10 rules of a successful trader. Part 1

Trading on the exchange is a business with an easy and simple start. However, it doesn’t mean that you can become a successful trader with the same ease.

The majority of experienced traders know that the positive result depends on a multitude of factors: hard word, regular analysis, proper planning, strict discipline and ability to adapt to the constantly changing market conditions. Exchange trading, as well as other types of business, has certain principles, following which you can significantly increase the probability of success.

In this article, we will describe 10 principles, which have been tested by time and which are crucial for profitable trading independent of methods, trading platforms or time-frames you use.

1. Treat exchange trading as business

You shouldn’t treat trading as a hobby. Instability and absence of the necessary focus will not allow you to get the required knowledge and experience. You also shouldn’t treat trading as your work, since it doesn’t bring guaranteed income on the regular basis. It may happen that a trader would leave the market on Friday with no income although he worked the whole week for 10 hours every day. The conclusion is obvious – treat trading as business.

Trading on the exchange, as well as any other business, assumes expenditures, losses, taxes, uncertainty and risk. Planning is the cornerstone of successful trading. If you plan to stay in the exchange industry for a long time, focus all your time and efforts on development of your trading plan. Set short-term and long-term goals and describe your trading strategy in it in detail.

2. Stick to the trading plan

There is a saying in the Western traders’ community: ‘Plan your trade and trade your plan’.

Trading plan is a written set of instructions, which determine the points of entry and exit, as well as money management criteria. Efficient trading plan is often based on experience and market observations. Conduct a deep market analysis and test your trading ideas before you start to develop your trading plan. Composition of a full-fledged trading plan is a time-consuming and complex undertaking, but you can take our word for it – your efforts will be generously repaid.

Strictly stick to your plan without any guesses or different interpretations – respect your labour, since the trading plan is the result of lengthy analytical studies. Execution of a trade contrary to your trading plan is a sign of unprofessionalism, even if you made a profit from that trade.

Loss-making trades are frequently a result of such emotions as fear, greed, impatience or overconfidence. Losses could also be provoked by mechanical mistakes due to carelessness or overtiredness of a trader. It is not that simple to strictly stick to the trading plan as it might seem and it is necessary to work hard during a long period of time to develop the necessary skills.

3. Risk what you can afford to lose

People come to the exchange in order to make money, but things sometimes differ from what you expect them to be. Do not invest the only money you have into trading. It is not simple to lose money, but the risk will be unjustified if you risked the money, which wasn’t planned for trading.

It is obvious that you shouldn’t risk the money, which is planned for your children’s education, utility services and other financial obligations. This stupid action may result in aweful and catastrophical consequences. Moreover, it would directly influence your emotional state during trading and provoke stress situations.

Quite often such a psychological pressure results in making wrong decisions and, consequently, in losses. It is important to decide before starting to trade what money could be used for trading. If you do not have such money, amass a certain amount of money little by little.

4. Use modern technologies

Electronic exchange trading emerged relatively recently, but this trading instrument, being accessible to modern traders, is constantly developed and improved. Computers and the Internet have become much faster and technological innovations constantly extend the analytical arsenal of traders.

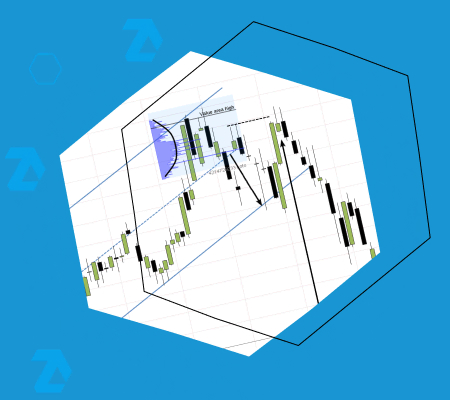

The trading and analytical ATAS platform is one of such technological developments. It provides a trader with a set of modern instruments for comfortable trading and for efficient market analysis.

ATAS is a wide spectrum of instruments for analysis of order flows, cluster charts and volume profile of the market. The platform functionality contains all advanced technologies. The innovation decisions of its developers make this platform one of the most state-of-the-art products in the industry. High ergonomics of the interface ensures easiness of the study of the applied solutions for beginners and high speed of operation for experienced users.

The use of outdated technologies may put a trader at an extreme disadvantage. Trading is a competitive business and you can ensure competitiveness only if you keep pace with the development of technologies.

5. Develop your trading plan based on your own market analysis

In order to develop a full-fledged trading plan, you need to conduct a deep market analysis. Abundance of information on the Internet often prompts many traders to use somebody else’s trading developments. However, it is wrong for a number of reasons.

Firstly, not all trading methodologies, spread around the global network, are profitable, although they are presented as such. Secondly, even if we assume that they work for someone, there is no guarantee that you could use them with the same efficiency. Every trader has his own style and risk tolerance, consequently, it is inexpedient to rely on somebody else’s experience. And finally, traders should properly understand the developer’s logic, which is behind the trading plan, otherwise they could lose confidence in it and, as a consequence, stop going with it.

Please, check our blog for new articles. We will continue describing main principles of efficient exchange trading in our next article – Trading on the exchange. 10 rules of a successful trader. Part 2.