What trading strategies are found in the financial market?

The goal of this article: To give the most complete list of well-known trading strategies and describe them from the point of view of their application. It is important for beginner traders to know them in order to form a general picture of available approaches and identify a clear goal: where to move.

What you will not find in this article: Detailed information about each strategy with a step-by-step instruction – how and why to enter, when to exit, indicator settings, etc. You can find ideas and examples of trading strategies using the following links:

- Top 5 simple volume strategies (the article consists of 2 parts);

- Footprint strategy;

- Scalping strategy;

- Our YouTube channel.

Let’s return to the current subject. What important issues will we discuss in this article? Read in this article:

- What characteristics a trading strategy has;

- What trading strategies professional market participants use;

- What trading strategies are available for beginner traders;

- Selection of a strategy for personal trading.

What a trading strategy is

Trading strategy (system) is, simply and practically speaking, an action plan for making profit in the financial markets.

The following has to be determined for any trading strategy:

- trading instruments. For example, trading strategies of the stock market might not work for Forex;

- market entry/exit points;

- capital management – that is, what volume of funds you will invest in every next trade;

- risk management – that is, what risk of losses you can afford for one trade and for the whole account.

Some systems have complex and complicated rules with a multitude of conditions. A piece of paper will be enough for description of others (for example, trading strategies without indicators).

A strategy should be tested after it is formulated. You can use software for testing trading strategies or do it manually.

Testing could be carried out with the help of:

- historic testing on a sufficiently long interval in order to check the strategy operation under different market conditions. For example, you test a trading strategy for daily charts. Then you need to look through the history for 2-3 years (better more) and analyze not less than 100 trades so that the statistics would be more or less objective;

- forward testing (so-called trading ‘on paper’ or on the demo account). For example, try to apply the same day strategy on the demo account. Collect statistical data for, at least, 3-6 months and check how the result coincides with the historic testing;

- real market testing on minimum volumes. It is required to switch psychology and finally make sure that a strategy is efficient and it fits you.

You can say that a trading strategy is formed only after making these steps.

Trading strategies from professional market participants

Professional trading strategies are the strategies, which are used by professional market participants – market makers, investment funds, hedge funds and HFT funds. Detailed information about these systems is closed and protected as a commercial secret.

- HFT strategies are algorithmic trading systems, which execute financial asset buy and sell trades within milliseconds. They require expensive equipment and direct connection to the exchange servers for minimization of the trading time. More details about HFT trading.

- Arbitrage is an algorithmic trading strategy, under which sets of interconnected trades are executed.

There are the cross-border arbitrage (trades are executed on one asset, which is traded on different exchanges) and time arbitrage (trades are executed on the same exchange but at different moments of time). The prices of financial assets, traded on different exchanges, are equalized due to arbitrage strategies.

A simplified example: for example, 1 bitcoin costs USD 9,100 on exchange 1 and USD 9,700 on exchange 2. An arbitrageur buys 1 bitcoin on exchange 1 and sells it on exchange 2. Profit. - Investment trading strategies are long-term portfolio trading strategies based on a deep fundamental analysis of financial instruments, closed information, statistical analysis, mathematical modelling and portfolio theory.

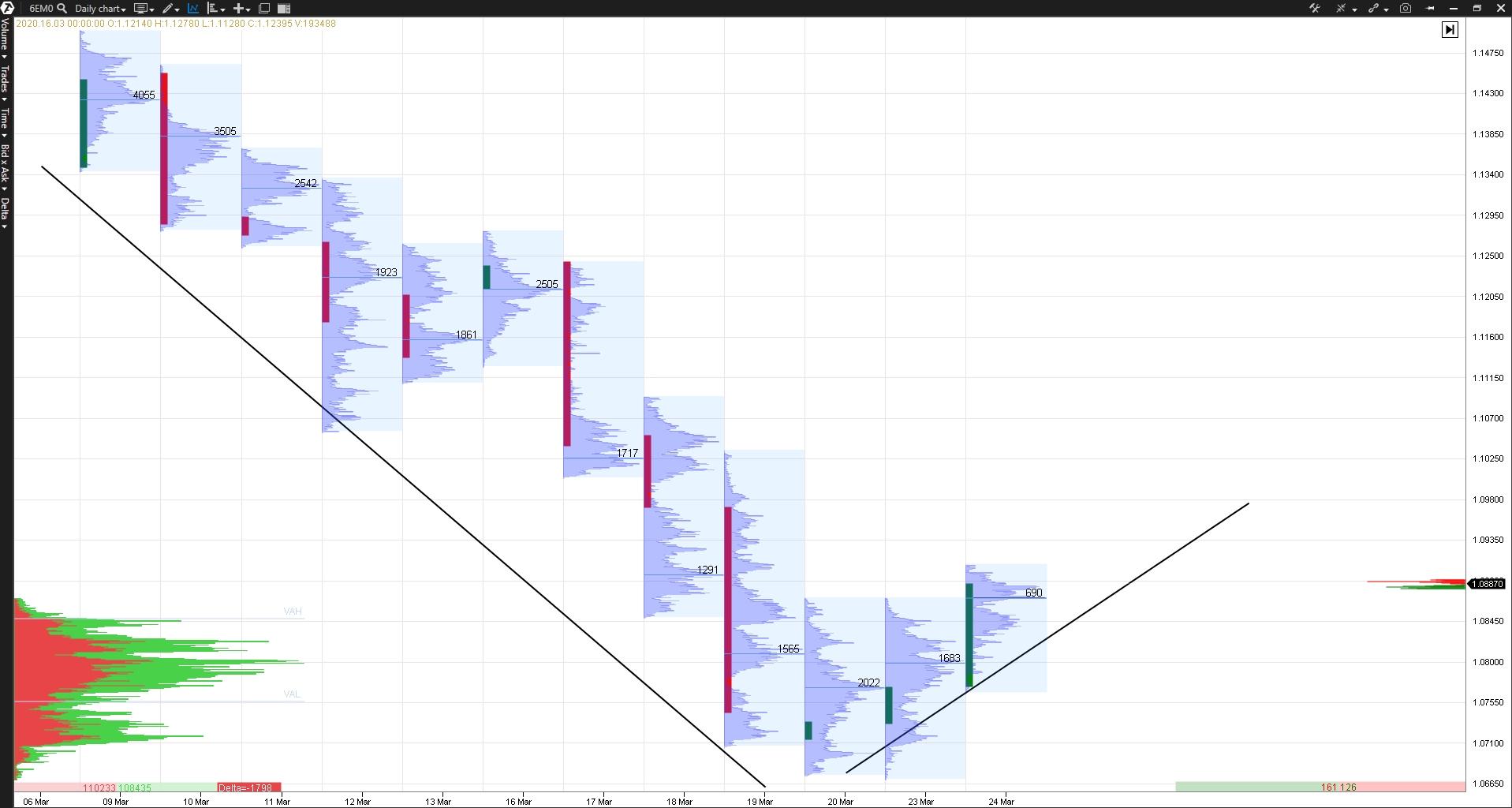

- Using Volume and Market Profile are trading methods based on the volume analysis. These strategies analyze accumulations of big traded volumes at certain prices, which form resistance and support areas for the price. Special software (for example, the ATAS trading platform) and access to the exchange volume data are required for the work with these strategies.

All professional trading strategies require special knowledge and expensive software and hardware. However, namely these strategies provide advantages for making money in the financial markets.

Basic trading strategies of beginner traders

These are more simple trading systems, which are used by private traders. These strategies are often based on technical analysis.

These strategies could be divided into several categories.

By the trading style:

- Scalping – 10-100 trades a day, analyzing M1 (1-minute) or M5 (5-minute) charts. Profit from every trade is several points. Trades are held from several seconds to several minutes.

- Intraday trading – 2-5 trades a day, analyzing M30 (30-minute) or H1 (1-hour) charts. Profit from every trade is several dozens of points. Trades are held from several minutes to several hours. Positions are closed the same day to avoid the risk of strong night moves and price gaps.

- Swing trading – 1-2 trades a week, analyzing D (daily) charts. Profit from every trade is several dozens or hundreds of points. Traders do not need to constantly monitor the charts and positions during the day since positions are held for more than one day.

- Position trading – 1-2 trades a year, analyzing W (weekly) and M (monthly) charts. These are long-term trading strategies, under which trades are held for several months and more.

More details about the trading styles.

By the analysis method:

- Strategies, based on fundamental analysis. They mean making decisions on the basis of geopolitical and economic factors, which influence a financial asset (interest rates, GDP, elections, terrorist attacks, epidemics, poor harvest and so on). These could be both long-term and short-term trading systems. An example of a short-term strategy could be trading on the news. Trades are executed before or after publication of an important piece of news in the hope of a strong price impulse in the expected direction after the news publication.

- Strategies, based on technical analysis. They use analysis of the past price movement and indicator dynamics for forecasting movement in the future.

There are 4 types of technical analysis: charts, indicators, Japanese candles and waves. These could be short-term and middle-term trading systems.

By the market state:

- Trend Following is a trading strategy, under which a trend is identified first and then entry points are identified in accordance with the current market trend. This strategy is based on the theory that, most probably, the prices would continue to move in the direction of the previous movement.

- Retracement trading is a trading system, under which entry points are identified by the current main trend but after an interim retracement (rollback). This strategy is based on the theory that the prices never move along absolutely straight lines between highs and lows and usually ‘take rest’.

- Non-Directional trading is a bounce from the levels. This strategy is for trading in the times of a quiet market. First, it is necessary to identify the range, within which the price has stayed for some time. The price range is limited by the resistance and support levels. Trades are executed on the price return to this range.

- Breakout trading. Traders identify a breakout of the current price range and execute trades in the breakout direction. This strategy is based on the theory that the trend, after a strong breakout, would, most probably, continue to move in the direction of the breakout.

- Reversal trading is a trading system, the aim of which is to identify the price reversal and the end of the current trend. This strategy is considered to be the most complex and risky one, since it is difficult to identify true price reversals.

By the highly risky trading methods:

- Pyramiding – this trading system assumes the next trade opening in a double size if the previous position brought profit. In other words, it means accumulation of a position. It is designed for working along the trend.

- Locking – this trading system assumes opening a long in the event of an available short. And vice versa – entry into sells with an available long position. This action mostly refers to the Forex market, since it is not allowed to have a long and a short simultaneously on the official exchange (at least, for a regular trader on one account).

- Averaging – this trading system assumes opening further trades in the direction of a loss-making trade with an increased or standard lot and closing all trades simultaneously when they reach the set level. Example – martingale.

These are very dangerous methods, which are not recommended for beginner traders.

Summary

Trading strategies are important and necessary conditions for achieving success. However, there are so many of them. What to do with this wide variety?

1st step: In order to acquire experience, you need to select a trading strategy, which would correspond with:

- your goals. Do you want to master the profession of a trader or are you interested in some investment income?

- your time.

- your personality. Are you a gambler? What is your attitude to risk?

Perhaps, swing trading without risky methods of capital management is an optimal direction for a beginner trader, which allows combining his own and new specialties.

2nd step: Master new trading strategies in order to build own portfolio of trading strategies. Trading strategies will produce mixed results since the market situation changes. The only solution to this problem is a trading portfolio consisting of different strategies.

3rd step: Study trading strategies in theory and apply them in practice with the use of progressive platforms for the market analysis – for example, master the volume analysis with the help of the ATAS trading platform.

Wish you all profitable investments and trades!

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.