5 recommendation for cryptocurrency trading.

In this article:

- the story of cryptocurrency emergence – everything you need to know;

- what in fact a blockchain is;

- how best to choose an exchange for cryptocurrency trading;

- specific features of connection with ATAS Crypto – the best platform for cryptocurrency exchange trading;

- what cryptocurrency trading is and how to open trades on a cryptocurrency exchange;

- orders of what types could be on cryptocurrency exchanges and how to use them correctly;

- 5 useful recommendations, which would make your cryptocurrency trading a profitable business with a minimum risk.

However, before discussing a practice of profitable cryptocurrency trading at an exchange, let us formulate in brief:

- what cryptocurrencies are;

- distinctive features of cryptocurrencies (using the example of the bitcoin);

- what the mining is.

- why the blockchain technology is unique.

THE STORY OF BITCOIN EMERGENCE

Bitcoin = Bit + Coin = A digital coin

The bitcoin was first mentioned in 2009, when documentation with description of the protocol and principles of operation of this payment system appeared in the Internet. Its basis is the use of a chain of blocks, which store all transactions about bitcoin transfers between the network participants. Safety of this network is guaranteed by each network participant, who is a bearer of all transactions without exceptions, which makes it impossible to forge transactions and appropriation or expropriation of bitcoins.

Main features and advantages of the bitcoin network:

- Anonymity. Only the wallet owner can use the wallet’s number.

- Decentralization. The network does not have controlling bodies and it does not report to state structures;

- Safety of transactions. Only those transactions could be executed, which were confirmed by the network participants;

- Irrevocability of transactions. If a transaction is confirmed by the network, it is impossible to stop the bitcoin transfer.;

- Equality of participants. Every person can install the Bitcoin Core application on his or her computer, become a network participant and be a controller node;

- Distributiveness. The database itself is stored with every network participant and new participants make this database more and more distributed. In order to eliminate the network it is necessary to eliminate each computer, which stores this database.

- Deflationcy.The number of possible blocks in the network is limited to 21,000,000. Periodically, a search for a new block becomes more complex, in the result of which the exhaustible resource tends to become more expensive.

Why bitcoin became a cryptocurrency

Sometimes bitcoins are compared with cheques. A cheque is a banking instrument, which could be endorsed, for example, for repayment of a debt to a creditor.

Now then, in our case, the bitcoin owner is a cheque issuer who has the right to endorse any transaction within the balance of own account. The whole blockchain network of bitcoin serves as a controlling bank. The bitcoin recipient becomes the owner of all rights on the received bitcoins and can transfer digital money to other people all over the world. Also, the bitcoin recipient can convert bitcoins (and other digital money) into a required currency on cryptocurrency exchanges – Bitfinex, BitMEX and others (we will consider them further in more detail).

It turns out that payments abroad in the cryptocurrency epoch became as simple and easy as never before. Now, international settlements could be done without banking bureaucracy and red-tapery, a payer can just send bitcoins from his computer and a payee will exchange them on the exchange by himself. These features made the bitcoin a very attractive instrument for settlements. Since, having a settlement value, a bitcoin can be a universal transnational payment instrument.

The bitcoin success triggered a mass emergence of alternative digital currencies and a help in realization of ICO (analog of IPO – stock offering in the open market) became a profitable business. Today, one can be caught in a diversity of digital money and many new digital currencies continue to fill the market. At the time of writing this article, 2054 digital currencies were registered at the coinmarketcap.com site, but the majority of them have no value at all.

Who are bitcoin miners?

A lot of computation shall be done to get a bitcoin. This process is called mining. Mining is earning and a miner is an earner.

A bitcoin miner solves a cryptographic task on his computer and a result of his computations is a block, which he sends into the network. The network needs blocks to store transactions. Each block of the bitcoin network is unique and shall meet special parameters and the more blocks were earned, the more complex the network becomes and the more resources will be required for the search for next blocks. A miner gets remuneration in bitcoins and its size halves after formation of each 210,000th block.

Special equipment is produced today for mining and mining is a separate direction in business. Mining companies spend millions of dollars for construction and maintenance of mining farms. Read about a mining farm from China in the “Making Money on Cryptocurrencies” article.

Introduction into the blockchain technology

All transactions in the bitcoin network are united into blocks, information in which is stored in the open form. Each block has its order number and a cryptographic hash of the previous block. All blocks are united into a serial chain, which is called a blockchain.

The first record in each block contain information about a remuneration to a miner for a received block and this is how the first bitcoins are produced. Further movements of a bitcoin are formed into transactions, which become known to the whole network.

When a miner finds one more block, he sends it to the network for examination by other participants. If there are no mistakes, the block is recorded by all the participants in their own copies of the database. In doing so they ensure transparency and stability of the bitcoin network operation. Each network participant can examine authenticity of any transaction. Even “unwind” the whole chain of blocks to the very beginning.

The blockchain technology is attractive in the spheres where:

- a system of tracking of rights of citizens is required;

- storage of big data bulks is a priority task;

- openness and transparency are supported by the society.

Emergence of first exchanges

A historical event took place on October 5, 2009. Namely on that day the New Liberty Standard site published the first dollar to bitcoin exchange rate: USD 1 = BTC 1,309.03. Yes, it’s true. One could buy more than a thousand of bitcoins for one dollar and not vice versa. Because the bitcoin cost was determined at that time on the basis of an average power, which was consumed by a miner-computer, multiplied by the cost of electricity and divided into a number of generated bitcoins. This was how a fair price of the bitcoin was formed on the basis of energy expenditure required for its production.

The MtGox Exchange was founded on July 17, 2010, and this exchange performed quotation of basic national currencies to the bitcoin. The growing popularity of the bitcoin provoked emergence of other cryptocurrencies. The general capitalization of the market exceeded USD 1 billion in 2012 and reached its peak heights at abround USD 800 billion in January 2018. Dozens of various cryptocurrency exchanges started to operate due to the active growth of the blockchain industry. As of today, 220 cryptocurrency exchanges are registered at the coinmarketcap.com site.

THE MODERN STATE OF THE CRYPTOCURRENCY MARKET

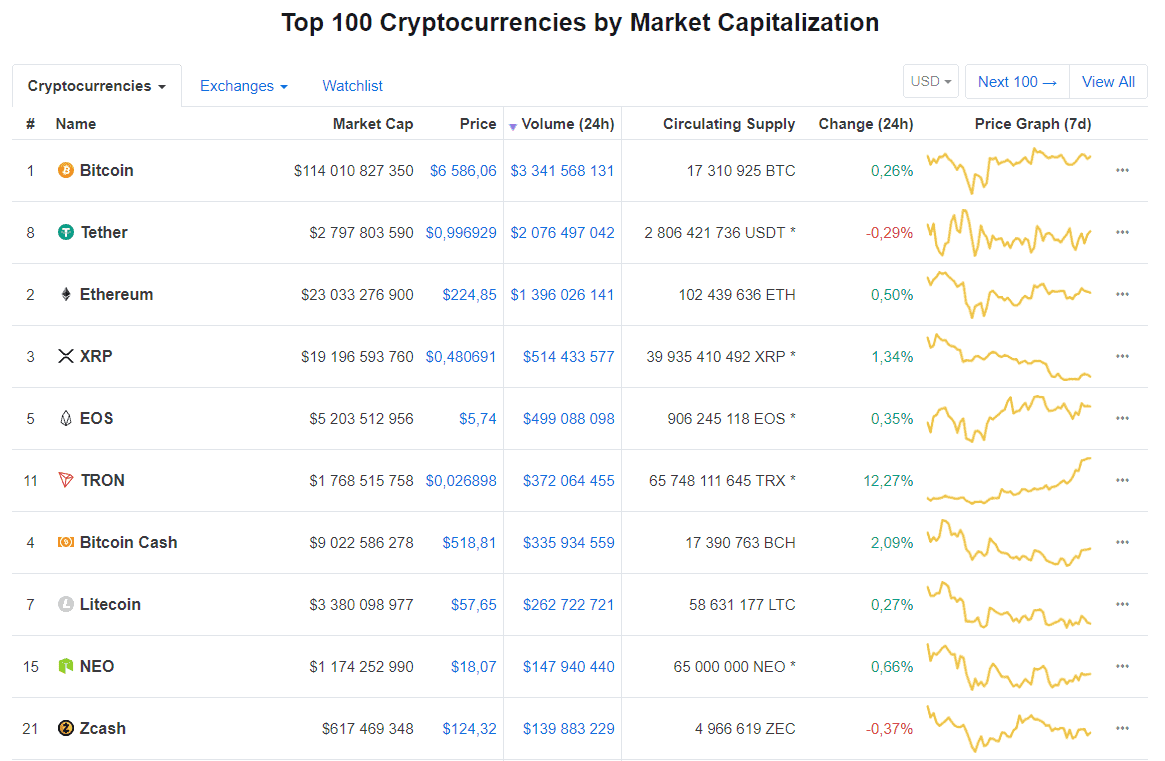

The current situation shows stability of the cryptocurrency market, despite the absence of legislative regulation, transnational nature and chaotic emergence of new cryptocurrencies and exchanges. Domination of the bitcoin, ethereum, XRP and other currencies from the first ten leading ones is clearly traced in the market.

The Chicago Mercantile Exchange (CME) (the main platform for trading futures contracts on energy sources, currency pairs, metals and agricultural products) started trading futures contracts on BTC/USD exchange rate.

The cryptocurrency trading gains popularity mostly due to high volatility. Daily fluctuations of the bitcoin rate often reach 10% and price changes between the bitcoin and other cryptocurrencies can exceed 100% during one trading session. These wide exchange rate fluctuations provide great opportunities for making money in the cryptocurrency exchange trading.

ATAS Crypto was specially developed for cryptotraders. This trading and analytical platform brings the cryptocurrency trading to the top level. Now, efficient instruments of volume and technical analysis became available for the cryptocurrency trading.

The software version is absolutely free at this stage and available for download at https://atas.net/atas-crypto/

REVIEW OF EXCHANGES

In order to start trading on a cryptocurrency exchange you need to choose an exchange. Make a list of criteria before choosing an exchange. We recommend to focus on the following:

- exchange turnover;

- variety of instruments;

- trading on loans (marginal trading);

- deposit requirements;

- registration requirements;

- supported order types;

- resilience of the exchange to hacking attacks;

- sizes of trading commissions; deposit and withdrawal of funds.

Let us consider several main exchanges as an example.

Bitfinex

It’s site https://www.bitfinex.com. The exchange was founded in 2012 in Hong Kong. The exchange monthly turnover is about USD 15 billion. The exchange provides a possibility of the cryptocurrency exchange and maintains marginal trades. Two-factor authentication is provided for security purposes. Five types of orders are available for a trader:

- limit;

- market;

- a stop order for buying/selling when a price reaches a certain level;

- a stop limit, which cancels another stop order at execution;

- a FOK order, which is cancelled if it cannot be executed in case of insufficiency of the opposite volume.

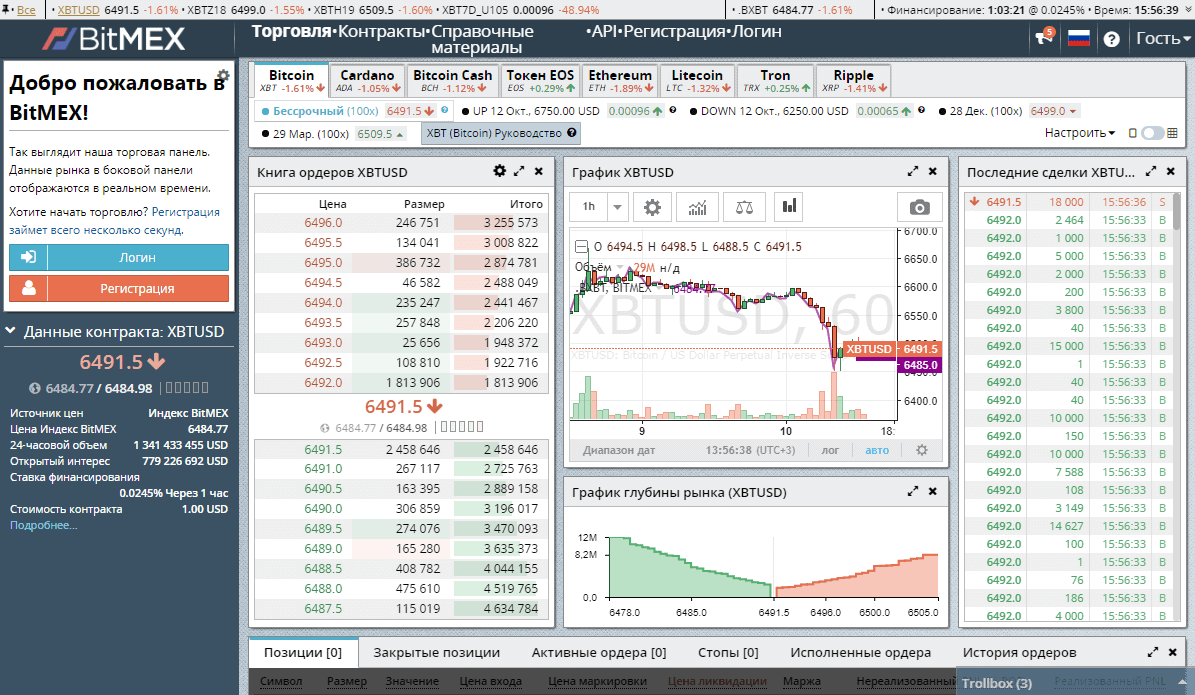

BitMEX

It’s site https://www.bitmex.com. The exchange was founded in 2014 by the bankers Arthur Hayes, Ben Delo and Samuel Reed and registered under the name HDR Global Trading Limited on the territory of the Republic of Seychelles.

The exchange offers a possibility to trade futures contracts with the credit support in bitcoins. All profits and losses are recorded in bitcoins only and payments are performed in bitcoins. BitMEX offers the credit leverage of 1:100 for some products. The exchange provides a possibility to trade both perpetual and forward contracts. There is also a possibility to use special Up or Down contracts, which are similar to Call and Put options, which could be used to hedge risks. Two-factor authentication is provided. The exchange actively attracts market makers in order to provide liquidity.

Apart from standard market, limit and stop orders, the exchange provides a possibility to use advanced orders:

- hidden orders, which are not reflected in the order book, but work as a limit order;

- iceberg orders, which allow hiding one part of it in the order book and displaying the rest in the order book;

- a trailing stop order allows a position trailing if the price moves in a strong impulse until the movement stops. It is convenient for making a maximum profit on strong impulse movements. The order triggers when the impulse decays and the reverse movement starts;

- a post only order does not consume market liquidity, but is used by market makers for creating liquidity in the order book, and market makers get remuneration for such orders.

The BitMEX exchange has demonstrated a high resilience to hacking attacks and there have been no cases of theft of funds from the exchange.

Binance

It’s site https://www.binance.com. The exchange is based in Hong Kong and Tokio. It was founded in 2017 by Changpeng Zhao who previously headed the development department in blockchain.com. The exchange gained its first popularity due to low commission fees and big turnovers. There are more than 100 coins, of which more than 300 currency pairs were made, in the listing of the cryptocurrency exchange. The exchange offers its own internal token, called BNB, to its participants. The exchange provides reduction of its commission fees for the token holders.

CRYPTOCURRENCY TRADING ON THE EXCHANGE – CONNECTING

Each exchange has different trading modules, which often are not convenient, both for market analysis and for active and professional trading. In fact, it would be more practical to assess the cryptocurrency markets and perform operations in them through the ATAS Crypto platform, which provides a full range of instruments for efficient cryptocurrency trading.

Application of ATAS Crypto gives a number of advantages:

- a common trading module for all exchanges;

- a flexible navigation;

- a possibility of the volume analysis of cryptocurrencies;

- customizable protective strategies;

- application of unique indicators

- common statistics.

In order to connect the trading module of the ATAS Crypto platform to a cryptocurrency exchange, it is necessary to adjust a connection between the through API.

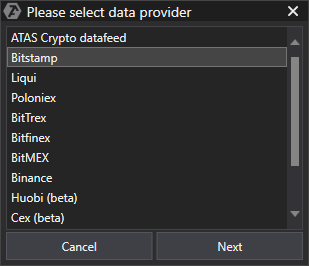

The ATAS Crypto platform provides a possibility to connect to APIs of the following exchanges:

- Bitstamp;

- Liqui;

- Poloniex;

- BitTrex;

- Bitfinex;

- BitMEX;

- Binance.

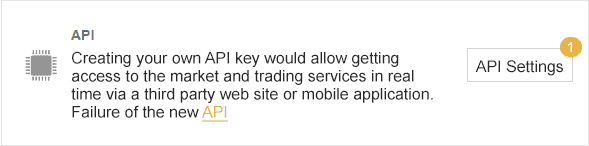

Let us assume that you plan to trade on Binance. In the picture below you can see the entrance into API settings in your personal account:

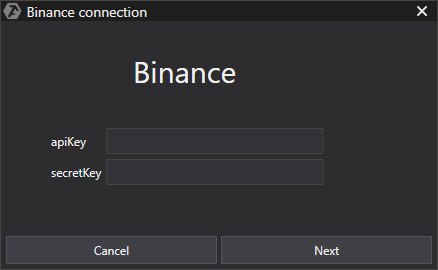

Go to the API menu item Settings and find the Create New Key option. The system would automatically create two unique digital keys (apiKey + SecretKey), which you just copy and paste into ATAS Crypto.

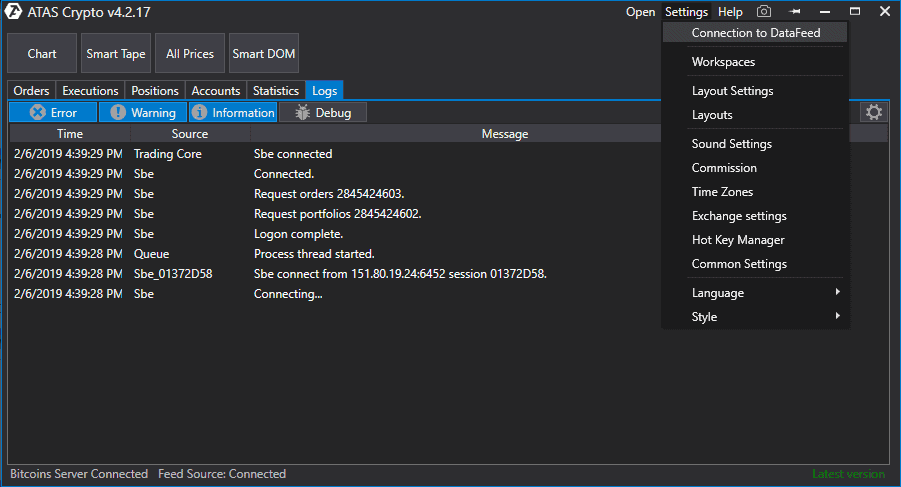

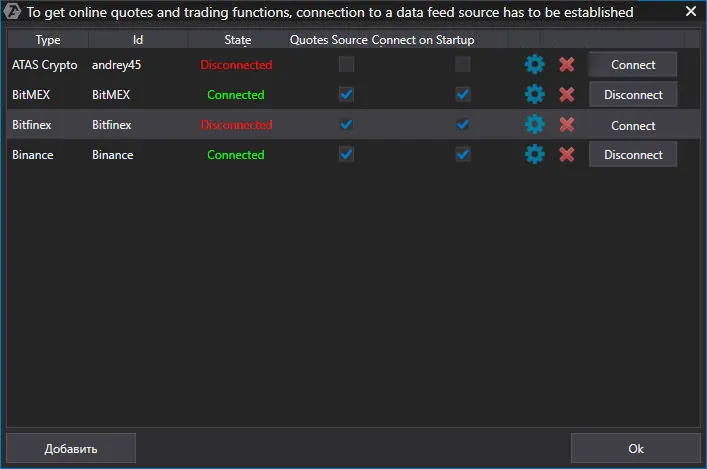

To accomplish it, go to ATAS Crypto. Select Settings in the menu of the main window and go to Connecting Trading and Quotation section:

ATAS Crypto datafeed is a universal quotation source for all currency pairs independent of their exchange belonging, however, you will not be able to trade in this mode from the platform. This source is good only for the analysis of the flow of orders, quotations and charts.

Select your exchange (Binance in our case) and press Next:

Insert your keys in this window and press Next:

The exchange will appear in the list of connections. Press the Connect button and the connection Status shall change to Connected in several seconds, which means a successful connection to the exchange.

CRYPTOCURRENCY TRADING ON THE EXCHANGE – SELECTING A CRYPTOCURRENCY PAIR.

Instrument volatility is one of the main criteria for cryptocurrency trading. For example, the BTC/USD pair has volatility of about 5% and the distance between daily lows and highs quite often is about USD 300-400.

Instrument liquidity is the second important criterion. Selection of an instrument with a maximum density of trading orders would protect your stop loss orders from slippage in the event of absence of liquidity. The BitMEX example shows that each price level has limit orders, which testifies to a high density of limit orders.

You can find information about trading volumes at special aggregators. For example, the coinmarketcap.com site allows formation of a volume rating for each currency or exchange.

Availability of a solid foundation under a cryptocurrency is the third criterion for selecting a trading pair. This foundation could be assessed by the following factors:

- the currency applicability;

- the project behind the coin;

- the team of developers and management;

- the news background influence;

- availability of major institutional investors;

- important upcoming events.

High-quality solid foundation generates interest in a coin from the side of investors, which increases the probability of holding the coin within the boundaries of supply and demand. In the event of absence of a proper solid foundation, the asset could be thrown out of the market with zeroing its value.

Cryptocurrency trading on the exchange – types of accounts.

As a rule, the cryptocurrency exchanges provide several types of accounts:

- exchange transactions account;

- marginal account

- financing account.

The exchange transactions account is designed to carry out the exchange of cryptocurrencies between themselves and with participation of fiat currencies (such as USD, RUB, UAH, etc.) with further withdrawal of the funds to own banking account.

The marginal account allows trading with a leverage. The leverage size is different on different exchanges. For example, Bitfinex provides a leverage approximately equal to 1:3 and the BitMEX leverage could be 1:100. This type of account is for traders that use speculative trading with the aim to make money.

The financing or funding account envisages a passive income for the owner of the funds. This account is like a bank deposit – you get interest for keeping money on the account and the exchange lends your coins at interest to other market participants for cryptocurrency trading.

Cryptocurrency trading on the exchange – how to open trades and develop a protective strategy

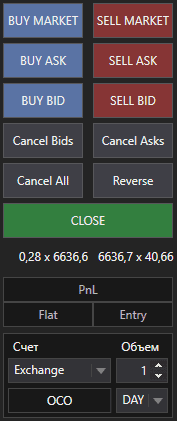

In the event you activated account management through API, it is necessary to activate the trading module in the ATAS platform. To do this, click Chart Trader in the chart window and the trading module appears to the right.

A convenient feature of the module is a possibility of performing trading operations directly from the chart. To activate this mode, it is necessary to set On in the respective section of the trading module.

The trading module envisages the following operations:

- buy/sell market – offering a market order for buying/selling, which would be executed at a better prise;

- buy/sell ask – offering a limit order for buying selling at the ask price;

- buy/sell bid – offering a limit order for buying/selling at the bid price;

- Cancel Bids/Asks/All – cancelling orders, which were placed at the bid/ask prices, or all orders;

- Reverse – reversal of the position; for example, a long position will be closed and a short position, with the same volume and at the current price, will be opened;

- Close – closes all open positions independent of whether they are profitable or adverse and removes all orders.

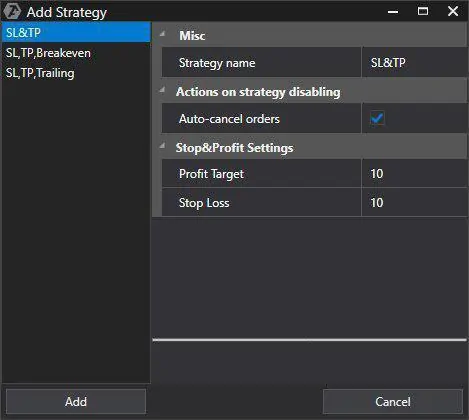

In order to build a protective strategy, you need to add, in the trading module, your protective strategy, three types of which are provided by the platform:

- SL&TP – when a position is opened, take profit and stop loss orders are placed, when one of them triggers, the other is cancelled automatically;

- SP, TP, Breakeven – this protective strategy is similar to the previous one with the difference that if the price moves to the profit area, the stop loss will be shifted to the area of position opening, which allows minimization of losses in case of a negative scenario;

- SP, TP, Trailing – the strategy envisages the TP order trailing of the price if it moves towards increase of profit, but if the price rolls back to the specified value, the position is closed. This strategy is convenient for catching a maximally possible movement of the price with consideration of its inertia.

5 RECOMMENDATIONS FOR A CRYPTOCURRENCY TRADER

1. Always take security and reliability issues into consideration when selecting an exchange.

Hackers stole BTC 850,000 from the MtGox accounts in 2014. The exchange management filed for bankruptcy and the users never got their money back. We understand that you cannot look into the exchange code and are not acquainted with the exchange personnel. However, you can and you must use a complex password, set the two-factor authentication and get acquainted with reports about the exchange performance. For example, in spite of availability of a strong security system, BTC 120,000 were stolen from the Bitfinex in 2016, however, the exchange took action to compensate funds to victims. This incident demonstrated the exchange attitude towards its clients and enhanced its reputation.

2. Assess trading instruments by fundamental parameters

The following are the ones:

– applicability and novelty of a proposed project, which is behind one or another coin;

– decentralization of the system;

– availability of white papers (activity memorandum); check fulfillment of promises previously announced by the management;

– availability of a strong team and well-known persons increases reliability of projects; well-known developers ensure sustainable project development. Ignore projects that are realized by unknown persons;

– availability of unique content and design on home pages of projects indicates serious financial investments and expectation of return after their realization;

– footprint of projects in social networks, frequent publications in social networks, maintenance of a dialogue with investors – all this shows interaction of the project authors with investors and their interest in development and promotion of the project;

– assess the news background influence on the coin value; low influence of the negative news background speaks about the coin resilience.

3. Trade instruments with maximum trading volumes and high volatility

Such tools will create better trading opportunities, both for intraday and mid-term trading.

4. Build your own unique working space in the ATAS Crypto platform

It will provide you with a possibility to:

– follow movements of major limit orders in the order book;

– analyze support and resistance levels;

– set correlations between cryptocurrency pairs;

– filter spreads.

Let us consider organization of the working space using the following example:

In this case, the working space is organized in such a way, so that to:

– keep track of major traders on the Bifinex exchange and build support and resistence levels (1st chart: the BTC/USD pair and the Cluster Search indicator);

– analyze behavior of limit orders on the BitMEX exchange (2nd chart: the BTC/USD pair and the Dom Levels indicator);

– determine support and resistance levels on the Binance exchange (3rd chart: the BTC/USD pair and the Dom Levels and Big Trades indicators);

– analyze reaction of the ETH/USD pair to movement of the BTC/USD pair.

5. Use unique platform indicators.

Such indicators as Cluster Search, Big Trades and Dom Levels have flexible settings and will be useful for a search for support and resistance levels. It would be useful for those who have started to use the platform features recently to use ready-made templates for the ATAS Crypto platform, which are available at this link. Specific features of search for major traders on the Bitfinex exchange are already taken into account in the templates for the following currency pairs:

- BTC/USD

- BCH/USD

- ETC/USD

- ETH/USD

- LTC/USD

- ZEC/USD

Download the ATAS-Crypto right now free of charge. The whole cryptocurrency trading world will be in front of your eyes as early as in 5 minutes!