What to invest in? Ideas for a small capital

It is impossible to provide yourself with financial independence and stability in the modern world without regular investment of a part of your income. The earlier a person realises this fact, the higher his chances are to acquire wealth in the future.

Besides, many potential investors are discouraged by a wide-spread myth that investing is the domain of some wealthy elites. In fact, financial markets allow starting to invest when you have not more than USD 1,000. No, we didn’t miss zeros! You can start even with this small amount. Well, as regards your prospects, they will depend on how patient and consistent you are.

So, let’s discuss what you can invest in without having huge capitals. We decided to analyse the US stocks, cryptocurrencies, primary commodities and bonds.

Option 1 – the US stocks.

It goes without saying that the US stocks are considered to be the unofficial champion in the context of financial investments from private investors for a good reason. The matter is that namely the American market is the most liquid and diversified one and it shows the most stable growth during the past hundred years.

According to the Bank of America, the inflow in ETF and mutual funds, which invest in stocks, reached USD 56 billion per week in March 2021. There is no other stock market in the world, which is able to accept such a gigantic amount of money for such a short period of time.

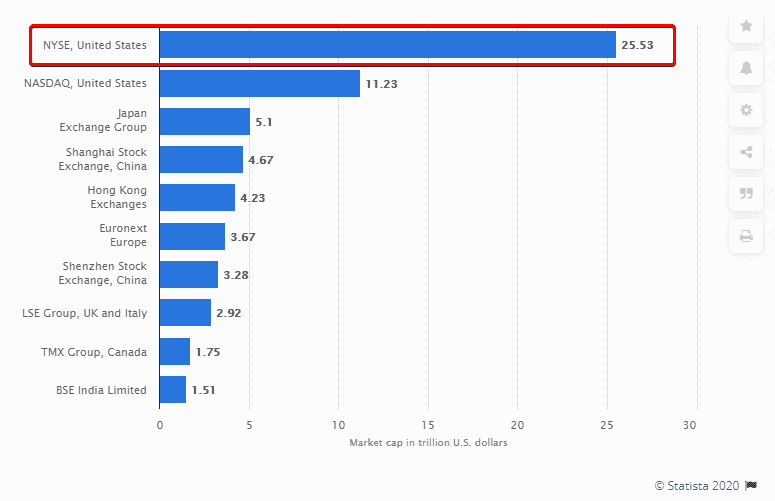

Minimum 2-3 thousand rather liquid stocks are traded on the New York Stock Exchange (NYSE) in all branches of the world economy, which satisfy requirements of investors with any type of preferences. The general capitalization of stocks on the NYSE is times bigger than that of all competitive exchanges.

What profitability can you count on?

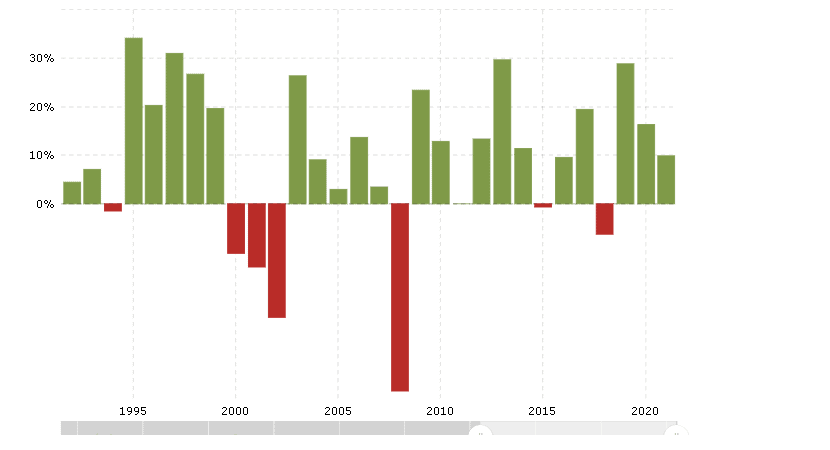

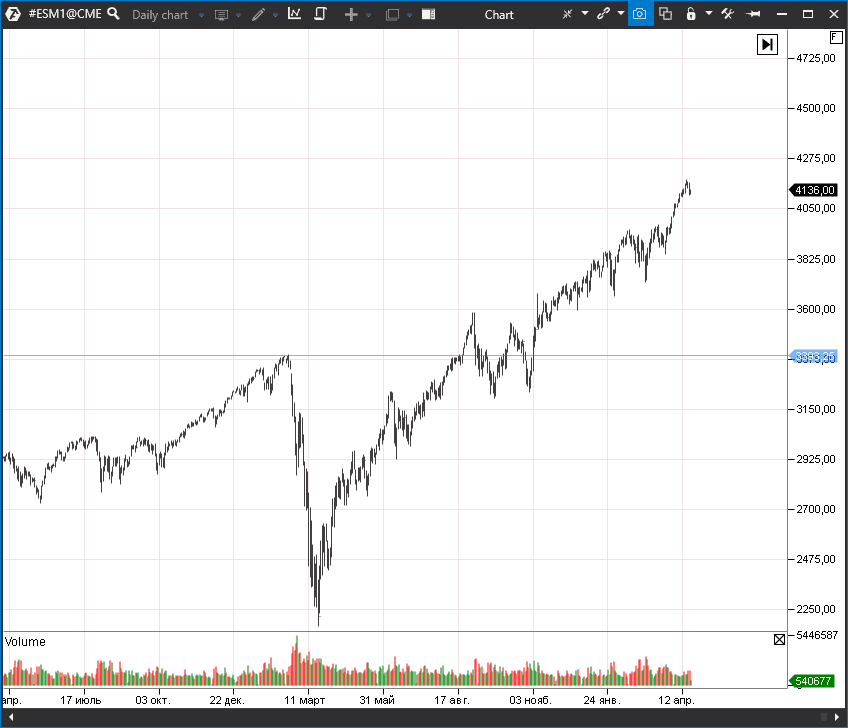

Historical growth rates of the S&P 500 index constitute 9.2%, and they even were higher than 11% during the past 2 decades. Of course, the markets sometimes fall but bearish phases are usually more than outweighed by the subsequent growth.

The S&P 500 index grew by 16.3% in 2020 even despite the corona-crisis. The matter is that the main world printing press is located in the United States. The Federal Reserve (analog of the US Central Bank) repeatedly demonstrated its ability to throw money at any crisis, which gives investors more confidence than in the developing markets.

What amount can you start with?

A majority of international brokers, who offer access to the US stock market, do not impose constraints on the minimum deposit volume. It could be any amount, which justifies your time investments.

Even if you have USD 1,000 only, investment choices are rather numerous. You can buy index ETF or cheap stocks. Many brokers offer stock splits. If you do not have enough money to buy one whole stock of an expensive company, such as Amazon (AMZN), you can buy a stock split.

What stocks to invest in for the rest of 2021?

You can study the topic of how to compose a stock portfolio in more detail, however, many influential investors, including Warren Buffett, recommend starting from investing in index ETF. The matter is that independent portfolio composition requires deep study of financial analysis and even many big funds sometimes fail to outperform indices by yield.

Index ETF is, in fact, a deeply diversified portfolio. For example, the S&P 500 index includes companies from all major sectors of the US economy, while the Dow Jones index includes industrial giants and Nasdaq index includes major technology companies. ETF on these indices completely repeat their structure and are regularly balanced by professional managers.

There are also ETF in the US market with low commission fees for management (usually less than 0.5%), which help to invest in various economic trends from speculative startups and aerospace companies to blue chips.

Option 2 – cryptocurrencies.

Despite its high volatility, bitcoin could be a part of a modern investment portfolio. The cryptocurrency made a huge step forward in 2020-2021 towards mass adaptation in the traditional financial markets. Some investment funds and private companies, including Tesla (TSLA), already invested some of their funds in it.

Although the bitcoin capitalization exceeded USD 1 trillion in 2021, many big investment funds, including Fidelity, believe that we are only at the beginning of accepting cryptocurrencies as a new class of assets.

Besides, it looks like bitcoin gradually replaces gold as an asset, which protects from inflation and devaluation of classical fiat currencies, such as the Dollar and Euro. The matter is that the issue of this cryptocurrency is predictable and only reduces year after year. It creates a deficit, which pushes prices up in the long run.

What cryptocurrency to invest in?

Bitcoin is the main cryptocurrency, the price of which sets dynamics of other coins and tokens. That is why diversification in this market makes little sense. Of course, you can try to buy another cryptocurrency but it will increase rather than decrease your portfolio risks.

What amount can you start with?

There are no strict limits for a minimum investment in this market. You can buy a small part of a bitcoin even with USD 10-20. The question is whether such an acquisition makes sense. It is preferable to start with at least USD 1,000 to have a more or less meaningful result.

What profitability can you count on?

On the average, bitcoin has grown by 230% a year during the time of its existence. However, it is important to understand that the existing historical data are insufficient for development of a more trustworthy picture, since this asset was born only in 2009. At the same time, it will be very difficult for bitcoin to maintain such growth rates with the growth of its capitalization.

Cryptocurrency is still very volatile. You may have big losses if you trade during unlucky periods. There were times when bitcoin lost up to 70% of its value during short periods of time. And although the price finally always returned back, quite a few investors failed to recover after such shocks.

However, there is also good news. Perhaps, volatility will be reducing with the price growth and adaptation in traditional finances. Some well-known Western investment companies, including Goldman Sachs and Fidelity, already offer bitcoin to their customers. Moreover, the market of cryptocurrency derivatives received a boost during the past 2 years, which allows investors hedging risks more accurately.

Option 3 – commodity markets.

Demand on primary commodities increases on the wave of the economic recovery, which pushes the prices up. Thus, the copper prices increased during the year after March 2020 by nearly 2 times. Iron ore, nickel, aluminium, oil and many agricultural commodities have significantly grown in price during this time.

They believe in Goldman Sachs that underinvestment during the past few years is an additional factor in favour of the primary commodity price growth in the future, which leads to a deficit in many commodity groups. The largest currency issue in world history by the biggest world countries also keeps prices high.

What profitability can you count on?

The commodity prices are volatile. You can either make several dozens of percent or lose them if you get into a retracement. Surprises are not rare here, as it is the case with cryptocurrencies, that is why it is better to invest a small part of your capital in them, taking into account long-term goals.

What is the entry threshold?

The most affordable variant is ETF with a focus on the purchase of commodities or commodity company stocks. There are a lot of them in the US market. There are funds that invest in gold, silver, oil or industrial metals. You can start with even USD 1,000, which makes such investments popular even among minor investors.

Option 4 – bonds.

Bonds, especially public bonds, have low profitability but very high reliability. If you have low risk tolerance, then it makes sense to invest some of your funds in public bonds.

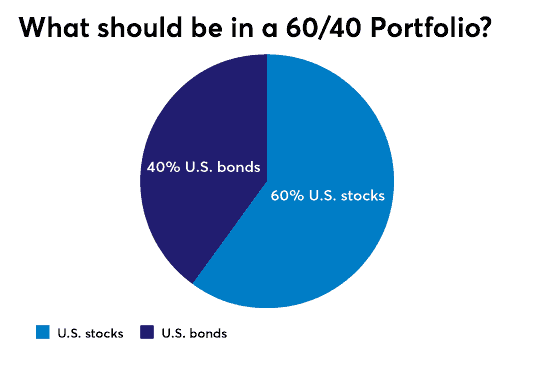

The 60/40 investment scheme was very popular in the United States for quite a long time. It means that investors direct 60% of their funds in stocks and 40% – in bonds. Some influential investors, including Ray Dalio, recommended in 2021 to reduce the bond share due to a low profitability and excessive control of the market by the government.

What amount can you start with?

The bond investment entry threshold usually starts from USD 10,000. You can find even cheaper offers, but brokerage companies would ‘eat’ in such a case a significant part of the already low profitability. As always, ETF can help us out. In such a case, the entry threshold could be reduced to USD 1,000.

What profitability can you count on?

Do not expect high profitability from bonds. In a best-case scenario, you will be able to cover the Dollar inflation. Thus, profitability of the 10 Year US Treasury bonds was about 1.5%-1.6% in the second half of April 2021. Profitability of Russian treasury bonds, denominated in USD, fluctuates within the range of 1.2%-2.4%.

Of course, you may look for eurobonds of countries with lower credit ratings and higher risks, but is it worth it? It is very difficult to conduct a full-fledged assessment of such securities risks if you are not a professional. The same is true for corporate bonds.

4 main secrets of successful investing

As we already successfully proved, you can start investing even if you have USD 1 thousand only. In case you have USD 3-5 thousand, you can start considering the formation of a portfolio. So, the main secret of successful investments definitely is not availability of a huge capital!

In fact, there are 4 main secrets:

Aspiration. If you already realised that investing today is the key to your wellbeing tomorrow, you will definitely find a small amount of money to start with. Even the biggest investment portfolios started from small investments.

Consistency. Of course, USD 1-5 thousand is sufficient for beginning but not sufficient for ambitious goals in the long run. That is why consistency plays the key role in achieving success. If you set the rule to transfer a part of your income for investment purposes every month, you may have a significant capital in several years.

Patience. The magic of compound interests lies in the fact that reinvesting accumulates your capital in progression. However, you need time for achieving the desired result.

Curiosity. It goes without saying that the investor’s life is a non-stop search for opportunities. Cryptocurrencies are a hot issue today, however, in 10 years, they could be replaced by new biotechnologies or aerospace companies. You should always monitor the market dynamics and new trends in order to be always aware of what it is more profitable to invest in.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.