Market Theory

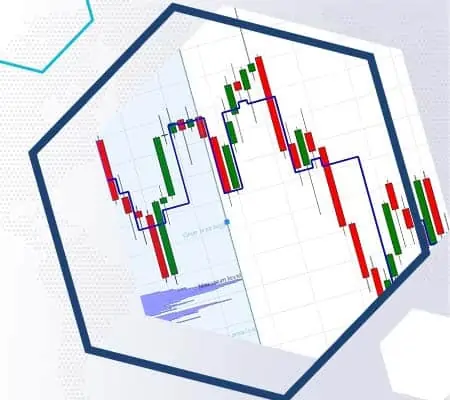

Support and resistance levels: how to distinguish genuine ones

/in Market Theory, Trading, Trading Basics, Volume AnalysisHow to analyse the market and develop a trading plan

/in Market Theory, Volume AnalysisWhy to analyse the market structure? Very often traders are in a hurry to start trading. Besides, the existing variety of trading systems and indicators will always give a signal for trading. However, you shouldn’t hurry in this business because opening a trade against the current market moods will, most probably, be loss-making or have […]