In this article we will speak about:

- why traders experience the stop loss fear;

- how to fight it;

- how to derive benefit in situations when others experience fear.

Stop loss fear - how it is formed

On the one hand, it may happen due to the fact that a stop loss is posted too close to the current quotation. But there is another point of view, which lies in the fact that the majority of exchange traders, which are inexperienced traders, post their stop losses in one place as if they came to an agreement to do it.

This happens because they read the same popular literature (what traders really should read), in which the so-called ‘gurus’ usually recommend them to ‘hide’ their stop losses behind the fresh extreme points. However, when it happens in reality, the situation becomes very interesting. Accumulation of stop losses behind extreme points could be used by major players, who possess power in the market, for optimisation of their positions.

We can make a short intermediate conclusion here. Initially, nobody is interested in your small stop. But as soon as hundreds (of thousands) of stop losses of other traders are posted together with your one at the same level, then this concentration may attract a major player and provoke ‘hunting’.

If you act again and again in accordance with your strategy and post stop losses by the same formulated rules and the stop loss is knocked out practically every time, this forms negative emotions, which evolve in the emotional distress and sometimes even in serious depression. Then, as a consequence, a real fear and hesitation are formed when you open a new position. Your experience contains many cases when the posted stop losses brought you losses. Of course, you do not want to make another loss.

And traders become hostages in such cases. On the one hand, the stop lost posting becomes a synonym of making a loss, but traders have to create a protective order, because trading without stops is a direct way to drain your deposit.

Let’s consider one scenario

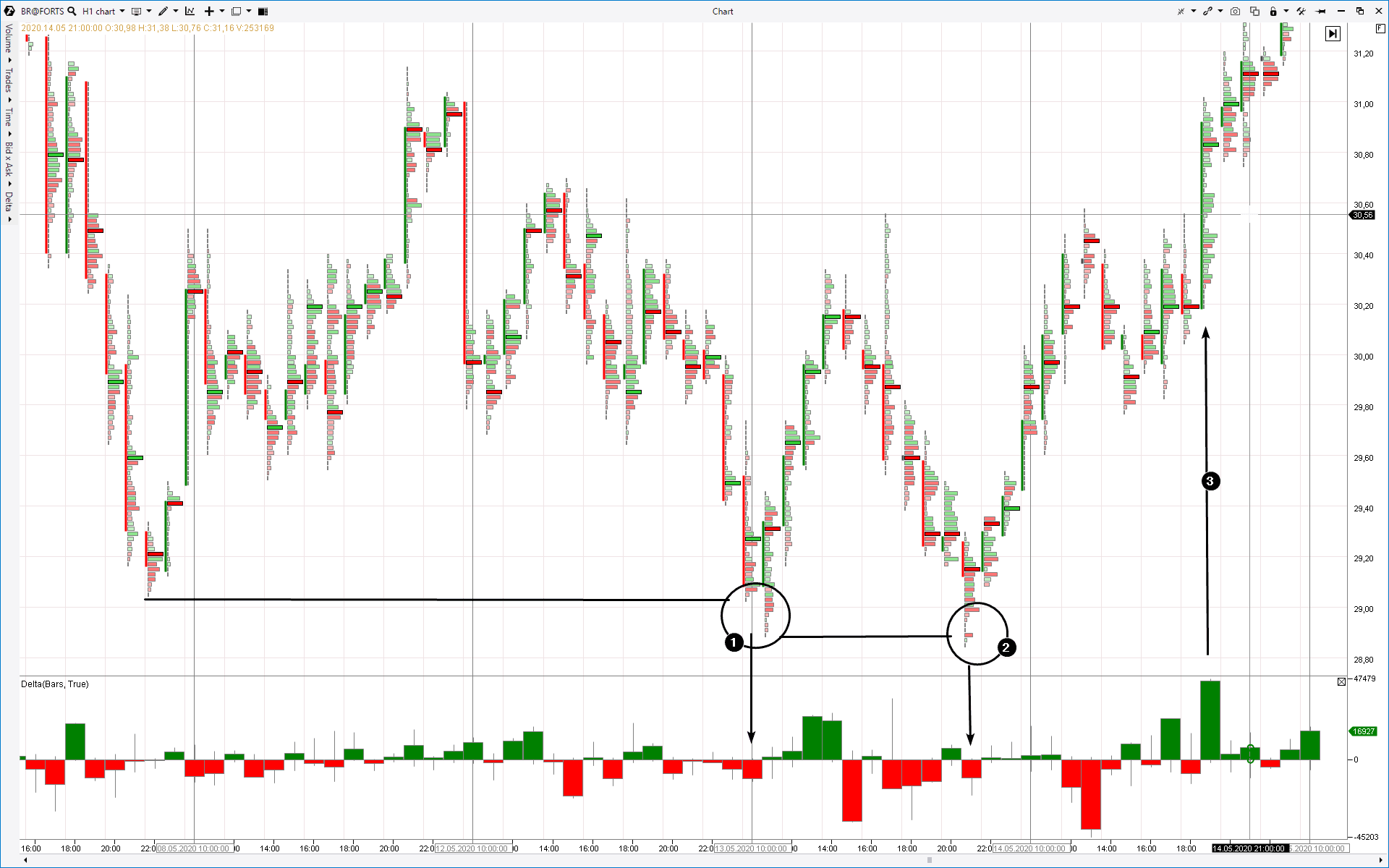

You monitor the chart of one of your favourite oil futures and how the price recovers after negative values.

You notice formation of higher highs and higher lows on longer time-frames. You decide that the current moment is the best time for development of this tendency and decide to make it your friend. You buy at 29.50 and post a stop loss order a bit below the fresh low of May 7 in order to protect your positions. Then you wait until the price starts ‘moving north’.

Unfortunately, Mr. Market has other ideas. In point 1 it makes a dive, which is sufficient to knock out your stop. You enter again, post a stop loss but you are knocked out again in point 2.

And then (you know it too well) the price recovers and starts its growth, which confirms your forecast. In point 3, you see buyers’ pressure, which pushes the price up (green delta on a bullish breakout is a sign of the demand strength).

You send ‘expressive thanks’ into the screen of your computer accusing the world in general and your broker in particular and start to calm down. You read many times that you should accept what market gives you, control your emotions and look for another opportunity.

However, it is very difficult to do in reality when you make a number of losses instead of deserved profits. It undermines your confidence.

How often has it happened to you? Old-timers know what really happens behind the curtains and they stopped to complain a long time ago and, in fact, developed a trading strategy in order to use this cunning market behaviour, which is called ‘stop hunting’, in their interests.

What are the real reasons of stop hunting

The ‘guilty one’, if we have to use this label, is a conventional major institutional trader who needs to post a big position. which far outweighs your order, to use the same trend which you noticed. However, his main problem is liquidity. If he tries to enter the market with a big BUY-MARKET, he knows that the market will go up like a rocket, which would cost him a lot.

That is why he acts differently. He knows that stop orders hide a bit below the support, that is why he would send sell orders of moderate size first and these orders would slightly push the market down. He also knows that after that he can ‘collect’ stop orders and form his position by means of them.

You may ask what about spreads. You saw how spreads expanded and the market as if trying to ‘reach’ namely your protective order. Your broker has nothing to do with it. It happens when the quotation enters the ‘stop area’ and their cascade activation takes place. Activation of stop orders one after another expands the spread.

Well, you may write a complaint into the regulatory bodies or you may act more professionally. Use it as a lever for changes.

How to avoid becoming a stop hunting victim?

If you have FOBSO (stop loss fear), you have variants.

If you are absolutely sure that the uptrend would continue, you may avoid using a stop loss order. This variant, however, makes your risk infinite. You welcome inevitable death if you chose this variant of trading.

A more preferable variant is posting a stop loss order above the level, which could be expected in such a situation.

One more idea is to select a wider stop with reference to the Average True Range indicator, so that your protective order would correspond with the current market range.

Beginner traders are inclined to post stop losses for a set value, for example, 15-25 ticks below their entry points. Old-timers and people with smart money know about it and rely on it applying various strategies.

It makes sense to remind you about the market margin, which we described here.

One more way of fighting fear is strategy testing

Approach your strategy testing on history with maximum responsibility. Use all possible ways: software, services and monotonous manual research in order to get as much statistics and results of your strategy trading as possible. When you analyze these data, you will understand that your strategy brings the alternate periods of losses and profits. However, if, in the end, the yield curve moves up, then it would be easier for you to understand and accept the fact that exchange trading is a stream of profits and losses and no trader can avoid making loss from the stop loss activation.

In such a way, you will start to perceive a stop loss like one of the possible outcomes, which reduces your capital in the short run, but you have positive expectations in the long run, since you know that the profit period will come and outweigh the negative result.

What trading strategy could be built around stop hunting?

There is one more variant. Perhaps, you had an idea after you read the above scenario. Old-timers learnt to perceive the above described phenomenon as a potential trading setup and developed an aggressive strategy, which allows using the hunting scenario for the entry point.

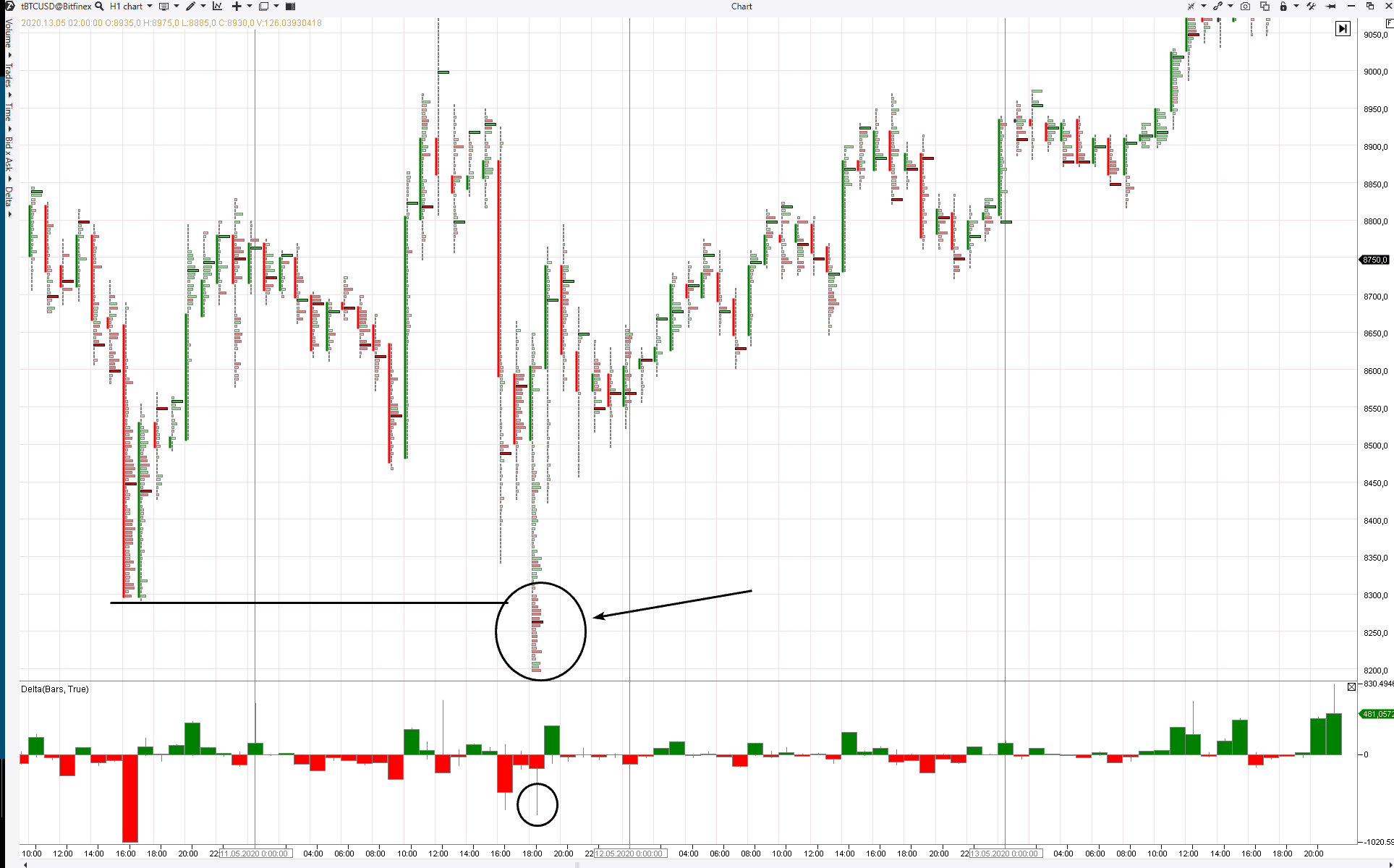

Being retail traders in the huge financial market with capitalization in billions of dollars, we are hardly able to hunt stop loss orders, as powerful major players do. However, we are able to notice that the hunting is about to stop and we should be ready to use this quick price return.

You need patience here. Monitor the candles, which form the support level. If the quotation moves below the support level, focus your attention. Use the Cluster Search, Delta and Footprint indicators to see an accumulation of red clusters. It could be a proof of stop activation. You face a nice opportunity while other traders make losses.

Conclusions

Do you suffer from FOBSO? Do you accuse your broker? It might be fun to play in the accusation game, but it doesn’t help to become better as a trader. Take responsibility and control into your hands. You can avoid pain in different ways but you shouldn’t remove the stop from your trading system.

Learn to detect stop hunting in order to ride the wave, which the majority planned to ride. Maybe, in this strategy, you will be more concerned with when to take profit than where to hide your stop.

Download ATAS in order to check how advanced trading and analytical software can help you to move from the category of hunting victims into the category of steadily profitable traders.