Knowledge and understanding of the exchange algorithms is mandatory for every professional trader.

In this article we will describe:

- basic order types;

- how trades are executed;

- algorithms of order matching on CME.

However, before we start, let’s specify what is the difference between offers, instructions or orders. There is no difference between them from the point of view of the exchange terminology. All of them mean an order to execute an exchange trade.

Start using ATAS for free with no time limits! Or activate the advanced tariff right now to access the full range of functionality.

Basic order types

There are limit and market orders on the exchange. Limit Orders reflect intentions. They are executed at the moment when the price reaches a certain level specified in the order. Unlike them, Market Orders are executed immediately at the best available price.

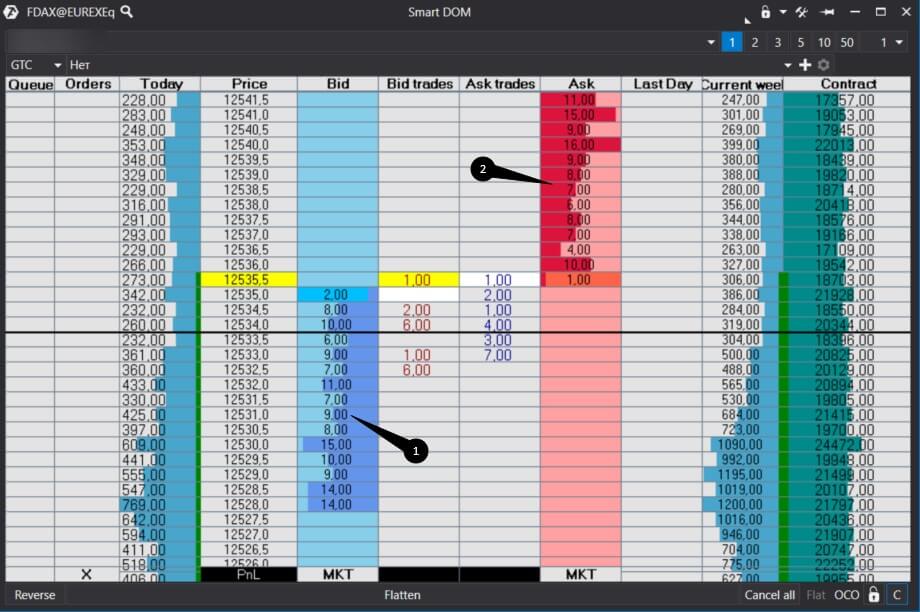

All limit orders are registered in the order book (which is also called Depth Of Market – DOM). The order book is called the Smart DOM in the ATAS platform.

- Limit orders of buyers are located to the left and are called bids (demand). The best bid is the highest price of the buyer.

- Limit orders of sellers are located to the right and are called asks (supply). The best ask is the lowest price of the seller.

- The best bid and the best ask are located maximally close to each other.

You can find more detailed information about asks and bids in the What bid, ask and spread are article.

How orders are matched

In order for a buy trade to be executed, the market buy order should ‘meet’ the best limit sell order or the best ask price.

In order for a sell trade to be executed, the market sell order should meet the limit buy order or the best bid price. See Picture 1.

In order for the price to move up or down, the market orders should absorb all limit orders at a certain price level.

Market orders are often called aggressive since they are posted by traders who do not want to wait for the price to reach a certain level but want to execute a trade immediately.

How to post a market order

Variant 1. Through Chart Trader. If you press button 1, the panel, which we marked with number 2, emerges. This panel is called Chart Trader, which traders use to manage their orders – open, change order volume, close, reverse or cancel. See Picture 2.

Variant 2. Directly in the chart. You can turn on this function through the Chart Trader panel (3) or post orders in the chart using the right mouse button.

Variant 3. Through Smart DOM. See Picture 3.

- Traders post buy orders in the blue field marked with number 1. They post limit buy orders below the current yellow price. If a trader tries to post an order at the level of the current yellow price or above, the market buy is executed at the best price.

- Traders post sell orders in the red field marked with number 2. They post limit sell orders above the current yellow price. If a trader tries to post an order at the level of the current yellow price or below, the market sell order is executed at the best price.

It is very important to have limit orders in the market at each moment of time since trades are executed when limit and market orders are matched. Limit orders supply or create liquidity. Namely, that is why, a lower commission is charged for posting limit orders on many cryptocurrency exchanges (how to make money on cryptocurrencies).

Market makers’ orders

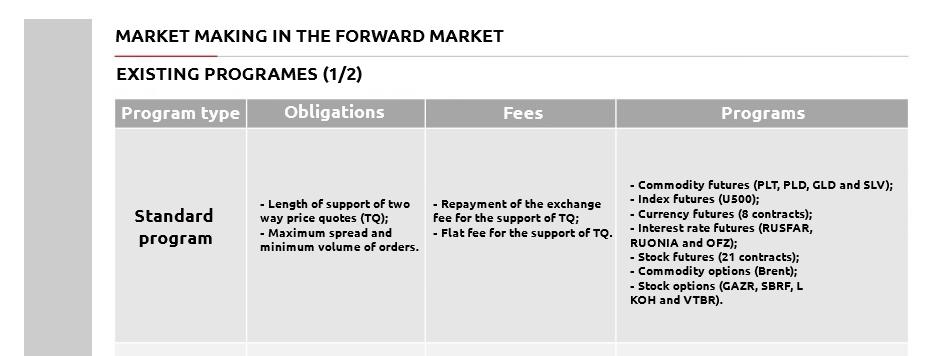

Privileges for limit orders also exist for participants of the classical exchanges. It also concerns market makers. Very often limit orders are posted mainly by them. Market makers execute agreements with the exchange and the exchange provides them with special commissions for and conditions of execution of orders.

Market makers, in their turn, support liquidity and do not allow expansion of the spread. You can find lists of market makers and various programs of cooperation with them on the web-sites of exchanges. See Picture 4.

Algorithm of order matching

Algorithm of order matching is the procedure of order distribution. The algorithm should provide each market participant with the order execution at the fairest price.

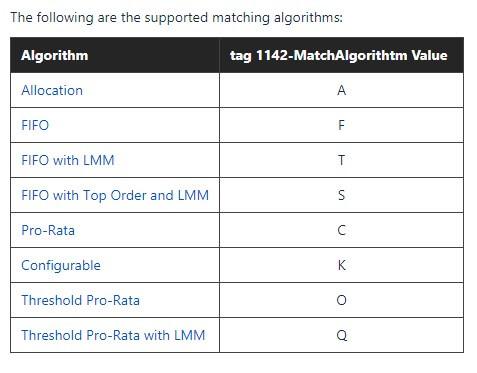

The following algorithms are applied on CME:

- FIFO First in First out

- FIFO with LMM Lead Market Maker

- Pro Rata

- Configurable

- Threshold Pro Rata

- Threshold Pro Rata with LMM

- Allocation

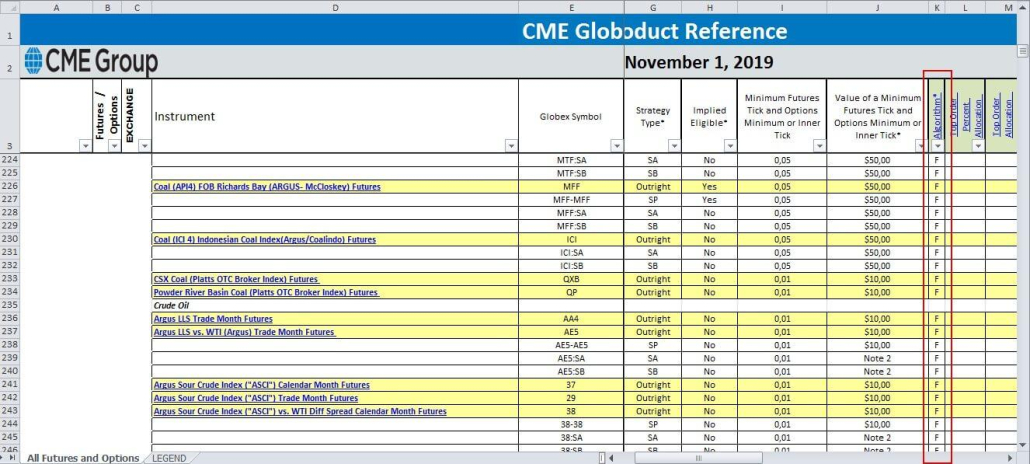

In order to specify what algorithm is applied to a specific instrument, you can check the ‘CME Globex Product Reference Sheet’ file. See Picture 5.

You can also find additional details in this file, which concern each algorithm of the order distribution. Each algorithm is denoted with a certain Latin letter. See Picture 6.

Let’s analyze these algorithms in more detail. This section could be quite complex for perception.

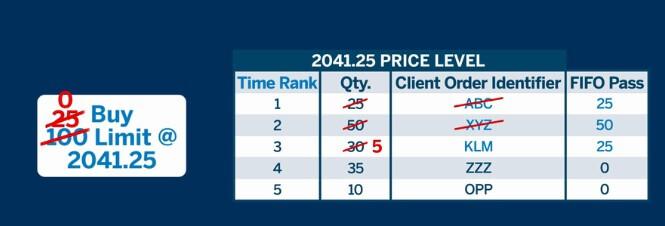

FIFO (First In First Out). All orders with the same price level are executed in accordance with the time priority. The first order at a certain price level will be executed first. However, the order could be shifted to the end of the queue if:

- the amount is increased;

- the price is changed;

the account number is changed. See Picture 7.

This algorithm, for example, is applied to the E-mini S&P 500 and crude oil futures.

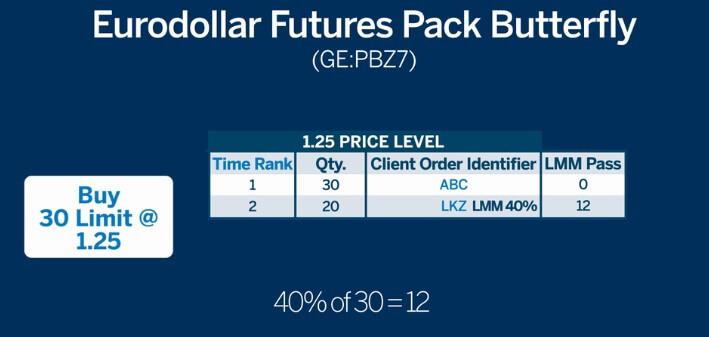

FIFO with LMM (Lead Market Maker) is an improved FIFO algorithm. LMM is a leading market maker whom the exchange provides with special conditions for ensuring liquidity of certain instruments.

However, if the exchange has executed LMM orders only, it would have been unprofitable for other participants. That is why, only a certain percentage of the orders of leading market makers is executed on a first-priority basis. The percentage of orders is specified in the agreement between the exchange and market maker. See Picture 8.

The market maker’s order was the second, time-wise, in our example, but 40% of it (12 lots) will be executed in the first place. And the order which was the first one will be executed only after that.

This algorithm, for example, is applied to the EUR/USD futures.

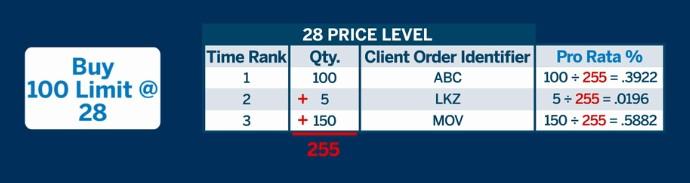

Pro Rata. Orders are executed depending on the price, time and quantity. This algorithm is more complex than the previous ones. See Picture 9.

A general number of sell lots at a certain price level will be calculated as soon as a buy order emerges. In our example, there are three orders with the general number of 255 lots at the price level of 28. Pro Rata percentage data or share of a certain order in the general volume will be calculated for each order. After that, shares are rounded down to the nearest whole number and multiplied by the incoming number – it is 100 lots in our case.

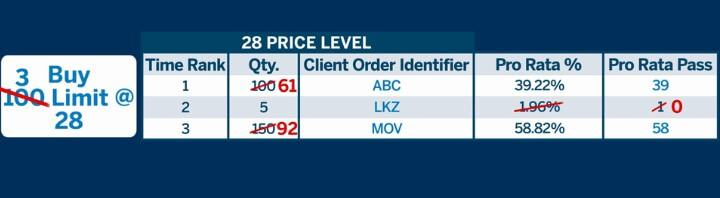

Moreover, Pro Rata algorithm has the threshold or minimum distribution. For example, it is 2 lots in the AUD/USD futures. If the result is less than 2 lots after all the calculations, this order will not be distributed by Pro Rata. It will not be lost, it will be executed a bit later. See Picture 10.

Lots with a bigger amount will be executed first by the Pro Rata algorithm. The rest of the orders are executed by FIFO. This algorithm is applied to E-mini Japanese Yen, New Zealand and Canadian Dollar futures.

Configurable. This algorithm combines the previous algorithms. For example, 40% of FIFO and 60% of Pro Rata. It is applied to the corn futures.

Threshold Pro Rata. It is an improved Pro Rata algorithm, which provides priority to the order, which was posted first at the best price level. Such an order is called Top Order in the system. This order will be executed first but with some restrictions, which are stated in the algorithm description. For example, if an order for 150 lots is posted and the maximum limit of the Top Order is 100 lots, these 100 lots will be executed and the Pro Rata algorithm will be applied to the rest 50 lots of this order and other orders. It is applied to the EUR/USD futures.

Threshold Pro Rata with LMM. First, the Top Order will be executed, then a part of the market maker orders and then the Pro Rata algorithm will be applied. All the rest orders will be executed by FIFO. It is applied to the 10-year US Treasury Bond option.

Allocation. First, the Top Order is executed, then the Pro Rata algorithm is applied and then FIFO. It is applied to the EUR/USD futures.

We described algorithms of order matching on CME very briefly. If you want to study the subject in depth, read the article about CME order matching algorithms.

Summary about order matching

Beginner traders should remember that:

- Trades are executed when limit and market orders ‘meet’.

- Neither limit nor market orders cannot move the price in isolation from one another.

- Limit orders stop movement and they could be seen in Smart DOM or with the help of the Depth Of Market indicator.

- Market orders start movement and show aggression of market players. They could be seen with the help of the Delta indicator or in the footprint.

- Market makers have an advantage when orders are executed since they ensure liquidity in the market.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.