Both options and futures allow an investor to conduct an operation on the exchange at a certain price until a certain date. However, the markets of these two products are fundamentally different from each other in how they work and how risky they are for an investor.

Before we analyse differences of futures from options, let’s first briefly describe:

- what options are,

- what futures are.

What options are

Options are a derivative form of investing and they are based on the underlying asset value, for example, a stock option. The option is the derivative instrument, while the stock is the underlying asset.An option agreement provides an investor with a possibility (not an obligation) to buy or sell an asset at a certain price until the agreement expiration date. The investor is not obliged to buy or sell the asset if he decides not to do it.

For example, you want to buy a stock for USD 200. However, the current quote fluctuates around USD 250 and doesn’t wish to move down to the target level. In this case, you may sell the put option at the strike of 200 and kill several birds with one stone. This way, you may quietly wait as long as you wish until the price reaches the target level of USD 200. If this doesn’t happen, you will put the whole premium from selling the option in your pocket, receiving the reward of waiting. If we take into account that expirations of American options take place every week, you could make a decent amount of money just waiting for the stock to reach the target level. If, in the end, the stock price moves down, you will get 100 stocks for 1 put option lot at the target price of USD 200.

Options are often used as a safety asset. That was their initial purpose.

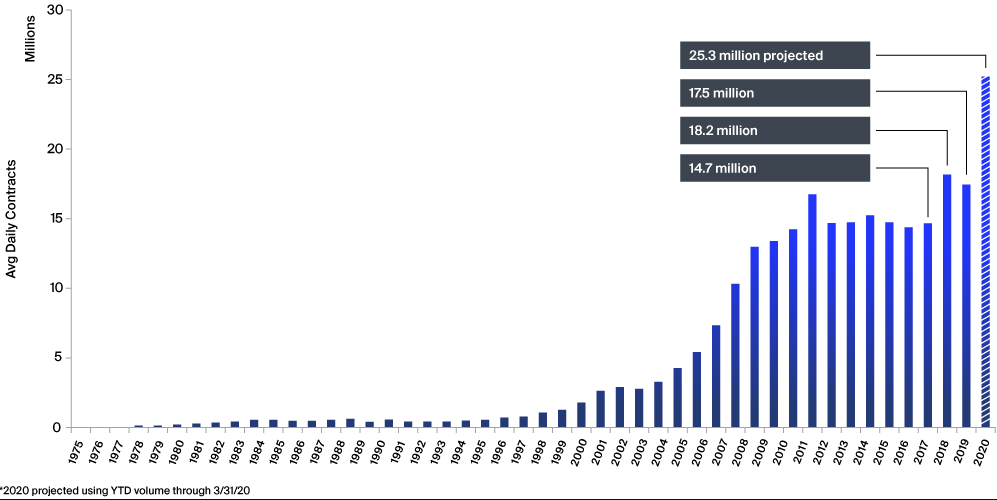

Their trading volume grows year after year. It is expected that the roaring 2020 will establish a new record, including due to the fact that options are more often used in speculative strategies.

- What options are. 5 examples of hedging,

- What options are. Principles of trading,

- 9 option trading strategies from a professional.

Futures

A futures contract is an obligation to sell or buy an asset later at a previously set price. Futures contracts are better understandable if you consider them from the point of view of such primary products as wheat futures or corn futures.For example, a farmer sees high prices and wants to take occasion and sell wheat at the current price, but deliver wheat after the crop has been harvested. He executes a futures contract with the expiration date, on which the crop will be already harvested and ready for delivery.

Read more about futures, standardization of futures contracts, their history and specific features in the articles from our blog:

- What futures are,

- What futures expiration is,

- The best futures for intraday trading.

The main difference between futures and options

So, perhaps you already guessed that the main difference of futures from options lies in their definitions.- An option agreement gives an investor the right but not the obligation to buy (or sell) assets at a certain price at any time while the agreement is still valid.

- A futures contract, on the contrary, requires a buyer to buy assets and a seller to sell them at a certain date in the future, if only the holder’s position is not closed before the contract expires.

As you can see that the difference is in the rights and obligations.

Two sides, which executed a futures contract, have similar rights.

The situation with an option contract is different – one side has the right (‘I want or I don’t want’) and the other side has the obligation (‘I am obliged’).

It might seem that it is disadvantageous to have option obligations, because you don’t know whether the counteragent would wish in the future to use the right to accomplish the trade.

There is a premium, which counterweights this disadvantage. A premium is a fixed reward of an option seller for uncertainty. The premium will stay in any case, whether the trade is accomplished or not. The premium size changes during a trading session, its value is called the option quote and it’s formed by the exchange.

A real life example. Your neighbour sells his car for USD 10 thousand. You give him a security in USD 200 and tell him that you are interested in buying his car in 1 month. However, you change your plans in 1 month and tell your neighbour: ‘Sorry, bro. That’s how it goes. Keep the money for yourself’.

In this example:

- USD 200 is the premium for the call option.

- USD 10,000 is the strike price.

- 1 month is the expiration period.

Despite the differences, options and futures have a lot in common

Both options and futures are:- derivative instruments, which are ‘tied’ to an underlying asset (stock, index or agricultural product);

- standardized instruments, which are traded on exchanges. They have clear specifications, approved by the exchange;

- forward contracts and have a period of validity (expiration date). That’s why, the markets, where options and futures are traded, are called forward markets;

- applicable both for speculations and risk hedging (limiting).

Both futures and options have a long history. These instruments were used for limiting risks.

- option trade execution is not mandatory;

- futures trade execution is mandatory.

The clearing house makes sure that the rights and obligations of participants are met. If the trade participant’s account doesn’t have sufficient funds for the trade execution, the broker asks the trader to deposit additionally the required amount to the account.

We can specify 2 option advantages based on the difference between options and futures.

Forward contracts. Differences.

There is also such an instrument as a forward contract.A forward contract, as well as futures and options, also envisages postponement of accomplishment.

However, unlike futures and options, forward contracts have a bigger freedom in their specification. If the centralized exchange sets all futures and option details very clearly, the forward contract terms and conditions could be changed by the contract parties in each specific case.

Quite often the forward contracts circulate in the over-the-counter (OTC) markets.

A forward contract could be issued for any trade. Any broker may offer a forward contract to his customers if there is demand.

For example, a broker notices that a customer has a lot of the money ‘caught’ in stocks. Then the broker may offer a forward contract to him for a certain interest in order to:

- make money on the difference in the forward price,

- relieve the customer’s money for other trades.

However, the broker is obliged to insure this forward contract by himself. Most probably, he would buy an option on it.

Conclusions

The article’s goal is to show what the main difference of the futures from the option and forward is. We hope we coped with the task and the article was useful to you.At the same time, you should understand that options and futures have disadvantages and advantages. In the event you want to learn more special information about these exchange derivatives, read the articles, the links to which you can find in the text above.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.