Short Squeeze is not a very popular phrase in the trader’s glossary, it is mostly used by more experienced market participants. We will speak in this article about:

- what a Short Squeeze is;

- how to identify it;

- why a Short Squeeze is important;

- how to use it in making trading decisions.

We will also provide practical examples.

Short Squeeze - what it is

In fact, Short Squeeze is a sharp price growth, which is accompanied with short position closing, since bears are forced to minimize losses.

The Short Squeeze concept usually is applied to securities.

The process theory

In order to understand the Short Squeeze process we need to remember theory.

When investors short securities, they borrow them from brokers hoping that the price would move down. Then they will buy cheaper stocks, give them to their brokers and make money on the price difference.

However, if the price starts to grow, investors close loss-making positions with disappointment. They buy in order to close short positions, which leads even to a higher price growth. Thus, the price growth is not the result of new buys, it is a result of short position closing.

Usually, those assets are shorted, which are considered to be overvalued either fundamentally or by technical indicators, but, at the same time, beginners often act against a strongly growing trend (which is very dangerous for the deposit).

Traders work differently. They often buy assets when they believe that a Short Squeeze may happen.

Example

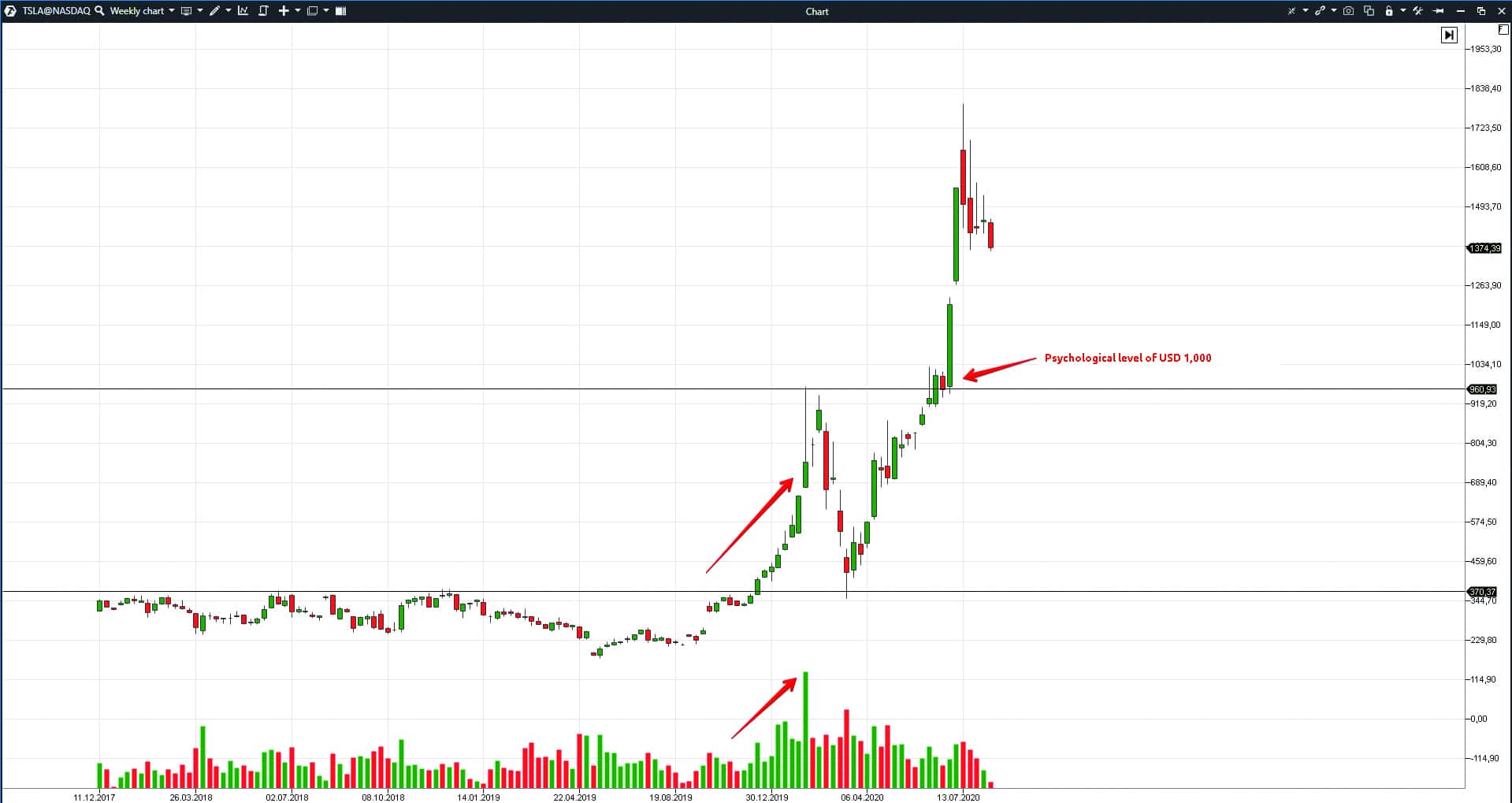

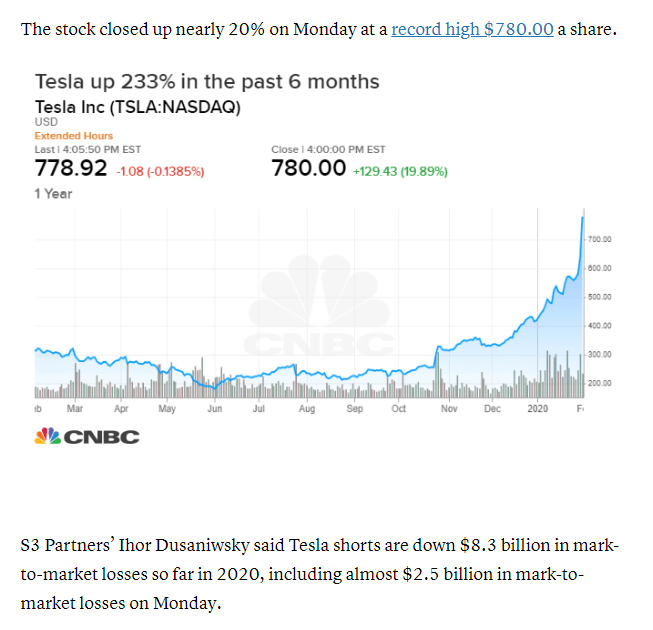

There were more than 18% of short positions in the Tesla stock at the end of 2019, which is a very big number. Investors and traders lost millions of dollars when the stock price grew more than 2.5 times, but the stock attracted shortists anyway.

A similar situation took place when the price passed the psychological mark of USD 1,000. This weekly chart clearly shows growing volumes with a breakout of a long consolidation area at the end of 2019.

The next picture is a screenshot of the news, in which CNBC informs about record-breaking money losses during one day.

Importance of a Short Squeeze

When a trader opens a long position, his risk is limited with the asset value.

Which means that if the worst comes to worst, the trader cannot lose more than the asset value. However, if the trader opens a short position, especially in futures, his risk might be not limited at all. For example, when the stock price reaches its historic high, there are no resistance levels above and it is very difficult to assess the growth potential.

Where to find the data

Some exchanges regularly publish a number of short positions.

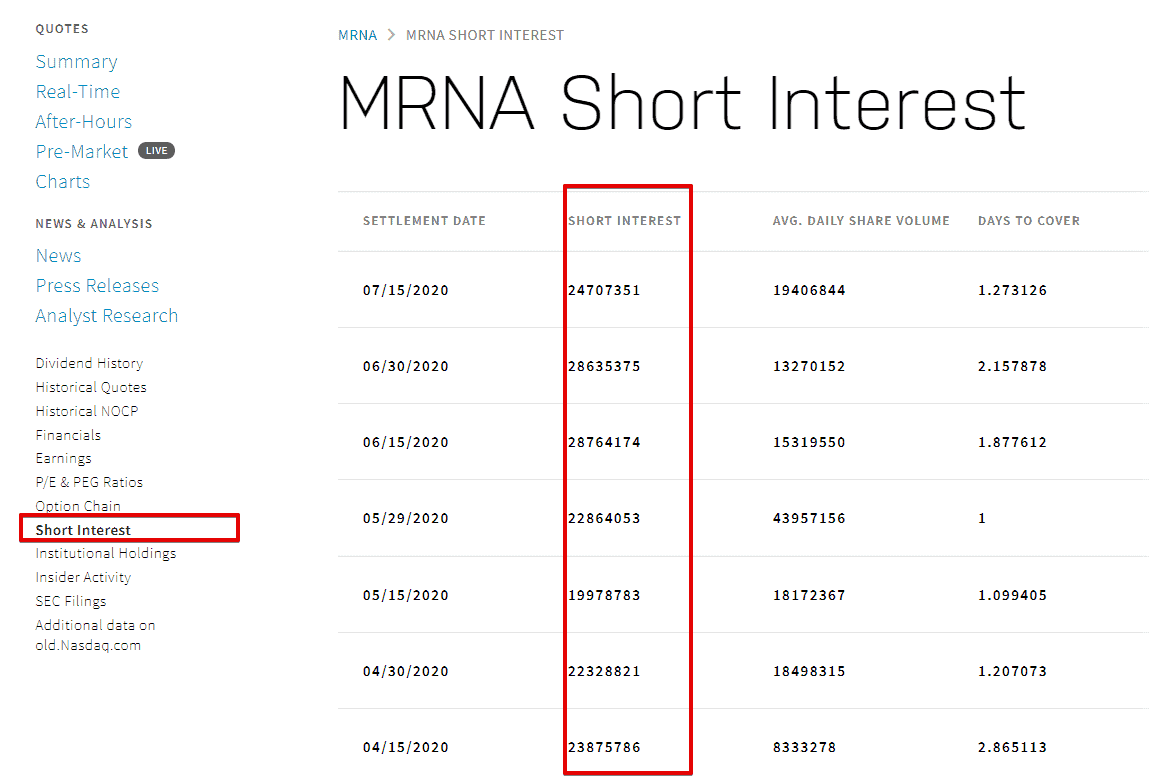

For example, Nasdaq publishes the short position data twice a month.

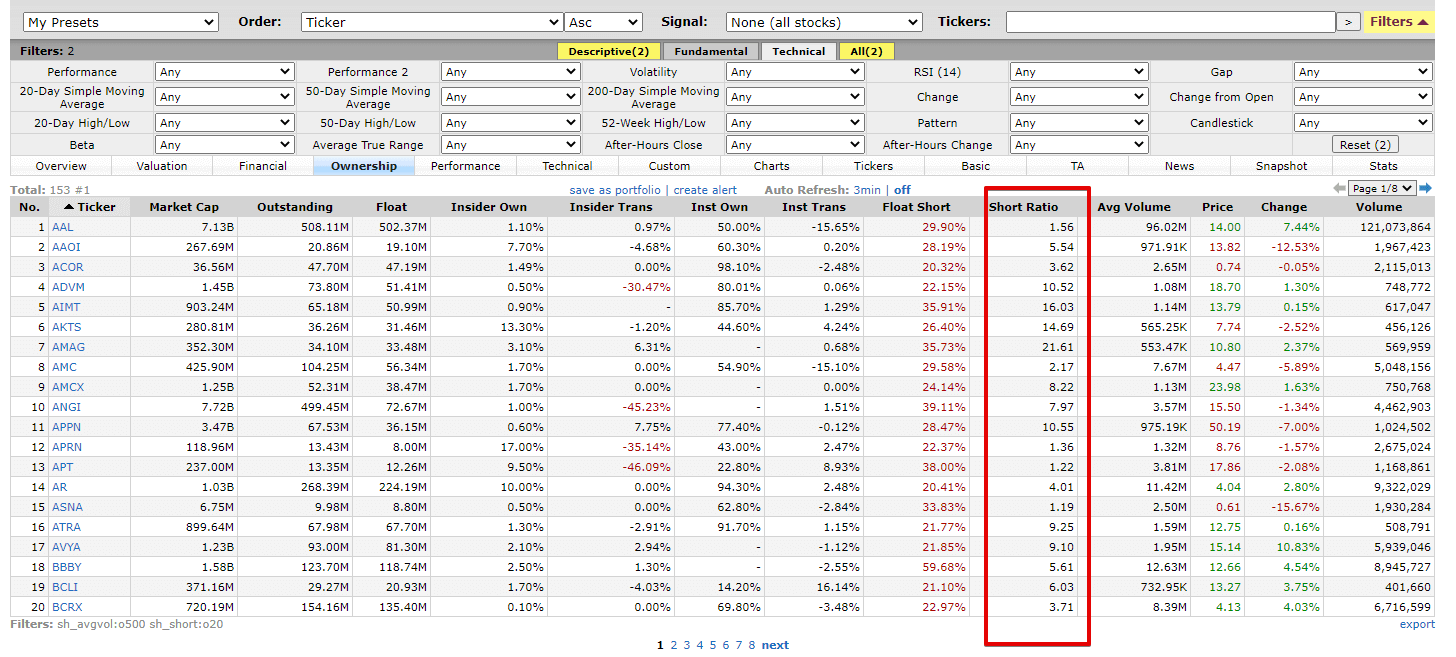

Apart from a number of short positions, the exchange also publishes Short Interest Ratio (SIR) a relation of a number of short positions to an average daily trading volume. SIR is measured in days (the last column in the picture above). It shows a number of days, required to close all short positions under the current average daily trading volume. The higher this indicator, the higher the probability of a sharp price growth is.

Apart from the official exchange reports, the short position data could be found in paid and free stock scanners. For example, on website finviz

The Moscow Exchange doesn’t provide their users with such data. The Moscow Exchange traders can read the article about the unique OI Analyzer indicator.

How to select and trade a Short Squeeze

Here are some important points for working with a Short Squeeze:

- An extremely high value of short positions with respect to the standard one could be a sign of a Short Squeeze. Percentage of short positions is a number of short positions divided into the number of stocks in circulation. Those stocks have a bigger potential, for which this value is higher than 10%.

- SIR (a number of days required for closing all short positions) should be more than 5. In simple words it means that the number of short positions exceeds the average daily volume by more than 5 times. At such a relation, shortists may panic if the price sharply grows.

- It is possible to use technical analysis indicators for filtering stock. For example, SMA (50) or VWAP. Prices should be above the indicators and availability of an explicit uptrend is required on long time-frames.

- It is good if prices reach a new historic high on a longer time-frame. Or if they break the upper boundary of long consolidation.

- The opening gap >2% will also increase chances for a profitable trade.

Conclusions

In fact, an ideal candidate for a Short Squeeze is a stock in an uptrend with a big number of open short positions and it should be quite strong from the fundamental analysis point of view. A Short Squeeze often appears after publication of news and financial reports.

However, a Short Squeeze doesn’t always mean that the price would grow. Sometimes, it continues to fall, for example, in a downtrend. That is why, the Short Squeeze indicator shouldn’t be considered out of context.

Is there a Long Squeeze? Yes, there is. It is the opposite situation when the prices sharply fall and long position holders close them in order to keep the profit – either manually or automatically (by a stop loss).