What the brokerage company business is based on?

A broker is a financial intermediary, without whom it is just impossible to trade on the exchange. In this article, we will answer the main questions, which arise when you work with a broker. In particular, we will consider:

What a broker is and what you need him for

Licencing of brokerage services

What the broker types are

How brokers make money and types of their commission fees

What you need to start working with a broker

How to select a proper broker

What a broker is and what you need him for

Broker is a certified market participant, who serves as a professional intermediary between the asset seller and buyer. By ‘asset’ we mean securities, contracts, commodities, real estate and other valuables.

When we speak about the stock market, a broker is usually a legal person – an intermediary company in the process of trade execution in the exchange and over-the-counter markets. Brokers are also physical persons with a brokerage licence or specially certified brokerage company employees.

Brokers and dealers are not the same. The key difference between a broker and dealer is that a broker executes trades on behalf and in favour of customers, while a dealer executes trades on his own behalf and in his own favour.

One and the same company could be both a broker and dealer. In order to exclude the conflict of interests, these types of activity are certified separately and regulators monitor the division of business directions inside companies.

Licensing

In the majority of countries, stock exchange brokers have to get a state licence. The right to issue such licences is in hands of a Central Bank, as in the Russian Federation, or a special independent body as the US Securities and Exchange Commission (SEC). These bodies also deal with general regulation of the brokers’ activity, law enforcement and protection of rights of the financial service consumers.

Regulation of the brokers’ activity is practically absent or rather superficial in some offshore jurisdictions such as the Seychelles Islands. The rights of customers of brokers with such registrations are practically unprotected.

Types of brokers

Depending on the sphere of activity, brokers are divided into several types. Below is a widely spread classification of brokers:

Exchange broker. A certified exchange participant, who executes trades with securities on behalf of the customer. These could be stocks, bonds, contracts, gold, raw materials and also various derivative financial instruments.

Insurance broker. A certified participant of the insurance market, who executes insurance transactions on behalf of the customer.

Customs broker deals with servicing export-import operations in favour of the customers.

Shipping broker provides services on organisation of cargo transportation in favour of the customers.

Credit broker works in the debt market. The subject of services could be drawing rights, credit portfolios, formation of credit pools, etc.

Exchange brokers are of interest to traders and investors and we will discuss them in more detail. There are several subtypes of exchange brokers:

Stock broker provides services in buying and selling stocks, bonds and Exchange Traded Funds (ETF). Such a broker is a member of stock exchanges, the largest of which are NYSE, Nasdaq and LSE.

Commodity broker is a member of commodity exchanges, such as Chicago Mercantile Exchange (CME) in the United States. In the majority of cases, commodity trading is carried out through futures contracts.

Options broker is a member of the exchange, which trades options contracts. As of today, the world leading options trader is the Chicago Board of Options Exchange (CBOE).

Forex brokers provide services in the international currency market. Major international investment companies and the banks of the level of JPMorgan Chase (JPM) and Goldman Sachs (GS), which work with institutional customers only, set the tone on Forex. However, there are multiple intermediaries that aggregate liquidity flow from major players and provide retail traders and investors with access to this market.

The companies, which do not provide direct access to the currency market but execute trades inside their own dealing centers using the Dealing Desk model, also call themselves Forex brokers. They are popularly called ‘kitchens’ due to the problems with reputation and regular scams. Forex kitchens play against the customers in the market, since they are the opposite side in trades.

The largest international brokers may operate in several markets at the same time, providing direct access to trading on hundreds of exchanges in dozens of countries.

How brokers make money and types of their commission fees

An exchange broker makes money basically by means of providing intermediary services on the asset buying/selling and providing credits to customers for executing trades.

Commissions

The brokerage commission size depends on the degree of competitiveness in the market and broker’s type.

Discount brokers, that provide very low commissions along with a minimum of accompanying information and analytical services, have become very popular in recent times. Usually, these are major international brokers that charge from 1 cent per share to USD 1-2 per 100 share lot. As regards the futures and options market, from 20 cents to USD 1.5 is charged per contract.

Depending on the trading plan, a discount broker may charge a commission for:

Each individual share/contract;

Each lot. Usually, a standard lot in the stock market is 100 shares, and in the Forex market it is 100 thousand of the base currency units;

Order. In fact, it is payment for an individual trade independent of its size. This scheme is beneficial to major customers;

Trading volume. Payment is set in the form of a percentage of the customer turnover.

Some brokers also make money by means of a spread – the difference between the asset buying and selling prices.

As a rule, the more actively a customer trades, the less commissions he pays per asset unit.

Other sources of the brokers’ income

Also, brokers in the stock and currency markets make money by means of providing their customers with accompanying financial and information-analytical services, such as:

- Currency crediting of operations;

- Lending stocks and other exchange assets;

- Providing software for trading and investing;

- Providing analytical support;

- Providing historic data arrays;

- Managing assets;

- Training.

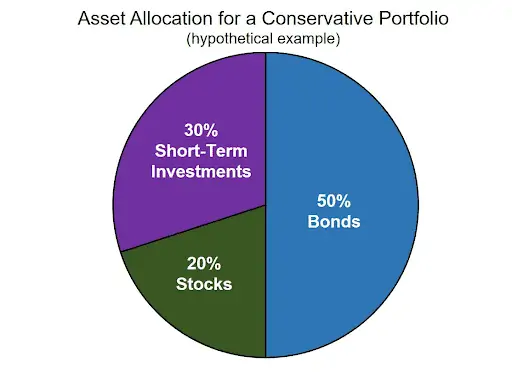

Investment companies, which have a brokerage licence, focus their efforts on providing asset management services and often charge a commission as a percentage of the invested capital or of the net investment income.

What you need to start working with a broker

To start working with a broker you need to sign a service agreement with him, open a brokerage account for keeping money funds and custody account for keeping securities. In the majority of cases, one and the same company provides both services, although each of the services requires a separate licence.

All legally operating brokers in the US, Russia and EU countries observe the anti-money laundering rules (KYC/AML).

Most commonly, brokers ask customers to provide some basic set of information and documents:

- Personal data: full name, year of birth, place of residence, email address and phone number;

- A copy of the passport or another document of identity;

- A copy of the certificate of tax registration;

- If the investment amount is big, a broker could require documents that confirm the source of income origin. It could be a certificate of income from the place of employment or an extract from the tax authority register;

- In some cases, an international broker may ask for additional information, which confirms the customer residence. These could be copies of utility payment slips or similar documents.

In recent years, advanced brokers allow to conduct the whole registration procedure online, without physical mailing of documents and visits to the office. This allows them to cooperate with customers from all the regions of their countries or even the world without physical availability of their offices there.

Nevertheless, the procedure of account opening and data verification may take from 1-2 working days to 1-2 weeks. A broker may refuse a customer in opening an account if he doesn’t receive a comprehensive set of documents or if he finds wrongs in the course of data verification.

Scheme of work with an exchange broker

Usually, the scheme of work with an exchange broker looks as follows:

- A customer and broker sign a service agreement. From that moment, the broker has the right to buy stocks, bonds, futures and other assets on the exchange on behalf and in favour of the customer.

- To start trading, the customer credits his account and the broker deposits these funds for trading on the exchange.

- The customer sends orders to the broker to buy or sell some asset. The quickest way to do it is to use the trading platform. He can also send orders by email or phone if such services are envisaged by the agreement.

- The broker posts orders for exchange trading and buys/sells the asset at the price and in the volume set by the customer.

- The broker keeps records of the customer securities and money funds and sends information into registers for dividend payment.

In some countries, brokers also serve as taxation agents and are liable to keep track of the customer’s financial results and tax payment on his behalf.

How to select a proper broker

There are three basic rational criteria for selecting a broker:

- Reliability. It assumes the broker’s ability to execute a trade in the shortest time possible and preserve the customer capital from exchange and transaction risks.

- Availability of those financial instruments with the broker, which are of interest to you.

- Commission size.

As regards reliability of the broker, you should pay attention to the following aspects:

The level of the licence for brokerage activity. It makes sense to give preference to major brokers that are registered in the country you live or to international brokers with the licences of the countries that have high legal culture (EU, USA and Great Britain). As a rule, brokers with offshore registration are much less reliable. You can check the broker’s licence availability on the web-site of a respective regulator. For example, you can find all broker’s documents and audit results of his operations on the SEC web-site through the search form over the upper menu.

Participation in the deposit insurance funds. Some brokers contribute to the fund, from which it is possible to get a refund in the event the intermediary becomes insolvent.

Account protection. We speak here about protection from hacker attacks, such as two-factor authentication, modern data encryption systems, etc.

Everything is obvious when we speak about availability of financial instruments. It makes sense to give preference to those brokers that provide access to a big number of markets in different countries. This will add to flexibility of your investment strategy.

As regards commissions, it makes sense to select a broker based on your trading style. The key features for passive investors are absence of payment for the inactive account and analytical support. For active traders, of course, it is important to find a broker with minimum commissions and trading volume discounts.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.