Content

Calendar of economic events

Trump blocked the deal of ‘saving’ the economy

FRS sent a proper signal to the markets

Apple, Amazon, Google and Facebook are threatened with a split

Calendar of economic events

|

Date, Time (GMT+3:00) |

Event |

Impact/forecast |

|

Tuesday, October 13 9:00 |

Great Britain. Claimant Count in September. |

GBP. FTSE. Forecast – 100K, previous value – 73.7K. |

|

12:00 |

Germany. ZEW economic sentiment index in October. |

EUR.DAX. Forecast – 69.8, previous value – 77.4. |

| 14:00 |

United States. OPEC monthly forecast. | OIL. |

|

15:30 |

United States. Consumer Price Index (CPI) in September. |

USD. Gold. Forecast – 0.2%, previous value – 0.4%. |

|

Wednesday, October 14 15:30 |

United States. Producer Price Index (PPI) in September. |

USD. Forecast – 0.2%, previous value – 0.3%. |

|

Thursday, October 15 5:00 |

China. Industrial production in September. |

CNY. AUD. Oil. Copper. Previous value – 5.6%. |

|

Friday, October 16 12:00 |

Eurozone. Consumer Price Index (CPI) in September. |

EUR. Forecast – 0.2%, previous value – 0.3%. |

|

15:30 |

United States. Retail sales in September. |

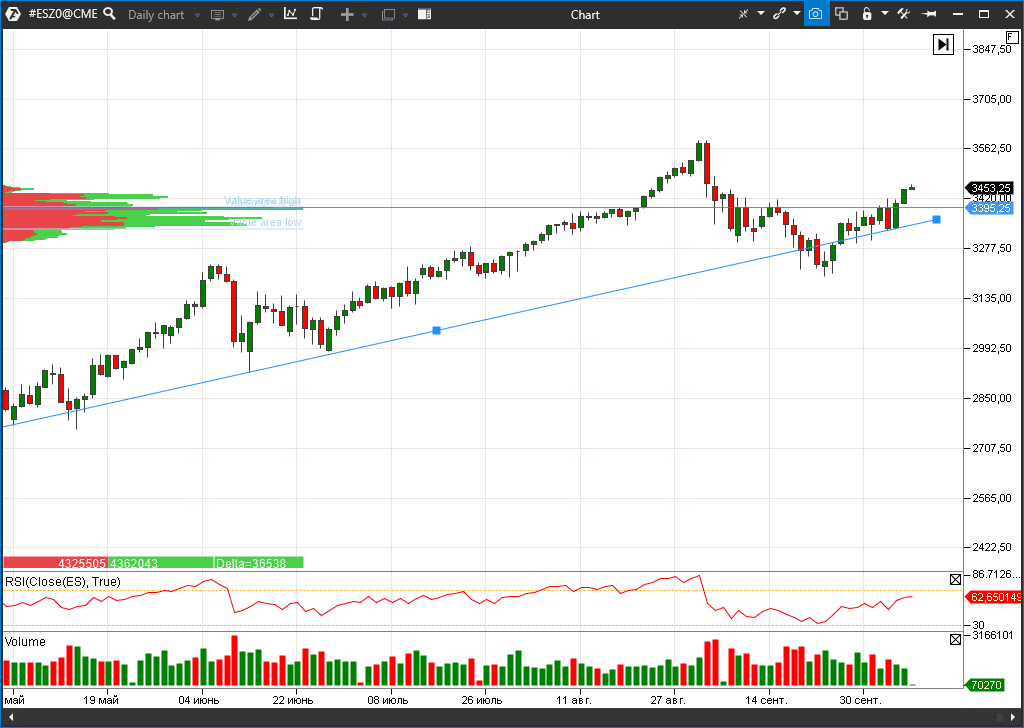

USD. S&P 500. Forecast – 0.5%, previous value – 0.6%. |

|

Tuesday, October 13 9:00 |

|

Great Britain. Claimant Count in September. |

|

GBP. FTSE. Forecast – 100K, previous value – 73.7K. |

|

12:00 |

|

Germany. ZEW economic sentiment index in October. |

|

EUR.DAX. Forecast – 69.8, previous value – 77.4. |

| 14:00 |

|

United States. OPEC monthly forecast. |

| OIL. |

|

15:30 |

|

United States. Consumer Price Index (CPI) in September. |

|

USD. Gold. Forecast – 0.2%, previous value – 0.4%. |

|

Wednesday, October 14 15:30 |

|

United States. Producer Price Index (PPI) in September. |

|

USD. Forecast – 0.2%, previous value – 0.3%. |

|

Thursday, October 15 5:00 |

|

China. Industrial production in September. |

|

CNY. AUD. Oil. Copper. Previous value – 5.6%. |

|

Friday, October 16 12:00 |

|

Eurozone. Consumer Price Index (CPI) in September. |

|

EUR. Forecast – 0.2%, previous value – 0.3%. |

|

15:30 |

|

United States. Retail sales in September. |

|

USD. S&P 500. Forecast – 0.5%, previous value – 0.6%. |

Attention of traders will be attracted by publication of the Consumer Price Index in the United States and EU during the next week. High volatility of EUR/USD is quite possible. Attention should also be paid to the industrial production data in China on Thursday and retail sales in the US on Friday. Good numbers will help to make investors confident in stable recovery of the leading economies.

The hot phase of the corporate reporting season starts on Tuesday, October 13, in the US. Traditionally, the major banks (JPM, С, BAC, GS and MS) will report. Reports will be the main drive in the stock market during the coming 2-3 weeks.

Trump blocked the economy ‘saving’ deal

Political news in the US on the eve of elections bomb the markets so intensely that they make the volatility trading followers smile. Events, which were considered a catastrophe, turned out to be not so dreadful and the market recovers fast.

The same happened with the news about Donald Trump coronavirus infection at the end of the previous week. The same happened with the White House Head statement that Republicans would drop out of negotiations on the second package of social assistance to Americans, which is aimed at supporting the economic recovery. The markets lost 1.5% on Tuesday, October 6, but completely recovered on Wednesday and Thursday. Quotations became greener again on Friday, October 9, morning.

FRS sent a correct signal to the markets

Minutes of the Federal Open Market Committee (FOMC) were published on Wednesday, October 7. Investors received proper signals from the monetary authorities, which allowed markets to grow in the second half of the week.FRS continues to buy assets in the open market (Quantitative Easing) supporting the high level of liquidity. Moreover, if required, FRS is ready to increase volumes of buying both Treasury notes and mortgage bonds. In fact, it means that managers have no concerns with respect to the emission volume.

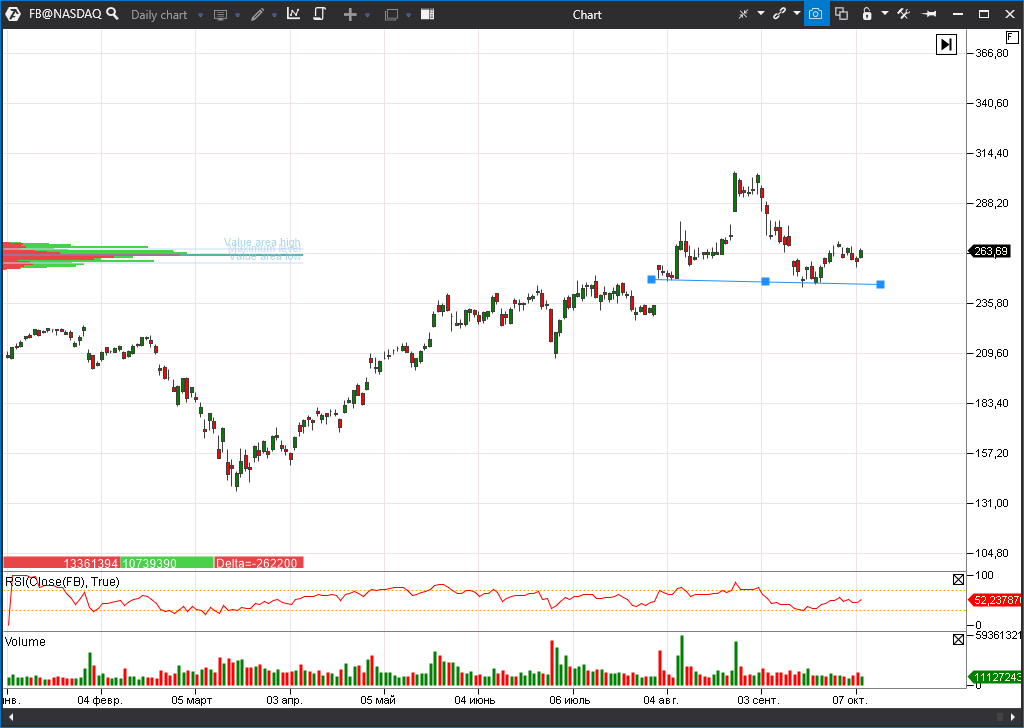

Apple, Amazon, Google and Facebook are endangered with a split-off

The biggest world technology companies face the danger of the anti-monopoly split-off. This conclusion could be drawn from the 449-page report of Democrats in the US Congress following the results of investigations in respect of Apple, Amazon, Google and Facebook. We already wrote that congressmen arranged a multi-hour inquiry for the CEO of the legendary companies.

- Apple is accused of using the monopoly position in the iOS application market. In particular, the company barriers independent developers and tries to discredit them.

- Facebook is accused of buying major competitors (Instagram first of all) for becoming the monopoly in the online-advertising market in social networks.

- Amazon took the monopoly position in the online-retail market and also wouldn’t mind to suppress the competitors.

- Google, according to the investigative committee, is the monopolist in the search advertising market.

As a response to the threats, the Congress offered to split the companies into structural subdivisions. In particular, YouTube could be split from Google and Instagram and WhatsApp from Facebook. The companies would also have to prove at any moment that their actions do not cause harm to competition.

While markets are quiet, stocks of technical giants are a bit more volatile. It seems like investors do not believe in the reality of congressmen threats.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.