous value – 28.7. |

| 11:30 Moscow Time | Great Britain. PMI in the sphere of services. | GBP. FTSE 100. Previous value – 27.8. |

| 15:15 Moscow Time | United States. Change of the unemployment level in the non-agricultural sector from ADP (May). | USD. S&P 500. |

| 17:00 Moscow Time | United States. PMI in the non-production sphere. | USD. S&P 500. Previous value – 36.9. |

| 17:00 Moscow Time | Canada. Decision of the Bank of Canada about the interest rate (June). | CAD. Expected value – 0.25%. Previous value – 0.25%. |

| June 4, Thursday 14.45 Moscow Time | Eurozone. Decision of the ECB about the interest rate (June). | EUR. Expected value – 0.00%. Previous value – 0.00% |

| June 5, Friday 15:30 Moscow Time | United States. Unemployment level in the US (May). | USD. S&P 500. Expected value – 19.8%. Previous value – 14.7% |

| 15:30 Moscow Time | United States. Jobless claims. | USD. S&P 500. |

Important! The forthcoming week would be rich in economic events of high significance. This may result in splashes of volatility in the key currency pairs and stock indices. Observe the risk management rules and do not roll loss-making positions overnight.

Monday. PMI (Purchasing Managers’ Index) block in the industrial sphere is published in China, Eurozone, Great Britain and United States. This is the key leading indicator, which would allow investors to assess the rates of recovery of investment activity in the production sphere after completion of the most active phase of the quarantine. If the data are higher than forecasts, it would significantly support the stock market and raw material assets. The disappointing statistics, on the contrary, would be yet another cold shower for the markets. It makes sense to pay attention to the positions in oil, RUB, AUD and EUR. High volatility is possible.

Tuesday. Decision of the Bank of Australia about the interest rate is the most important event of the week for AUD. Perhaps, the rate would stay at the level of 0.25%. Nevertheless, splashes of volatility are possible. The AUD position rolling overnight from Monday to Tuesday brings additional risk.

Wednesday. Investors would monitor PMI in the sphere of services and also changes of the unemployment level in the non-agricultural sector in the US. The data would exert strong influence on the consumption sector stocks and also the currency market. Decision of the Bank of Canada on the interest rate is the main event of the week for CAD. Volatility splashes are possible.

Thursday. Decision of ECB about interest rates is the key event for the whole Forex market at the beginning of June. Accompanying statements of officials could result in sharp EUR volatility splashes.

Friday. Statistics of the unemployment level in the US would exert strong influence on all markets from stocks to currencies and raw materials. Any positive surprise would be perceived by bulls like a reason to buy risky assets – stocks and raw materials.

Calendar of expiration of futures contracts

Expiration of only livestock contracts (LEM0) is expected next week. Date: June 5, 2020.

Coronavirus pandemic: the United States are back at work while Brazil sets new anti-records

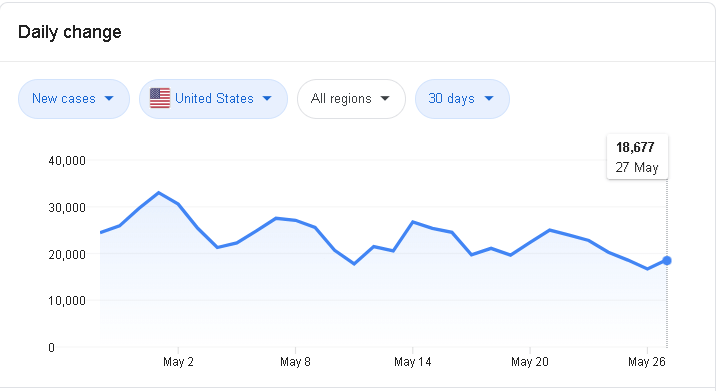

A stable dynamics of decrease of coronavirus incidence continues in the US, which stirs up investors’ interest in the stock market. The number of registered new cases a day stays below 20 thousand.

One state after another declares about easing the strict phase of self-isolation. In particular, cafes and restaurants are opened again in Washington and people gradually return to normal life. Statistics of power consumption and cargo transportation shows that the country revives after the strongest shattering experience in modern history.

Europe also revives. Despite the quarantine easing, there is no splash of incidence in the region. It strengthens investors’ hope that the worst is over and coronavirus will lose its strength in summer due to the seasonality effect. Portugal, Greece, Spain and other countries already announced their readiness to accept foreign tourists in June-July. It may cushion the blow to local economies, which significantly depend on the sphere of services.

Meanwhile, the situation in Brazil changes for the worse. The country takes the first place in the world in incidence and death rates. Markets react to this fact rather softly since the influence of Brazil on the global economy is not big. The situation in Brazil may only cause local interruptions in delivery of ores and some other raw materials.

Farewell to the bearish market: is it for long?

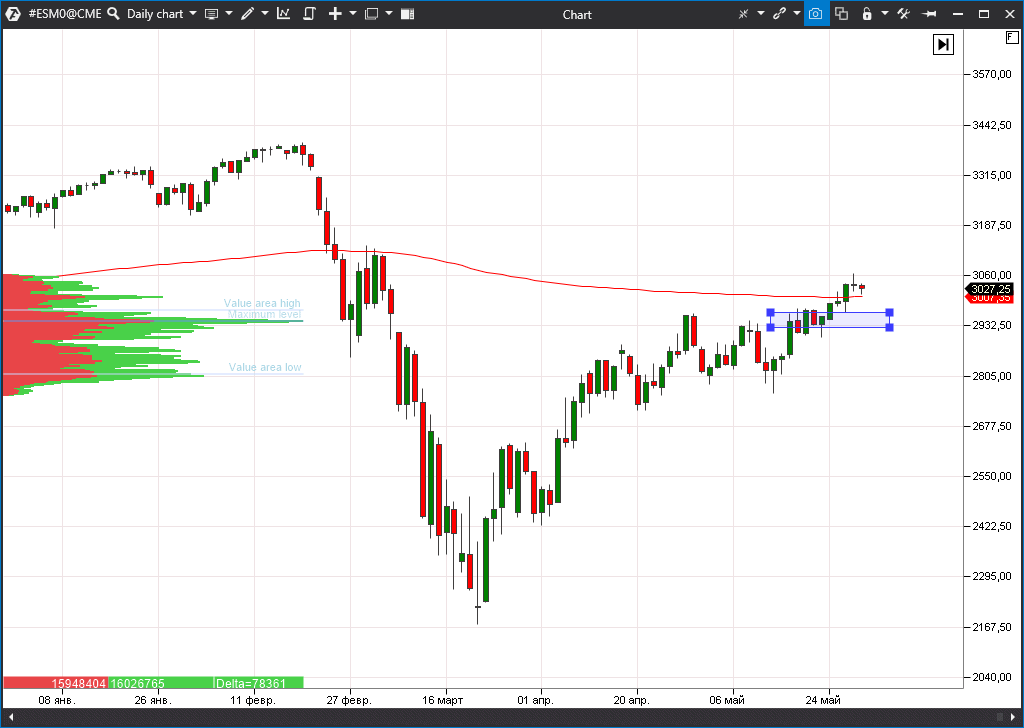

The S&P 500 index passed the psychologically important resistance level in the area of 3,000 points with confidence. Technical importance of the event was supplemented by the fact that bulls managed to push the index above the 200-day moving average. Technical analysts traditionally call this indicator a watershed between the bearish and bullish markets.

So, we may only state that even the biggest optimists didn’t expect such a quick comeback from the risky assets. Sceptics keep saying that the stock price levels are not justified due to a sad state of things in the US economy. And, of course, they are right. The unemployment level still grows and GDP recovery to previous values may take more than a year.

But who is interested in it? Buyers have their own truth. They just do not have anywhere to go. FRS continues to flood the markets with liquidity. At the same time, US Treasury Notes, which are the main haven of investors during crises, demonstrate the level of yield less than 1% and, taking into account the inflation, it is even negative. On this background, 2% of the dividend yield of stocks look not only as the best but as the only alternative to save capitals. Nobody knows the future and it is difficult to say whether this stake would work.

Meanwhile, optimism strengthens in the market. Thus, buyers slowly started to sell stocks of technology giants (Facebook, Amazon, Microsoft, Google and Apple). On the contrary, recent underdogs – stocks of banks, energy companies and airlines – were among favourites during the past week. The ‘grab everything that became cheaper’ slogan is a typical manifestation of the hot phase of the bullish market.

It is very evident in ETF in these sectors. The weekly growth increased 20% in some of them. It is surprising, but even the real estate market, where statistics doesn’t fulfil nightmare expectations, feels itself quite well.

Trump punches the air: social networks and China had a lot to bear

Meanwhile, the restless US President keeps the bulls busy. The approach of elections, probably, excited already active and sharp enough Donald Trump.

The markets become even more concerned with his adverse rhetoric in respect to China. Trump cast the full blame for COVID-19 pandemic on Beijing and threatened to punish. For the time being, these are just words.

On May 28, during a trading session, a piece of news was published about Trump’s press-conference on China, which was planned for May 29. If Washington starts to act and announces sanctions, it may crash markets. Earlier Trump showed that his determination could be stopped only by the index fall. He considers high S&P 500 quotations one of his main achievements of his term of office.

At the same time, the assets, which are the most sensitive to trading wars, such as oil and currencies of the raw material producing countries, already started to react by high volatility. Oil tried to go into retracement on May 26, but the downfall was quickly bought out. Chances for testing the USD 42 level are still available. The key task now is the breakout of the volume accumulation area near USD 31-34 per barrel.

Social networks became unexpected victims of Trump criticism. Rage of the White House head was caused by the Twitter reaction to one of his multiple posts. The President wrote that voting via mail during the forthcoming elections would facilitate distortion of results. For whatever reason, Twitter decided to check this post and marked it as a fake. Trump’s reaction was emotional. He promised either to impose a ban on social networks or to introduce control over them. There’s a feeling of thunder in the air, the Twitter stock retraced but is still within the up channel.

Facebook CEO Mark Zuckerberg tried to cast himself in the role of judge. He criticized Twitter for doing something unnatural – interpretation of political statements. Zuckerberg also criticized Trump. He called his reaction unproportional to the scale of the event. And, of course, Mark is right. Censorship in social networks is not quite what markets expect now from the American authorities.

Economists warn about the developing danger

Of course, the main basis for investors’ optimism is not so much the economy as the printing presses of FRS and other countries. Dynamics of growth of the US Central Bank balance supports bulls.

Meanwhile, The EU and Japan made investors glad by additional stimulation measures for EUR 750 billion and USD 1 trillion respectively. Let’s note that these billions are just a general European support package. Nearly every country undertook its own measures for many dozens billions of EUR.

The world is overflooded with money. At the same time, more and more economists warn that the excessive money stock would lead to ‘stagflation’ after passing the active stage of the crisis. It is a combination of high inflation (10% and more) and slow rates of economic growth. Investors, in their turn, may face quick depreciation of assets. Especially the holders of long-term notes would have a lot to bear.

This course of events may become a rescue at somebody else’s expense for many countries which are overloaded with huge debts. Liabilities will just lose their value. We want to remind you that the aggregate debt of the countries of the world already increased USD 257 trillion by the beginning of the second quarter of 2020. It is 332% of the world GDP. The world lived above its means for too long.

Bitcoin becomes the investors’ favourite

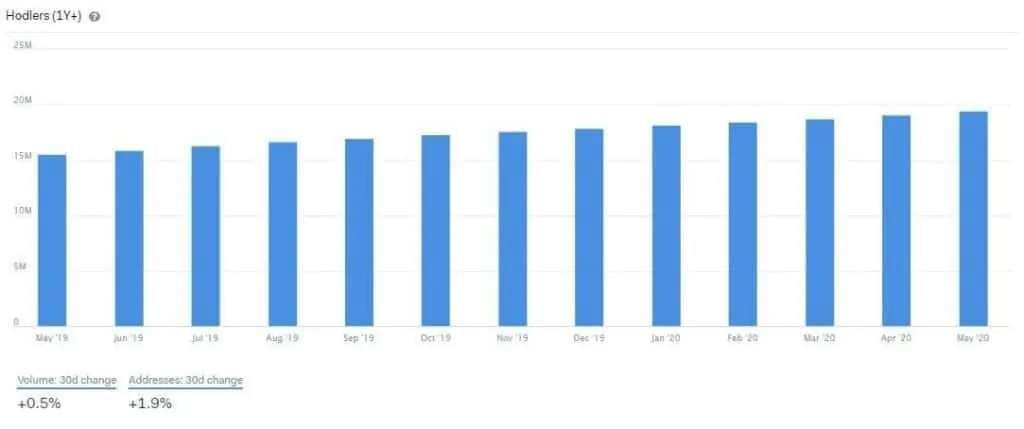

At the same time, the news from the cryptocurrency market becomes more and more interesting. The number of long-term holders – the wallets, which hold cryptocurrency for more than a year – is ever-increasing as well as the volume of funds in them.

Besides, there is a massive withdrawal of cryptocurrency from exchanges. After the rate crashed in March, it reached its yearly peak in the middle of May. Perhaps, the money is withdrawn after the buys during the spring retracement.

People trust in bitcoin more and more as in a long-term investment instrument. If the world would really face strong inflation and a fall of purchasing value of the main currencies, bitcoin and gold would become, perhaps, the only alternatives. These quasi-currencies are protected from the printing press effect since their emissions are limited.

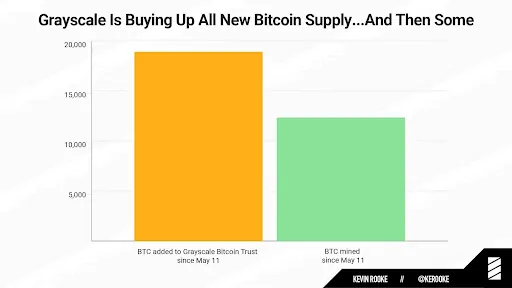

One more piece of news is interesting in this context. The largest American cryptocurrency fund, Grayscale Bitcoin Trust, announced a significant growth of interest of institutional investors in cryptocurrency after halving. Thus, investors acquired BTC 19 thousand in May through the fund instruments, while miners produced only BTC 12,300 during the same period. It is still difficult to say what the reasons for this growth are – excessive liquidity of the world markets or faith in the brighter future for ‘crypto’.

There is no common opinion even among the largest banks. Goldman Sachs once again insistently recommended not to buy bitcoin. Its analysts say that the asset is too volatile and speculative. At the same time, their colleagues from another Wall Street giant – JPMorgan Chase – stated that bitcoin is undervalued by the market. They believe that the fair price is USD 11,500.

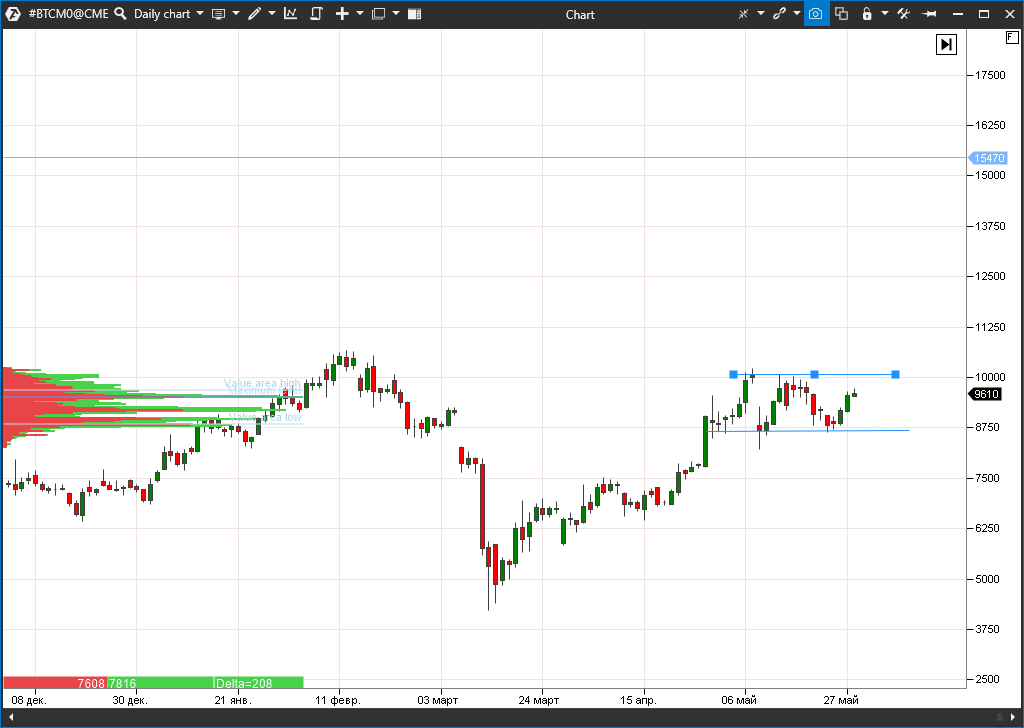

Meanwhile, the price of the main cryptocurrency ‘got stuck’ in consolidation. It would be possible to speak about new long-term targets only after the breakout of USD 10,000.

Chart of the week: EUR/USD

The EUR/USD currency pair broke the 1.1000 level and moved out of the consolidation, which lasted from the beginning of April. The USD emission by FRS exceeds the ECB measures. The intermediary target here is 1.1220, after the breakout of which we can speak about a more stable growth of the European currency.

We should also note that a cheap dollar would be useful for developing countries, which depend on the raw material export, in order to exit from the crisis. However, they will not be very enthusiastic in Europe about it. Expensive European goods are far from being the best idea in such a difficult year.