Heard the news? PayPal Boosted Bitcoin

Nervousness is growing in the US stock market. Democrats and Republicans cannot reach an agreement with respect to the economy saving package. Instead, Bitcoin feels itself excellent. It set a new price record not without PayPal’s help. It goes without saying that investors monitor the corporate reporting season with special attention. Quarterly reports of Tesla and Netflix have been published this week – it hasn’t been without surprises.

Topics

- Calendar of economic statistics

- Stocks fall due to the political clinch in the US

- Reporting season is in full play: Tesla and Netflix results have been published

- Bitcoin set a new price record: not without PayPal’s help

Calendar of economic statistics

| Date and Time (GMT +3:00) | Event | Impact. Forecast |

| Monday, October 26 17:00 | United States. Sales of new houses in September. | USD. S&P 500. Forecast – 1M, previous value – 1,011M. |

| Tuesday, October 27 17:00 | United States. CB Consumer Confidence Index in October. | USD. S&P 500. Forecast – 102.8, previous value – 101.8. |

| Wednesday, October 28 17:00 | Canada. The Bank of Canada decision on the interest rate. | CAD. Forecast – 0.25, previous value – 0.25. |

| 17:30 | United States. Crude oil reserves. | Brent. WTI crude oil. Previous value -1.001M. |

| Thursday, October 29 10:55 | Germany. Unemployment level change in October. | DAX. EUR. Forecast -8K, previous value -8K. |

| 15:30 | United States. GDP for the 3rd quarter (quarter-over-quarter). | USD. S&P 500. Forecast – 32.5%, previous value -31.4% |

| 15:45 | Eurozone. ECB decision on interest rates. ECB statement on monetary policy. | EUR. DAX. |

| 16:30 | Eurozone. ECB President conference. | EUR. DAX. |

| Friday, October 30 10:00 | Eurozone. GDP of Germany for the third quarter (quarter over quarter). | EUR. DAX. Forecast -9%, previous value -9.7%. |

| 13:00 | Eurozone. Consumer Price Index (CPI) in October. | EUR. Forecast -0.2%, previous value -0.3%. |

| Monday, October 26 17:00 |

| United States. Sales of new houses in September. |

| USD. S&P 500. Forecast – 1M, previous value – 1,011M. |

| Tuesday, October 27 17:00 |

| United States. CB Consumer Confidence Index in October. |

| USD. S&P 500. Forecast – 102.8, previous value – 101.8. |

| Wednesday, October 28 17:00 |

| Canada. The Bank of Canada decision on the interest rate. |

| CAD. Forecast – 0.25, previous value – 0.25. |

| 17:30 |

United States. Crude oil reserves. |

| Brent. WTI crude oil. Previous value -1.001M. |

| Thursday, October 29 10:55 |

| Germany. Unemployment level change in October. |

| DAX. EUR. Forecast -8K, previous value -8K. |

| 15:30 |

| United States. GDP for the 3rd quarter (quarter-over-quarter). |

| USD. S&P 500. Forecast – 32.5%, previous value -31.4% |

| 15:45 |

| Eurozone. ECB decision on interest rates. ECB statement on monetary policy. |

| EUR. DAX. |

| 16:30 |

| Eurozone. ECB President conference. |

| EUR. DAX. |

| Friday, October 30 10:00 |

| Eurozone. GDP of Germany for the third quarter (quarter over quarter). |

| EUR. DAX. Forecast -9%, previous value -9.7%. |

| 13:00 |

| Eurozone. Consumer Price Index (CPI) in October. |

| EUR. Forecast -0.2%, previous value -0.3%. |

New splashes of volatility are quite probable in financial markets during the last trading week of October. There are a lot of reasons for this. They are: influence of the US Presidential election, culmination of the corporate reporting season and important economic news. Players in the EUR/USD pair should be especially attentive. On October 29, ECB will make its interest rate decision and its President will hold a press conference. Also, important statistics, including the inflation level in the eurozone and GDP in Germany, will be published.

Stocks fall due to the political clinch in the US

The coming Presidential election in the United States, which takes place on November 3, promises to be very hot. Financial markets are already thrown from fire into smother by the flow of news. As of now, there are two main factors of volatility:

- The budget inflow package of USD 2 trillion has been practically blocked. Democrats and Republicans, who learnt to reach at least some agreements in ‘peaceful’ times, are ready to put at stake even their own country’s economic stability in the course of the election.

- Investors become more and more concerned that calculation of votes could last until the end of November, which would prolong uncertainty. Some political analysts also prophesy a political crisis if one of the candidates would refuse to admit his own defeat.

Index S&P 500 reflects investor concerns and moves down in a volatile turbulence.

Reporting season is in full play: Tesla and Netflix results have been published

The quarterly reporting season is in full play. Apart from the political events, this is the main fundamental factor in the US stock market. We want to mention Tesla and Netflix results out of a number of interesting reports, published during the past week.

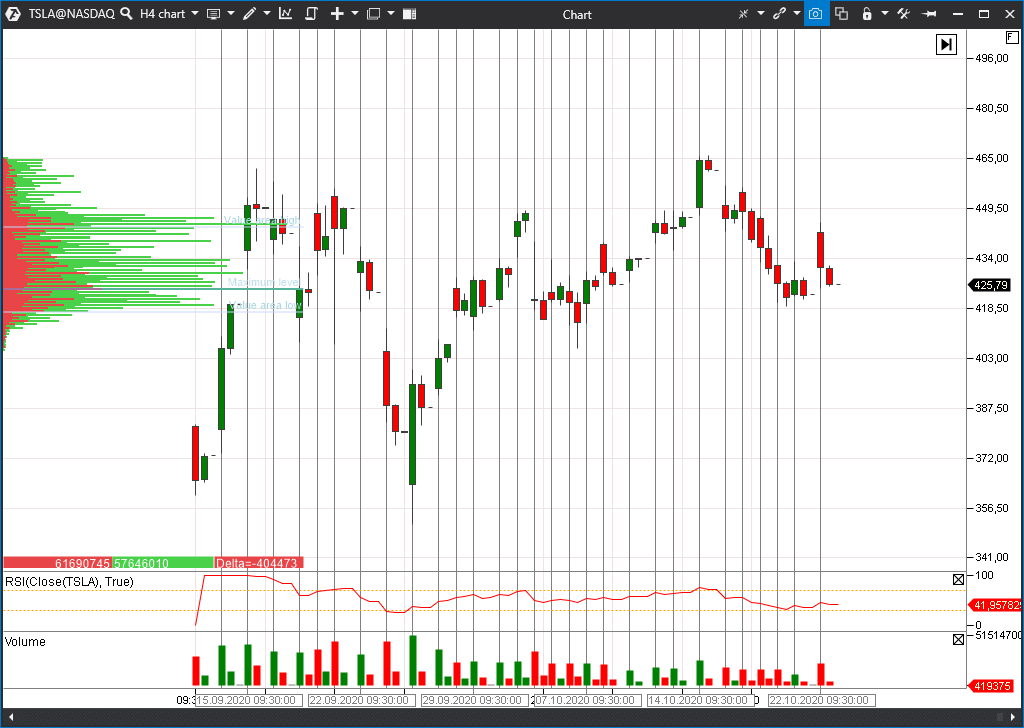

The Tesla (TSLA) report brought a surprise. The company confidently improved financial indicators. The net profit, compared to the previous quarter, immediately increased 2.3 times – up to USD 331 million.

However, the per share result wasn’t that impressive – just 76 cents and, without consideration of single factors, just 27 cents. It’s like a drop in the ocean. The P/E ratio stays astronomically high. The Tesla securities didn’t win back the profit growth and are corrected, as usual, in the volatile mode.

The Netflix (NFLX) report on Tuesday night was also disappointing. Earnings per share was USD 1.74, while USD 2.13 was expected. Investors were even more disappointed with a sharp slowing down of the subscriber amount growth rate. Stock reacted with a nearly 7% fall already the next trading day and the trend continued on Thursday.

On the one hand, the world leading multimedia content producer shows a confident growth of the yield and profit, on the other hand, the company lags behind the market expectations.

Next week, investors should look closely at the US top companies’ reports. Increase of volatility is probable:

- Tuesday, October 27: Microsoft (MSFT) and the world largest pharmacological concern Pfizer (PFE) publish their quarterly reports.

- Wednesday, October 28: the world largest payment services Visa (V) and MasterCard (MA) publish their reports.

- Thursday, October 29: investors will face the reporting season culmination. Technology giants Apple (AAPL), Facebook (FB), Alphabet (GOOG) and Amazon (AMZN) will show their results.

Bitcoin set a new price record: not without PayPal’s help

Cryptocurrencies started to steadily grow. The Bitcoin futures renewed the year’s highs during the October 21 trades, reaching the USD 13,285 level. The growth rate exceeded 8% during the session.

The key altcoins – Ethereum, Bitcoin Cash and Litecoin – added 7%, 9% and 13% to capitalization respectively.

Two following factors helped cryptocurrencies to break local resistance levels:

- The market was just blown away by the news that one of the world’s biggest and acknowledged payment systems – PayPal – added a possibility to pay with Bitcoin, Ether, Bitcoin Cash and Litecoin. It is an extremely positive event for the crypto, its acceptance and practical use are steadily growing in the ‘traditional’ financial world.

- The demand on cryptocurrencies is supported by the USD weakness in the world markets. It became cheaper with respect to EUR and gold during the week.

The cryptocurrency inclusion news also increased the PayPal (PYPL) stock value, setting a new historic high. However, the stock value moved back to previous levels already the next day.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.