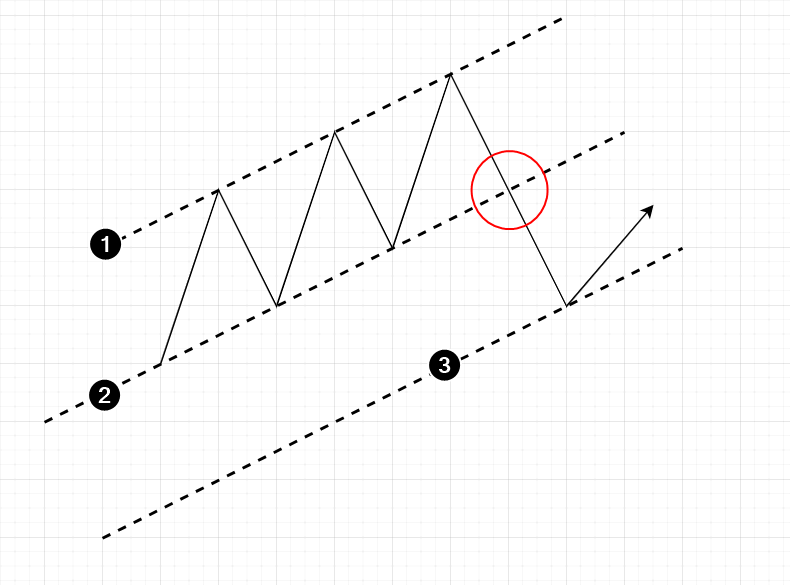

How to create parallel channels and why does a trader need them?

Parallel channels are an underrated pattern of technical analysis. When used with instruments for analyzing exchange volumes, parallel channels can become the basis for developing an effective trading strategy.

Read more: