You can read more about futures, their history, idea and purpose in our ‘What futures are’ article. We also have articles about volatility of futures.

As regards this article, which we wrote for beginner traders, we will supplement the subject of commodity futures contracts and focus on their classification. In other words, we will tell you what commodity futures categories are.

Where you can buy a futures contract

Futures are traded on the exchange. The exchange itself sets the trading rules and specific features of every contract.

Since futures contracts are standard, the complete information about them could be found on the exchange web-site.

All futures are forward instruments, which means that they have a certain date of their execution or expiration.

In order to buy a futures contract, you do not need to have the whole contract cost on the brokerage account, but only a small part of it – a margin. The exchange itself sets the size of the margin.

The exchange has the right to stop trades and change the margin size at the moments of high volatility. Besides, some exchanges increase the margin size before long holidays. For example, the Moscow Exchange sometimes does it before the New Year holidays.

Futures specifications

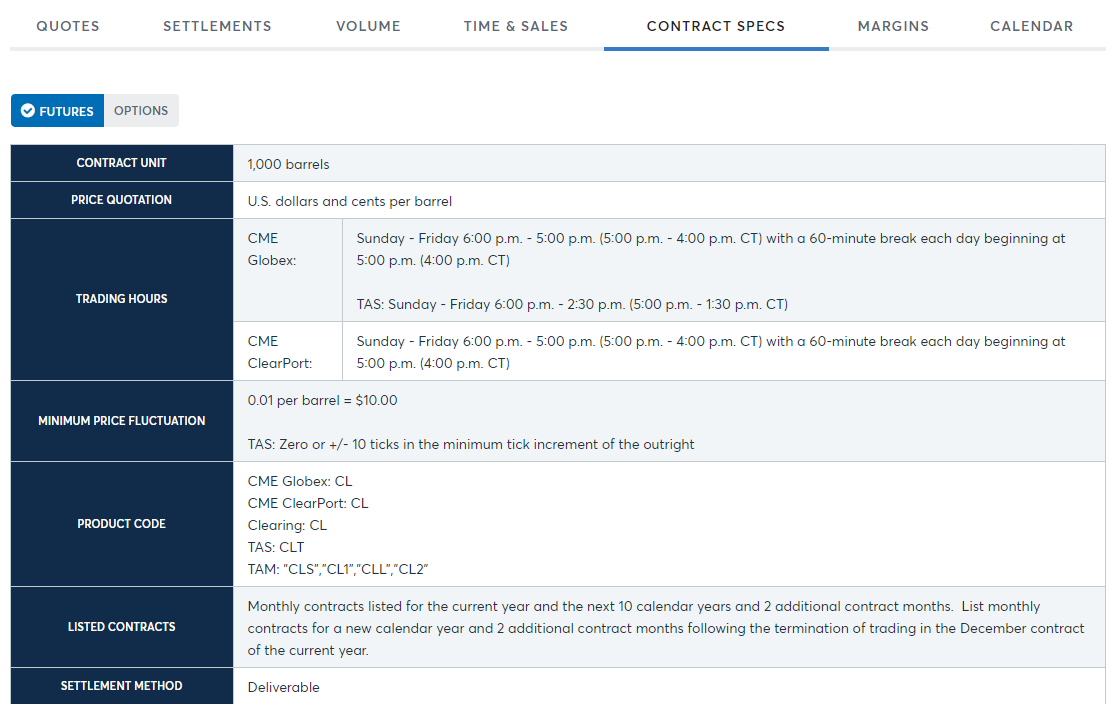

The next picture shows specifications of the WTI oil futures contract. These futures are traded on the largest derivative exchange – CME.

Futures classification

Futures contracts are divided into two big groups:- financial futures;

- commodity futures.

Let’s consider them in more detail and we start with commodity futures.

Commodity futures

They can be both delivery and settlement futures, which means that they may envisage physical delivery of commodities.Producers use these contracts to insure themselves against sharp changes of prices on commodities. The commodity futures group includes contracts on:

- metals (for example, gold, silver, copper and platinum futures);

- agricultural products (soybean, coffee, corn and wheat futures);

- electric energy;

- livestock products.

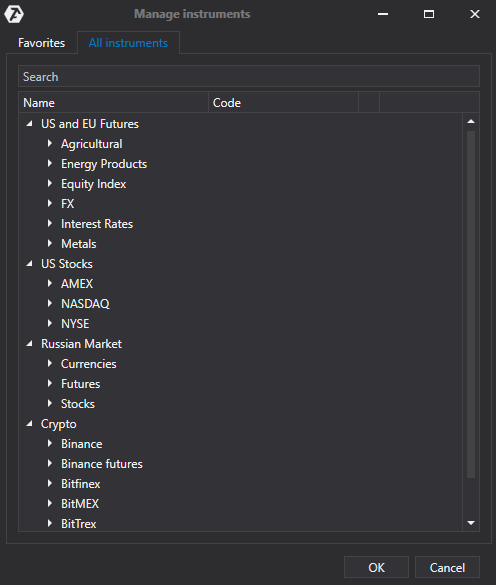

There is no generally accepted classification of futures. Here’s how we split futures into categories in the ATAS platform instrument manager:

- US and EU (futures, which are traded on American and European exchanges). This is the main category.

- Russian Market. Here you can find futures, which are traded on the Moscow Exchange.

- Crypto. Cryptocurrency exchanges also have futures. For example, XBT/USD on Bitmex.

Classification of commodity futures

Commodity futures emerged before the others, that is why they were initially used by producers and buyers to agree on the physical delivery of a commodity, for example, after the crop harvesting. In this case, both sides were confident that they would receive a commodity in exchange for a certain amount of money, set before.All futures contracts, connected with a physical commodity, are classified as commodity ones.

We can specify five big commodity contract groups:

- Grain. This type includes grain crops, which are suited for nutrition or for further processing. As a rule, the contract size is 5,000 bushels. For example, Jesse Livermore made very good money on trading corn futures.

- Metal. This type includes futures on precious metals: gold, silver, platinum, copper and so on.

- Energy products. This is an important type of a contract, since ordinary people depend on mazut, natural gas and electricity prices. This is one of the most active and speculative markets.

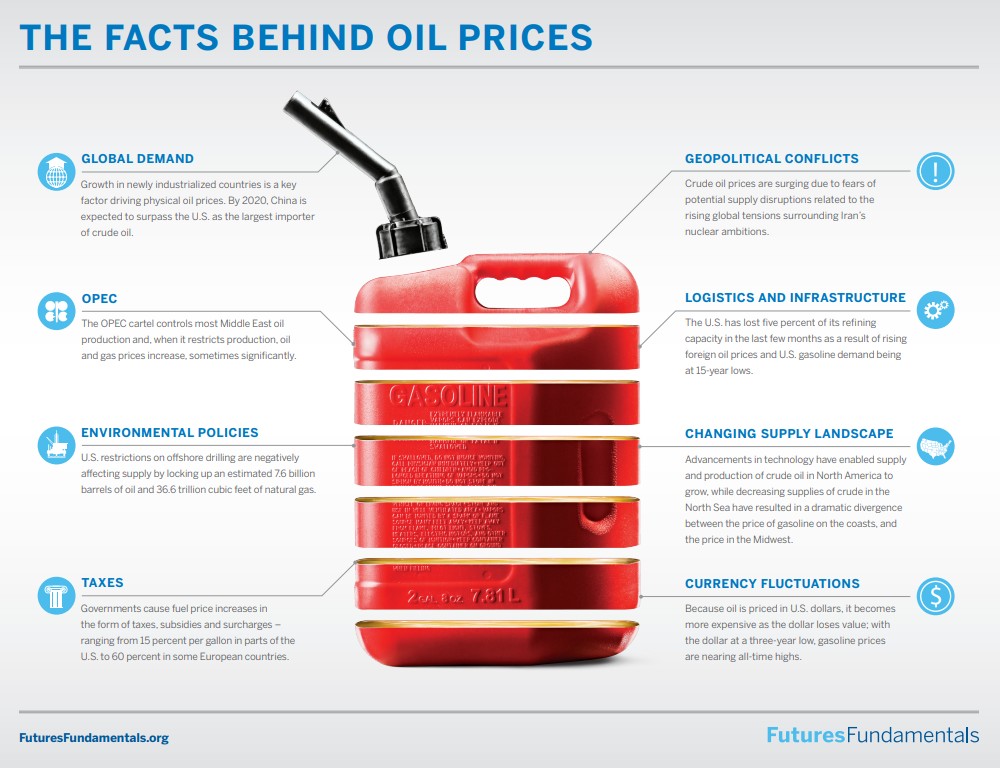

Crude oil is the main raw material of the energy market. Many factors influence oil prices. For example, when people and whole countries stayed in self-isolation due to coronavirus, demand on oil fell, because aircraft didn’t fly, cars didn’t drive and borders were closed. The global fall in demand led to the oil price decrease. Oil futures contracts were traded in the negative zone because oil storages were overfull.

- Livestock products. This contract type is also important for ordinary people, because it is connected with food products, which are sold in stores. However, unlike the energy product market, it doesn’t have such liquidity and only major institutional investors work here.

- Soft commodities market. It’s interesting that this type includes both cotton futures and coffee, juice, sugar and other commodities futures.

As a rule, commodity futures have seasonal nature. For example, mazut prices increase when the weather is cold and wheat prices decrease if the harvest is good.

Not all commodity contracts are equally interesting for traders, because some of them are not liquid. For example, major players trade in the livestock futures market, that is why minor speculators can easily make significant losses.

Financial futures

As a rule, these futures are settlement ones, which means that they do not envisage physical delivery of commodities. Traders trade these contracts to make money on the price difference, while producers use them to insure their production against currency rate fluctuations (it is called hedging). This group includes:- interest rate contracts;

- currency rate contracts (for example, GBP and EUR futures);

- individual stock contracts;

- index futures (for example, Nasdaq-100 stock index futures).

Financial futures were introduced in order to be able to trade obligations, which are connected with non-physical commodities, for example, indices or interest rates. However, this type includes not only settlement futures, which cannot be delivered. They also include stock delivery contracts.

Financial futures are divided into 4 big groups of contracts:

-

- Interest rates. In spite of the name, this group includes Treasury Note futures and bills of exchange. The name was given because the Note prices were inversely proportional to interest rates. These contracts helped to insure against the risk of the borrowed money value increase.

- Currency or Forex. These contracts are very popular among traders, because they allow to trade currency pairs with a huge leverage and with a minimum startup capital.

- Stocks. This type of futures contracts became less interesting for traders after emergence of options.

- Indices. This is one of the most interesting and significant types of financial contracts, since it allows investing or trading ‘by the whole’ market. Major institutional investors can use these futures for hedging their portfolios and sell index contracts at the moments of sharp security value falls.

Conclusions

It is profitable to trade futures contracts because they have low margins and commissions and the ATAS platform will help you to analyse futures markets with the help of the most advanced instruments. Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.