Front-page events in brief.

The short holiday week in the US stock market has passed under dictation of the risk asset buyers. The S&P 500 index is close to the historic high and the greed indicator has approached the record level. The cause for optimism arrived from the American politics, where key officials in the Joe Biden government have been finally defined. Only the oppressive epidemiological situation restricts the growth.

Calendar of economic statistics

The old acquaintance: the former FRS Chair will head the US Department of Treasury

The market approaches the euphoria state

Oil prices jumped up to March highs

Calendar of economic statistics

| Date, time (GMT +3:00) | Event | Impact, forecast |

Monday, November 30 | The whole day. | Retail. Consumer Services. Winning back the Black Friday selling results. |

Monday, November 30 18:00 | United States. Unfinished sales in the residential real estate market. | USD. S&P 500. Previous value -2.2%. |

Tuesday, December 1 4:45 | China. Manufacturing PMI from Caixin. | CNY. Commodities. Forecast – 53, previous value – 53.6. |

| 6:30 | The Reserve Bank of Australia interest rate. | AUD. Forecast – 0.1%, previous value – 0.1%. |

| 11:55 | Germany. Manufacturing PMI. | EUR. Dax. Forecast – 58, previous value – 57.9. |

| 13:00 | Eurozone. Consumer Price Index. | EUR. Forecast -0.3%, previous value -0.3%. |

| 18:00 | United States. Manufacturing PMI from ISM. | USD. S&P 500. Forecast – 58, previous value – 59.3. |

Wednesday, December 2 16:15 | United States. Employment in the non-farm sector from ADP. | USD. S&P 500. Forecast – 500K, previous value – 365K. |

| 18:00 | United States. Crude oil reserves. | OIL |

Thursday, December 3 12:30 | Great Britain. Composite PMI. | GBP. FTSE. Forecast – 52.9, previous value – 47.4. |

| 18:00 | United States. PMI in the non-manufacturing sphere. | USD. S&P 500. Forecast – 56.2, previous value – 56.6. |

Friday, December 4 16:30 | United States. Employment change in the non-farm sector (Nonfarm Payrolls). | USD. S&P 500. Forecast – 520K, previous value – 638K. |

| 16:30 | Canada. Employment change. | CAD. Forecast – 100K, previous value – 83.6K. |

Monday, November 30 |

The whole day. |

Retail. Consumer Services. Winning back the Black Friday selling results. |

Monday, November 30 18:00 |

United States. Unfinished sales in the residential real estate market. |

USD. S&P 500. Previous value -2.2%. |

Tuesday, December 1 4:45 |

China. Manufacturing PMI from Caixin. |

CNY. Commodities. Forecast – 53, previous value – 53.6. |

| 6:30 |

The Reserve Bank of Australia interest rate. |

AUD. Forecast – 0.1%, previous value – 0.1%. |

| 11:55 |

Germany. Manufacturing PMI. |

EUR. Dax. Forecast – 58, previous value – 57.9. |

| 13:00 |

Eurozone. Consumer Price Index. |

EUR. Forecast -0.3%, previous value -0.3%. |

| 18:00 |

United States. Manufacturing PMI from ISM. |

USD. S&P 500. Forecast – 58, previous value – 59.3. |

Wednesday, December 2 16:15 |

United States. Employment in the non-farm sector from ADP. |

USD. S&P 500. Forecast – 500K, previous value – 365K. |

| 18:00 |

United States. Crude oil reserves. |

| OIL |

Thursday, December 3 12:30 |

Great Britain. Composite PMI. |

GBP. FTSE. Forecast – 52.9, previous value – 47.4. |

| 18:00 |

United States. PMI in the non-manufacturing sphere. |

USD. S&P 500. Forecast – 56.2, previous value – 56.6. |

Friday, December 4 16:30 |

United States. Employment change in the non-farm sector (Nonfarm Payrolls). |

USD. S&P 500. Forecast – 520K, previous value – 638K. |

| 16:30 |

Canada. Employment change. |

CAD. Forecast – 100K, previous value – 83.6K. |

PMI indices in the key world economies will be published next week. They will help to assess how strong the new lockdown wave influence is. Attention should also be paid to the Nonfarm Payrolls data, which are the best indicator of the US economy state.

The old acquaintance: the former FRS Chair will head the US Department of Treasury

The short holiday week in the US stock market (the Thanksgiving Day celebration) was closed in a cheerful mood despite a small profit registration on Wednesday. The markets continued to win back successful results of testing the coronavirus vaccine. Announcement of the candidates on key positions in his office by Joe Biden was also accepted positively.

So, the old acquaintance of all investors and speculators Janet Yellen will become the Head of the US Department of Treasury. She chaired the FRS from 2014 until 2018 and was known as a follower of soft monetary policy. The market accepted it as a signal that the government will not fight the huge budget deficit and ‘will give its blessing’ to dollar printing.

As a result, the S&P 500 index futures (ESZ0) was closed on Wednesday near the historic high at the level of 3,629 points. Thursday is the day-off in the United States and Friday is a short day.

Meanwhile, everything speaks in favour of adoption of a package of fiscal assistance in the amount of approximately USD 2 trillion by the Congress. Only the raging coronavirus and some new black swan may interfere with the full-fledged bullish Christmas rally.

The market approaches the euphoria state

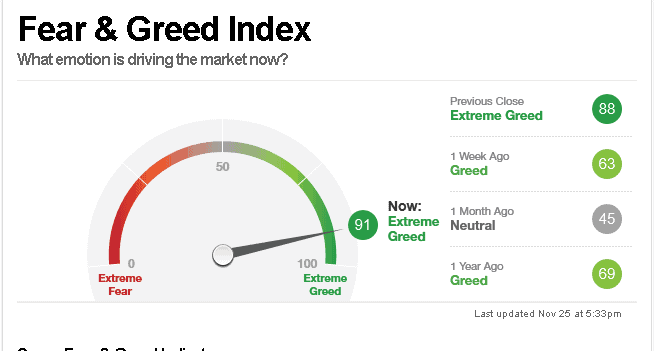

Meanwhile, the CNN Fear and Greed Index shows the state close to euphoria – 91 points out of 100. The agency calculates this indicator on the basis of investor actions by 7 markers, such as the real demand on protective assets and correlation of put and call options.

This indicator by itself doesn’t mean that the crash starts tomorrow. A similar picture was observed in December 2019 and, nevertheless, the market continued to grow until the advent of the coronavirus crisis.

However, such moods are still a warning sign for long-term investors. As the great John Templeton pointed: ‘Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria’.

Oil prices jumped up to the March highs

The speculative warming-up of the stock market supported the rally in the oil market. The Brent oil futures (BRZ0) managed to leave the flat boundaries for the first time since March 2020 and approach the USD 50 per barrel mark, although on ‘weak’ volumes.

The growth is supported by hopes for the start of massive vaccination in the United States and other major countries as early as at the beginning of 2021. Investors believe that it will positively influence the epidemiological situation, which means that transportation flows and demand on fuel would grow.

However, the majority of analysts are sceptical regarding long-term prospects of the oil market, which will continue to be in the state of excessive supply in the coming months.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.