Optimism came back to the world markets after a short retracement. More and more investors believe in the brighter future. Donald Trump, who outlined one more stimulus program in the amount of USD 1 trillion, supported the positive mood. Meanwhile, we observe a paradoxical situation – beginner traders with simple strategies definitely outperform big time Wall Street operators. The growing confidence of investors also inspired a renewed interest in IPO (Initial Public Offering) and brought Zoom securities at the next highs. Nobel Prize Winner Robert Shiller described main versions of the current developments. Some of them are astounding.

Traditionally, we start with consideration of the most important events of the next week.

Content:

- Calendar of economic events

- Statistics and Trump promises supported the market

- How ‘robin hoods’ outperform Wall Street wolves

- IPO market revives. What is known about the champion of the year?

- New high of Zoom stock

- Robert Shiller named the main stock growing theories

Calendar of economic events

| Date | Event | Impact |

| Monday, June 22 17:00 Moscow Time | United States. Selling houses in May. | S&P 500. USD. Expected – 4.38 million, previous value – 4.33 million. |

| Tuesday, June 23 10:30 Moscow Time | Germany. Purchasing Managers’ Index (PMI) in industry for June. | EUR. Expected – 39.2, previous value – 36.6. |

| 10:30 Moscow Time | Eurozone. Composite PMI for June. | EUR. Expected – 25, previous value – 31.9. |

| 11:30 Moscow Time | Great Britain. PMI in the service sphere for June. | GBP. FTSE 100. Previous value – 29. |

| 16:45 Moscow Time | United States. PMI in the service sphere for June. | S&P 500. USD. Expected – 30, previous value – 37.5. |

| Wednesday, June 24 11:00 Moscow Time | Germany. Business Sentiment Index (IFO) for June. | EUR. Expected – 78.3, previous value – 79.5. |

| Thursday, June 25 15:30 Moscow Time | United States. Jobless claims for the previous week. | S&P 500. USD. |

| Friday, June 26 17:00 Moscow Time | United States. Michigan University Consumer Sentiment Index for June. | S&P 500. USD. Expected – 78.9, previous value – 78.9. |

The coming week doesn’t have much of important economic statistics. The main attention of investors will be focused on politician comments and revision of the company profit forecasts for the 3rd and 4th quarters of 2020.

The most interesting statistics will be published on Tuesday. PMI, which is the most relevant leading index, will be published. Special attention of investors will be grabbed by the data from the service sphere, which is the basis of the developed countries’ economies.

On Thursday, investors will look at the dynamics of change of the US jobless claims number. At the moment, it is the main marker of the labour market and the country’s economy recovery. High volatility of futures on the American stock indices is possible.

Statistics and Trump promises supported the market

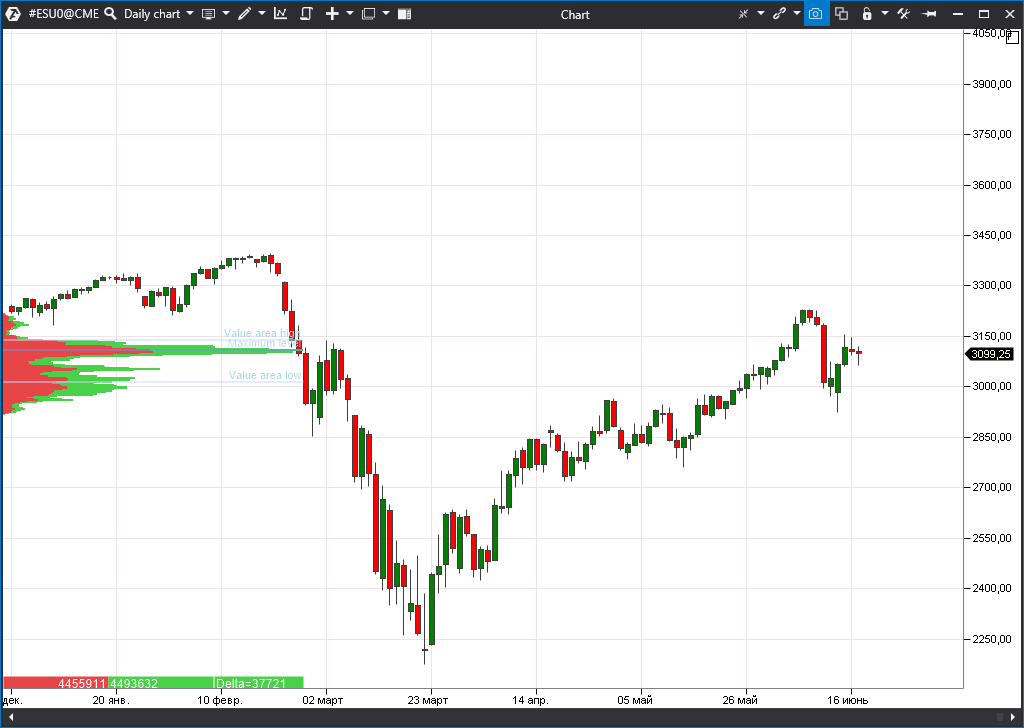

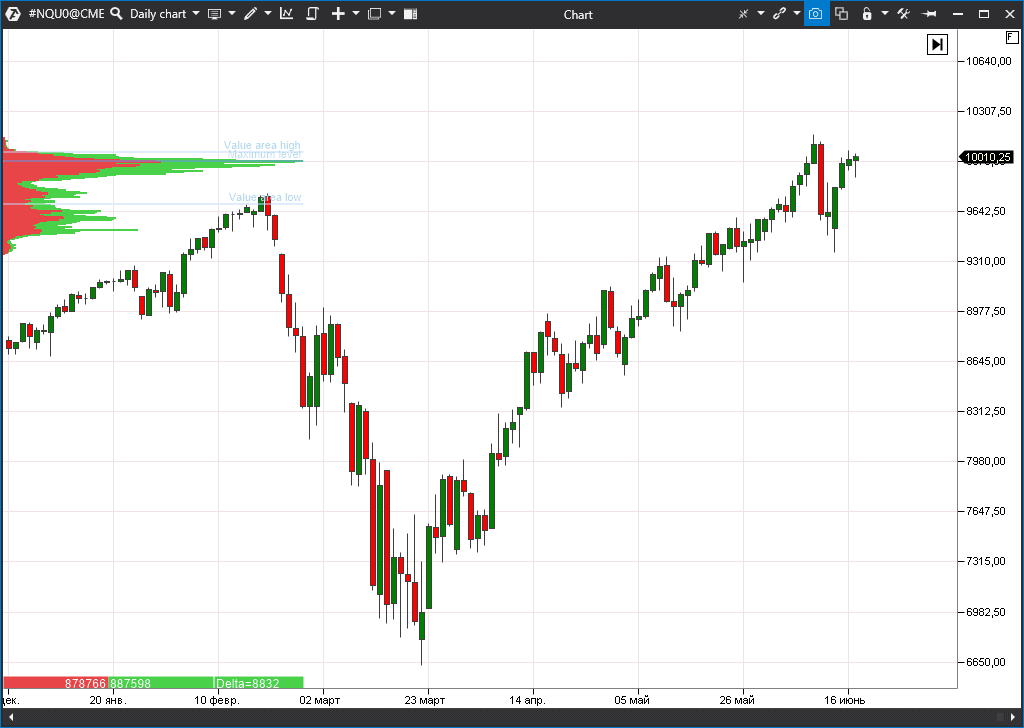

Retracement, which reached its peak on June 11, is gradually fading away. Indices have restored a significant part of losses and investors are waiting for new signals, which would help to identify the further movement direction.

The news are still contradictory. On the one hand, the authorities, which are prodigal of new economy assistance programs, render support to bulls. Thus, some new details of a big plan of the US President Donald Trump became known. The White House wants to allocate around USD 1 trillion for infrastructure development. The question of where to take money from for construction of roads and bridges is still a stumbling point for republicans and democrats. However, both parties are interested in having a good image in the eyes of the electorate on the eve of elections.

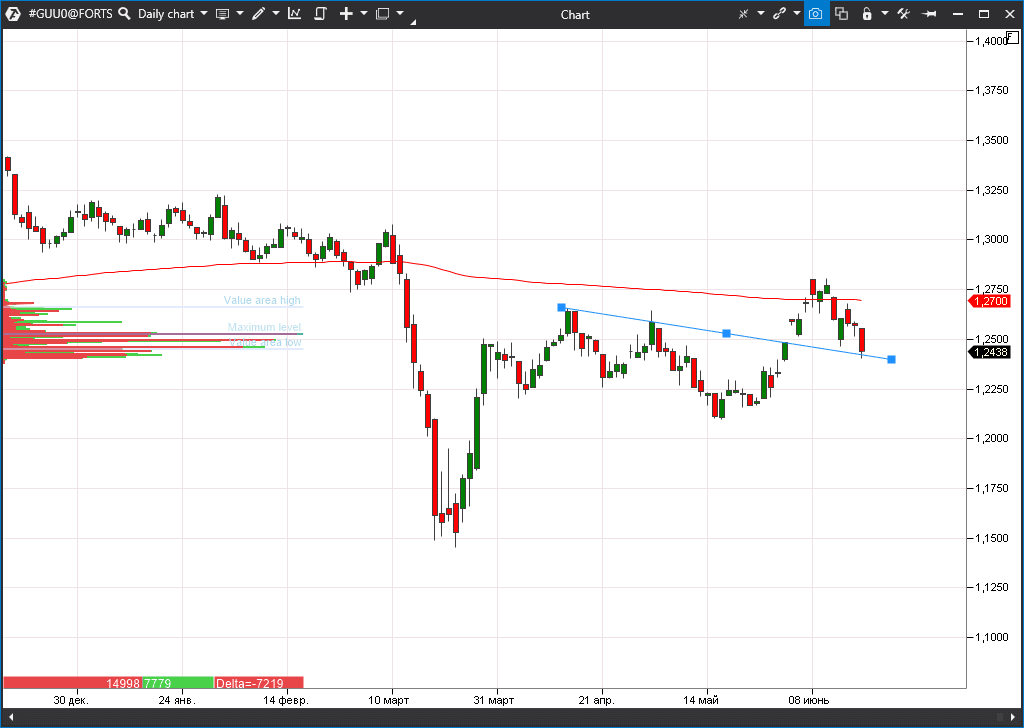

The Bank of England expanded its quantitative easing program (actually, emission) for GBP 100 billion (around USD 125 billion). The program volume will reach 745 billion by the end of the year. Taking into account the size of the British economy, the emission is huge. However, it is absolutely within the modern methods of fighting the crisis by FRS, ECB and Bank of Japan – overflood the crisis with money.

The pound, together with the dollar, reacted by 1.06% drawdown, which made British exporters happy since the cheap currency is very good for them. However, the further reduction is not obvious at all, taking into account synchronicity of the monetary policy of the leading countries.

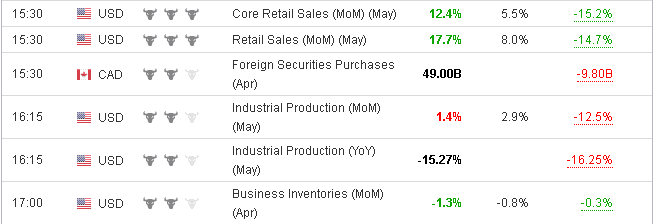

Economic statistics from the US also plays for bulls. FRS and White House stimuli supported not only stock indices but also confidence of Americans in the near future economic recovery. We already wrote that the unemployment growth in May turned out to be lower than it was expected. The news came on Tuesday that retail sales have grown by 17.7% during the month, which is much better than the analysts forecasted.

However, there is a fly in the ointment. There is still a reduction of sales by 6% compared to the previous year. The industrial sector is not in the best shape. Economists call such a slow growth ‘the dead cat bounce’.

Too high expectations of the market participants present the risk for the markets. Bulls believe that, after the fall of corporations profits in the second quarter, there will be a very fast recovery. Revision of forecasts for the worse may easily kill their inspiration.

Coronavirus is also still here. Quarantine measures easing leads to new waves of incidence. Experts believe that it would take around a year to conduct clinical tests and produce the vaccine. During this time, whole economic sectors, such as tourism and passenger transportation, will stay at the edge of survival. However, there is no talk about coming back to the total lockdown. Economic catastrophe is not less awful than the health care catastrophe.

How ‘robin hoods’ outperform Wall Street wolves

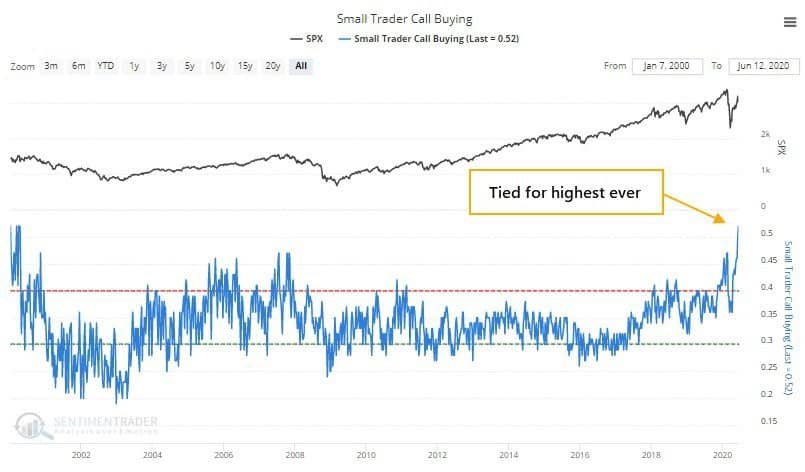

The strongest growth in the US stock market history, which started at the end of March 2020, gave birth to an interesting phenomenon. ‘Robin hoods’ became real kings of the market. If we take the yield only for this short period of time as the success criterion, they utterly defeat authoritative hedge funds under leadership of acclaimed gurus of the financial markets.

Robinhood online broker. According to statistics, the tactics of the majority of them is very simple – they use all their money to buy call options. The growth stake of beginners became the biggest one since the dotcom bubble crash. Also, ‘robin hoods’ are not afraid of opening longs in the most risky companies, which are at the stage of bankruptcy or are overloaded with huge debts.

The straightforward options strategy helped many traders to earn hundreds percent, while the Bridgewater Capital fund under the management of legendary Ray Dalio lost 15% and Renaissance Technologies of the outstanding mathematician and algotrader James Simons lost even more – 21%. For many years Renaissance had been the US market leader in the profit-making capacity (on average – 66% annual before taxes from 1988 until 20018). Simons himself bears the unofficial title of the best financial manager of all times.

Could it be that ‘robin hoods’ found the legendary ‘Golden Grail’ of the stock market and use the optimum enrichment strategy? Could it be that the epoch of complex algorithms has passed?

Really, the tactics of the growth focused game turned out to be quite successful in the current market situation. Moreover, it still may work for several months and the champion of growth among indices – Nasdaq – could well improve its performance.

However, the real trader success is not measured by the ability to earn hundreds percent annual for a couple of weeks. Sometimes, the market is generous and allows even know-nothings to do it. Mastery manifests itself in the ability to preserve what was earned and make money year after year how Renaissance Technologies did.

In this context, there are good chances that professionals would continue to flourish even in 5-year time, when only a few ‘robin hoods’ will be able to preserve their deposits from the complete blow up. In order to understand better how unsteady success is and how more important the yield stability is than short-term results, we recommend you to read the book of the options trader Nassim Taleb ‘Fooled by Randomness’. It is also useful to remember the stock market crash history in the 21st century, to which an individual article is devoted on our web-site.

IPO market revives. What is known about the champion of the year?

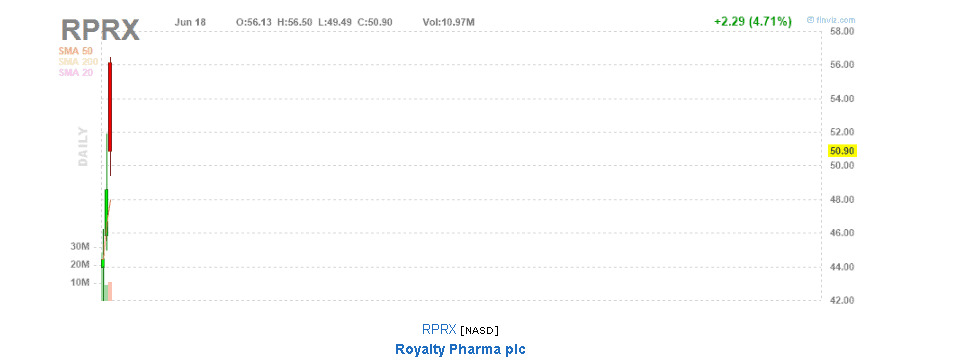

The FRS liquidity inflow and restoration of investor confidence made it possible for the IPO market to revive. June 16 brought news about the biggest initial public offering in 2020. The biopharmaceutical Royal Pharma Plc company, which attracted a total USD 2.2 billion, achieved success. Allocation of 77.7 million shares has been done at the average price of USD 28 per share. By the cost of allocation, the company capitalization reached USD 16.7 billion.

Royal Pharma was founded in 1996. The main direction of its activity is financing innovations in the biopharmaceutical industry. The company income is built on the royalties from investments in other projects. The company also buys royalties from the original prospective medicine right holders.

Renaissance Capital analysts called the company ‘highly profitable and generating a powerful cash flow’. It is expected that the dividend yield of the stock would be 2.3% annual, which is better than the yield of American Treasury Notes (less than 1% annual).

Royalty Pharma stock (ticker: RPRX) trades started on the Nasdaq exchange on Tuesday, June 16, at a much higher level than the allocation price – USD 42. The stock price doubled in the course of the June 18 session and the peak was USD 56.5 while trades closed at USD 50.9.

Traders need to remember that the chart rarely shows real balance of demand and supply during the first days after the trades started. Some investors, who failed to take part in the IPO, are in a hurry to buy, when some stock holders get rid of them while the prices are ‘hot’. It would be possible only in a couple of months to say how the market really assesses the company and what multipliers it has.

We want to note that the previous IPO record of the year 2020 belongs to Warner Music Group Corp, which attracted USD 1.9 billion before the crisis.

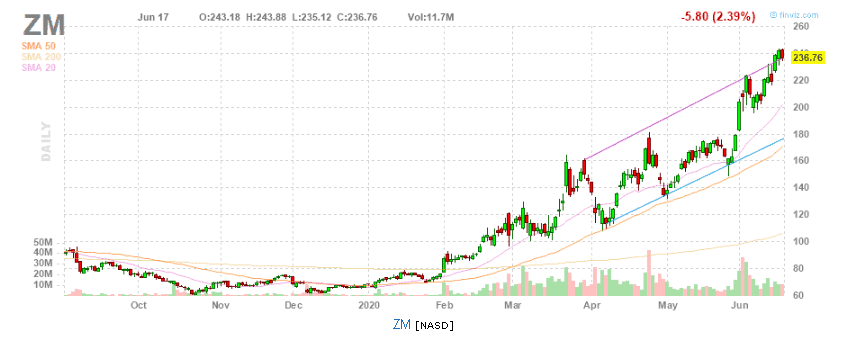

New high of Zoom stock

The real star of the stock market in 2020 is Zoom – a developer of the service of group video chats. The company carried out the IPO a bit more than a year ago. Its capitalization at that time was USD 16 billion, which already was considered to be a big achievement.

However, the coronavirus epidemic allowed Zoom (ZM) stockholders to win big. As it usually happens, even if the whole world suffers, there always would be a lucky one who takes it all. Demand on Zoom services provoked a sharp increase of the stock value. The price increased from USD 68 to USD 238 from the year beginning (as of May 18, 2020). A new wave of buys has been observed the past few weeks, which resulted in a price leap. The company capitalization already reached the fantastic USD 65 billion.

We want to note that financial Zoom indicators grow much slower than the stock prices. The buyers included the whole possible positive attitude in it. The ‘buy and do not think’ strategy could be very dangerous in such a competitive market where technology giants Google and Microsoft are among the main competitors.

Nobel Prize Winner named main stock growth theories

While ‘robin hoods’ buy and the market gurus make losses, people try to explain the record-breaking rally in stocks. Some versions look quite exotic. The Nobel Laureate and classic of behavioural economy Robert Shiller combined 6 growth theories, which are popular among investors at the moment.

We want to remind you that Shiller is the author of the classical study of market bubbles – Irrational Exuberance – in which he carried out a boom ‘trepanation’ workshop in the real estate and stock markets in the second half of the 1990s.

So, how they explain the discrepancy between the state of things in the economy and stock prices during the 2020 crisis. In total, Shiller collected six variants:

- The theory of super-bored Americans. Americans just have nothing to do due to coronavirus. All entertainment establishments, including casinos and bars, are closed. Beginner traders open trading accounts and buy stocks en masse, that is why stocks are growing. The main argument of this theory supporters is that 800,000 new trading accounts were opened in the US after the pandemic started.

- Corporate America has immunity against the crisis. Only small businesses, such as bars and restaurants, suffered from the crisis. The theory supporters believe that any crisis is a piece of cake for such companies as Apple and Microsoft.

- The almighty FRS theory. They believe in the market that stocks will grow while FRS prints money. Shiller himself believes that the Central Bank’s role is greatly exaggerated.

- FOMO (Fear Of Missing Out). The psychological effect called FOMO results in a situation when more and more investors try to catch up with the leaving train.

- TINA (There Is No Alternative) theory. Due to the fact that profitability of state bonds fell to nearly zero values, investors have very few variants for saving their capitals. The theory supporters are sure that the stock market looks just about the only decent option.

- Efficient Market Hypothesis (EMH). This theory has been popular among economists for decades. Its main postulate is that the asset price takes into account everything. The market operates as a super-efficient mechanism where investors make optimal decisions. Shiller himself is sure that it is not so. He tries all his life to prove that the efficient market hypothesis is a dangerous myth, which is easily refuted by facts.

We want to underline that Shiller doesn’t try to explain the market, he just stated the versions of the current developments, which are proclaimed by business mass media and analysts. Some of these hypotheses are quite logical, although they cannot be regarded to have the forecasting power. In fact, nobody, including Nobel Laureates in Economics, knows the future market. There are too many unknown variables in this equation. Investors just have to act in accordance with their plans, adjusting the strategy in the course of the situation development.

We want to end this article with the words of legendary Warren Buffett: “Only when the tide goes out do you discover who’s been swimming naked”.