What should you learn about an IPO before investing

Investments in IPO is one of the ‘hottest’ types of investment in 2020-2021. However, a high profitability potential, as it is often the case, goes along with high risk. Companies are often overestimated due to high demand and big volume of free liquidity. In this article, we will discuss where to start investing in an IPO and what prospects and risks, which should be taken into account, are. We will also discuss main possibilities of participation for private investors.

What is IPO?

Initial Public Offering (IPO) is a public sale of the company stock. In the process of IPO, a joint-stock company sells its stock to a wide circle of investors through subscription. Recently, such an IPO mechanism as direct listing on a stock exchange has gained popularity.

A company can attract capital in the course of both Primary Public Offering (PPO) and Secondary Public Offerings (SPO).

The main IPO goals:

- Attraction of additional capital. IPO is one of the most popular and efficient methods of capital attraction in the United States.

- Exit of venture investors from the capital. IPO is often a part of the company roadmap and is a requirement of primary investors.

- The company value increases due to a more objective market valuation.

- Increase of the company status and transparency due to public exposure. Legislative requirements to public companies are higher than to private ones. They are obliged to publish transparent reports, key data and estimates of their operation.

How a classical IPO takes course

Preparation of a company for the IPO often is a rather long process, which requires involvement of a big number of professional participants of financial markets.

Stage 1 – underwriter identification

Underwriters are major professional investment companies and banks, such as Goldman Sachs, JPMorgan Chase and Credit Swiss. They are organizers, consultants and main public relations representatives of an IPO.

Stage 2 – document preparation

In the course of preparation for an IPO, a company develops Prospectus for submission into regulatory bodies. In the United States, it is the Securities and Exchange Commission (SEC). The company prospectus includes all key facts about the company business: financial reports for the recent years, business plans, projects, prospects and risks.

Stage 3 – Roadshow

In the course of the Roadshow, the company management holds meetings with potential investors – pension funds, investment companies, major private investors, etc. In the course of these meetings, investors may receive exclusive information and assess the management competence in face-to-face communication.

Stage 4 – public stock offering

The exchange price, the price at which the stock will start to trade on the stock exchange, is determined after many meetings have been held and demand on the stock has been ‘tested’. Any investor with a brokerage account can buy stock if a company is listed.

IPO investments: main numbers and trends

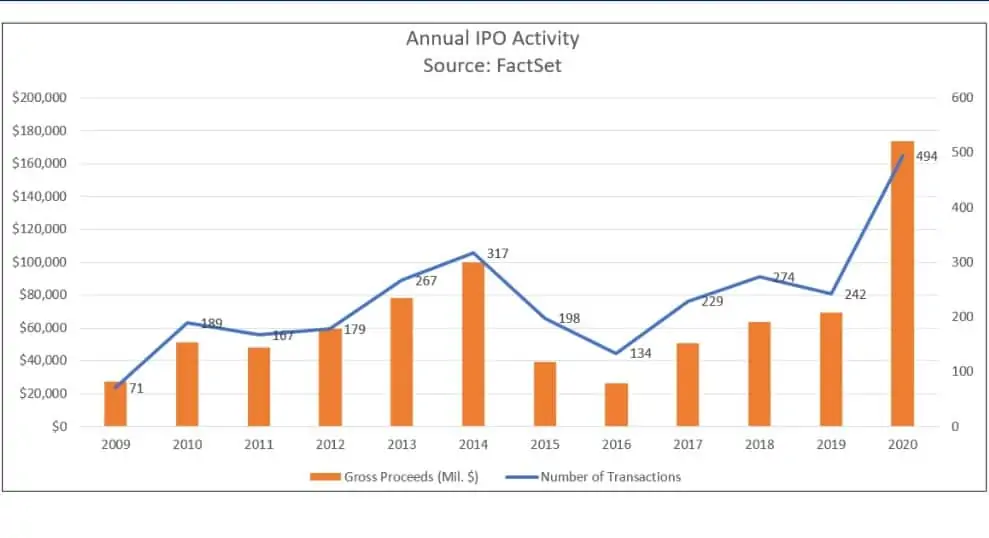

The year 2020 was successful for the IPO market. The boom took place in spite of the economic crisis, caused by the COVID-19 pandemic. It was the result of an unprecedented pumping of the world financial system with liquidity from central banks.

According to Factset, the total number of IPOs in the United States was 494, while a year earlier the number was 242. In general, companies managed to attract USD 174 billion through IPOs, which was 150% higher than the 2019 results.

Besides, an average IPO size reached USD 353 million compared to USD 288 million a year earlier. 28 companies attracted more than USD 1 billion through IPO – the record-breaking result for the whole history.

Stock behaviour after an IPO

Below is a table, which demonstrates stock trading results of the companies, which held an IPO in 2020. We ranked the top 5 companies by gross proceeds during IPOs and looked at their stock prices as of the day of the trade beginning on the stock exchange and as of May 25, 2021. The rating includes only those companies, which held their initial public offerings. Here’s what we got:

| Company | Gross proceeds | Industry | Stock dynamics until May 25, 2021 | Maximum growth for the period until May 25, 2021 |

| Pershing Square Tontine Holdings Ltd. (PSTH) | USD 4 billion | Finance | 16,67% | 58% |

| Snowflake Inc. (SNOW) | USD 3.864 billion | Technology | -7.88% | 68.8% |

| DoorDash, Inc. (DASH) | USD 3.336 billion | Technology | -25.88 | 35% |

| Royalty Pharma Plc (RPRX) | USD 2.501 billion | Healthcare | -8.49% | 27% |

| Lufax Holding Ltd. (ADR) | USD 2.363 billion | Technology | -1.87% | 56% |

Investments in what IPOs succeed? The main secret

Analysts of the Goldman Sachs investment bank conducted an interesting study, in which they tried to establish some regularities in what companies showed good results after an IPO. In total, they analysed 4,481 IPOs during 25 years.

The main concern of investors in the IPO context in recent years are overvalued stocks. However, there is one important secret in the process of selecting assets for investing – stocks of those companies are traded more successfully on the exchange, which showed high sales growth rates before the offering.

Analysts stated: “Starting from 2010, IPOs with the annual sales growth of more than 20% were more likely to exceed the Russell 3000 index during a three-year period than comparable ones with slower rates of growth”.

At the same time, the general age of a company has no significance for its success. Experts calculated that: “An average firm, founded 0-5 years before its IPO, informed about the sales growth by nearly 50% in five quarters after the offering compared to the proceeds growth by 30% for the 5-15 year-old firms and 19% for the firms older than 15 years”.

Investments in IPO: how to participate

Unfortunately, there is no transparent and affordable scheme of participation of private investors with a small capital in IPOs at early stages. As a rule, you need to be a professional investor and to have USD 500 thousand and more.

Some brokers make participation in IPOs easier by means of formation of customer pools, uniting several applications into one. Freedom Finance, Finam and Aton provide IPO investment services among brokers who are active in Russia. The participation threshold starts from USD 2 thousand to USD 50 thousand depending on a broker and issue.

You can find a lot of comments on the Internet that arrangements of the most active player with the most affordable entry threshold – Freedom Finance – are rather non-transparent and investors receive some derivative instruments rather than real stocks. The participation might also envisage a long-term lockup (93 days) – a period, during which the stocks are blocked and you cannot register a profit in them.

You can look for IPO participation with major Western brokers, however, the entry threshold in such a case, most probably, would be USD 50 thousand and higher.

As an alternative variant, you can try participation in an IPO with direct listing on the exchange. In such a case, you will need just several hundreds of dollars and an account with one of the major international brokers. The most recent example of such an IPO is the Coinbase cryptocurrency exchange listing (COIN) on Nasdaq.

What to start investing in IPO from

IPO is a high-risk type of investment, since the market may overvalue a company. Experts recommend not to invest much in one company, since even leading analysts often cannot reliably foresee the stock behaviour. If you invest during a year in 5-6 promising companies, then successful IPOs can easily exceed unsuccessful ones in profitability.

We offer you a step-by-step instruction for participating in an IPO:

- Make an estimate of all important participation aspects: entry threshold, broker terms and conditions details and investment risks. In case you are absolutely sure that participation in an IPO is an affordable idea for you from the point of view of risk and finance, then it makes sense to move forward.

- Attentively analyse lists of companies, which plan an IPO. Many big financial portals, such as Investing, Bloomberg and Yahoo Finance, provide calendars with ratings and expert reviews.

- It is necessary to labour the subject at the expert level and have your own opinion about a company. The main assessment criterion is the dynamics of financial indicators. If the profit and proceeds grow very fast, the overvaluation might be justified. You should also take into account a lot of other factors, such as force-majeure, change of market tendencies, etc.

- Invest only that amount of money, which you can put at risk.

- Diversify your portfolio through participation in several IPOs.

- Execute an agreement with your broker and replenish your deposit with the amount required to start investing.

As we can see, participation in an IPO is not a cheap and simple task. However, if you have sufficient capital, time for analysis and willingness, your profit might compensate for risks.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.