Investors are nervous on the eve of the biggest IPO in 2020.

The previous week wasn’t boring in the financial markets. On the one hand, precious metals suffered a painful retracement, on the other hand, the tension in the first line stocks grows. Sceptics believe that the reason for the volatility growth is within the walls of the FRS, which behaviour fuels more and more fears against the inflation background. There is interesting news in the corporate sector, where, perhaps, the biggest IPO of 2020 is planned. Read the details in our front-page weekly review.

Plan

Calendar of economic statistics

Politics comes to the fore

Portfolio rebalancing has started: the market is rough

Statistics and FRS behaviour make investors nervous

Airbnb prepares for IPO filing and Tesla announced a split

| Date and time. Time zone GMT+3:00 | Event | Impact and forecast |

| Tuesday, August 18 15:30 | United States. Permission for construction in July. | S&P 500. Forecast – 1.295M, previous value – 1.258M. |

| Wednesday, August 19 09:00 | Great Britain. Consumer inflation in July. | GBP. Forecast – 0.4%, previous value – 0.6%. |

| 12:00 | Eurozone. Consumer inflation in July. | EUR. Forecast – 0.4%, previous value – 0.4%. |

| Thursday, August 20 15:30 | United States. Philadelphia Fed Industrial production index for August. | S&P 500. Forecast – 21.0, previous value – 24.1. |

| Friday, August 22 09:00 | Great Britain. Retail sales in July. | GBP. FTSE 100. Previous value – 13.9%. |

| 10:30 | Germany. Industrial PMI for August. | EUR. Forecast – 48, previous value – 51. |

| 17:00 | United States. Sales of new houses in July. | S&P 500. Forecast – 5.1M, previous value – 4.72M. |

| Tuesday, August 18 15:30 |

| United States. Permission for construction in July. |

| S&P 500. Forecast – 1.295M, previous value – 1.258M. |

| Wednesday, August 19 09:00 |

| Great Britain. Consumer inflation in July. |

| GBP. Forecast – 0.4%, previous value – 0.6%. |

| 12:00 |

| Eurozone. Consumer inflation in July. |

| EUR. Forecast – 0.4%, previous value – 0.4%. |

| Thursday, August 20 15:30 |

| United States. Philadelphia Fed Industrial production index for August. |

| S&P 500. Forecast – 21.0, previous value – 24.1. |

| Friday, August 22 09:00 |

| Great Britain. Retail sales in July. |

| GBP. FTSE 100. Previous value – 13.9%. |

| 10:30 |

| Germany. Industrial PMI for August. |

| EUR. Forecast – 48, previous value – 51. |

| 17:00 |

| United States. Sales of new houses in July. |

S&P 500. Forecast – 5.1M, previous value – 4.72M. |

The coming week would not have many important economic news. Traders in the Forex market need to pay attention to the consumer inflation statistics in Great Britain and Eurozone, which will be published on Wednesday. Important data on the real estate sector, which is one of the pillars of the US economy, will be published in the US on Tuesday and Friday.

Politics comes to the fore

Political twists will influence the market more and more with the approach of the US presidential election, which will take place on November 3. Thus, the market took a favourable view of the choice of a moderate politician Kamala Harris as the US Vice-President candidate from the Democratic Party. Investors sighed with relief, since several radical party representatives, who urged to ‘dispossess’ big capitalists a little bit, were considered as potential candidates for the post of the Joe Biden’s deputy.

The market also nervously reacts to uncertainty in respect of a new economy support package. The parties cannot reach an agreement about its size – they discuss amounts from USD 1 trillion to USD 3 trillion.

The risk of escalation of the trading conflict between the US and China has been traditional for the recent years. The parties try to agree on the final variant of the trade agreement, but successes are few.

Portfolio rebalancing has started: the market is rough

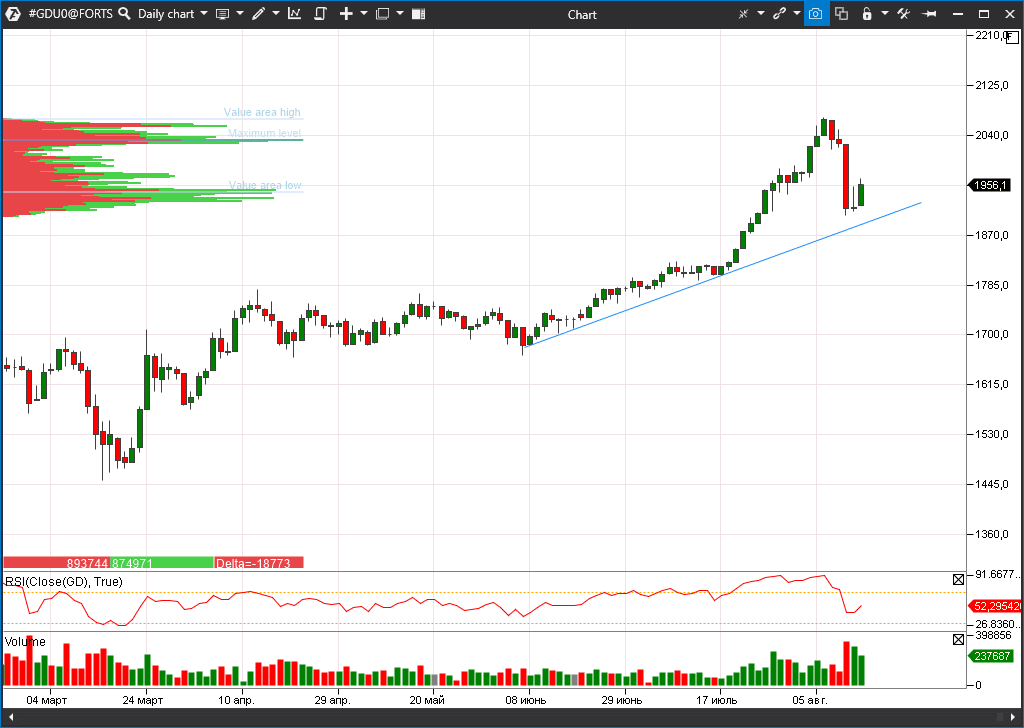

According to all indications, it looks like investors started portfolio rebalancing on the eve of the autumn. Those assets are corrected, which recently have grown more than others. Thus, the gold futures survived the worst day this year on Tuesday, August 10, falling all at once by 5.7% on very decent volumes. Other precious metals from silver (-13.72%) to platinum (-4.71%), followed the benchmark one.

We already mentioned a week ago that this asset is too overbought, that is why this behaviour was expected. The candle nature on Wednesday, August 11, tells us that the worst, perhaps, is behind. The uptrend is still in force.

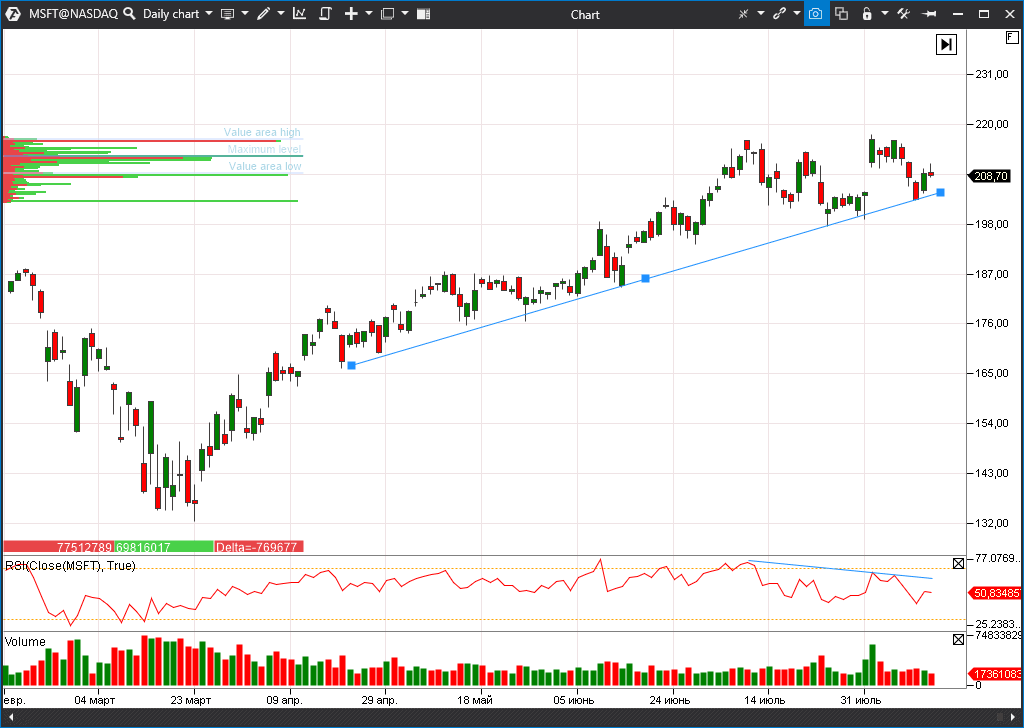

The Microsoft (MSFT) and Facebook (FB) stocks are corrected after a strong growth. However, the correction passes rather smoothly so far and the efforts of bears to push through significant levels have failed.

At the same time, the so-called Value companies from the cyclic and industrial sectors of the economy were particularly in demand. They are still relatively undervalued if compared to the technology sector, which creates a growth margin.

Statistics and FRS behaviour make investors nervous

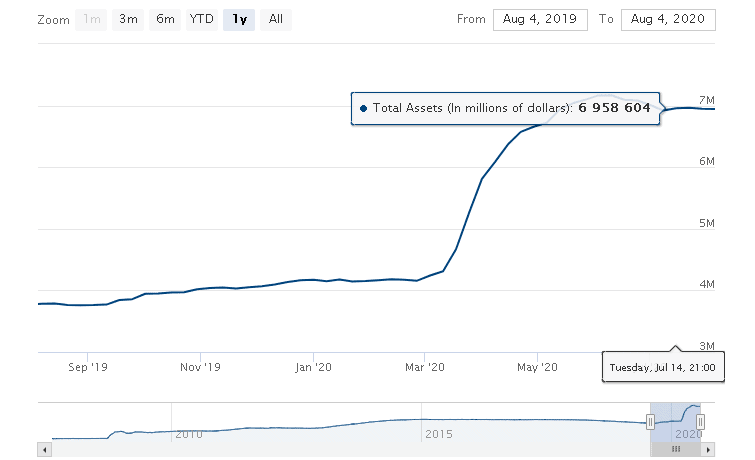

Meanwhile, there are talks in the market that the FRS would have to slow down the quantitative easing program. Inflation acceleration was the reason for these talks. The July indicator of industrial inflation, published on Tuesday, August 11, turned out to be much higher than forecasted (0.6% instead of 0.3%). On Wednesday, August 12, the consumer inflation confirmed the tendency – 0.6% actual instead of 0.2% forecasted. The indicator accelerated to 1.6% in annualized terms, which wasn’t expected at all. The FRS, perhaps, would start to tighten its policy if the inflation accelerates above 2%.

We want to remind you that the quantitative easing program of the regulator is the key prerequisite of the market positions at the current quite non-crisis levels. If the emission stops, the market is sure to nosedive. Some analysts say that we already witness the first signs of this development of events. We recommend investors to monitor the central bank balance and inflation statistics.

Airbnb prepares for IPO filing while Tesla announced a split

One of the most successful technology projects of recent years – Airbnb daily rental company – may file for IPO in August or September. The Wall Street Journal published some details of the stock offering.

The Journal’s source informed that Airbnb plans to file documents into the US Securities and Exchange Commission (SEC) very soon. The Morgan Stanley Bank will organise IPO.

Airbnb is not a public company as of today. Its value went down from USD 31 billion to USD 18 billion during the recent months due to coronavirus. Nevertheless, the rental demand grows fast after easing the quarantine. It is quite logical that Airbnb is in a hurry to attract funds while there is excessive liquidity in the market.

One more interesting corporate event is a split of Tesla stock. The stockholders will receive 5 new shares instead of 1 old share and the price, consequently, will be 5 times less. This step is meant to increase the popularity of stock among minor investors. Due to the company capitalization growth, one share reached USD 1,640 as of August 13, 2020, which is not every ‘robinhood’ money.