Powerful market pullback and Tesla stock rise

The past week has been interesting for a number of reasons in the world markets. Of course, the main economic sensation was the US labour market statistics, which surprised even optimists. However, the positive development didn’t last long. The US FRS forecast on Wednesday sent an important signal to the players – the crisis is a long-term phenomenon. It became a signal for a powerful selling out. Experts speak about a bubble even after the retracement. At the same time, Tesla, Apple and Microsoft set extraordinary historic records.

Read in our review: alerting forecasts of FRS officials, when the time to get rid of a long-term stock portfolio starts and what pushes Tesla to really ‘space’ heights.

We will traditionally start with a review of the calendar of main economic events of the coming week.

Content:

- Calendar of economic events

- Calendar of futures expiration

- The US economy brought a surprise to bulls

- FRS forecast provoked a powerful retracement

- A bubble is growing in the stock market. What to do?

- Oil prices got into a spin

- Tesla became the most expensive automaker in the world

Calendar of economic events

| Date | Event | Impact |

| Monday, June 15 5:00 Moscow Time | China. Industrial production in May. | Oil, Copper, AUD, RUB. Expectation is +5%, the previous month was +3.9%. |

| Tuesday, June 16 | Japan. Bank of Japan statement | JPY. |

| 7:30 Moscow Time 10:00 Moscow Time | about monetary policy. Press conference of the Chairman of the Bank of Japan. | |

| 9:00 Moscow Time | Great Britain. Change of the number of unemployed in May. | GBP. FTSE 100. Previous value is +856 thousand. |

| 12:00 Moscow Time | Germany. Economic sentiment index (ZEW) for June. | EUR. Previous value is 51. Forecast is 32. |

| 15:30 Moscow Time | United States. Retail sales in May. | USD. S&P 500. Previous value is -16.4%. Forecast is +7%. |

| Wednesday, June 17 9:00 Moscow Time | Great Britain. Inflation level in May. | GBP. |

| 12:00 Moscow Time | Eurozone. Inflation level in May. | EUR. |

| 14:00 Moscow Time | OPEC. Monthly report. | Oil, RUB. |

| 15:30 Moscow Time | Canada. Inflation level in May | CAD. |

| Thursday, June 18 4:30 | Australia. Change of the number of unemployed in May. | AUD. Previous value is -594 thousand. Forecast is -575 thousand. |

| 10:30 | Switzerland. Swiss National Bank statement about monetary policy. | CHF. |

| 14:00 | Great Britain. Bank of England statement about monetary policy. | GBP. |

| 15:30 | United States. Number of jobless claims. | USD, S&P 500. |

| Friday, June 19 9:00 Moscow Time | Great Britain. Retail sales in May. | GBP. FTSE 100. Previous value is -18.1%. Forecast is -16.00. |

The coming week will be full of important events. High volatility is expected in the Forex market. You should be careful about rollover of margin positions in currency futures.

Monday. The Chinese industrial production statistics for May will show how justified investor expectations are with respect to a fast (V-shaped) economy recovery. The Chinese industry is the main raw material consumer in the world. The data above the forecast will have a positive impact on quotations of oil and industrial metals and also on the currencies of the exporting countries (AUD, RUB and CAD).

Tuesday. Splashes of volatility of JPY are possible due to the Bank of Japan statement regarding monetary policy.

You should also be careful trading GBP. The key monthly statistics will be published in Great Britain – the change of the number of unemployed in May will show how fast the economy recovers from the corona-crisis consequences.

The data on retail sales in May will be published in the United States. The consumer sector is the basis of the US economy. The data will have a strong impact on the stock market. Statistics above the analyst forecasts could significantly support the market.

Wednesday. The monthly OPEC report is published. It will contain an analysis of the oil demand and supply balance in the world. It is an important event for quotations of black gold. Splashes of volatility are possible.

Thursday. A volatile day in the Forex (CHF and GBP) is expected. Swiss National Bank and Bank of England will publish their decisions regarding monetary policy. Traditionally, the weekly US report on the change of unemployment will exert a big influence on all markets.

Calendar of futures expiration

Expiration of popular futures contracts is expected during the coming week in the US and Russian markets. You should remember that splashes of volatility are possible on the eve of expiration. You should also take care of the rollover into the next contract if you have long-term positions.

US economy brought a surprise

Coronavirus doesn’t plan ‘to die’ even in summer, as many experts expected. Incidence in the world stays at a high level – more than 100 thousand new cases every day. However, investors switch the focus of attention to the economic recovery after the lockdown and are more interested in the employment statistics. And it inspires optimism.

The key event is publications of unemployment US data on June 5. The data showed that the rate of economic recovery in May was much faster than it was forecasted. The number of created working places (Nonfarm Payrolls) reached 2.5 million, while analysts expected their reduction by 8 million. The unemployment level also turned out to be lower than it was forecasted – 13.3% instead of 19.7%. The data, which were published in Canada, also were optimistic.

FRS forecast provoked powerful retracement

However, optimism didn’t last long. Cautious sells were started on Tuesday. Retracement reached peak values on Thursday, June 11 – the key index lost 5.89%. The uptrend was broken although bulls managed to stay above 200 MA.

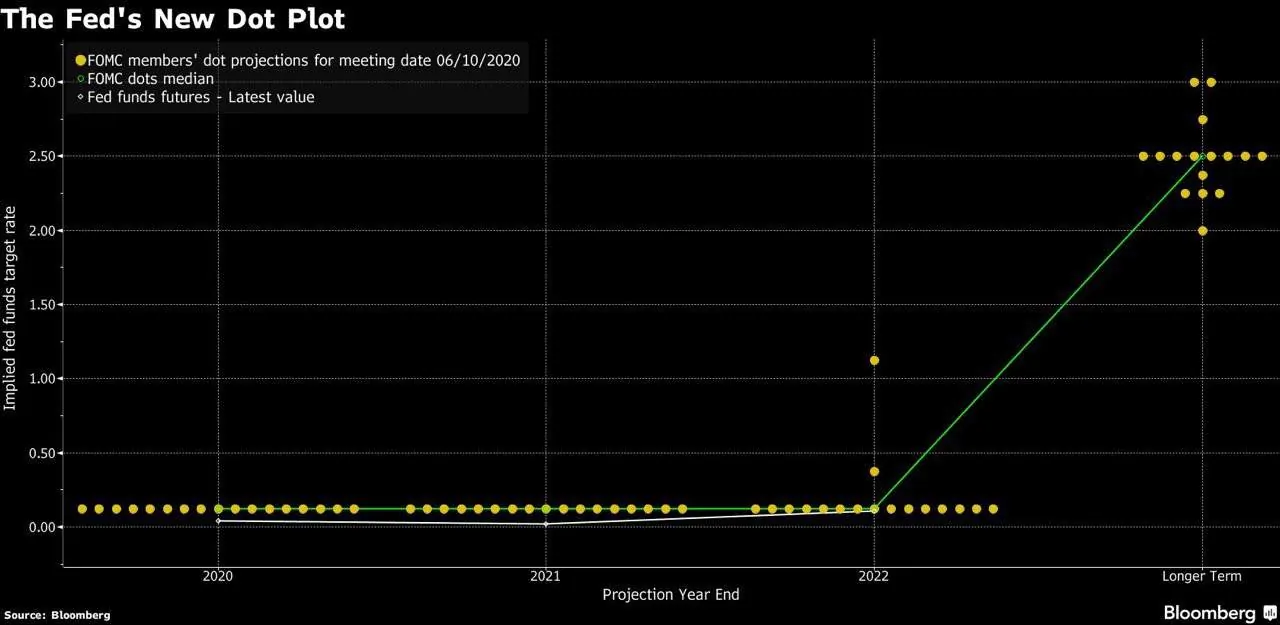

The FRS statement on Wednesday evening provoked the selling out. The Central Bank quite expectedly left the key interest rate at the 0-0.25% level. Officials also confirmed the promise to print as much money as it would be required for reduction of the unemployment level and recovery of consumer activity.

These words were not a surprise for investors. FRS officials repeat their ‘mantra’ again and again. Another forecast caused more concerns. The interest rate will stay at the zero level until the end of 2022. It means that FRS expects slow rates of economic recovery during the nearest 2 years.

It is a very unpleasant news for bulls who already included the maximum fast recovery after the crisis into the stock prices. Selling out was started practically in all sectors of the economy.

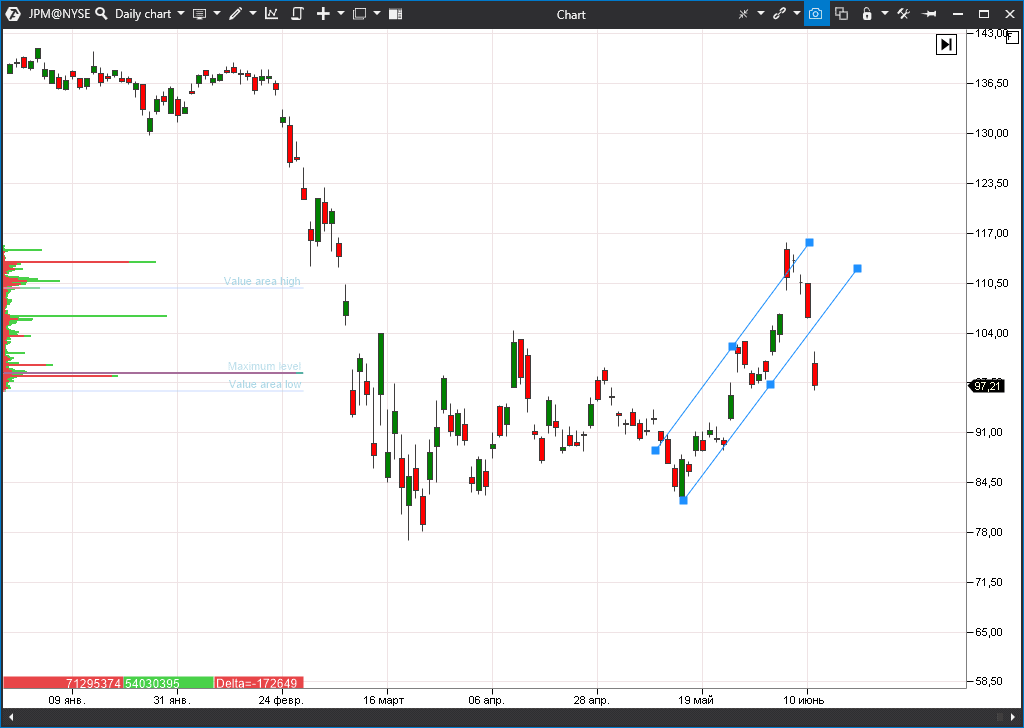

The FRS opinion turned out to be especially negative for the bank stocks. The low interest rate is a forerunner of reduction of long-term profitability of Wall Street companies. Massive selling out was started in the financial segment of the market. Quotations of JPMorgan Chase, Wells Fargo, Bank of America and City lost up to 20% on June 10-11. The technical picture doesn’t inspire optimism in all these cases.

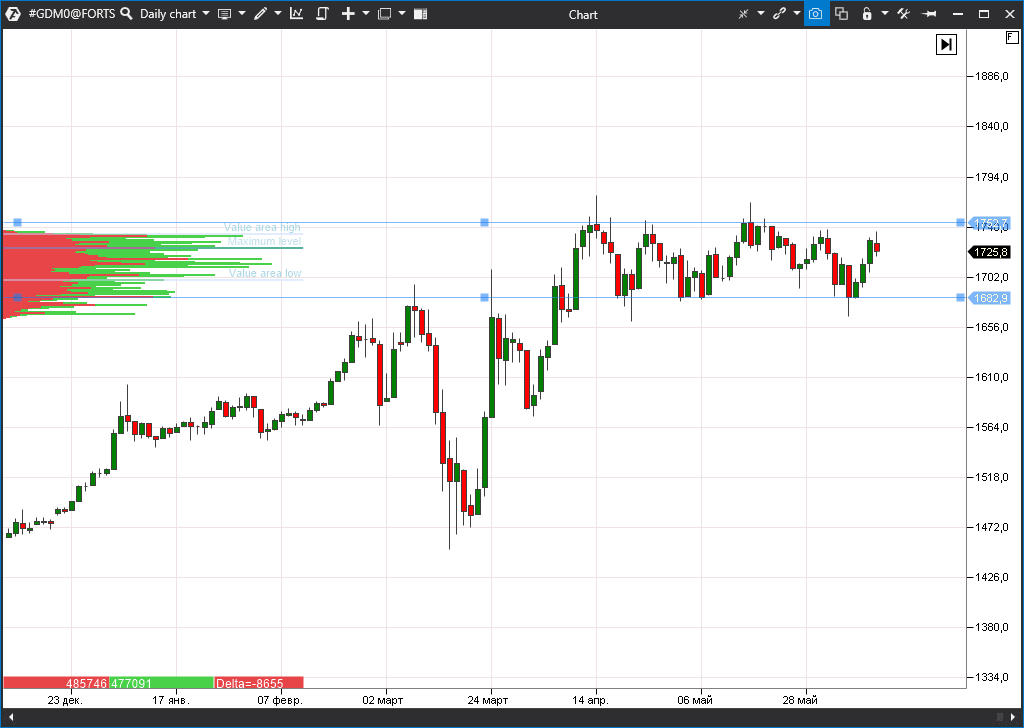

At the same time, a combination of low rates and economic uncertainty is very favourable for gold. Quotations of the precious metal got stuck in the flat, however, the chances for the growth to continue up to 1,900-2,000 still look quite strong. To achieve it, it is necessary to close the day above the resistance of USD 1,750 per ounce.

A bubble is growing in the stock market. What to do?

Even after a strong retracement of June 11, the stocks are still overbought. Moreover, many experts state that the market, probably, is in the state of inflation of a speculative bubble.

How does it work? FRS prints money, which are planned for the economy support programs. People get interest-free loans with the grace period of 2 years. However, many Americans prefer to take loans not for development of their own businesses but for speculations. What to waste time and nerves for if the main stock indices have grown from the end of March by 40%? The Nasdaq 100 index even renewed historic highs.

There was a sharp growth of demand during the past week before the retracement on the so-called penny stocks that cost less than USD 1, which resulted in the immediate price leap by 80%, as they calculated in CNBC. It is an obvious sign of appearance of ‘stupid’ money of unprofessional investors. The market behaved similarly during the dotcom bubble and mortgage bubble on the eve of the 2008 crisis.

Let’s note a new extraordinary landmark in the stock market history. The value of the Microsoft and Apple companies synchronously reached USD 1.5 trillion during the trades on June 10. Technology US companies suffered less than other companies from the crisis, however, investors already invested the full available positive into their quotations. Apple and Microsoft stocks are in the uptrend even after the June 11 retracement and are above the highs of the year beginning, when nobody even guessed about the coming crisis.

Meanwhile, it will take, perhaps, more than a year for recovery of corporate profits at pre-crisis levels. It means that the current quotations are not justified. Sooner or later, the market always moves to average values. And then the escape of the market crowd from the risk would result in a bubble collapse.

Does it mean that it’s high time for selling stocks and moving to protective assets? Not really. The matter is that the stock market bubbles could be inflated for years. Anyway, it makes sense for cautious investors to be cautious and diversify their portfolios.

FRS signals about completion of the quantitative easing program would serve as a trigger for really powerful selling out. Or it might be some other unpredictable event, just like the corona-crisis in the first quarter of the year.

Oil prices got into a spin

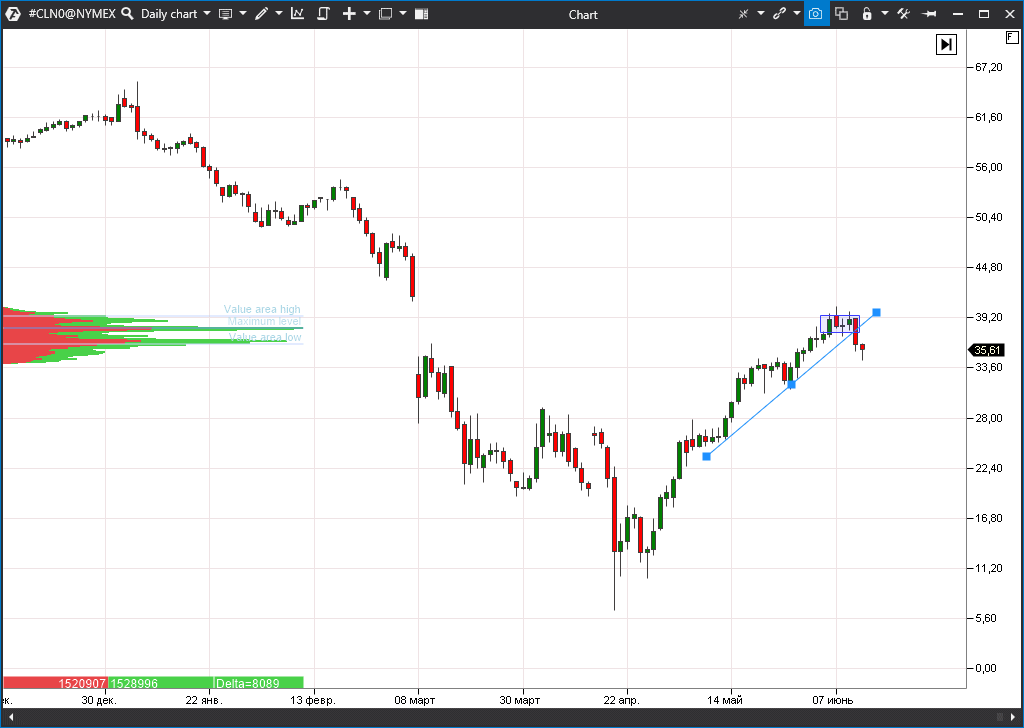

OPEC-plus countries continued the oil-cut agreement on the past week-end until the end of June. The event was expected and optimism of buyers didn’t last long. Retracement started on the June 11 trades and turned into a real crash by 7.5%. The main short-term reason was an overall exit of investors from risky assets. Bulls failed to stay above the resistance level of USD 40 per barrel, which significantly worsened the technical picture.

Let’s also note that Saudi Arabia declared its readiness to increase its production in July. Experts believe that American shale oil producers will become active at prices around USD 40 per barrel. These factors, along with huge reserves in storages, would press quotations in the nearest months.

Data about a faster recovery of the global economy and dollar weakening could render support. Key resistance levels in CL futures are within the area of USD 40-42 per barrel. A radical improvement of economic conditions is required for moving higher.

As we assumed in our previous review, RUB stays in a clear correlation with the oil prices. The USD/RUB pair failed to continue its decrease behind the key support levels.

Tesla became the most expensive automaker in the world

Elon Musk is not just an outstanding businessman but also a PR genius who continues to outperform anyone else. The successful launch of the first SpaceX manned spaceship was followed by the ‘space travel’ of another Musk creation – Tesla (TSLA). The stock set a new value record overcoming the USD 1,000 mark. Moreover, the increase of 9% on June 10 resembles a short position knock out, which was followed by equally powerful rollback.

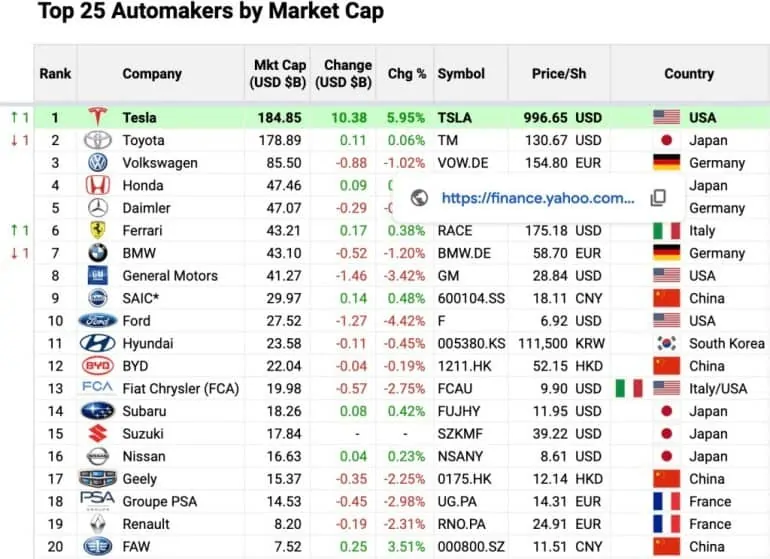

Tesla capitalization reached USD 185 billion on June 10. It is more than all the other American automakers taken together. Also Tesla, for the first time in history, became the most expensive automaker in the world, leaving Toyota behind by this indicator. It’s interesting that, having approximately the same cost, the Musk company produced 304,783 cars in 2019, while the Japanese car giant produced 8,578,155 cars (28 times more).

Tesla stock increased five times from June 10, 2019, until June 10, 2020, which is one of the best indicators in the market.

Such a success of the Musk company could be explained in economic terms only partially. It’s true, Tesla increased sales and started to be profitable for the first time. However, its price contains strongly inflated expectations and belief in Musk the ‘wishmaster’. Ratios show that its value is extremely overvalued. For example, the leading P/E ratio is 89, which is approximately 4 times worse than the average value in the S&P 500 index. Buying Tesla stock on hype could be a dangerous idea.

Текст №3